-

XRP prices have been flying, starting earlier than the BTC breakout past $60k.

This kind of price run before a news event could be a concern for long-term holders.

As a seasoned researcher with extensive experience in the cryptocurrency market, I have witnessed numerous price runs before major news events. While XRP‘s recent surge is certainly exciting, I cannot help but feel a sense of caution as we approach the potential verdict in the SEC vs Ripple case.

From July 8th to the 17th, Ripple‘s XRP experienced a significant surge, amounting to a 58.18% increase. This growth can be attributed to speculation that a decision in the ongoing legal dispute between Ripple and the United States Securities and Exchanges Commission (SEC) may favor the payment remittance firm.

On July 13, 2023, the court decision declared that the sale of XRP in its secondary market does not constitute securities. According to Attorney Fred Rispoli’s forecast, a judgment was anticipated this month. Regarding price and trend predictions for XRP from AMBCrypto’s market analysis, I would recommend checking their latest publication for the most accurate and up-to-date information.

Has the market priced in the verdict, or does the rally have room to expand?

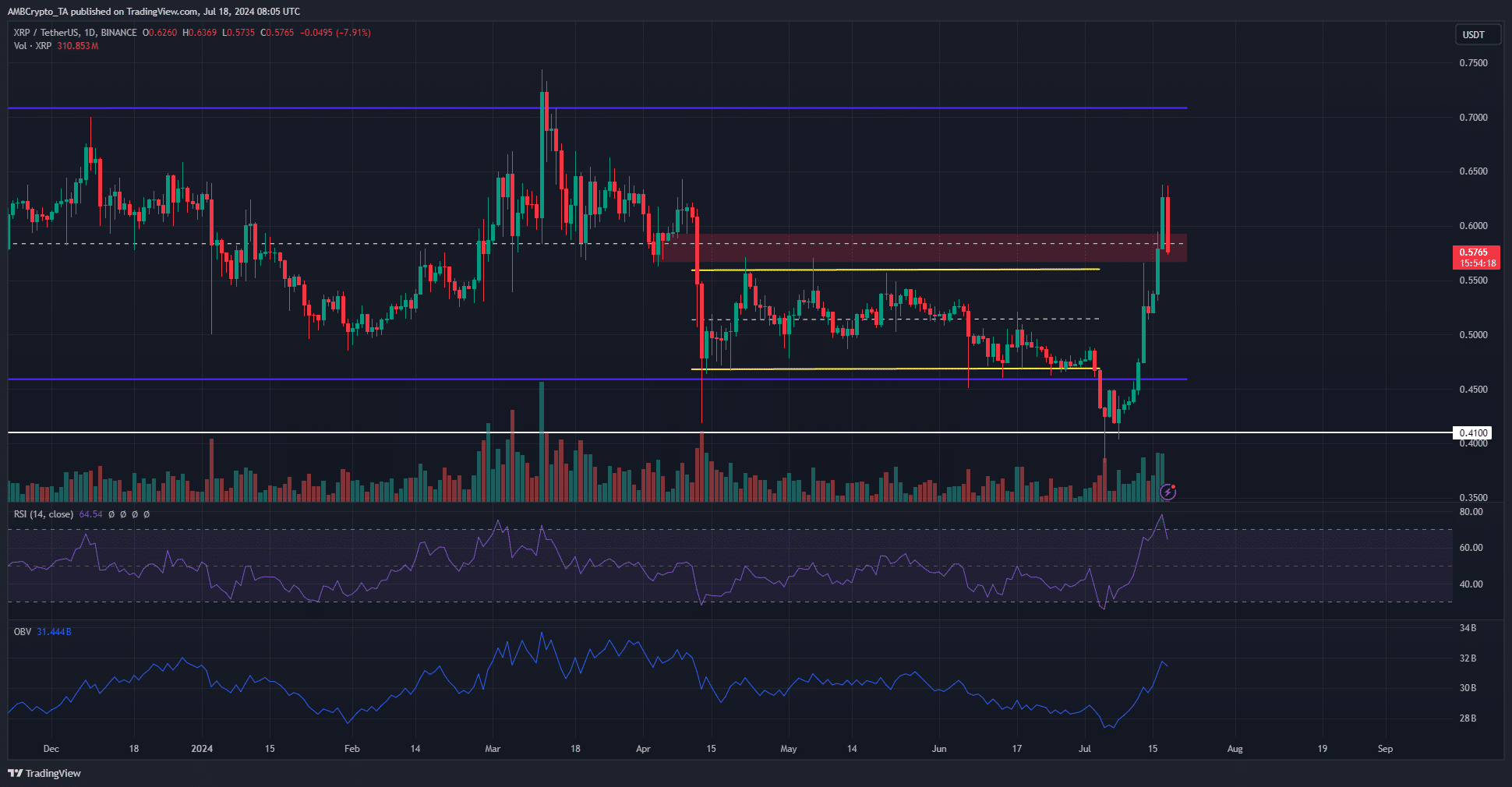

As a researcher studying the XRP market, I have observed that the price had recovered within the 11-month range at press time. The mid-range level was currently being tested as potential support at $0.585. However, if XRP ended its daily session below the early April low of $0.562, it could indicate a possible downward trend towards the previous resistance level of $0.46.

If the token manages to hold its value around $0.57 to $0.58 in the coming days, this could be a sign that the price may aim for the $0.71 mark in the near future.

Over the last ten days, there has been a consistent increase in trading activity. Additionally, the On-Balance Volume (OBV) indicator indicates stronger buying pressure, as it has risen significantly.

The Relative Strength Index (RSI) was reversing course from being overbought, indicating a buying opportunity following three months of bearish market conditions.

XRP market watch: The liquidity pools could inflict a reversal

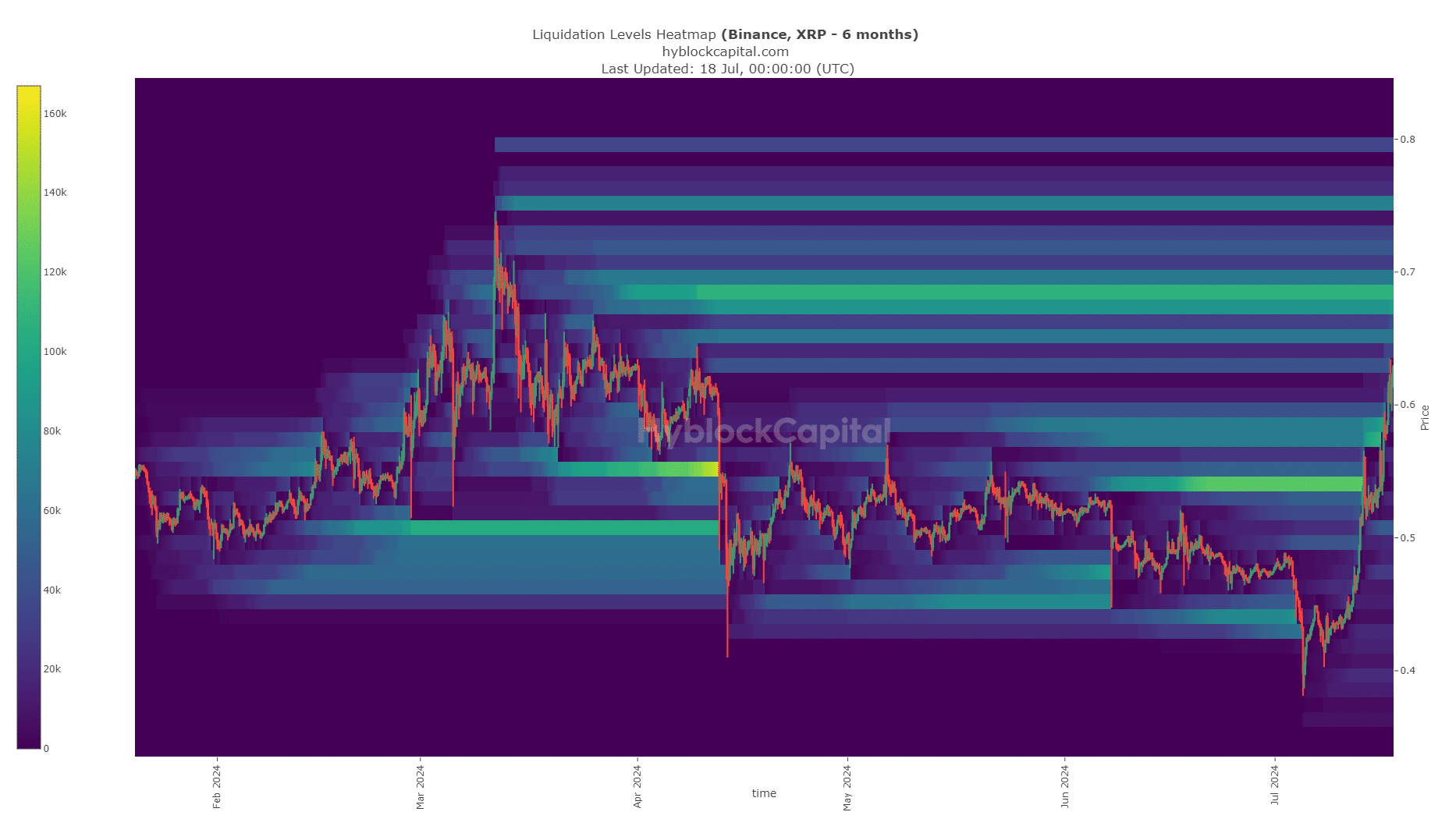

Six-month analysis of the liquidation heatmap revealed a significant concentration of liquidity near the $0.7 mark. This alignment corresponded nicely with the high end of the price range at $0.71, and an additional attractive area emerged at $0.751.

Is your portfolio green? Check the XRP Profit Calculator

The anticipated mid-range zone of $0.585, supposed to present resistance, has been breached by XRP. Consequently, this development presents an attractive purchasing chance for traders who follow trends.

Instead, there’s a chance that this situation might develop into a ” sell the news” phenomenon, potentially leading to price declines near the end of July.

Read More

2024-07-19 02:15