- XRP holders are monitoring whether the SEC will make an appeal by the 15th of January.

- The agency’s appeal could be dismissed, paving the way for a likely XRP ETF approval.

As a long-time crypto investor with a knack for spotting trends and navigating market fluctuations, I can confidently say that the upcoming decision by the U.S. SEC regarding their appeal on XRP is a pivotal moment for the entire altcoin community. The potential dismissal of the appeal could open the floodgates for an XRP ETF approval, which has been eagerly anticipated by many in the crypto world.

members of the Ripple (XRP) community are eagerly waiting for the deadline of the U.S. Securities and Exchange Commission’s (SEC) appeal, which falls on the 15th of January. They are closely watching this event as it could influence the future prospects of an XRP exchange-traded fund (ETF).

In November, the agency asked for more time to file its appeal, which some speculated was done to see the results of the U.S. elections first.

Currently, there’s uncertainty about whether the Securities and Exchange Commission (SEC) will follow through with its appeal due to the approaching pro-cryptocurrency administration led by President Trump and the appointment of Paul Atkins as SEC chair.

A former SEC lawyer, Marc Fagel, stated that the new regime could dismiss the appeal. He said,

For the time being, we’ll carry on with the appeal, which typically lasts around a year. However, it’s worth noting that a future administration might choose to discontinue this appeal. While such an action has not occurred in the past, it’s theoretically possible – even probable.

Is XRP ETF closer than most think?

If the appeal regarding XRP’s security status is rejected, it might help the regulator to clarify that XRP does not qualify as a security, which could potentially speed up the process for approving an XRP-based ETF. To date, the agency has only approved ETFs based on Bitcoin and Ethereum because these digital assets are considered non-securities.

Nevertheless, there’s optimism among investors that the upcoming administration may give the green light to multiple Exchange-Traded Funds (ETFs) based on altcoins by the year 2025.

At present, SEC filing documents for U.S. spot XRP ETFs have been submitted by entities such as Bitwise, Canary Capital, WisdomTree, and 21Shares.

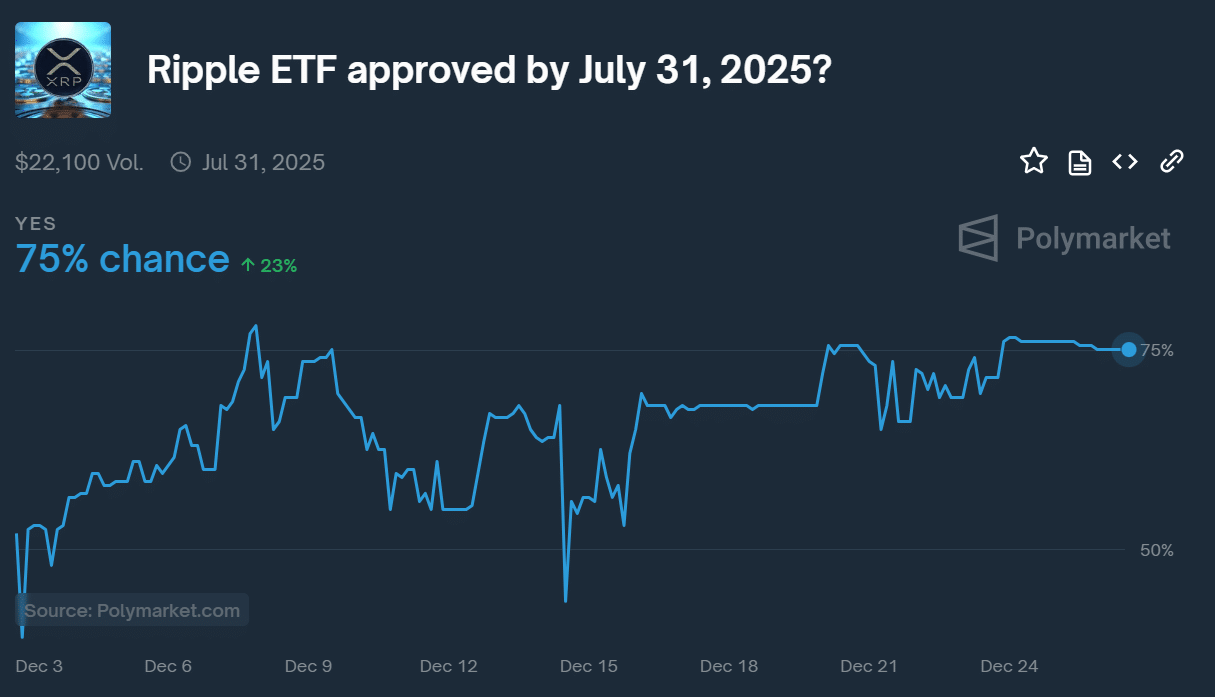

Currently, at the present moment, prediction platform Polymarket is estimating a 75% likelihood that an XRP Exchange-Traded Fund (ETF) will be available by the year 2025.

It seemed likely that XRP investors anticipated a surge in price, potentially fueled by speculation surrounding the possible approval of an ETF.

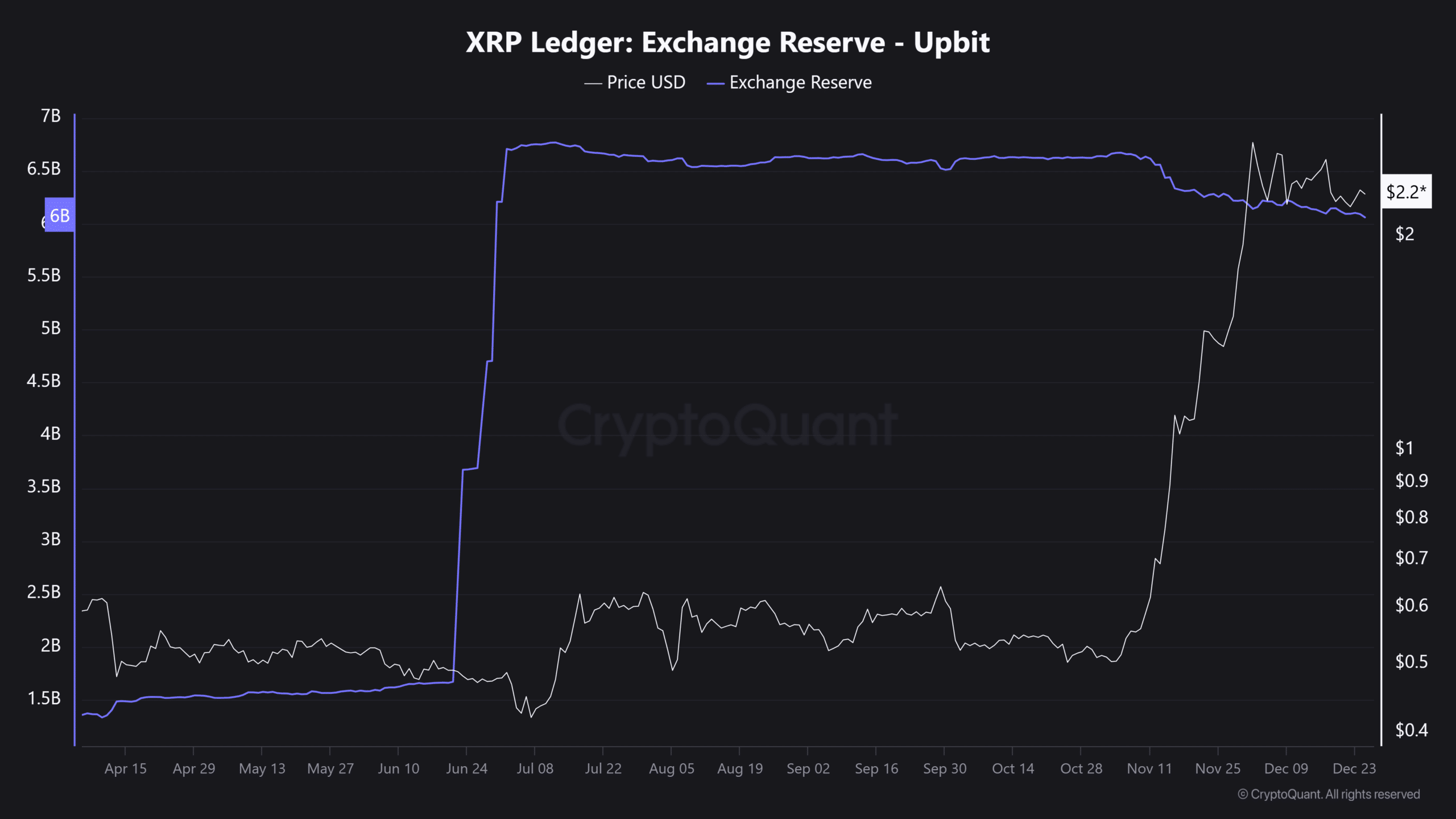

Based on information from CryptoQuant, the South Korean exchange Upbit, known for having the most significant XRP holdings, has reduced its XRP tokens from 6.6 billion to 6.0 billion. This suggests that users chose to keep their tokens even during the substantial 465% surge in XRP’s value in November, indicating a preference to hold onto their investments rather than sell.

It’s worth noting that the significant increase in sell pressure observed in this instance contrasted with the 100% rally experienced in July, where Upbit’s reserve of tokens surged from 1.6 billion to a staggering 6.7 billion – a remarkable 300% jump.

Essentially, XRP investors may find themselves in a state of anticipation regarding the ETF decision and the projected altcoin boom around 2025. Since some analysts predict that an ETF approval could drive XRP’s price over $5, their patience might prove beneficial.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Elden Ring Nightreign Recluse guide and abilities explained

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-12-27 03:03