-

XRP has a positive outlook based on the network value metrics.

A short-term drop was possible due to the magnetic zones just below the market price.

As an analyst with over two decades of experience in the cryptocurrency market, I find myself intrigued by Ripple [XRP]. The network value metrics suggest a positive outlook, but the short-term drop could be due to those magnetic zones just below the market price.

Currently, Ripple (XRP) is trading above a significant resistance area, which could potentially lead to an upward movement towards $0.7, its highest point in this range. At present, the short-term market outlook is overwhelmingly optimistic.

Despite a strong demand in the spot markets, it has remained relatively low. Since mid-July, the resistance level at approximately $0.63 has proven quite robust. AMBCrypto’s analysis suggests that accumulation is taking place, but the question remains: Is this accumulation sufficient to trigger a rise towards the upper range limits?

On-chain metrics point toward bullishness

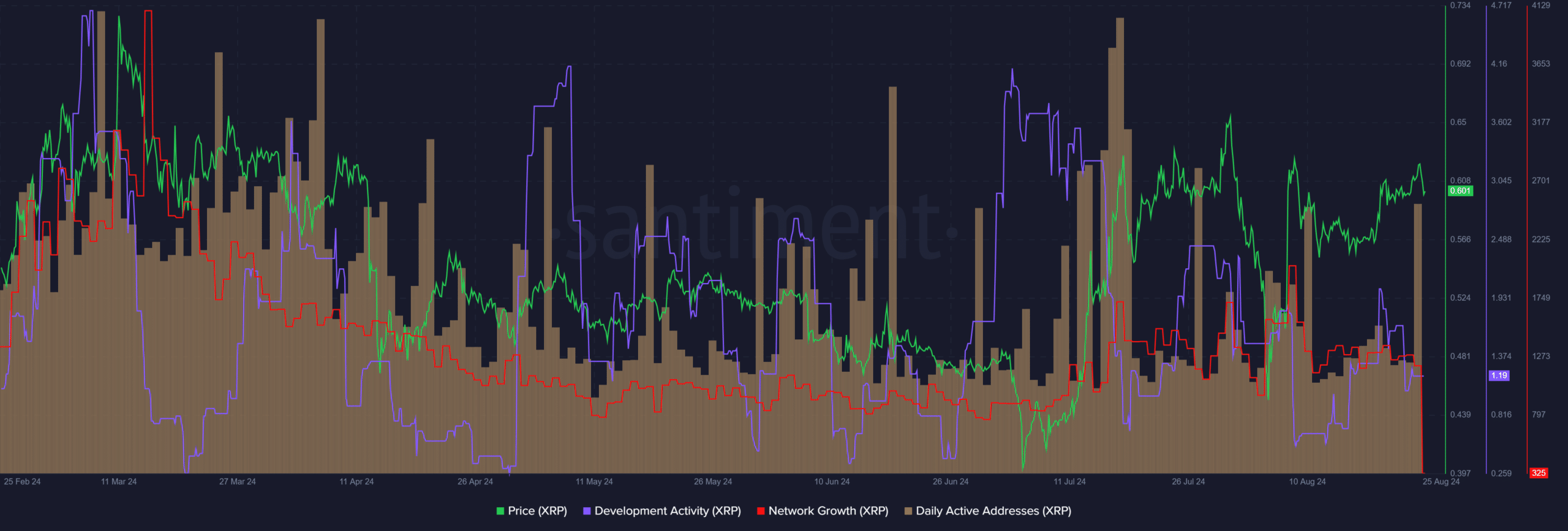

1) The level of progress has been minimal, and it’s also been on a downward trend lately. This isn’t particularly promising for those considering long-term investments.

In mid-July, there was an extraordinary surge in daily active users following the court decision in the SEC case. However, activity levels have since settled down. Meanwhile, the network’s growth rate has been steady, with a slight increase observed since June.

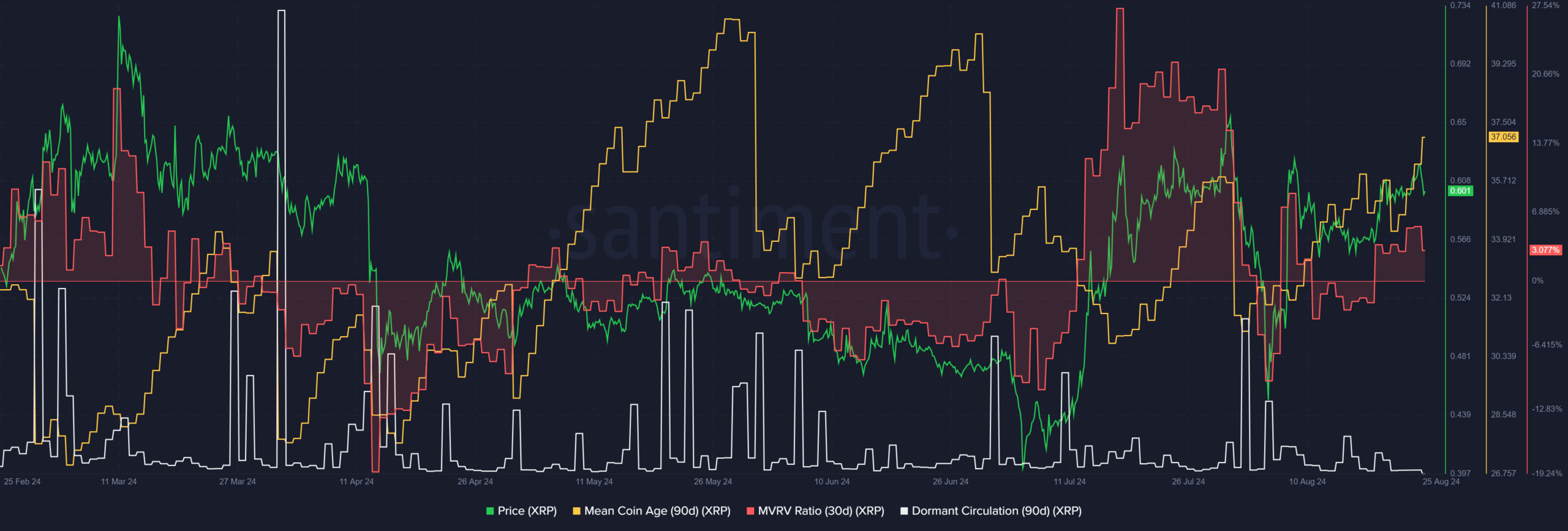

Following a significant decrease in prices during early August, the average age of coins started increasing, indicating that the token was being hoarded or accumulated. Simultaneously, the number of tokens lying dormant also decreased, suggesting less movement of tokens which might be a precursor to increased selling pressure.

Recently, the temporary MVRV (Maker of Realized vs. Unrealized Value) indicated that holders have made small profits. However, these profits are far from reaching the levels seen in mid-July. The growth of XRP was significantly affected by profit-taking and a general shift in market sentiment at that time.

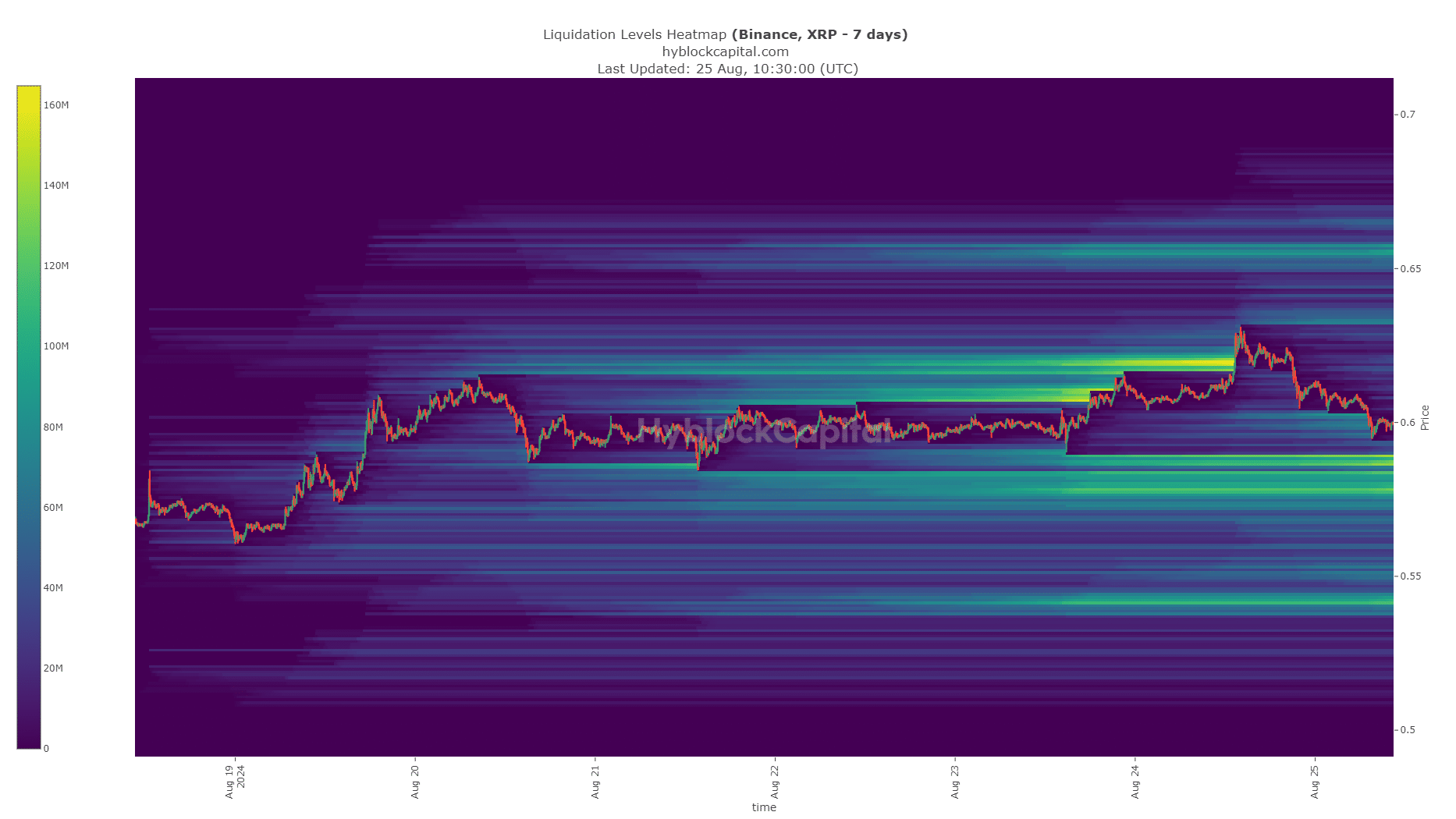

Liquidity favors an XRP price drop

According to AMBCrypto’s analysis, the data from the liquidation map indicated a potentially negative trend. The liquidation points were heavily concentrated in the range between $0.58 and $0.59.

As a crypto investor, I’ve got my eyes on XRP. While it might dip to certain levels, there’s a strong possibility that this could trigger a bullish rebound. If things pan out as expected, we might see XRP soaring towards the upper end of its range, potentially hitting $0.7.

Read Ripple’s [XRP] Price Prediction 2024-25

Meanwhile, it’s worth mentioning that according to Stuart Alderoty, Ripple’s Chief Legal Officer, in the Kraken case, it was established that cryptocurrencies are not classified as security assets.

He thought that this development would negatively impact the SEC, as it challenges the foundation upon which they base their enforcement-centric regulatory approach.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SOL PREDICTION. SOL cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

2024-08-26 10:15