- XRP is holding firm against a deeper pullback, bolstered by strong whale support.

- This resilience suggests that the current correction is part of a “healthy” retracement.

As a seasoned crypto investor who’s been through multiple market cycles, I can confidently say that the recent performance of XRP has me intrigued and cautiously optimistic. The strong whale support bolstering its resilience against this correction suggests that we might be witnessing a healthy retracement before the altcoin market truly takes flight in 2025.

😱 Trump's Tariff Bombshell Could Crush EUR/USD!

Markets on edge — read the urgent new forecasts before it’s too late!

View Urgent ForecastAs 2024 nears its end, Ripple (XRP) stands at a pivotal juncture. Anticipating that the altcoin sector will capitalize on Bitcoin‘s momentum and breach fresh psychological thresholds in 2025, this could be an opportune moment for those who are bullish on XRP and aim to see it surpass its competitors – much like the whales are doing.

Over the past month starting from December, there has been a noticeable trend among larger “mystery holders” of XRP, either selling off their existing stash or buying even more in a bold manner.

As an analyst, I’ve observed that the recent fluctuations have clearly influenced the price of XRP, creating a state of anticipation as we await its imminent significant shift – be it a rise or a fall.

XRP has a strong support base

Approximately ten days back, XRP almost reached the significant level of $3, boosted by a strong one-day jump of 19%. Currently, though, XRP is being traded around $2.30.

This dip represents a wider pattern, with numerous cryptocurrencies experiencing losses, leaving investors contemplating their strategies. Do they reduce their investments or seize this opportunity to purchase additional units at reduced costs?

Ripple isn’t exempt from this trend either. A closer look at its 1-day price chart shows bulls putting in significant effort to prevent a more substantial downturn, while bears remain resolute. For long-term investors (HODLers), the ongoing backing by whales provides a reassuring feeling of stability.

This support creates a strong base for XRP to rebound when the market shifts bullish once again.

When could that occur? It seems to be contingent upon two factors: the fluctuation in the value of Bitcoin, which boasts a massive market capitalization of a trillion dollars, and the forthcoming Federal Open Market Committee (FOMC) meeting, where speculators are anticipating a 25 basis points reduction in interest rates.

Regardless of the route taken, a robust base seems crucial for XRP’s ambition to reach the $3 mark in the near future. The increase in large investors stockpiling XRP lends credence to this trajectory, but is it sufficient to propel XRP beyond its current limits?

The recent correction is likely tied to external factors

Two altcoins from the top ten have experienced significant losses due to recent market fluctuations: XRP and Cardano (ADA).

It’s quite intriguing how closely their price patterns resemble each other. Both cryptocurrencies experienced significant surges, thanks to the “Trump effect,” breaching important resistance levels with impressive triple-digit percentage increases in a single month.

However, since these digital currencies are growing so quickly, they also become more susceptible to sudden changes or corrections as the market undergoes adjustments.

Actually, over the past day, both Ripple (XRP) and Cardano (ADA) have seen significant decreases – falling by over 3% each.

Although it might appear pessimistic, it’s evident that external influences probably led to the drop. In contrast, within XRP, there are robust indications of a bullish trend emerging based on various crucial benchmarks.

The tale seems far from concluded, as a significant comeback remains quite possible – even though there have been some turbulences in the derivatives market, specifically noticeable fluctuations in Open Interest (OI).

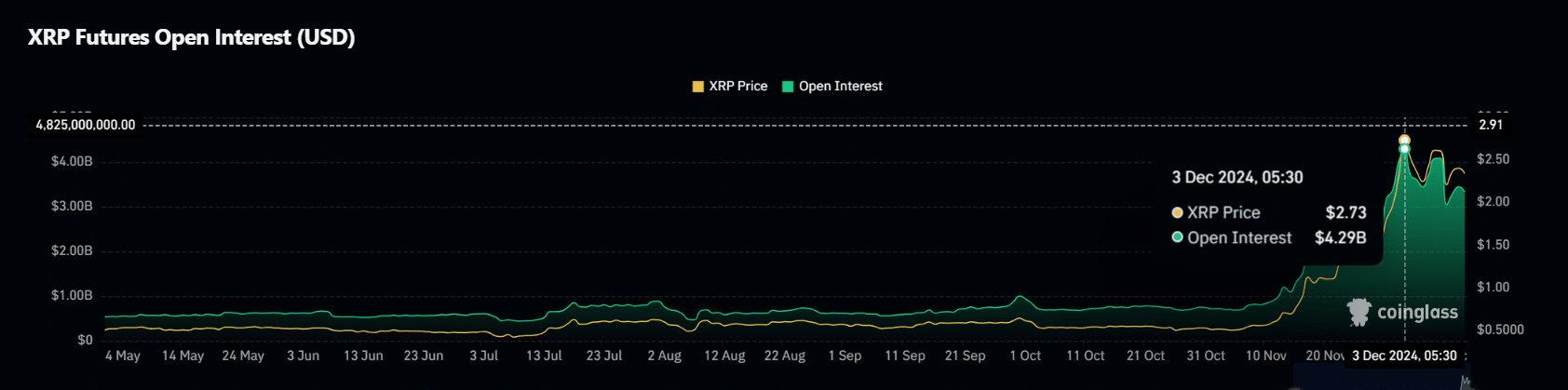

Source : Coinglass

In the last ten days, OI reached a record-breaking value of $4.29 billion, mirroring XRP’s daily peak at approximately $2.90.

Initially, numerous investors chose to invest heavily (went “long”), predicting a $3 price surge. Unfortunately, this anticipated breakout did not occur, causing the Open Interest (OI) to decrease to approximately $3.33 billion. This decline in OI resulted in around $6 million worth of long positions being closed – an increment of 1% compared to the previous day’s figures.

Read XRP’s Price Prediction 2024–2025

However, this is where the situation becomes intriguing: A surge in short positions might lead to a significant squeeze for XRP, given the backing from ‘whales’ and robust on-chain bullish activity.

In simpler terms, you may encounter challenges with patience as Bitcoin needs to overcome significant resistance points or else a larger economic pattern needs to develop.

Until then, with strong support in place, consolidation seems like the more probable path for XRP.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-12-13 21:12