- Ripple exec stated that an XRP ETF approval was likely this year.

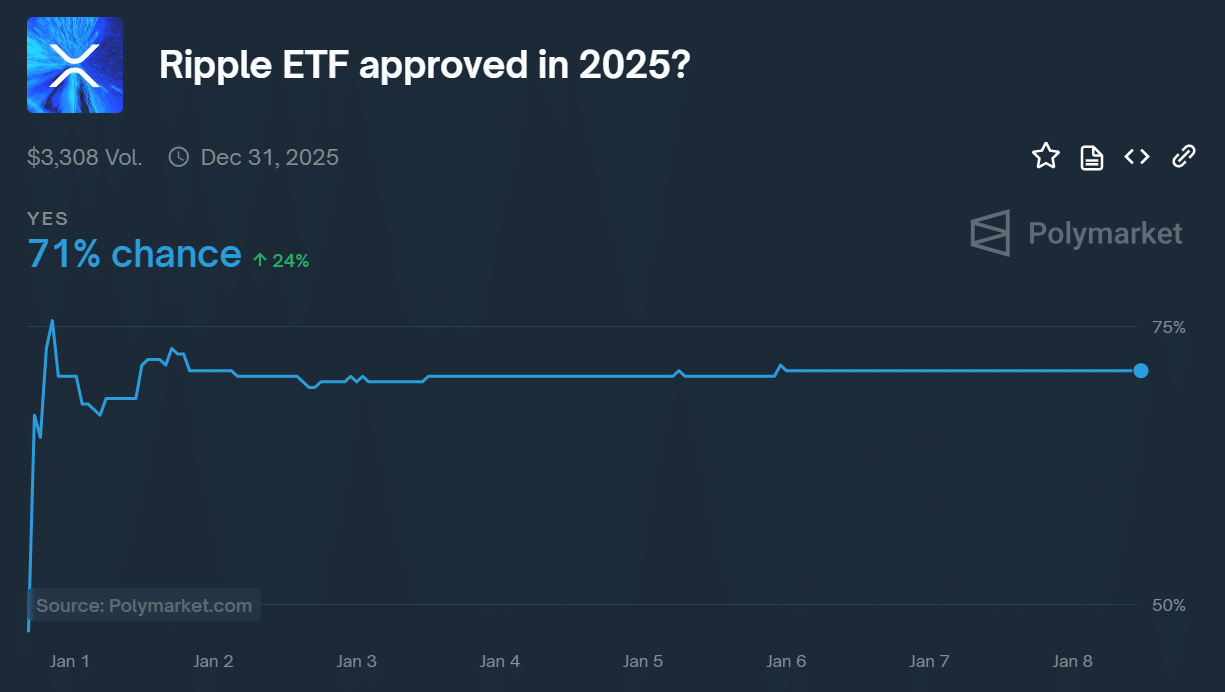

- Polymarket priced a +70% chance of ETF approval in 2025.

2025 looks promising for altcoins, as there’s a lot of positive anticipation regarding the possible acceptance of multiple ETFs (Exchange-Traded Funds) in the crypto market.

In a recent Bloomberg chat, Ripple’s president, Monica Long, emphasized that an Exchange Traded Fund (ETF) based on XRP could potentially follow the trend set by U.S. spot Bitcoin and Ethereum ETFs.

This year, we anticipate an increase in approved spot cryptocurrency exchange-traded funds (ETFs) originating from the United States. It’s my belief that XRP could very well be the next digital asset to gain widespread acceptance, following Bitcoin and Ethereum.

Mentioned clearly that Canary Capital, along with other possible initiators, have submitted XRP ETF proposals to the Securities and Exchange Commission (SEC). It is possible that these applications may receive faster approval due to the change in administration.

She mentioned that the Ripple dollar (RLUSD) is soon expected to become available on leading platforms such as Coinbase.

XRP ETF vs. SEC lawsuit

2023 saw U.S. District Judge Analisa Torres decide that XRP wasn’t classified as a security during its sale on open markets. However, it falls under the Securities and Exchange Commission’s jurisdiction when it is provided to big-time investors directly.

Following the latest legal action taken by Coinbase, it won’t be long before we find out if digital asset trades on ‘secondary markets’ are classified as ‘securities’, thanks to potential regulatory clarification.

The case concerning whether the Securities and Exchange Commission (SEC) correctly classified “transactions involving secondary market digital assets” as securities will now move forward to the Second Circuit Court for determination.

Reacting to the update, Jake Chervinsky, chief legal officer (CLO) at Variant Fund, stated,

The lower court has permitted an early review, focusing on if trading of digital assets in secondary marketplaces falls under securities regulations. Now, it’s up to the Second Circuit Court to potentially rule that the Securities and Exchange Commission (SEC) made an error in this matter.

If the court agrees with Judge Toress’s decision, it may strengthen the legal position of XRP. However, if the sale of tokens on exchanges is deemed ‘security,’ this could potentially hinder the chances of an XRP Exchange Traded Fund (ETF).

The Securities and Exchange Commission (SEC) plans to challenge Toress’s decision, and they have until January 15th to take action.

Under the speculation that the decision might be overturned under the new government, there’s a strong possibility that XRP’s price may significantly fluctuate next week due to the regulatory action.

In summary, according to prediction site Polymarket, there’s a 70% likelihood that an XRP ETF will be approved in 2025, reflecting the general anticipation within the market.

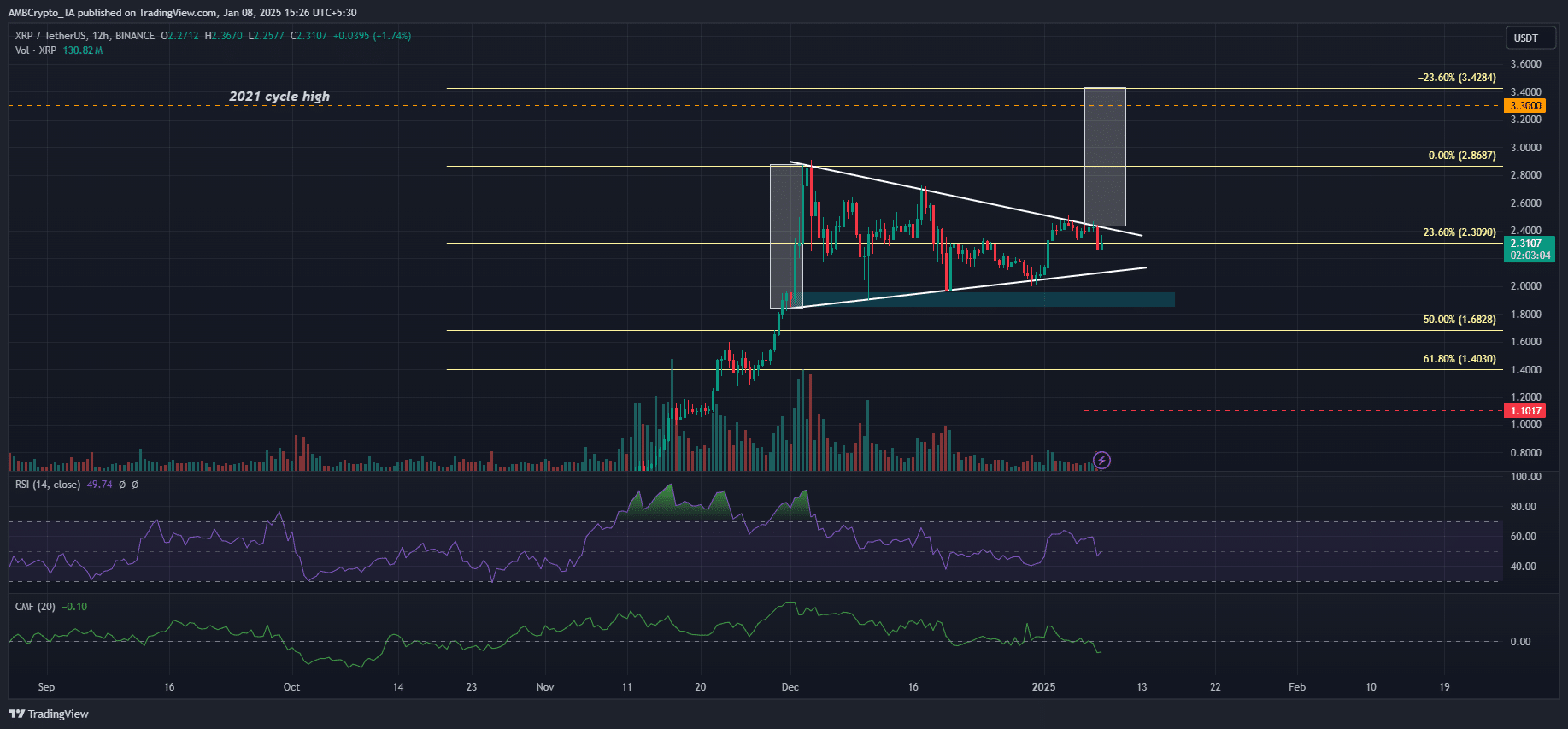

On the graph, XRP is currently holding steady inside a triangular formation. A potential breakout from this structure might propel it towards $3.4, or alternatively, push it down towards $1.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2025-01-08 22:15