-

XRP’s rally edged closer to the Q3 supply zone.

Will whales intensify profit-taking at the zone again?

As a seasoned analyst with years of observing and analyzing the cryptocurrency market under my belt, I can’t help but feel a sense of deja vu when it comes to XRP‘s current position. The altcoin has shown impressive gains, propelled by Grayscale’s inclusion of an XRP Trust, yet it seems poised to hit a familiar hurdle – the Q3 supply zone near $0.06.

Last week, the digital currency Ripple (XRP) experienced a 11% increase in value. A significant factor contributing to this growth was Grayscale’s decision to add an XRP Trust to their collection of cryptocurrency products.

Despite being close to touching a Q3 resistance level around $0.06 for the altcoin, this area has historically seen significant selling by investors, particularly whales. Is it likely that the pattern will recur based on XRP‘s forecasted price trend?

Will the supply zone reverse XRP price prediction?

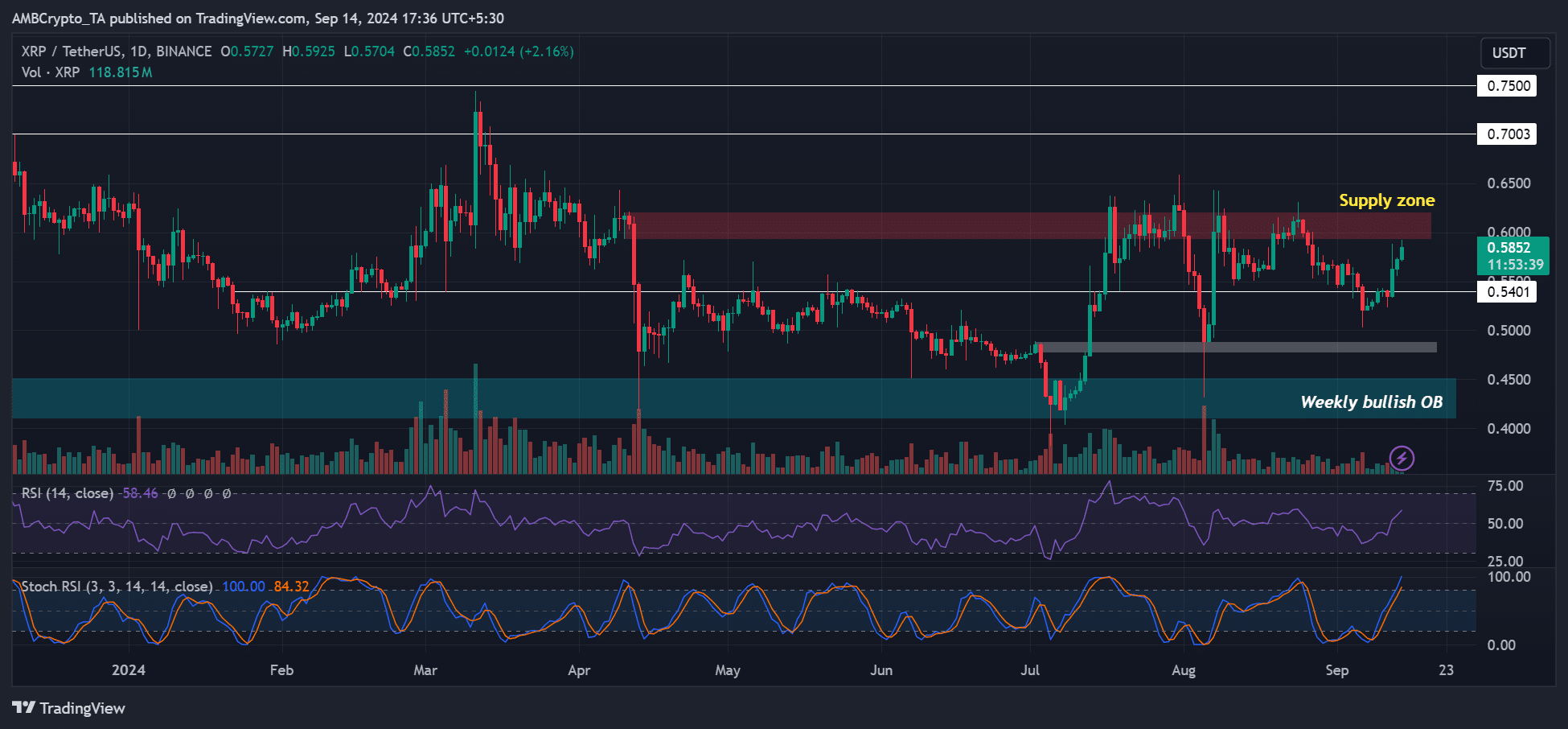

In the third quarter, it’s evident that XRP followed a distinct pricing pattern. Notably, the robust rebound in July and the semi-victory against SEC in August approached the resistance zone around $0.6. This positioning of $0.6 makes it a crucial level to monitor, particularly during periods of price growth.

As we speak, this week’s price increase is moving towards the supply area. If history repeats itself and there’s another price decline, XRP might drop to the $0.54 support level.

If we find ourselves in this situation, selling the asset could bring profits, particularly since the broader market might experience a downturn prior to the FOMC meeting.

However, given the bullish expectations from Fed rate cuts, market re-entry would make sense only if XRP flips the supply zone into support.

Simultaneously, the Relative Strength Index (RSI) indicated potential continuation of the ongoing upward trend, while the Stochastic RSI suggested signs of overbuying. This suggests that the supply zone should be marked as an important area to keep a close eye on.

Exchange flow shows eased selling, but…

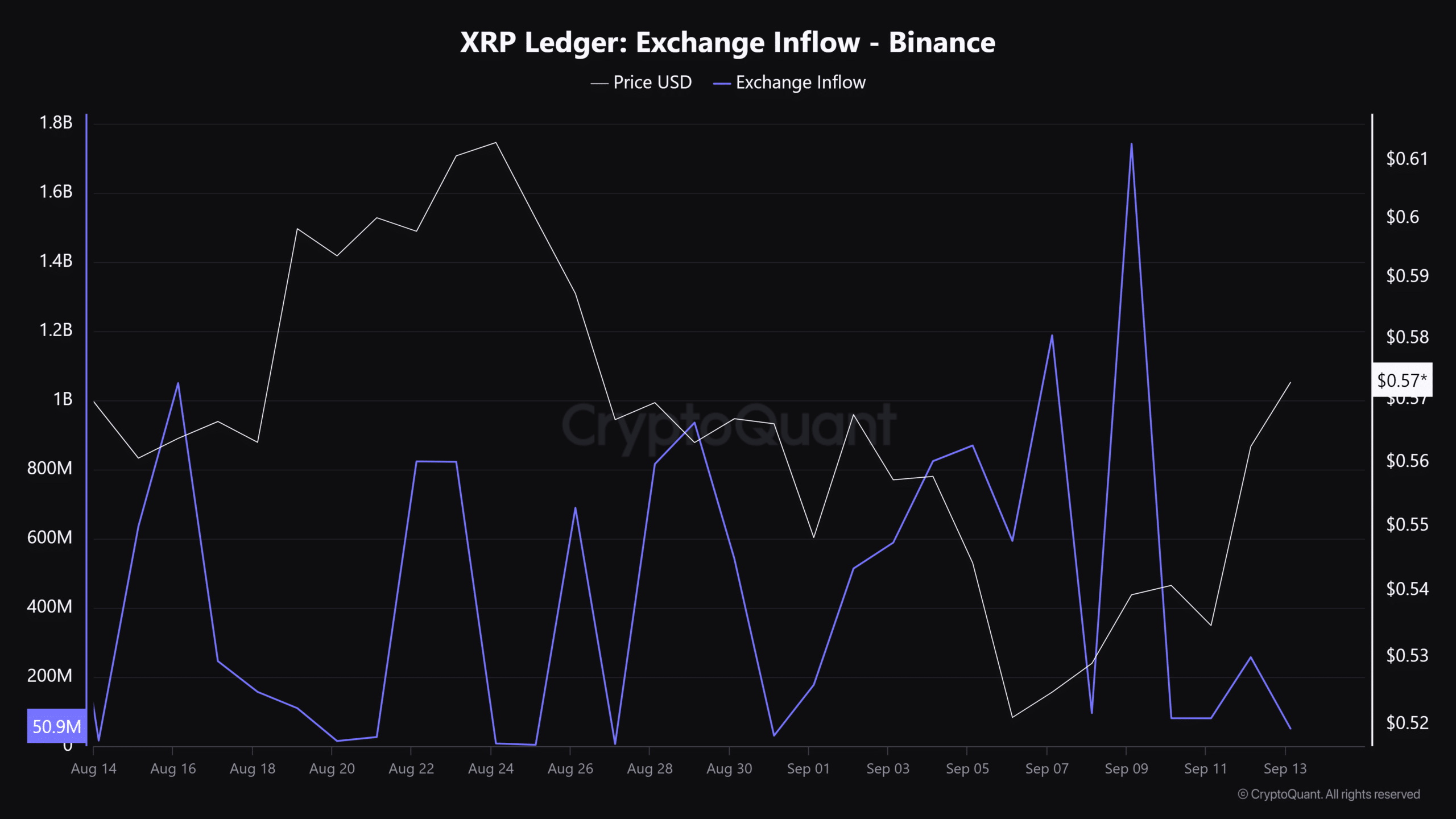

This week’s rise in XRP was additionally characterized by decreased selling activity on major exchanges, as indicated by a significant decrease in deposits into these platforms.

On Binance, XRP’s inflow dropped from nearly 1.8 billion tokens on 8th September to around 50.9 million at the time of writing. This reduced supply pressure aided this week’s uptrend.

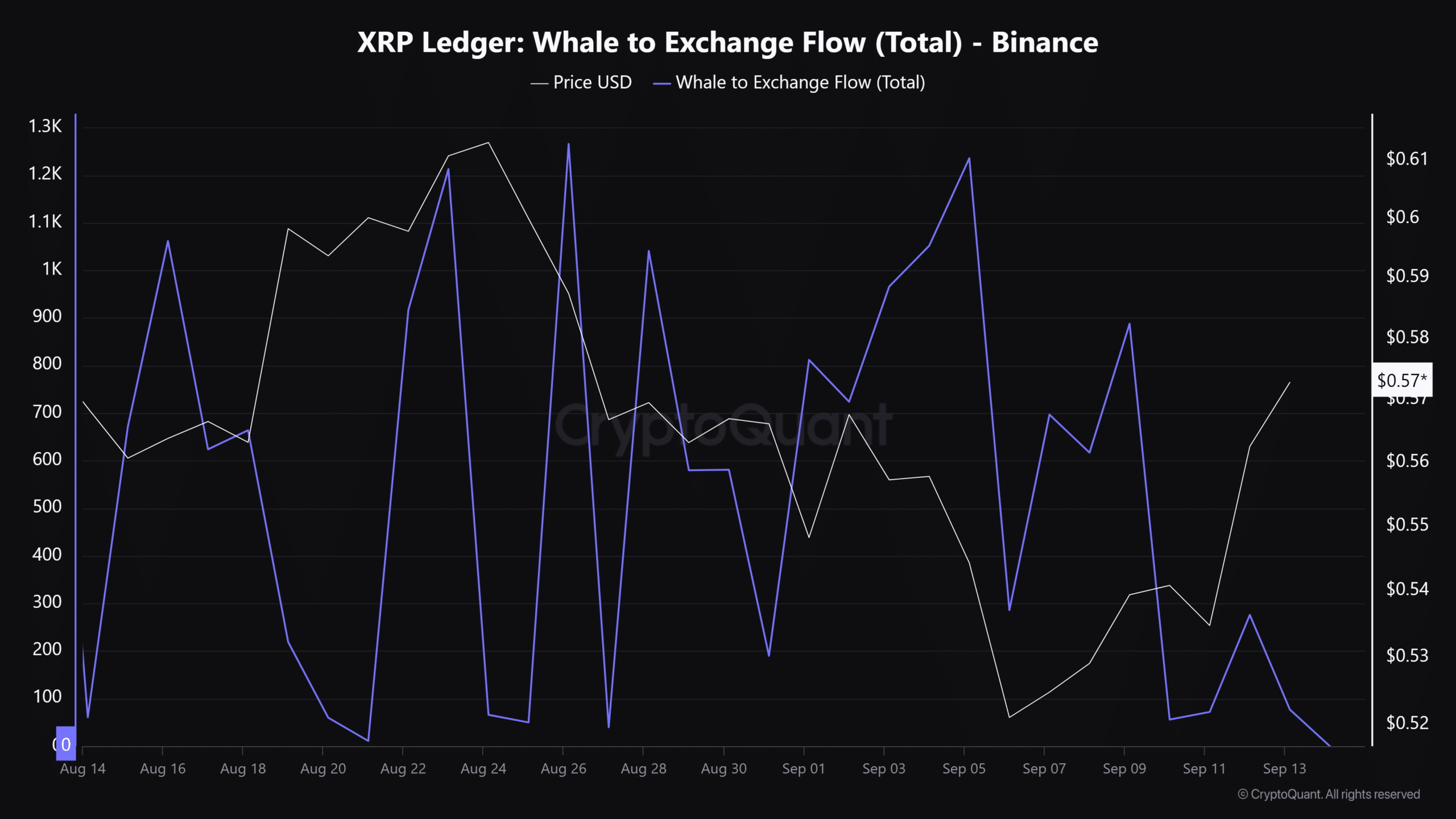

If the pattern from the previous month repeats, a surge in price to $0.6 might lead whales to sell off, given that they previously cashed out when XRP reached the supply zone at $0.6, as evidenced by increases in Whale-to-Exchange Flow during August.

Read XRP’s Price Prediction 2024–2025

If the pattern continues and whales decide to sell off once more around that point, it’s possible that XRP‘s advance past its supply zone might be halted. In this scenario, investors could consider re-entering the market at the support levels of $0.54 or $0.50.

On the contrary, the bearish argument might prove incorrect if stock markets experience a significant upturn following the FOMC meeting.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Flight Lands Safely After Dodging Departing Plane at Same Runway

2024-09-15 10:15