-

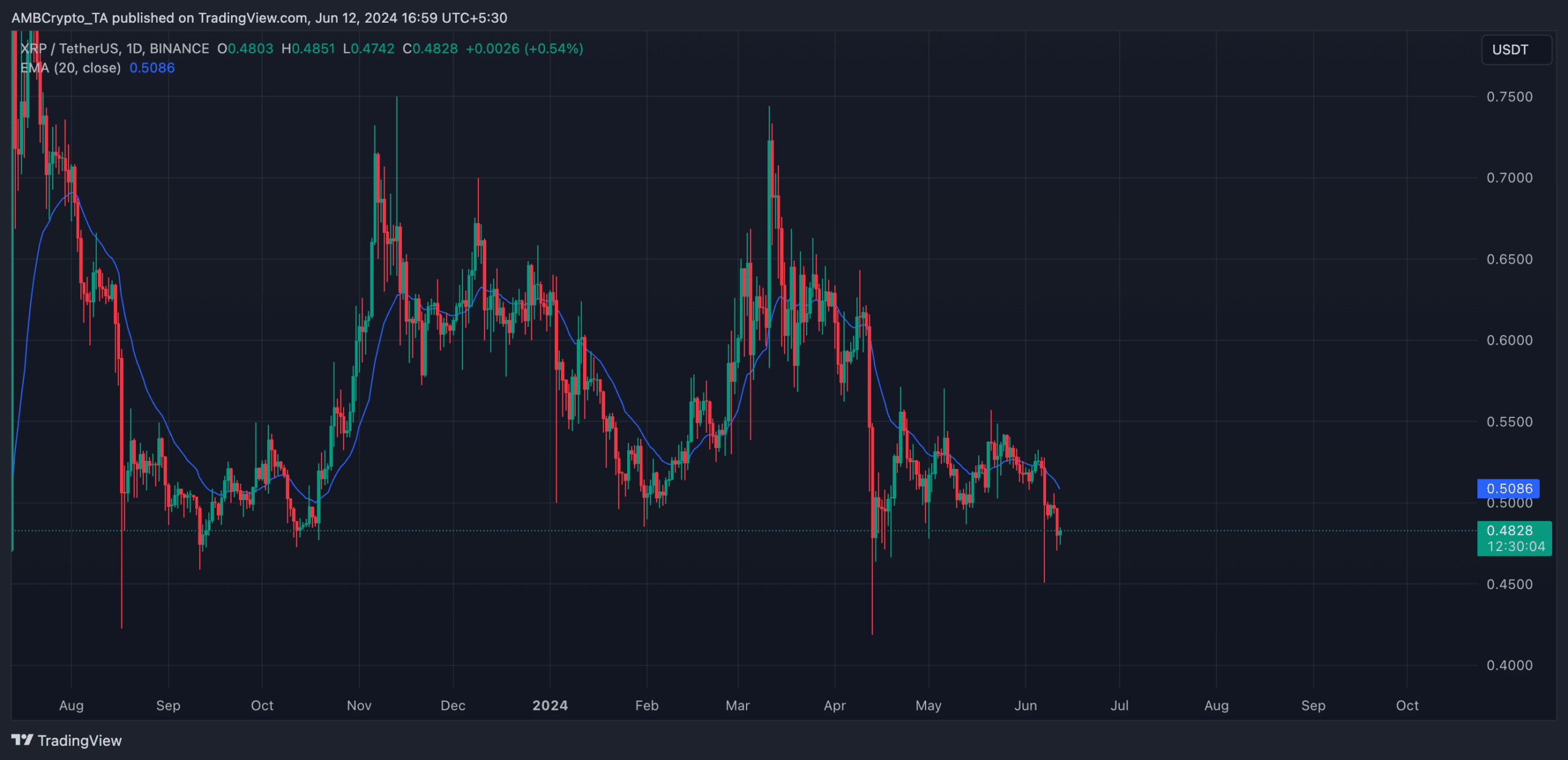

XRP’s price has dropped by almost 10% in the last week.

It now trades below its 20-day EMA.

As a researcher with experience in analyzing cryptocurrency markets, I’m concerned about the recent price drop of XRP. In just one week, its value has declined by almost 10%, and it now trades below its 20-day Exponential Moving Average (EMA). This is a significant shift in sentiment from bullish to bearish.

The price of XRP by Ripple has seen a decrease over the past week. Currently priced at around $0.5, this digital token has experienced a 8% decline based on recent market data from CoinMarketCap.

As an analyst, I’d rephrase it as follows: Based on my analysis of AMBCrypto’s findings, XRP dipped below its 20-day Exponential Moving Average (EMA) on June 7th. This average price indicator reflects XRP’s price trend over the previous 20 days.

If an asset’s price drops beneath its average pricing over the last twenty days, it is considered undervalued in the market. This occurrence signifies decreased demand for buying and heightened interest in selling. It indicates a transition from a bullish outlook to a bearish one.

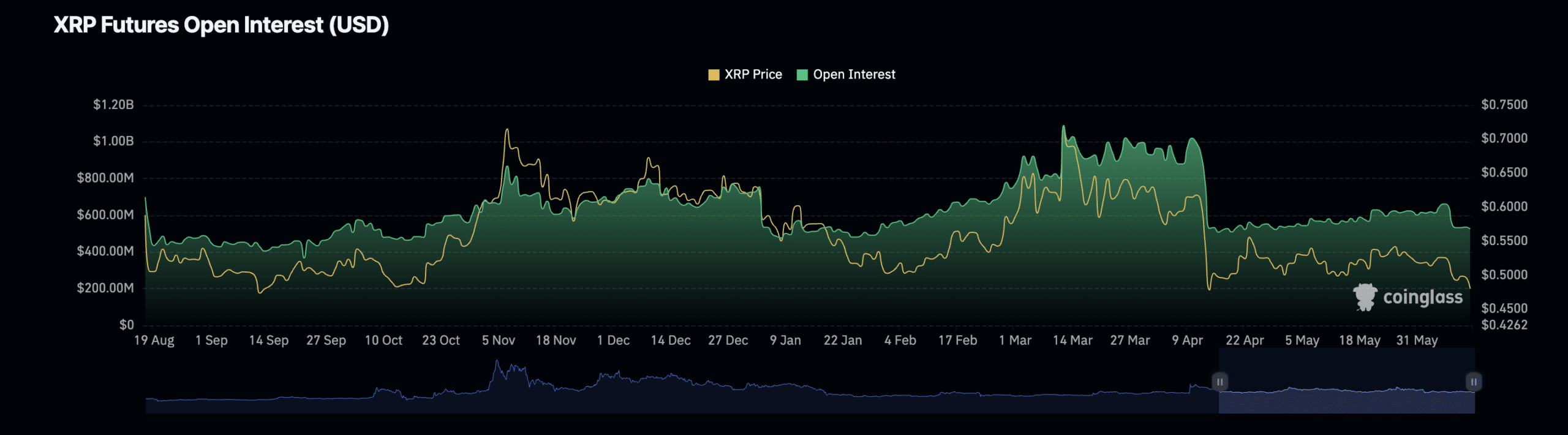

The decreasing open interest for XRP futures, currently at $525.57 million as of now, supports this observation. This figure represents a 20% decrease from the amount reported on June 6th, based on information from Coinglass.

The open interest for XRP futures refers to the number of open positions in these contracts, meaning those that have yet to be finalized through closing or settlement.

As an analyst observing market trends, when I notice a significant decline in the number of market participants entering the market without a corresponding increase in those leaving, it indicates a surge in sellers exiting their positions without replacing them with fresh buys.

XRP selling momentum skyrockets

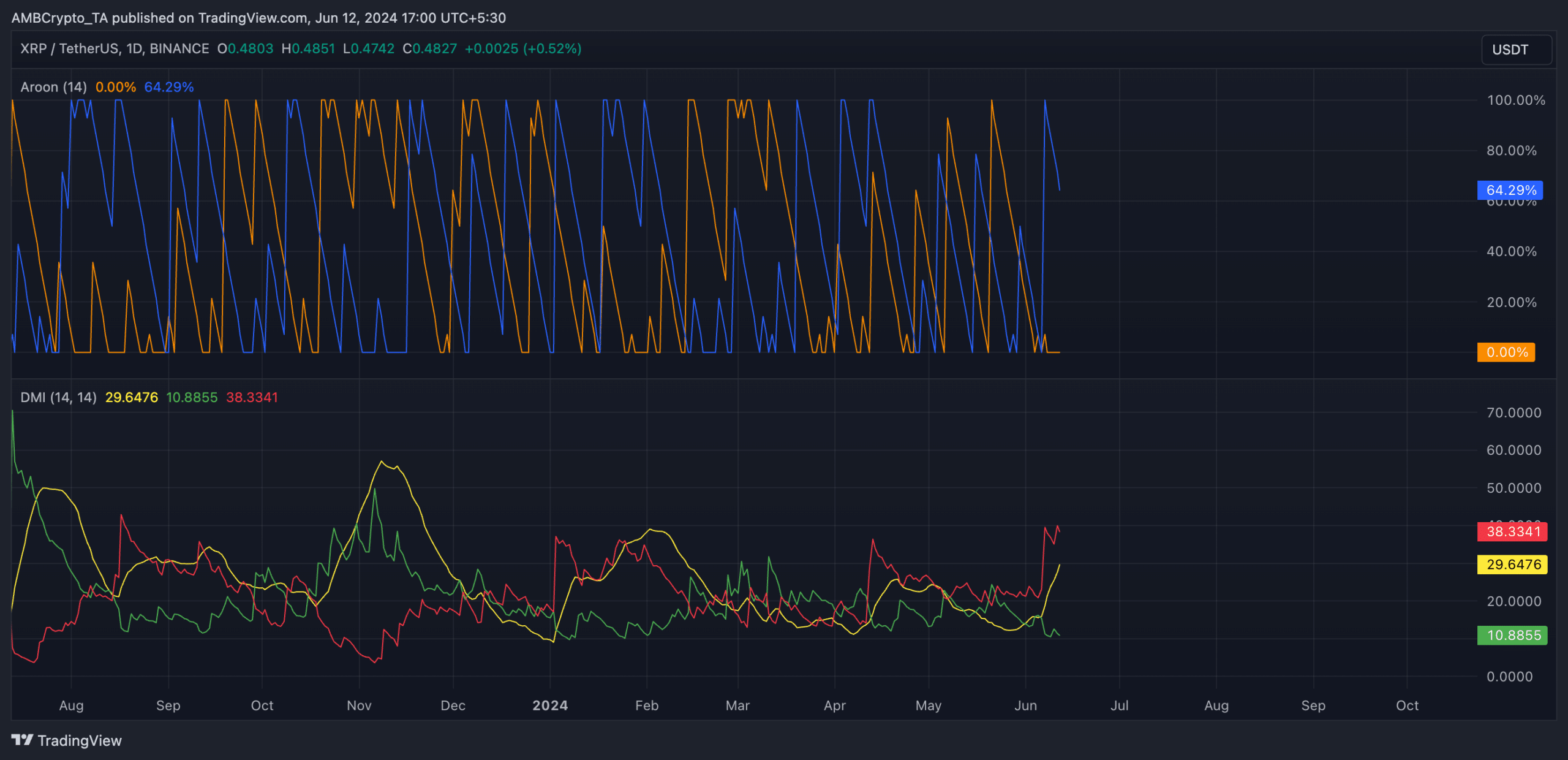

At the present moment, the Aroon Down Line of XRP, denoted by the blue line, stood firm at 64%, signifying a robust downtrend for the cryptocurrency.

The indicator highlights an asset’s trend direction and possible turning points. When the Down Line nears 100%, it implies a robust downward trend, indicating that the latest low was hit not too long ago.

At present, the significant indicators for XRP‘s momentum were situated beneath their neutral thresholds. The Relative Strength Index (RSI) stood at 35.12, and the Money Flow Index (MFI) was reported as 37.87.

At these levels, XRP traders were more inclined towards selling XRP tokens rather than buying new ones based on the signals from the momentum indicators.

As a researcher examining XRP‘s market trends, I’ve observed that the Directional Movement Index (DMI)’s positive directional indicator (represented by the green line) has been subdued compared to its negative directional indicator (red line) at the current moment.

Realistic or not, here’s XRP’s market cap in BTC terms

An asset’s DMI measures the strength and direction of a market trend.

When the positive indicator falls beneath the negative indicator, this signifies a downtrend in the market, indicating that sellers are more aggressive than buyers.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-06-13 07:03