-

LINK’s market cap outpaced the volume, suggesting that the network was overvalued.

The difference in XRP’s exchange inflow and outflow indicated that the price might climb.

As a researcher with experience in cryptocurrency analysis, I find it intriguing how the behavior of whale accumulation and exchange flow can significantly impact the price action of different digital assets like Ripple (XRP) and Chainlink (LINK).

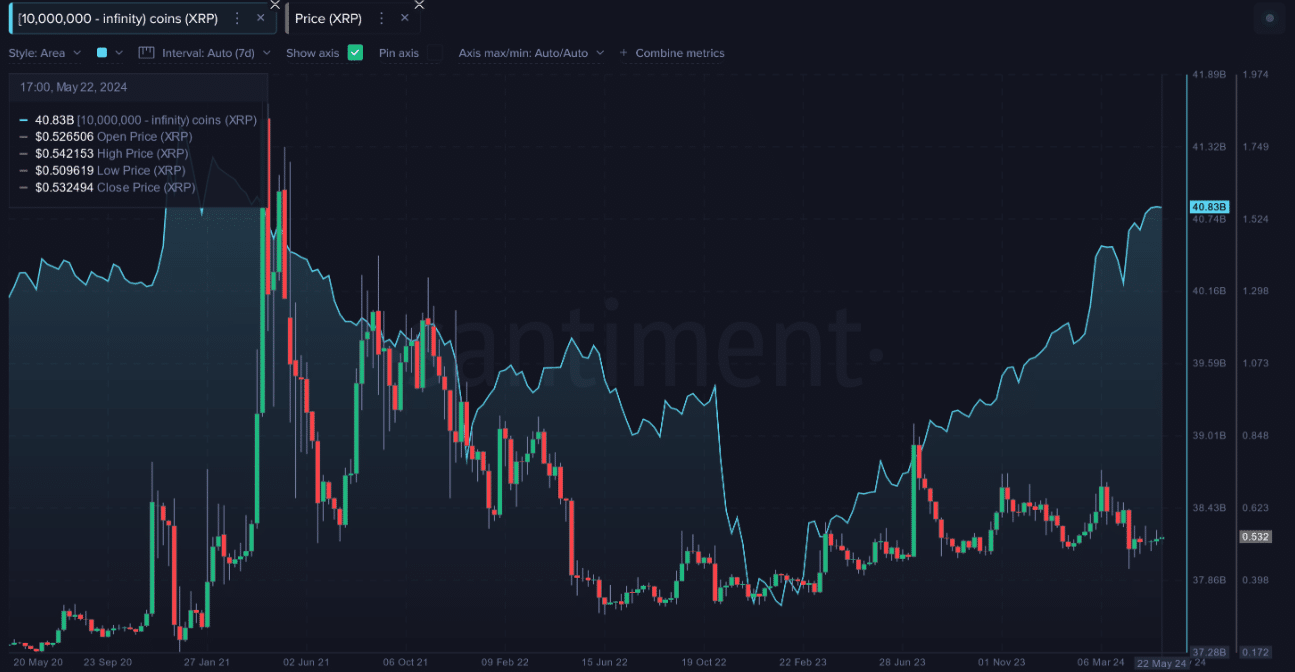

As an analyst, I’ve observed a significant trend in the past 16 months regarding the token accumulation by “whales” in the cryptocurrency market. Specifically, Ripple (XRP) has seen a more substantial increase in the number of tokens held by these large investors compared to Chainlink (LINK), according to AMBCrypto’s confirmation.

During the specified timeframe, I identified over 10 million XRP-laden wallets that collectively bought approximately 3.17 billion tokens. The monetary value of this purchase amounted to around $5.1 million.

The rise in value is expected to raise the price of the cryptocurrency. However, this hasn’t held true for XRP as certain off-chain elements have influenced its price negatively.

The whales go different ways

As of the current news cycle, XRP‘s value was priced at $0.52 – marking a 11.28% rise in the last year. However, considering the performance of other alternative coins, this growth can be considered modest.

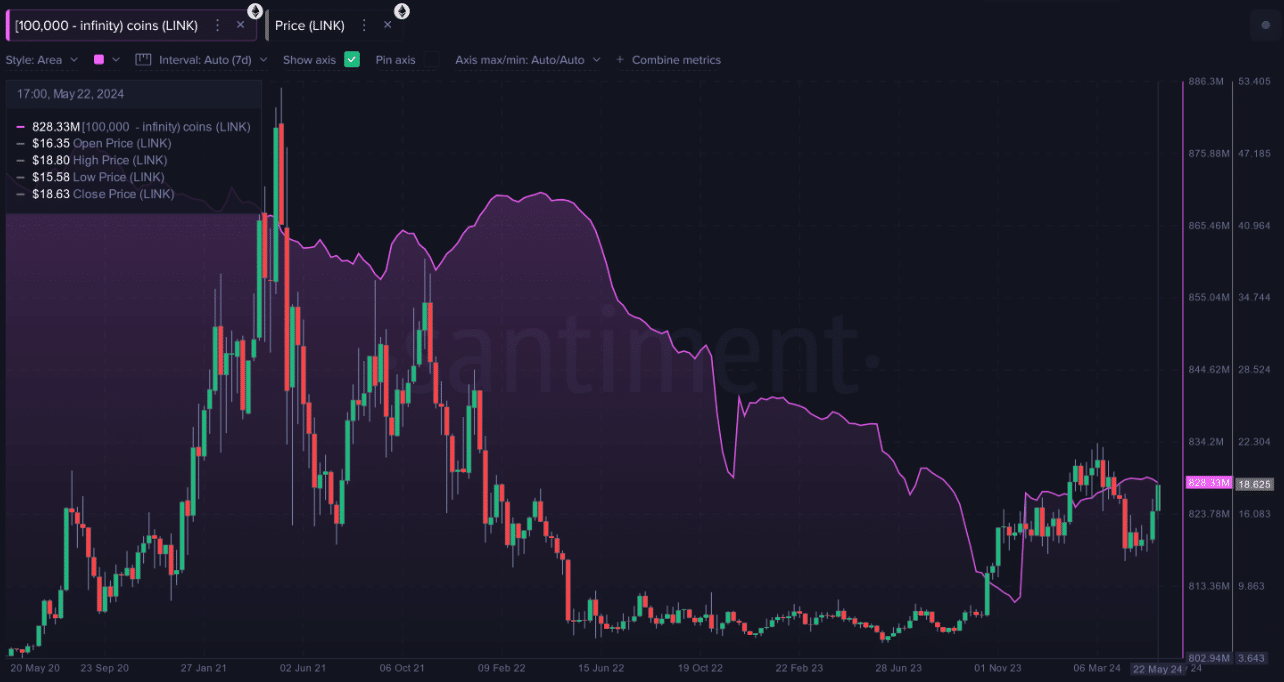

At present, Chainlink’s price stood at $18.11. Compared to the beginning of this period, its value has jumped by an impressive 178.21%. Similarly, XRP experienced this percentage of growth.

Surprisingly, LINK whales did not amass as many tokens as their XRP counterparts.

As a crypto investor, I’ve been closely monitoring the on-chain data provided by Santiment, and according to their latest analysis, the number of active addresses on the network has decreased over the past four years for most cryptocurrencies.

However, things seemed to have changed in the last six months with the insight explaining that,

As a crypto investor, I’ve observed a notable recovery in LINK‘s accumulation over the past six months, with a significant increase of approximately +17.27 million tokens. However, to validate further growth, I believe it is essential for key stakeholders to demonstrate increased confidence through their actions and communications.

Based on the examination conducted, it appeared that the influence of LINK whales on price movements was greater than XRP‘s reaction to long-term hoarding.

LINK eyes a decline but XRP wants its high

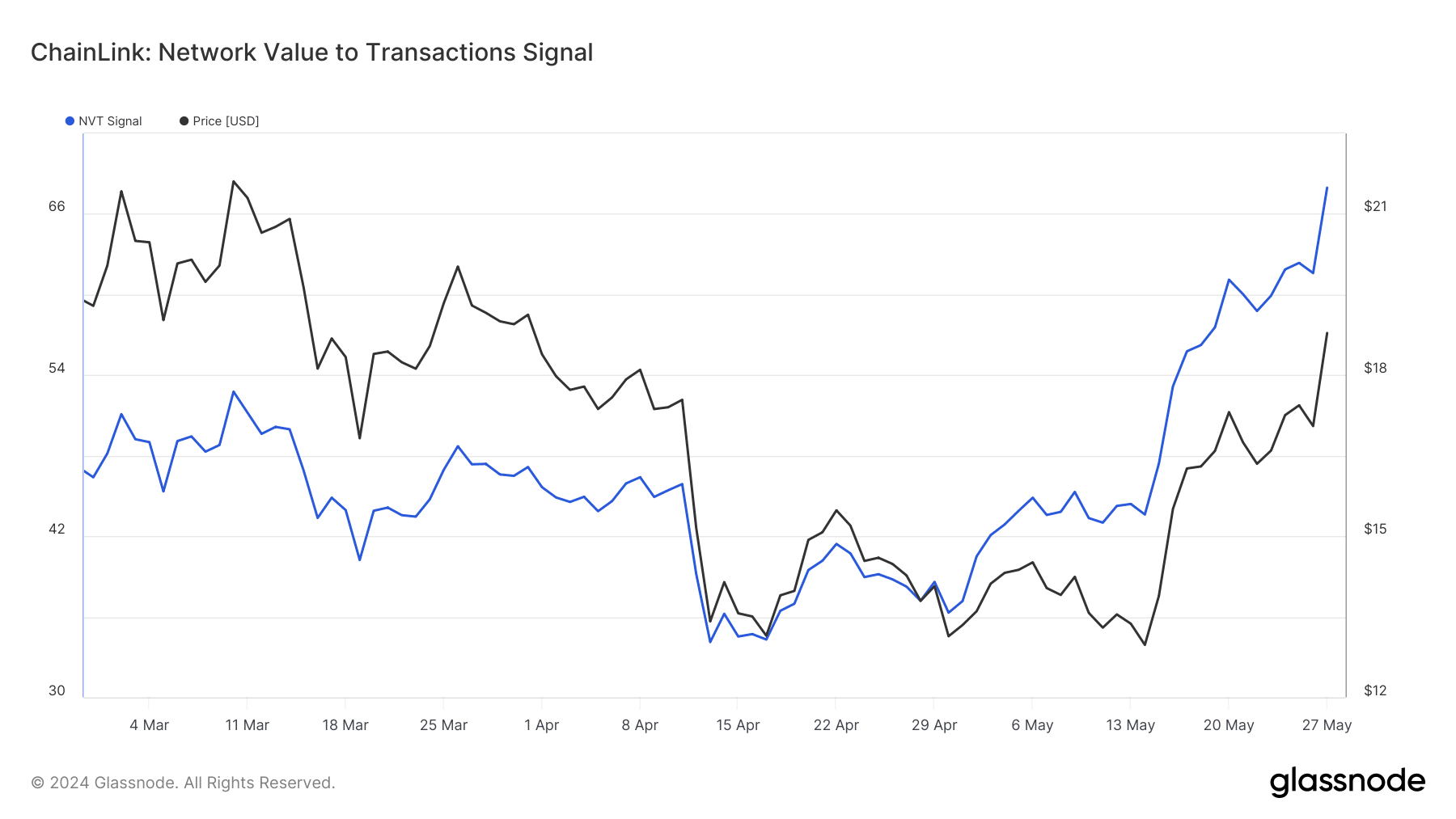

Based on my analysis of the latest data from Glassnode, I have reasons to believe that LINK‘s current upward trend could be coming to a halt soon.

At press time, the Network Value to Transaction (NVT) signal had hit a ceiling of 67.95.

A low NVT signal often coincides with the period transaction value outpaces the market cap.

If the situation held true, Chainlink’s price would have been considered a bargain, leading to a positive impact on its value.

As a crypto investor, I’ve noticed that the Network Value to Transactions Ratio (NVT) for LINK has been showing high readings lately. This indicator is used to determine whether the network’s value is appropriately priced based on its transaction volume. A higher NVT ratio implies that the network might be overvalued, which could potentially lead to a bearish outlook for LINK. Therefore, I believe there’s a possibility for LINK’s price to decline towards $13 or $14 in the near future.

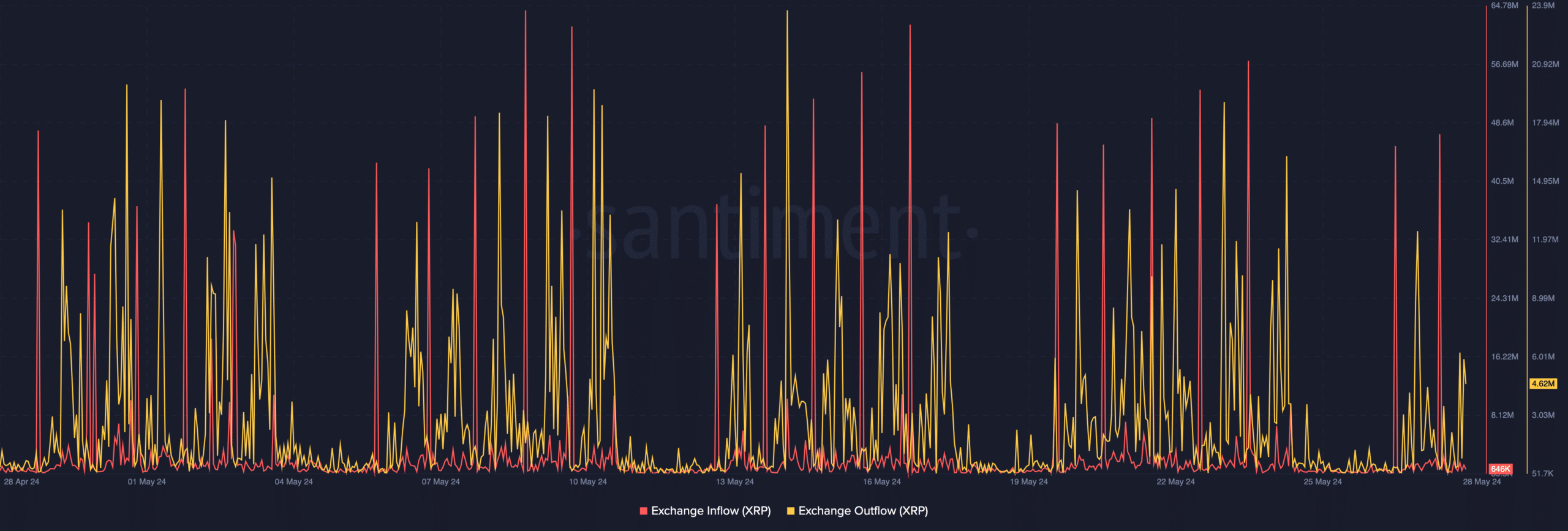

To check out XRP’s potential price movement, AMBCrypto looked at the exchange flow.

At the current moment, there were approximately 646,000 XRP tokens transferred to exchanges for trading.

As a crypto investor, I can interpret this data in the following way: The exchange inflow of 3.01 million XRP was lower compared to the outflow of 4.62 million. This signifies that more XRP were transferred out of exchanges for personal storage in non-custodial wallets instead of being prepared for sale.

Realistic or not, here’s LINK’s market cap in XRP terms

As a researcher examining the data, I’ve noticed a significant disparity between the number of XRP holders expressing bullish sentiment and those holding with a neutral or bearish outlook. This finding suggests that a larger proportion of XRP investors are confident in its future price growth.

If the current market conditions persist in the upcoming weeks, there’s a possibility that XRP‘s value will go up. Reaching $0.60 is a plausible target for its price rise.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-05-28 23:04