- XRP faces mounting resistance near $2.40, triggering a 10% correction to $2.00

- Liquidations and profit-taking add pressure, making the $2.00 level crucial for XRP

As a seasoned researcher with years of market analysis under my belt, I have witnessed many bull and bear cycles, but the unpredictability of cryptocurrencies never ceases to amaze me. XRP, once again, has hit a critical juncture at the $2.00 support level, a psychological and technical battleground where bulls and bears clash.

The surge of XRP reached a barrier at approximately $2.40, resulting in a decline exceeding 10% as it approaches the significant support level of $2.00. Although market-wide weakness is influencing this trend, it seems that escalating liquidations and profit-taking are exacerbating the downward movement.

With traders focusing on the $2.00 mark, there’s a sense of uncertainty: will XRP manage to maintain its position or might further declines be in store?

XRP rally stalls at $2.40 amid mounting resistance

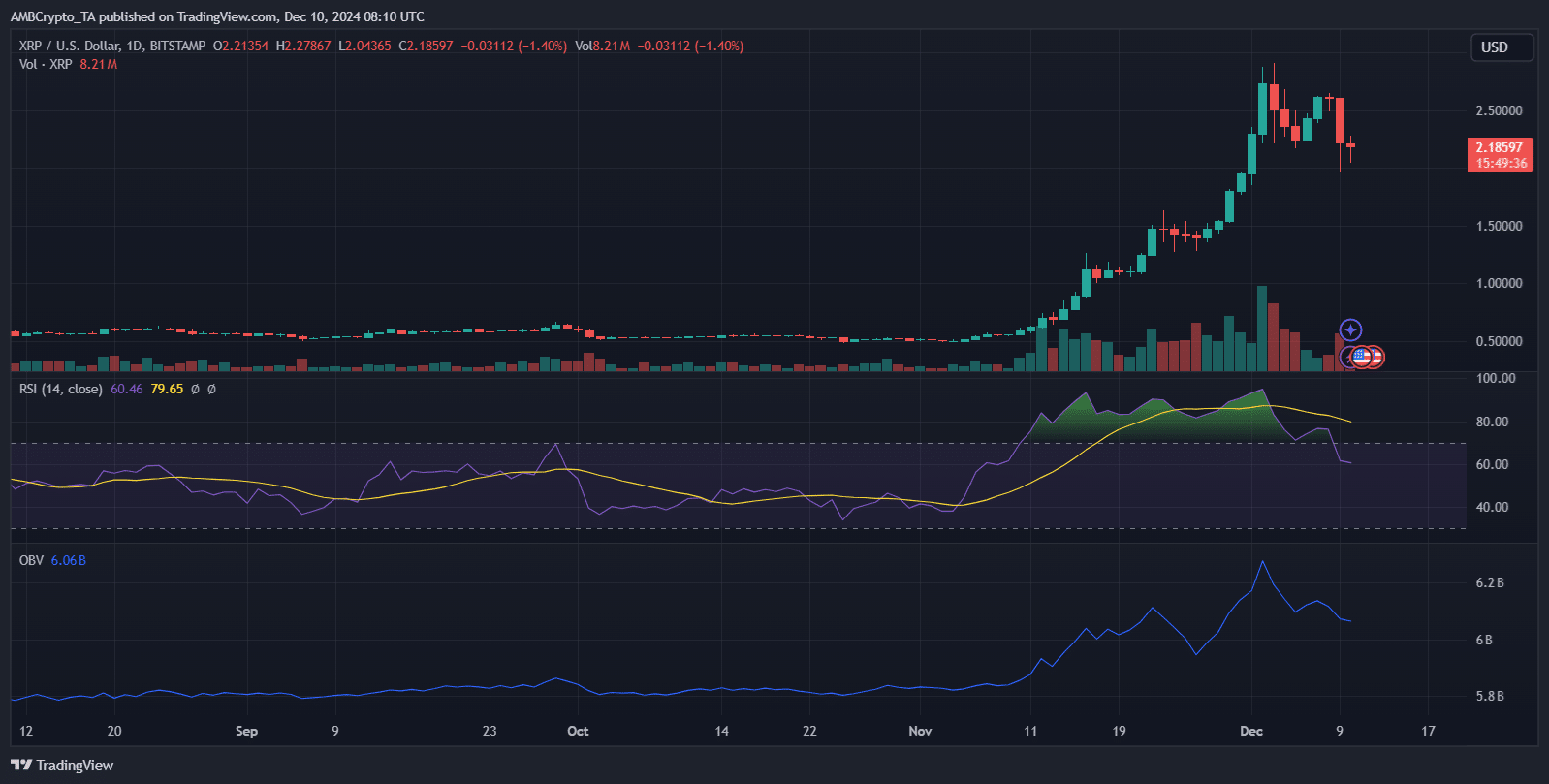

The surge of XRP up to $2.50 was halted by the resistance at $2.40, causing a steep decline that dropped its price below $2.30. At the moment of reporting, the Daily Relative Strength Index (RSI) has pulled back from overbought status, reaching 60.65, suggesting a decrease in the bullish momentum.

As the OBV decreased from its highest point, it suggested less buyer interest and diminishing excitement within the market.

Even though XRP briefly rose above $2.20, its inability to hold onto the $2.30 level and the presence of negative momentum signs imply that there is ongoing selling force at play.

As a crypto investor, I’ve noticed that without a strong break above the $2.30 mark, XRP might continue to face potential downward pressure. It’s crucial to keep an eye on the $2.00 level as it could act as a significant support point in case of further price drops.

The $2 support: XRP’s critical line in the sand

For XRP, the $2.00 mark is a crucial point of stabilization. This level holds significance not just theoretically but also technically. In the past, significant round figures like $2.00 have attracted traders, frequently functioning as a solid base or catalyst for potential price drops.

In simpler terms, if we fail to hold onto this current level, it might indicate a change in XRP’s mid-term direction, possibly leading to a more significant drop towards the support levels of around $1.88 or even $1.75.

If the price dips significantly below $2.00, it might lead to a chain reaction of margin calls on leveraged positions, intensifying the downward trend. Currently, the Relative Strength Index (RSI) indicates bearish market conditions and the price is having trouble staying above significant moving averages. Maintaining the $2.00 level is crucial to avoid further losses.

If this backing doesn’t hold up, it might lead to increased market turbulence and possibly disrupt the ongoing bullish market rebound in the short term.

The role of liquidations and investor sentiment

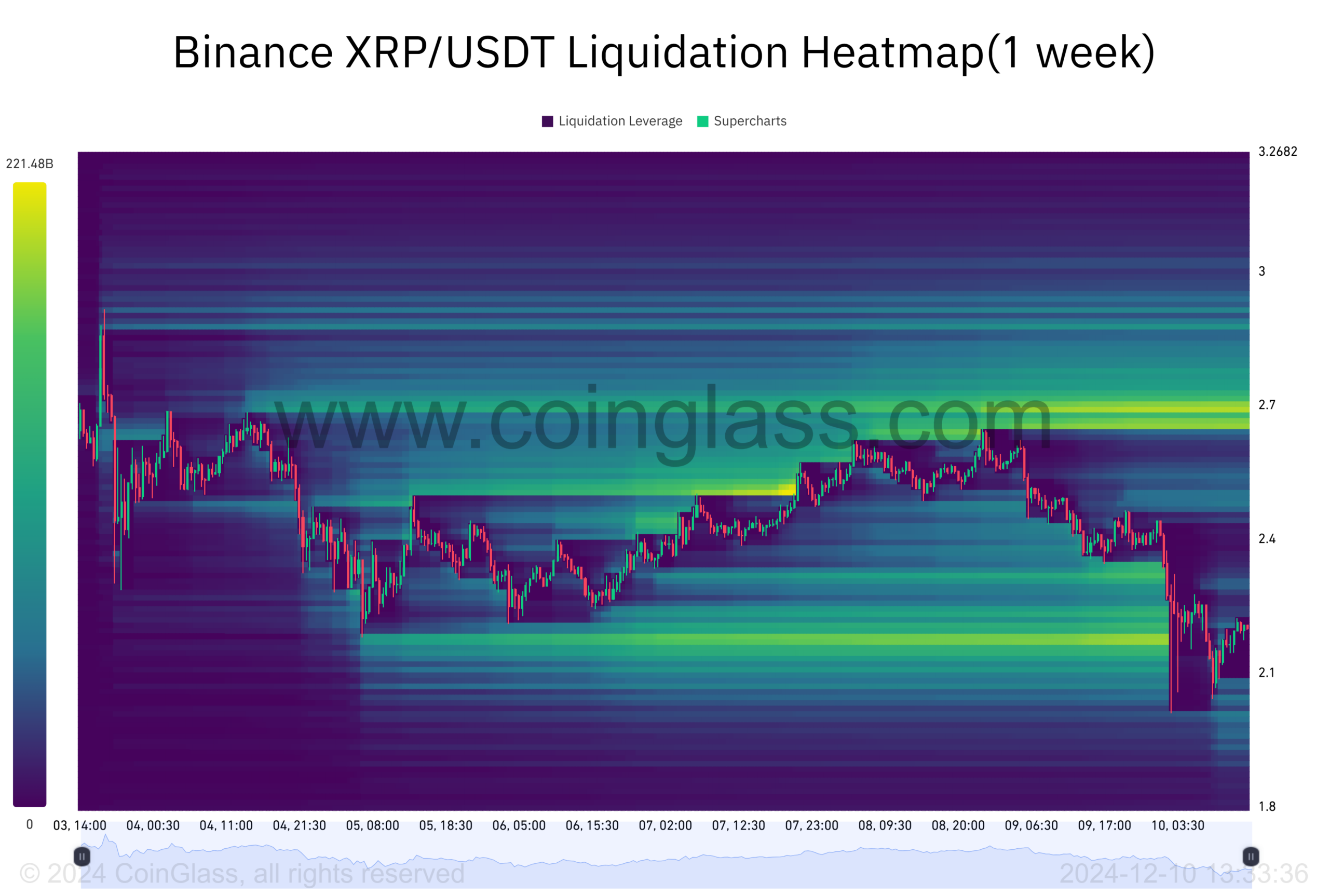

The data on the liquidation process indicates a notable instability in XRP’s price decline from $2.50 to $1.98. A color-coded chart, or heatmap, demonstrates that many liquidations occurred around $2.40 and $2.25, and there was particularly heavy activity close to $2.10, where a large number of long positions were terminated forcibly.

This suggests overleveraged traders contributed to the price cascade, compounding bearish momentum.

The actions performed on the blockchain suggest an increase in retail withdrawals and possible large-scale selling by whales as XRP neared a crucial support level. If the price exceeds $2.00, further liquidations might exacerbate market volatility, following similar trends observed recently.

These dynamics show the precarious balance between technical levels and market sentiment.

Is XRP poised for a reversal or more losses?

The potential for XRP to reverse its decreasing trend depends on whether it can surpass the $2.30 barrier and establish stability – the road to restoration looks unclear, given that liquidation pressures remain prominent.

Read XRP’s Price Prediction 2024–2025

If the price rebounds from the $2.00 support, it might initiate a brief uptrend. However, if the pace of selling increases significantly, XRP could face further drops, possibly reaching below the $2.00 mark.

The direction for XRP’s future price movement will largely hinge on the overall market mood and the trading strategies of those using leverage. Therefore, it is imperative to make a clear decision in order to predict where XRP might be headed next.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-12-10 16:08