So, Canary’s XRP ETF filing is making waves, huh? Big deal. Institutions want in on XRP now? What, they just noticed it exists? 🧐 Anyway, it’s supposed to be a “fully compliant, exchange-traded framework.” Because nothing says “mainstream” like a bunch of suits finally catching up to what the rest of us already knew. 🚀

Canary’s XRP ETF Filing: Wall Street’s Latest Crypto Fling 💼💖

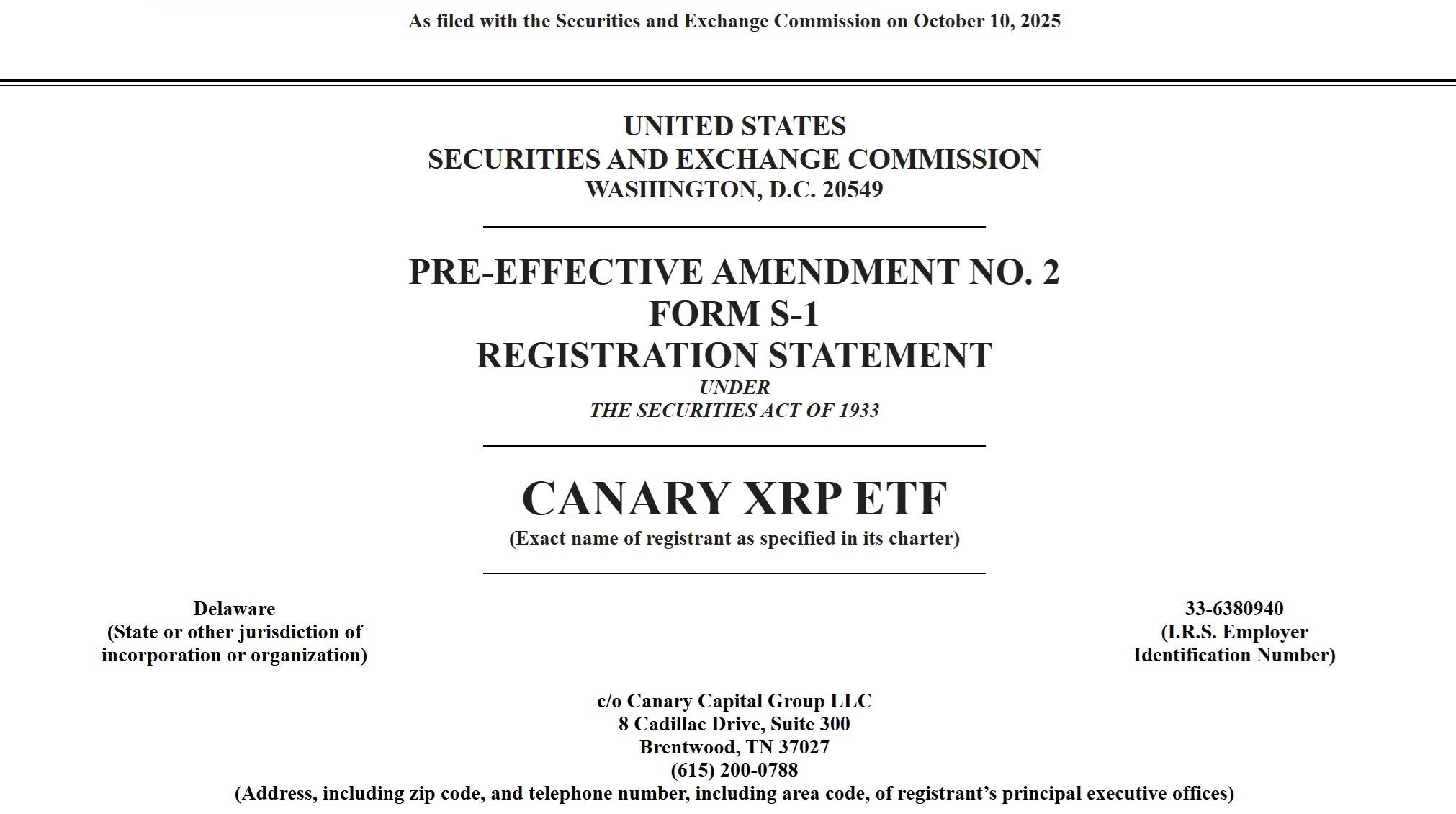

Apparently, a wave of XRP spot ETF filings hit the SEC on Friday. Big whoop. Everyone’s jumping on the bandwagon now. Canary Capital Group LLC filed Amendment No. 2 for their pre-effective Form S-1. Because nothing says “we’re serious” like more paperwork. 📜

Filed on Oct. 10, they plan to list this thing on the Cboe BXZ Exchange under the ticker “XRPC.” Finally, a way for investors to get in on XRP without actually owning it. Because who wants to deal with wallets and keys? Too much work. 🙄

Here’s the kicker: “The Canary XRP ETF is an exchange-traded product that issues shares of beneficial interest that trade on the Cboe BXZ Exchange Inc.” Blah blah blah. Basically, it’s a way to track XRP’s value without the hassle. Net of expenses, of course. Because nothing’s free in this world. 💰

In seeking to achieve its investment objective, the Trust will hold XRP and establish its net asset value (NAV) by reference to the Coindesk XRP CCIXber 60m New York Rate. Fancy words for “we’re keeping an eye on the price.” 🕵️♂️

“The Trust provides investors with the opportunity to access the market for XRP through a traditional brokerage account without the potential barriers to entry or risks involved with acquiring and holding XRP directly.” Translation: We’re making it easy for the lazy rich folks. 🤑

Oh, and they’re not using derivatives. Because who needs extra risk when XRP is already a rollercoaster? 🎢

The Trust will not use derivatives that could subject the Trust to additional counterparty and credit risks. Smart move. Or just obvious. 🤷♂️

The XRP will be held by Gemini Trust Company and Bitgo Trust Company. Because if you’re gonna trust someone with your crypto, it might as well be companies with “Trust” in their name. 🤔 Pricing will be based on the Coindesk XRP CCIXber 60m New York Rate. Fancy way of saying “we’re watching the price like hawks.” 🦅

Sure, there are risks-volatility, regulatory stuff. But analysts are calling this a “pivotal step.” Because apparently, bridging crypto and regulated finance is a big deal. Who knew? 🤷♀️

FAQ 🧭

- What is the Canary XRP ETF and why should I care?

It’s a way for institutions to get into XRP without actually owning it. Because who wants to deal with the hassle? 🛂 - Where will this thing trade and what’s the ticker?

Cboe BXZ Exchange, ticker “XRPC.” Finally, a way to trade XRP like it’s Apple stock. 🍏 - How are they keeping this secure?

Gemini and Bitgo are holding the XRP. Because if you’re gonna trust someone, trust companies with “Trust” in their name. 🤝 - Why’s everyone making a big deal about this?

Analysts say it’s a “milestone.” Because apparently, Wall Street finally noticing crypto is groundbreaking. 🙄

Read More

- Best Controller Settings for ARC Raiders

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- How to Get the Bloodfeather Set in Enshrouded

- These Are the 10 Best Stephen King Movies of All Time

- Meet the cast of Mighty Nein: Every Critical Role character explained

- How to Build a Waterfall in Enshrouded

- Yakuza Kiwami 3 And Dark Ties Guide – How To Farm Training Points

- Best Werewolf Movies (October 2025)

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- 5 Reasons Zootopia 2’s Reviews Are So Great (& How They Compare to the First Movie)

2025-10-14 02:30