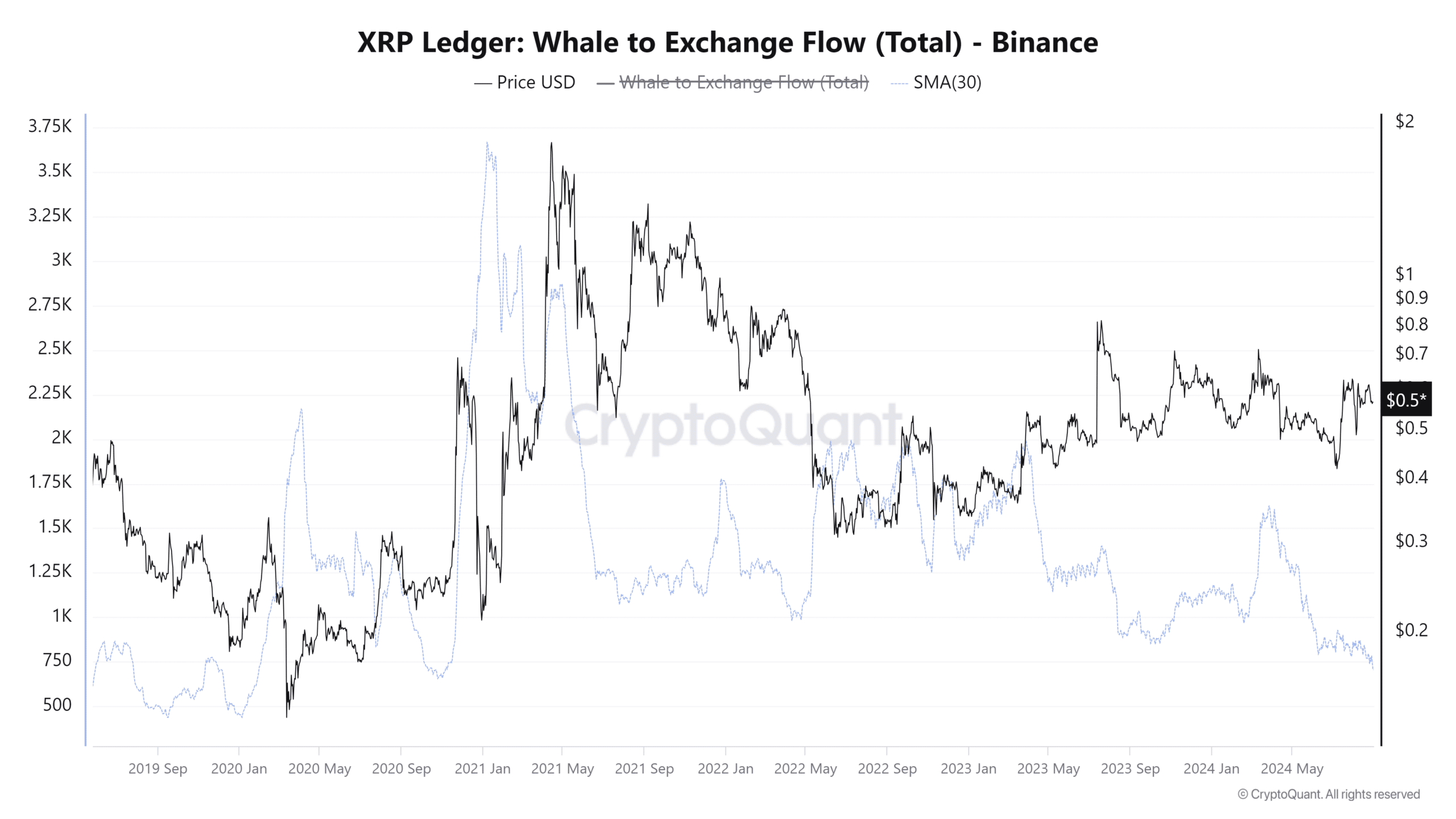

- Whale-to-exchange flow fell dramatically in recent months

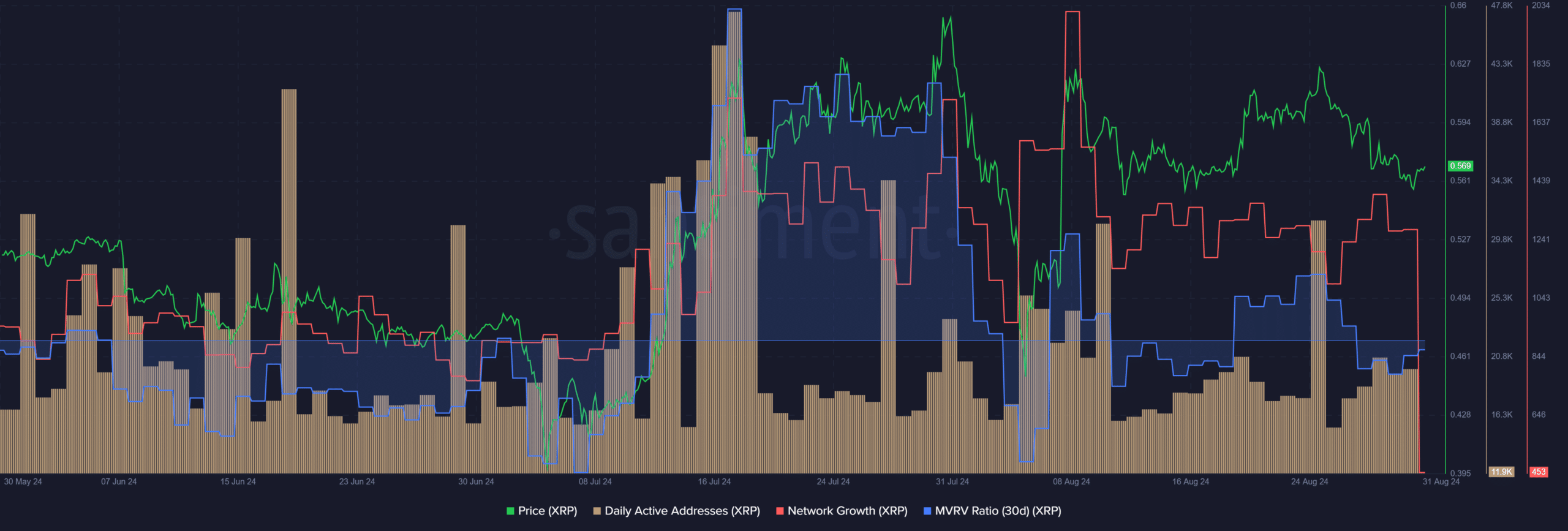

- Network activity was fairly good, but near-term sentiment remained weak

As a seasoned analyst with years of experience navigating the volatile and unpredictable world of cryptocurrencies, I find myself intrigued by the current state of XRP. The dramatic drop in whale-to-exchange flow suggests that these big players are holding onto their assets, perhaps anticipating a significant price movement. Yet, the network activity remains steady, hinting at a healthy and growing ecosystem.

1. The value of XRP was unable to surpass the middle-tier resistance point at approximately $0.585. Consequently, over the past three days, XRP has experienced a 5.35% drop, going from $0.6 down to $0.568. Nevertheless, some on-chain indicators have provided optimism to balance the pessimistic short-term price movement and the prolonged trading within a range over the past year.

A recent report noted that XRP whales capitalized on the price drop to add over 50 million tokens to their holdings. AMBCrypto looked closer at other metrics to see if XRP investors have more good news elsewhere or not.

Whale to exchange flow hits its lowest point since 2020

As an analyst, I’ve been tracking the Whale-to-Exchange (WTX) flow metric, which signifies the amount of tokens moved from large holders (whales) to cryptocurrency exchanges. Notably, this metric has hit a record low since October 2020.

An increase in this measure often coincides with significant changes in pricing, whether it’s an increase or decrease. Given that these values are at their lowest levels in almost four years, the long-term bullish argument has been strengthened.

Over the last two months, the number of daily active addresses has remained consistent, with occasional weekend spikes that didn’t result in a lasting increase. Likewise, the network expansion has been continuous since mid-July.

Combined, it suggests the expansion of a robust and flourishing connection, yet there hasn’t been a significant increase in daily engagement.

Additionally, the MVRM (Maker’s Value Realized to Market Ratio) indicated that XRP was a potentially underpriced asset since its 30-day holders experienced only minimal losses.

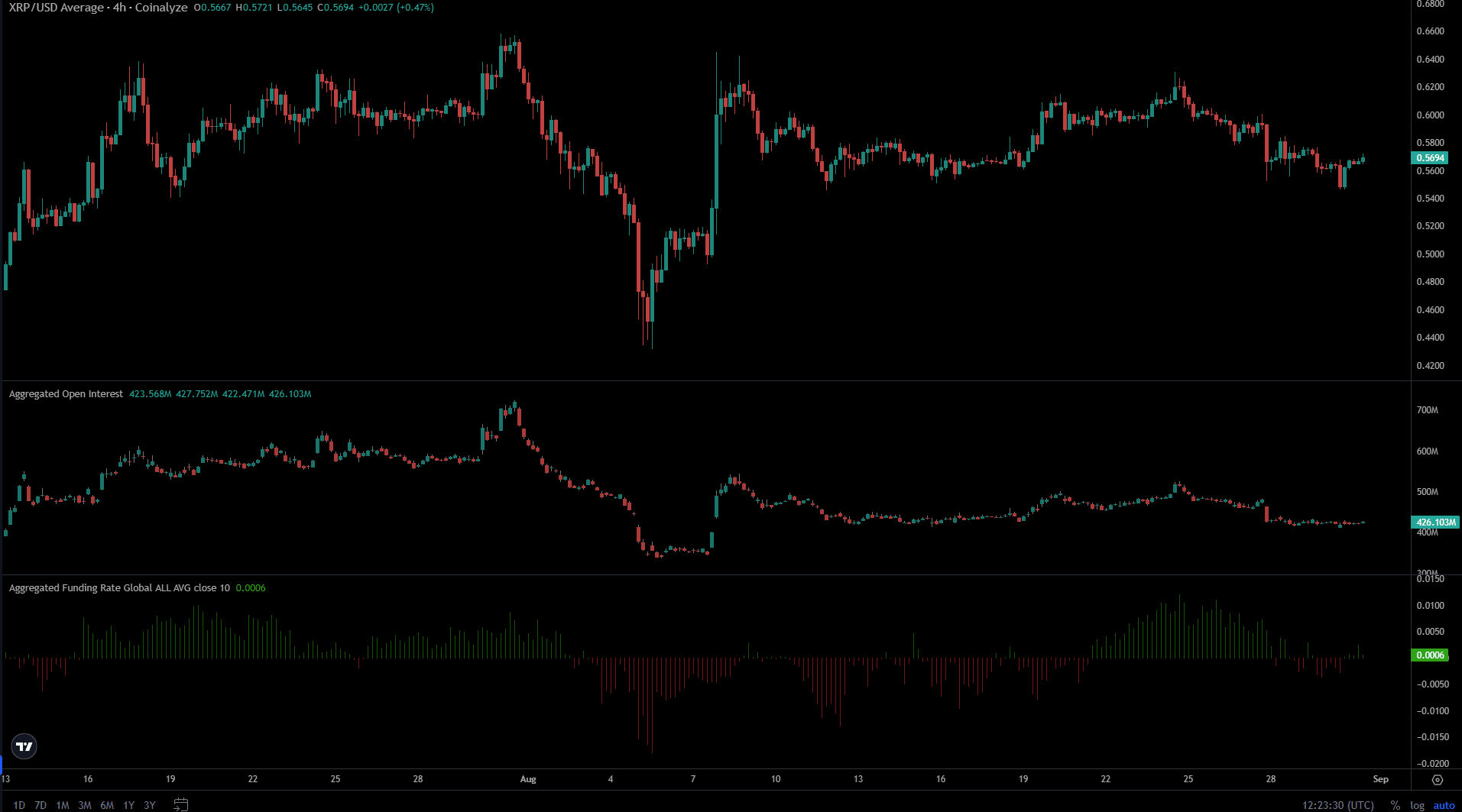

XRP’s speculative market unconvinced thus far

For most of August, XRP supporters have put forth significant effort to drive prices above the resistance level at $0.6. Regrettably, these attempts were unsuccessful, with the highest achieved price being $0.634. Over the past three weeks, the Open Interest has remained within a bandwidth of $430 million to $490 million.

Is your portfolio green? Check the Ripple Profit Calculator

In simpler terms, every decrease of $0.6 attracted optimistic investors (bulls), but the desire wasn’t intense enough to reverse the resistance into support. Furthermore, the funding has dropped lately, suggesting a decline in bullish confidence within the market.

In summary, feelings in the immediate future shifted between optimistic (bullish) and pessimistic (bearish). Yet, the long-term perspective stays positive, indicated by the active involvement of large investors (whales) and consistent network activity statistics. However, it’s crucial to exercise extreme patience when considering investments.

Read More

- WCT PREDICTION. WCT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- LPT PREDICTION. LPT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-09-01 04:07