-

The XRP market outlook was uncertain once again for the coming days after rejection at $0.64.

The price action and metrics showed that there is a buying opportunity targeting a 12% move upward.

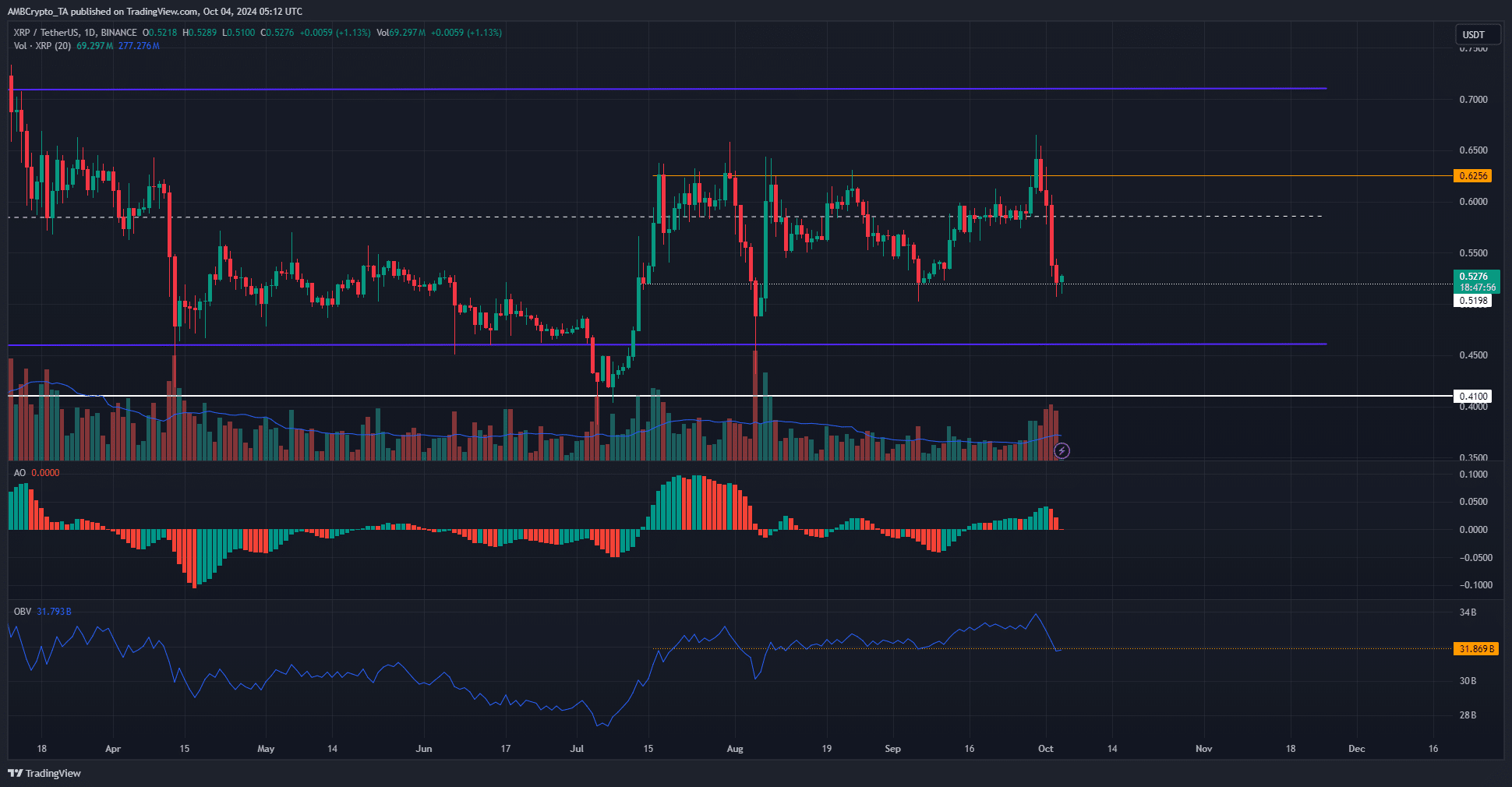

As a seasoned crypto investor with a knack for spotting trends and opportunities, I find myself intrigued by the recent developments of Ripple [XRP]. The past week has been a rollercoaster ride, with XRP threatening to break the resistance at $0.625 only to tumble 21% in the subsequent days.

Over the last seven days, I’ve observed a significant downward correction in Ripple [XRP]. On September 29th, it seemed poised to breach the immediate resistance level at $0.625, which the bulls successfully accomplished. However, since then, XRP has experienced a 21% decline on the price chart.

The Bitwise XRP exchange-traded product (ETP) application brought a flurry of social media engagement. However, the increase in whale transactions began when Bitcoin [BTC] saw a rejection at the $66.5k resistance.

Could the bulls manage to hold the $0.5 support level, given the subdued market mood, potentially if Bitcoin can stem its declines as well?

XRP price prediction shows brutal rejection for bulls

Over a mere four-day span, we experienced a nearly 20% drop, which followed the gloomy beginning to the month in the crypto market that’s been trending downwards since July. Contrastingly, the second week of June saw the trends shift bearishly over the next two weeks.

Supporters of XRP might be aiming to turn things around, while swing traders could see a potential chance to purchase. The OBV and price have reached supportive points. Bitcoin’s decline has slowed near the $60k region.

During the last week of September, the Awesome Oscillator registered a value of zero, indicating that the previous bullish momentum has been neutralized. In such circumstances, optimistic traders (bulls) are eagerly waiting for substantial trading volumes as potential price surges occur, hoping to capitalize on them.

Attempted breakout saw a storm of XRP selling

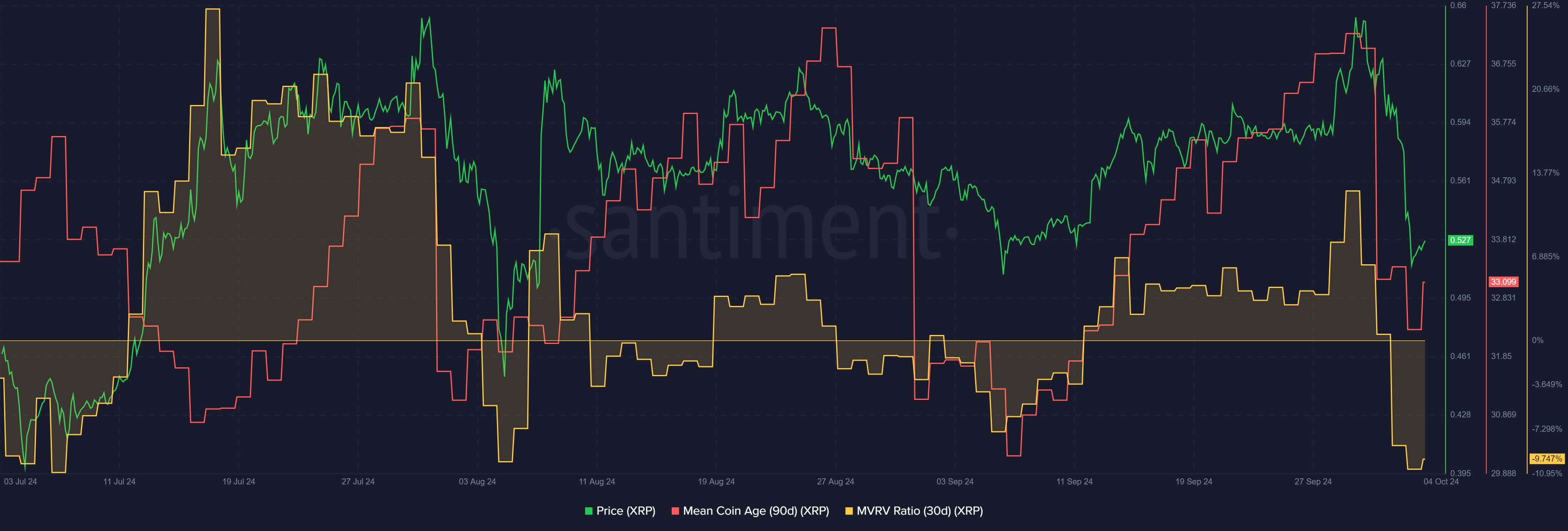

In September, the average age of coins was increasing, indicating an accumulation. However, in recent days, this indicator has suddenly dropped dramatically, suggesting a strong wave of selling. Moreover, the 30-day MVRV ratio is now close to -10%, signaling significant downward pressure.

Read Ripple’s [XRP] Price Prediction 2024-25

Reflecting on the data, I found that short-term investors, on average, incurred a loss of approximately 10% in this period. This implies that the majority of these investors likely purchased their holdings within the range of $0.57 to $0.58.

Moving forward, it appears that the $0.585 level, being a significant mid-term resistance point, could potentially pose a challenging hurdle on our upward journey.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Quick Guide: Finding Garlic in Oblivion Remastered

- BLUR PREDICTION. BLUR cryptocurrency

- Elon Musk’s Wild Blockchain Adventure: Is He the Next Digital Wizard?

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

2024-10-04 19:03