-

A second potential issuer filed for the U.S. spot XRP ETF.

However, the altcoin remained muted post-SEC appeal against Ripple Labs

As a seasoned researcher with over two decades of experience in the financial markets, I find myself intrigued by the recent developments in the world of cryptocurrencies. The latest move by Canary Capital to file for a U.S. spot XRP ETF is indeed an interesting twist in this rapidly evolving landscape.

Canary Capital has entered the competition to create a U.S. exchange-traded fund (ETF) based on Ripple [XRP]. On October 8th, they submitted an S-1 form, which is an initial document for registering securities, to the Securities and Exchange Commission (SEC).

The filing comes a week after Bitwise made a similar application with the regulator.

Canary Capital is a new investment firm launched by Steven McClurg, a co-founder of Valkyrie Fund.

The firm’s spokesperson cited a ‘progressive regulatory’ space as the reason for the move.

Positive indications suggest a forward-thinking regulatory landscape, along with increased investor interest in advanced crypto investments beyond Bitcoin and Ethereum. This interest particularly focuses on enterprise-level blockchain technologies and their associated tokens like XRP.

The latest XRP ETF filing has renewed market optimism about the altcoin.

Reactions to the filing

In response to the filing, Nate Geraci from ETF Store expressed confidence that the approval of an XRP ETF is not a matter of “if,” but rather a question of “when.” However, he noted that the result might be influenced by the upcoming U.S. elections.

More filings for an XRP-based Exchange Traded Fund (ETF) are emerging, and it seems like approval is not a question of ‘if,’ but rather ‘when.’ However, that ‘when’ will likely be pushed back significantly unless there’s a shift in the current administration.

Most market analysts agreed on this position following Bitwise’s filing for a comparable application the previous week.

Market analysts believed that the decision was influenced by the impending U.S. elections, since there was yet to be regulatory certainty from the current administration regarding other cryptocurrencies such as XRP and Solana [SOL].

Ripple Labs-SEC lawsuit

The ongoing legal dispute between Ripple Labs and the SEC is adding complexity to efforts to create an Exchange Traded Fund (ETF) based on XRP, from a regulatory perspective.

On October 2nd, the regulatory body filed an appeal contesting the decision that classified the sale of XRP to institutional investors as a ‘securities transaction,’ while exempting such sales to the general public from this classification.

Ripple deemed the appeal as unreasonable and off-target. This suggested that the regulatory body might still view XRP as a security, which could potentially hinder its approval process.

Therefore, it’s widely anticipated among market analysts that a shift in the Securities and Exchange Commission (SEC) or the U.S. administration might bring clarity regarding the legal status of the remaining cryptocurrency tokens.

Impact on XRP

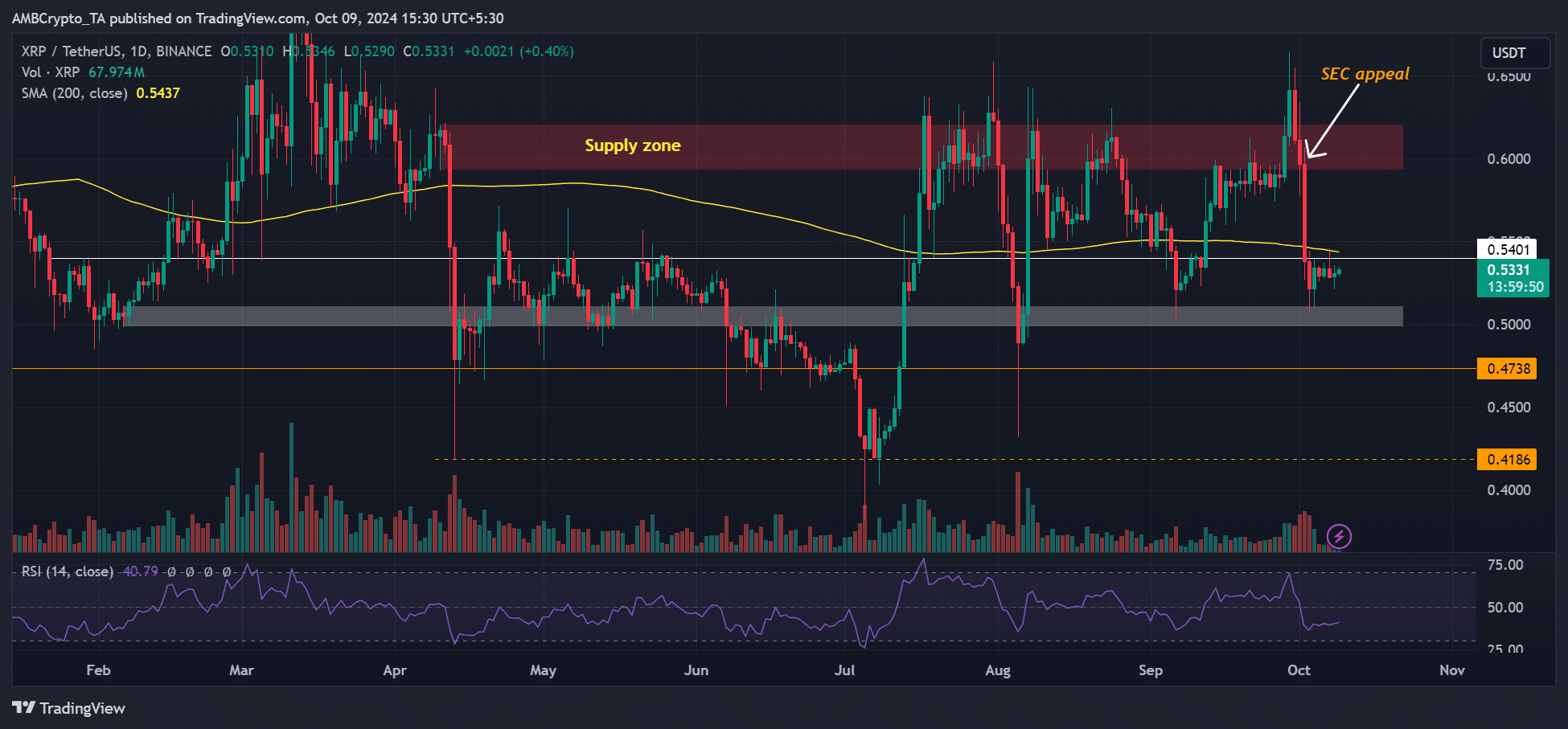

After the SEC’s appeal on October 2nd, XRP‘s price has decreased from $0.6, causing its overall trend to become more negative as it fell below its 200-day moving average (MA), indicating a bearish market condition.

At the moment of writing, the recent update on the XRP ETF didn’t bring significant changes. Over the last few days, the price has been holding steady below approximately $0.54.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-10-09 17:12