-

XRP shows signs of a possible breakout, with analysts predicting a major surge.

On-chain data reveals declining active addresses, raising questions about the strength of the bullish trend.

As a seasoned crypto investor who has witnessed the rollercoaster ride that is this market, I find myself both excited and cautious about XRP‘s current position. On one hand, analysts are pointing to a potential breakout, citing a seven-year compression pattern that could signal a major surge for Ripple. This long-term bull flag, as CrediBull calls it, certainly has my attention, especially given its rarity in the crypto space.

At the moment of writing, Ripple (XRP) was priced at $0.5842, representing a 1.8% growth and maintaining its ongoing recovery over the past few weeks. Over just the last seven days, XRP has climbed by 7.3%, generating enthusiasm among both investors and analysts.

As a seasoned investor with over two decades of experience in the stock market, I have seen my fair share of market fluctuations and volatility. Over the past few months, the cryptocurrency market has been particularly tumultuous, with XRP‘s performance being relatively lackluster compared to some other major digital currencies. However, it is always important to stay patient and not make hasty decisions based on short-term fluctuations.

Analysts point to a 7-year compression pattern

Renowned crypto analyst CrediBull commented on XRP’s recent price movements, highlighting the asset’s long-term compression over nearly seven years.

He described this as “the mother of all bull flags,” emphasizing its uniqueness in the crypto space.

CrediBull noted:

There’s simply nothing comparable in this field, primarily due to the fact that many of the coins here are barely a week-old laughs (7 years). When the established players catch on, it will undoubtedly become a legend.

Analyst MoonLambo shares a comparable viewpoint, saying “XRP won’t remain at its current level against the US dollar indefinitely,” implying his conviction that the price of XRP is likely to hit a fresh record high in the future.

XRP’s on-chain and market data: Assessing bullish signs

To determine if XRP might experience an uptrend, examining its on-chain statistics can provide valuable insights. While the technical analysis may suggest positivity, the on-chain data paints a slightly complex scenario.

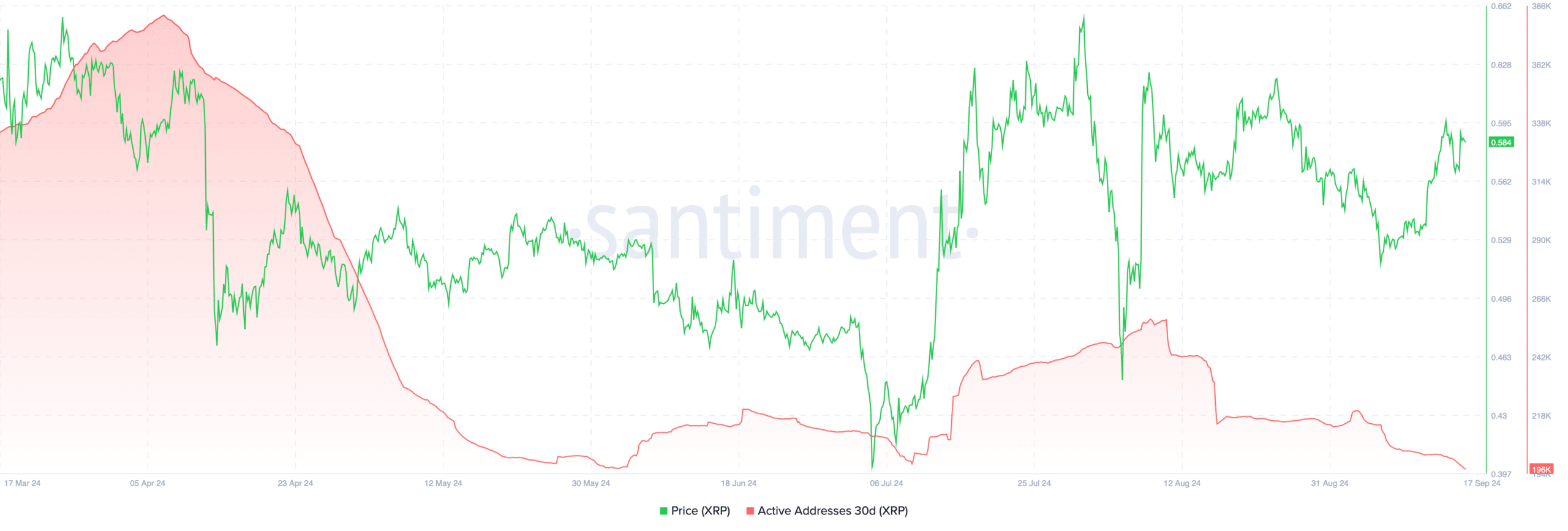

As reported by Santiment, there’s been a substantial drop in the number of actively used XRP accounts over the past few months.

The number of active addresses on this platform has decreased dramatically since its peak in April, which was about 382,000. Currently, it stands at around 196,000. A significant drop in the number of active addresses typically suggests a decline in user interaction and transactional activity within the network.

This decrease might indicate a need for caution regarding the near future, since fewer active addresses could curb the ongoing surge and hint that this rally might not sustain if there’s no fresh wave of contributors re-entering the market.

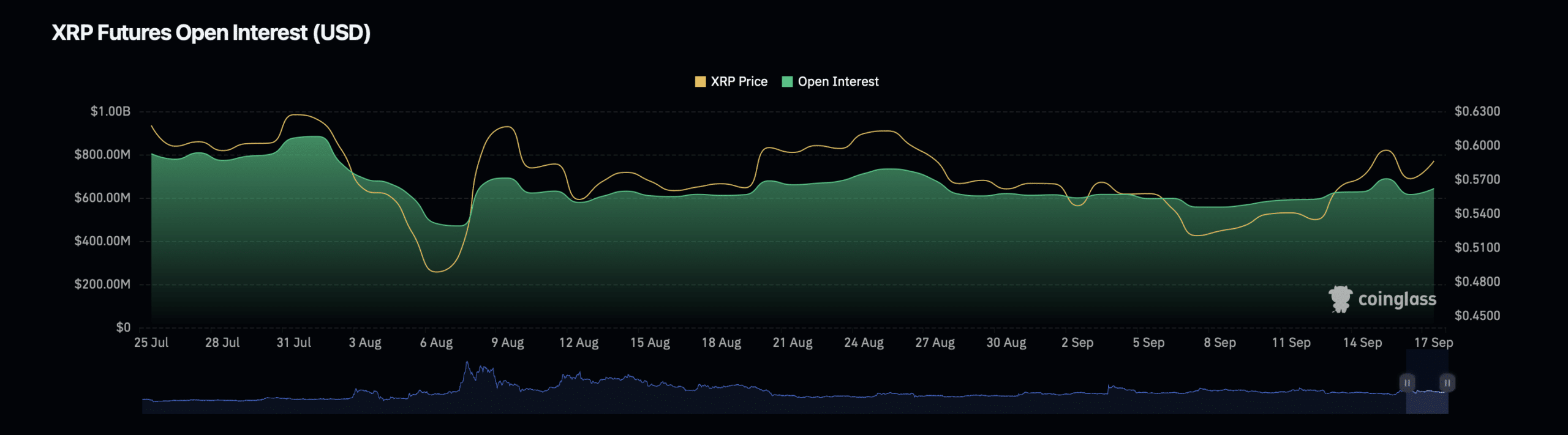

Additional information from Coinglass shows an increase of 4.32% in XRP‘s open interest, amounting to a worth of approximately $650.26 million at present. Open interest signifies the current tally of unresolved derivative contracts like futures and options.

A rise in open interest indicates more active trading related to XRP, showing that investors are becoming increasingly curious about its price movement trends. Moreover, there’s been a modest 0.15% boost in the asset’s trading volume, equivalent to around $1.32 billion.

Read XRP’s Price Prediction 2024–2025

An upward trend might be growing stronger if we see a rise in both the number of outstanding contracts (open interest) and trading activity (volume). This suggests that traders are making trades in expectation of a future price change.

On the other hand, this increase in open interest might also bring about a rise in market volatility because significant changes in news or prices could trigger strong market responses.

Read More

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- How to Get to Frostcrag Spire in Oblivion Remastered

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- Assassin’s Creed Shadows is Currently at About 300,000 Pre-Orders – Rumor

2024-09-18 00:39