-

XRP erased some of its losses but data showed that it might not be enough

While some traders bought the dip, the shorter EMAs signalled a downtrend

Between the 13th and 17th of April, XRP‘s price dropped from $0.59 to $0.43. On the 18th of April, however, the price overcame the significant psychological barrier of $0.50 and rose above it.

At the moment I’m writing this, the altcoin was worth $0.51, marking a 5% increase over the past day due to Bitcoin‘s halving. This growth is promising, but on-chain information hinted that the recovery might not last long. To examine this claim, AMBCrypto examined XRP‘s supply distribution.

A token in trouble

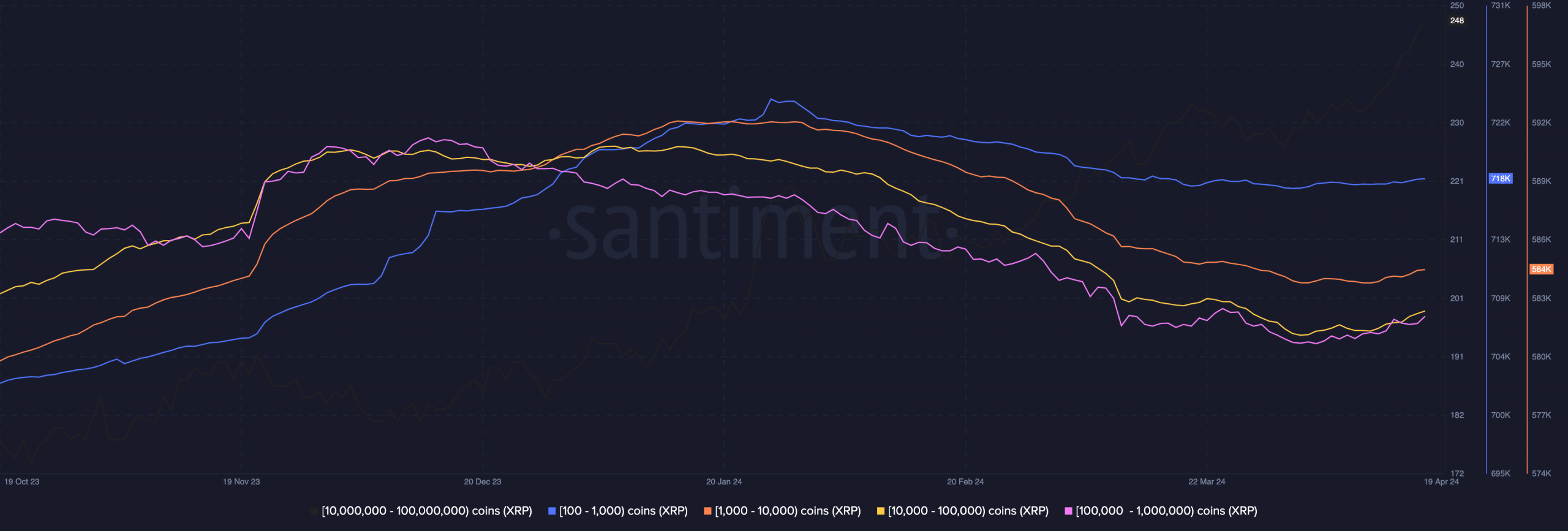

Based on Santiment’s data, there has been a considerable decrease in the number of wallets containing between 100 and 1 million tokens compared to a few weeks prior.

Approximately 31,000 XRP holders controlled between 100,000 and 1 million tokens in March. Yet, this is no longer true as of now. The number of XRP holders with 100 to 1,000 tokens was approximately 731,000 in the past. However, this number has also decreased and currently stands at 718,000.

In such a situation, it’s indicative that a segment of the military is unwilling to continue serving in the ranks. Consequently, XRP may struggle to regain its past highs around $0.72 due to this waning trust.

If the specified condition isn’t met, another potential obstacle for cryptocurrency’s growth is the legal dispute between Ripple and the SEC. Recent developments in the case indicate that Ripple intends to file a response to the SEC’s remedies-related brief on April 22.

The judge’s opinion, which may not be rendered that day, could influence XRP‘s value. A favorable view from the judge could keep XRP above $0.50, but if regulators prevail, the price of the cryptocurrency might fall below this key level.

This could be accelerated by the fact that XRP was close to being overbought on the charts.

What are the indicators saying?

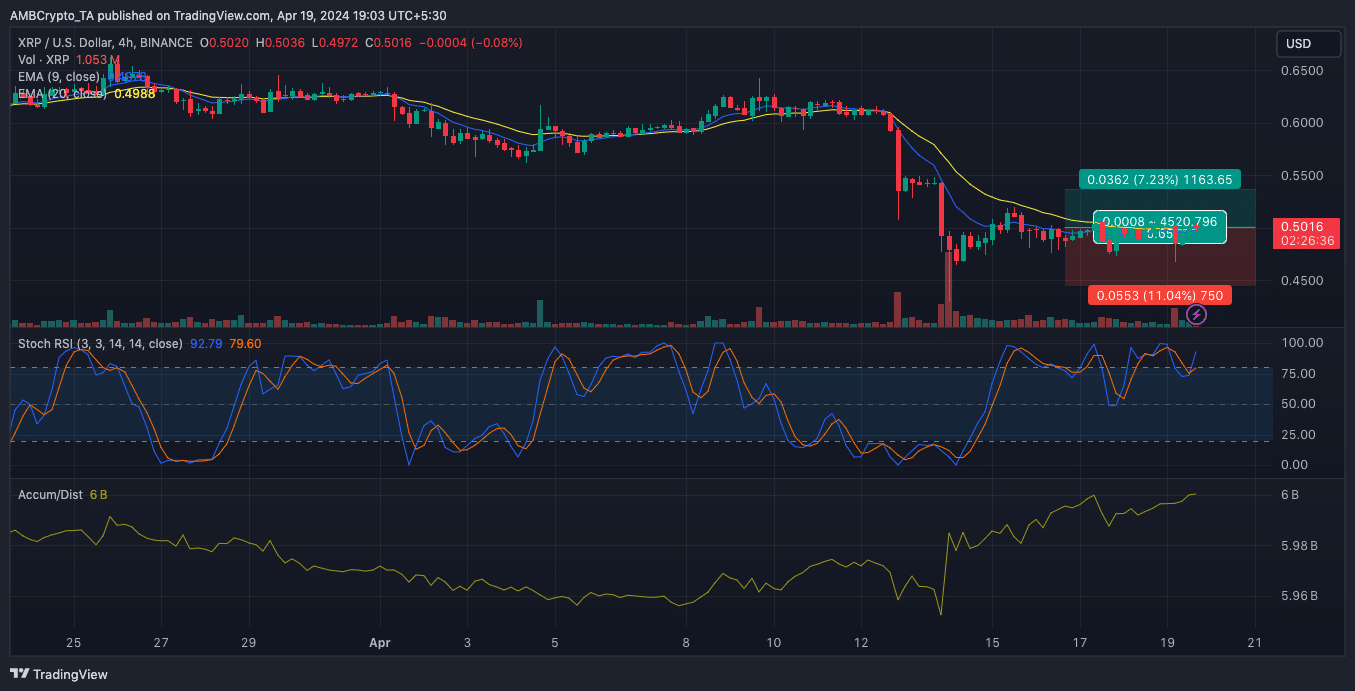

The Stochastic RSI (Stochastic Relative Strength Index), which is represented by the line above 80 on the chart, signaled that it was possibly time for a price reversal or pullback. This sell indication was derived from the indicator’s reading.

On the other hand, the Accumulation/Distribution (A/D) indicator has been rising, indicating that traders bought more during the previous price decline. If buying demand continues to exceed selling pressure, XRP could potentially rise in value.

Instead of “On the other hand, a hike in selling pressure could fuel a massive decline, one which could see the token drop to $0.45,” you could say “Conversely, an increase in selling pressure might cause a significant drop in price, potentially bringing the token down to $0.45.” As for “Here, it’s worth noting that the Exponential Moving Average (EMA) signaled bearishness as well,” you could paraphrase it as “It’s important to mention that, along with the selling pressure, the Exponential Moving Average (EMA) indicated a bearish trend.”

With the 9-day EMA (represented by the blue line) and the 20-day EMA (denoted by the yellow line) being close to each other, XRP‘s price dipped beneath both of these moving averages, implying a possible continued downward trend.

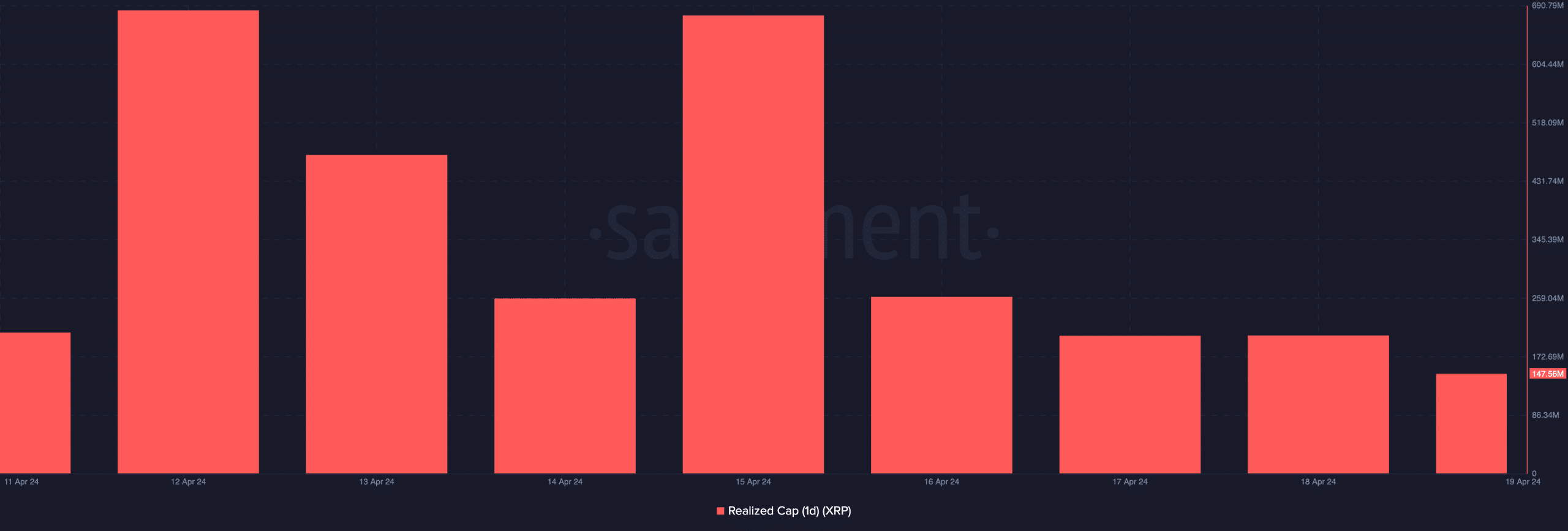

Furthermore, the value of the tokens in circulation amounted to only $147.56 million. During a bull market, an upward trend in the realized cap implies that investors have made greater profits by purchasing assets at lower prices.

Realistic or not, here’s XRP’s market cap in BTC terms

In simpler terms, this means that the decrease in price implies that more people have sold at a loss. Consequently, XRP may experience further price drops unless buyers step in to purchase at lower costs once more.

Read More

2024-04-20 10:15