- XRP faced bearish sentiment as the critical $2.73 resistance remained unbroken, frustrating traders.

- Futures Open Interest plunged $1 billion, exposing skepticism over XRP’s near-term recovery prospects.

As a seasoned analyst who has navigated through numerous market cycles, I find the current state of XRP particularly intriguing. The token has been locked in a prolonged consolidation phase, and while it’s not uncommon to see such periods in the crypto market, the absence of strong on-chain activity is a concern.

The recent drop in Futures Open Interest by over $1 billion is a stark reminder of the skepticism among investors. It’s like watching a party where everyone is talking, but no one is dancing – it lacks the energy needed for a breakout rally.

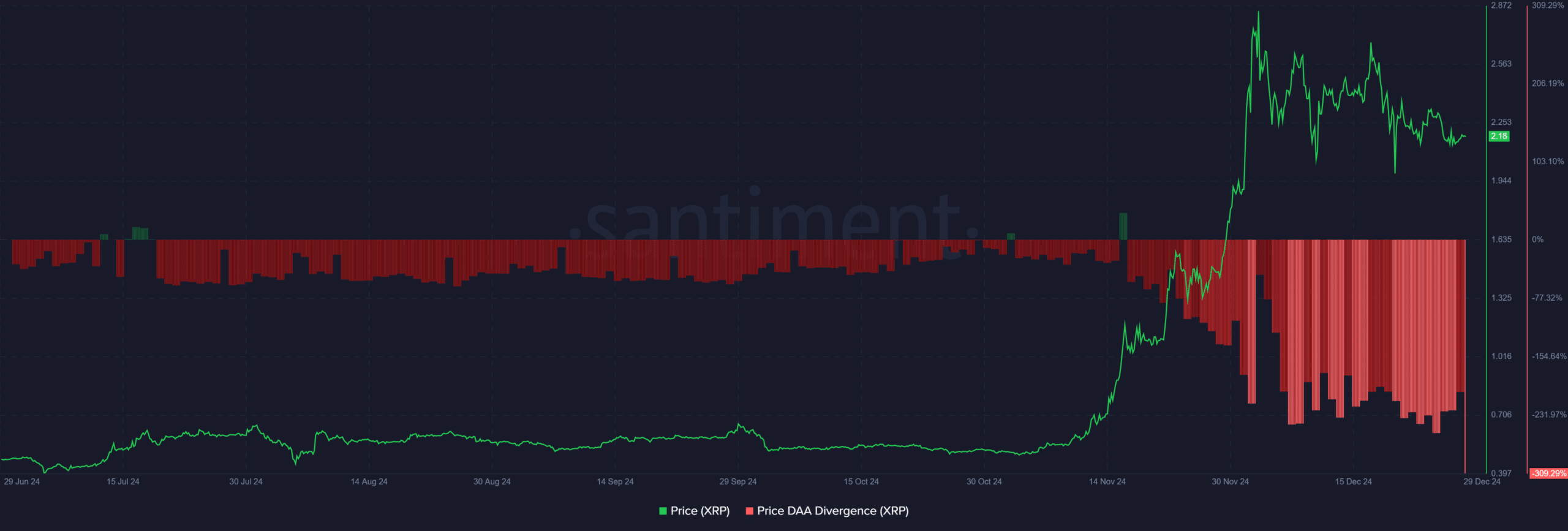

The Price DAA Divergence chart further underscores this point. It’s as if XRP’s price surge in late November was a mirage, leaving behind a trail of dust and disillusioned traders. The fact that network engagement failed to scale alongside the rally suggests that the price movement was more about speculative trading than organic growth or utility adoption.

However, it’s not all doom and gloom. The token remains above its critical $2.00 support, which acts as both a psychological and technical anchor. It’s like a lifebuoy in a stormy sea, keeping XRP afloat amidst the turbulence.

The next move for XRP will depend on broader market dynamics and the restoration of network confidence. Until then, it seems we’re stuck in a state of cautious equilibrium – a bit like waiting for a bus during rush hour: You know one is coming, but you never really know when.

And to lighten the mood, let me leave you with this joke: Why don’t we ever tell secrets on the blockchain? Because it always comes back to haunt us!

For more than a month, XRP has been stuck in an extended period of consolidation, remaining beneath significant resistance points without any indication of a sudden surge or breakthrough.

This lack of upward momentum has frustrated traders and eroded market confidence.

Lately, the data presents a dismal image: Over the past two days, the open interest for XRP Futures has plummeted by more than a billion dollars, suggesting a significant loss of investor confidence. What factors might be causing this sudden change in outlook?

XRP Futures OI sheds $1 billion

Over the course of two days, the Open Interest (OI) for XRP Futures decreased by a billion dollars, dropping from approximately 2.9 billion. This significant drop came after a potential breakout rally failed to sustain itself, dampening initial enthusiasm.

As investors pulled out their funds, a decrease in Open Interest (OI) indicated an increase in negative market feelings towards the asset. The repeated unsuccessful attempts to surpass significant resistance points have led to growing doubts about XRP’s short-term potential and trading dynamics.

XRP: Critical investor uncertainty?

The chart showing the divergence in XRP’s Daily Average Approach (DAA) revealed an important discrepancy between the network’s activity level and its price movement.

During the late November rise in XRP’s value, a significant decline was observed in the Divergence Against Average (DAA), suggesting that the level of user interaction on the network did not grow proportionately with the price increase.

This discrepancy indicates that the price fluctuations were mainly influenced by speculative activities, as opposed to genuine expansion of the network or increased usage for its intended purpose.

Following the rally, there continued to be a gap between DAA (Daily Active Addresses) and general market sentiment, indicating that on-chain participants maintained a consistent level of doubt or skepticism.

Without an uptick in active addresses, the price’s ability to sustain momentum may be in jeopardy.

As someone who has been closely following the cryptocurrency market for several years now, I must admit that the recent surge in the value of XRP has caught my attention. However, the noticeable lack of strong on-chain activity leaves me with concerns about its sustainability and potential for a near-term recovery.

In my experience, when a digital asset experiences a sudden increase in price without significant network activity to support it, it often results in a consolidated or downward trend. This could be the case with XRP unless some fundamental improvements are made within the network.

I believe that the key to unlocking XRP’s potential lies in addressing these underlying issues and fostering stronger on-chain activity. This would not only help solidify its position in the market but also build confidence among investors, ultimately leading to a more sustainable recovery.

Key levels to watch

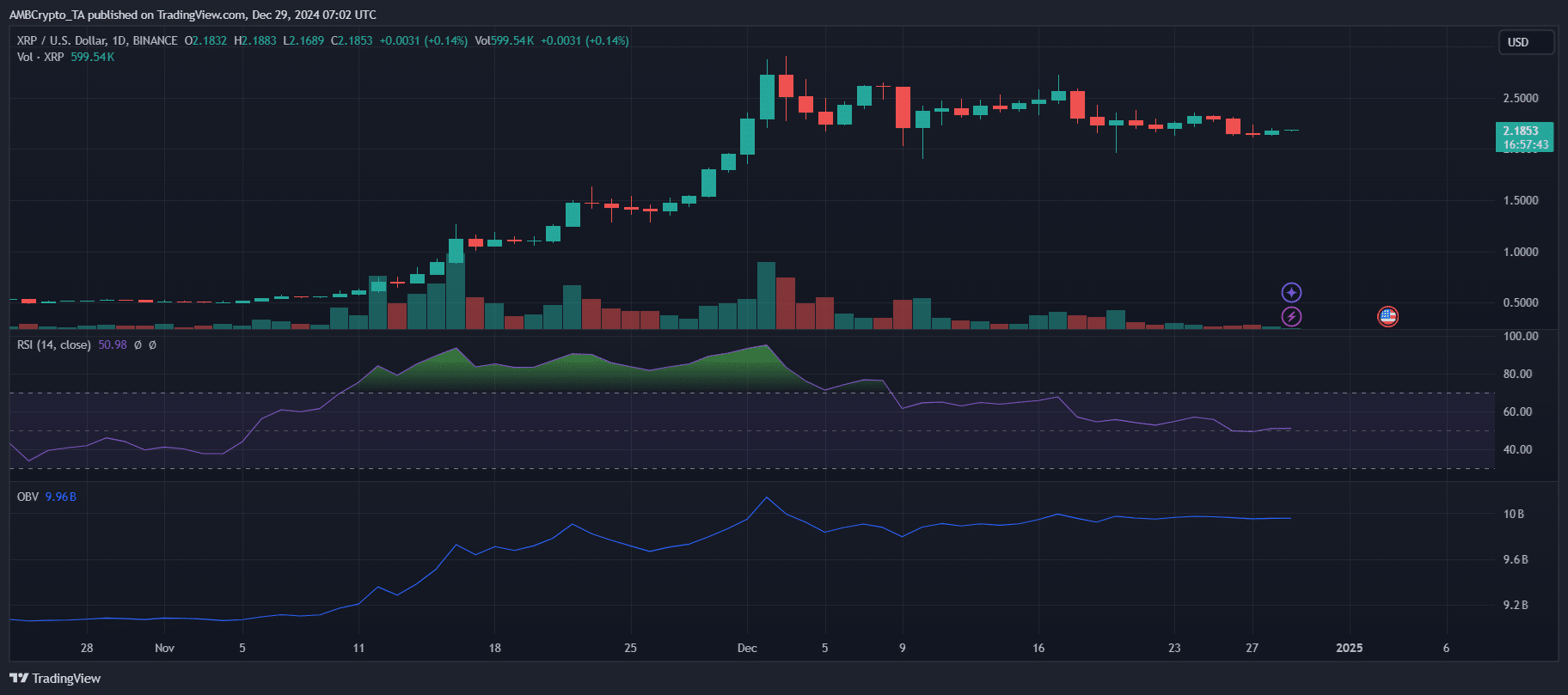

The current movement in XRP’s price is crucial, marked by an extended period of confinement below the $2.73 barrier, which serves as a significant resistance point.

Over the last four weeks, this particular token has lost about 20% of its worth. Remarkably, despite this decrease, it has maintained a position above the vital $2.00 support level.

At this stage, it functions as a stabilizer, psychologically and technically, holding back potential drops even with increasing unpredictability in the overall market scenario.

The indicators present a varied outlook regarding the token’s path, with the Relative Strength Index (RSI) being relatively stable at approximately 50.98. This suggests that the market is leaning toward neutrality, and traders appear undecided about their next move.

As someone who has spent years trading and investing in various markets, I have learned that trading volume is a crucial indicator of market health. In my experience, when trading volume remains low, it often indicates a lack of significant buying pressure needed for a breakout to occur. This means that even though the price might be moving, it’s not being driven by strong investor interest or conviction. As a result, I tend to approach such situations with caution and wait for clearer signs before making any investment decisions. In my view, understanding trading volume is essential for successful investing, as it provides insights into market sentiment and the potential for future price movements.

In a similar manner, the trend of OBV indicates a decrease in significant investments, leading to doubts about the token’s capacity to maintain its positive trajectory without fresh investment inflow.

If the price surpasses $2.73, it might trigger an upward trend potentially leading to XRP reaching its maximum historical value of $3.31, rekindling enthusiasm among investors.

Read XRP’s Price Prediction 2025–2026

Instead, if the $2.00 support is broken, it could make the current sluggishness worse, strengthening the negative outlook among traders.

Before a significant event or factor triggers change, XRP seems to be maintaining a balanced yet careful stance. Its future actions are largely dependent on broader market conditions and rebuilding trust within the network.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- PI PREDICTION. PI cryptocurrency

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- Dragon Ball Z: Kakarot DLC ‘DAIMA: Adventure Through the Demon Realm – Part 1’ launches between July and September 2025, ‘Part 2’ between January and March 2026

2024-12-29 18:16