-

XRP dropped to $0.40, falling 12.24% in 24 hours.

Ripple’s legal case with the SEC remains crucial, with potential outcomes significantly influencing XRP’s future market performance.

As a researcher with experience in the crypto market, I find myself closely monitoring XRP‘s recent price action and its connection to Ripple’s ongoing legal case with the SEC. The drastic 12.24% drop in XRP’s value within 24 hours, down to $0.400692, is concerning, especially given its ranking as the seventh-largest cryptocurrency by market capitalization.

Over the last few days, there have been significant drops in the cryptocurrency market. The total value of all cryptocurrencies combined has decreased by more than 7%.

This downturn has significantly affected XRP, which saw a sharp decrease in value.

At the moment I’m writing this, XRP is being exchanged for approximately $0.400692. The volume of trades involving this token within the past 24 hours reached a substantial figure of around $2.1 billion. Unfortunately, there’s been a decrease of 12.24% in XRP’s value over the past day, mirroring the overall market trend.

XRP’s press time CoinMarketCap ranking was #7, with a live market cap of $22,327,796,369.

XRP: Price predictions

On July 3rd, with XRP priced at approximately $0.46, analyst EGRAG CRYPTO pointed out that the token was approaching a significant resistance point – the Fibonacci 1.618 level.

The analyst suggested,

“If history repeats itself halfway, then we’re eyeing $27.”

Although this hopeful forecast diverges from the present negative market trajectory.

The ongoing legal battle between Ripple and the SEC significantly impacts the potential future pricing of XRP.

In December 2020, a disagreement arose between parties involving Ripple and certain of its top officials. The crux of the issue was claims that they offered and sold XRP tokens without registering the transaction as a securities sale.

A positive result in this case could significantly boost XRP‘s market value, possibly triggering a price surge for the cryptocurrency.

Technical analysis

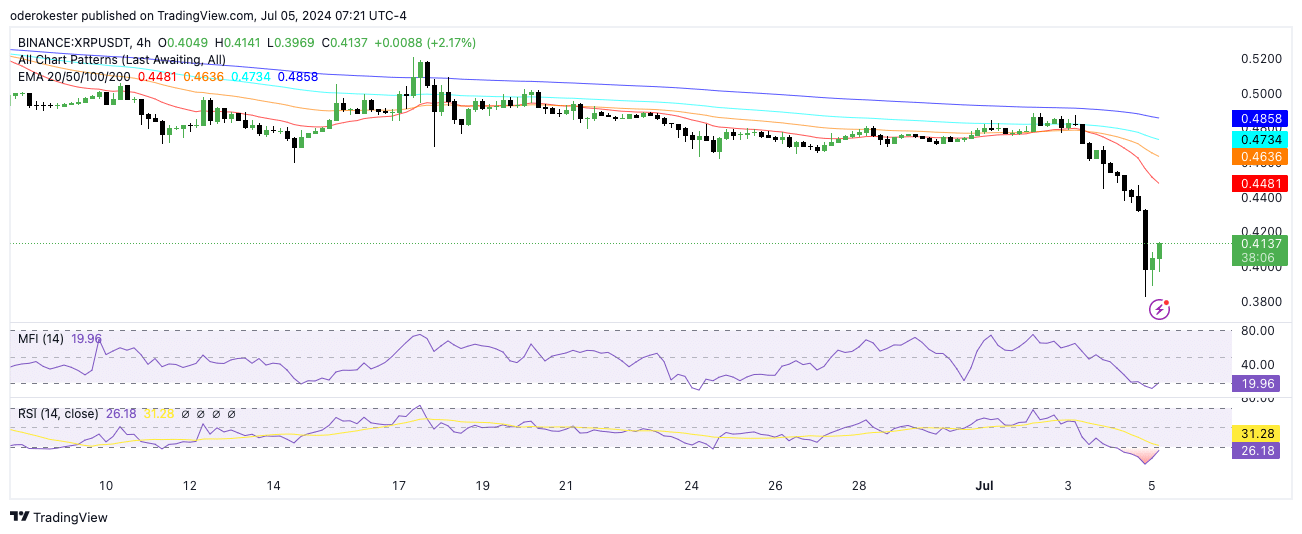

The MACD line signaled a bearish trend, while the MFI and RSI readings of 16.83 and 17.98 suggested that both indicators were in the oversold zone.

This suggested a potential for a short-term bounce.

The price stayed under the significant moving averages of 20, 50, 100, and 200 EMAs, implying potential downward influence until a noticeable turnaround takes place.

Based on XRPScan’s data, there was a significant uptick in transaction volume towards the end of June and into early July 2024. Simultaneously, there was a mild surge in payment activities during this period, pointing towards heightened user interaction.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Here’s What the Dance Moms Cast Is Up to Now

2024-07-06 03:03