- XRP was up nearly 30% in December but consolidated above $2.3.

- Here’s what could happen before XRP eyes $3 or 2021 highs.

As a seasoned crypto investor with a knack for spotting trends and analyzing market movements, I find myself intrigued by the current state of Ripple [XRP]. After a spectacular run in November and early December, XRP has shown signs of consolidation above $2.3. This consolidation period could be an opportunity for strategic buyers to enter the market before we potentially see XRP eyeing its 2021 highs or even $3.

Following a significant 280% surge in November, Ripple [XRP] continued its upward momentum at the start of December by adding an additional 30%, reaching approximately $2.9.

However, the surge of the altcoin has slowed down a bit over the last few days, with $2.3 emerging as an important temporary floor. Now, let’s consider some potential possibilities for the future price trend of XRP following this cooling period.

XRP’s next moves

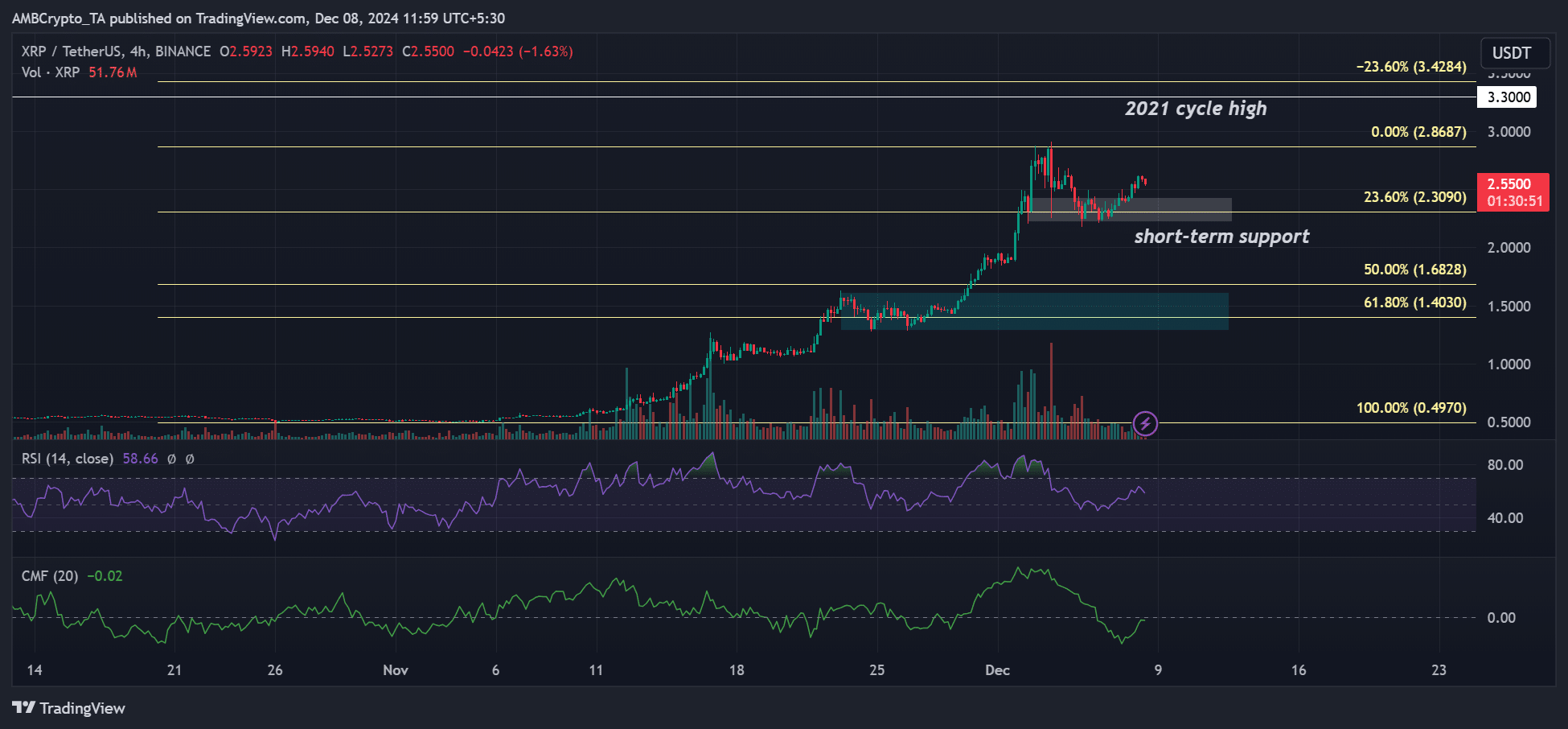

On the shorter-term chart, XRP has been successfully guarding the $2.3 level since December 2nd. If this immediate support continues, XRP could aim for its recent peak at $2.9 or even surpass $3 to reach the 2021 high of $3.3.

In simpler terms, the RSI (Relative Strength Index) level on the 4-hour chart backed up the previous situation. It held firm at the 50-neutral point, indicating that the demand for the altcoin was significant.

Yet, the absence of significant short-term capital inflows failed to reinforce the optimistic outlook suggested by the neutral interpretation of the Chaikin Money Flow (CMF) indicator.

A decisive move above the median mark could reinforce XRP’s odds of eyeing $3 or 2021 highs.

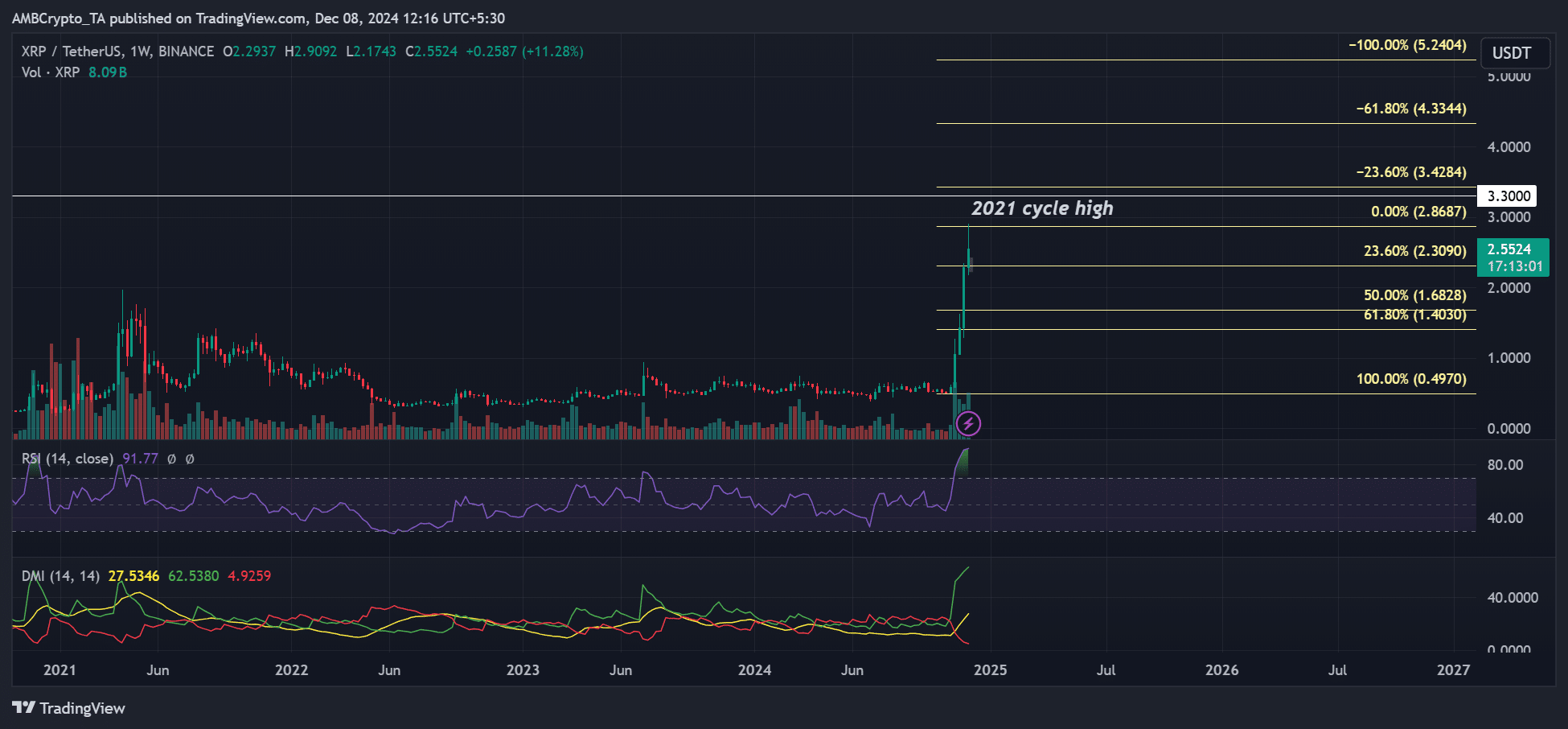

That said, XRP’s market structure was still solid based on the higher timeframe charts.

On a weekly basis, the price’s momentum was robust, as indicated by the yellow line consistently being above the 20 mark. This situation suggests that buyers were in control, as demonstrated by the DMI.

However, a crack below $2.3 could probably push XRP to the next support and Golden ratio at $1.5.

Liquidation heatmap insights

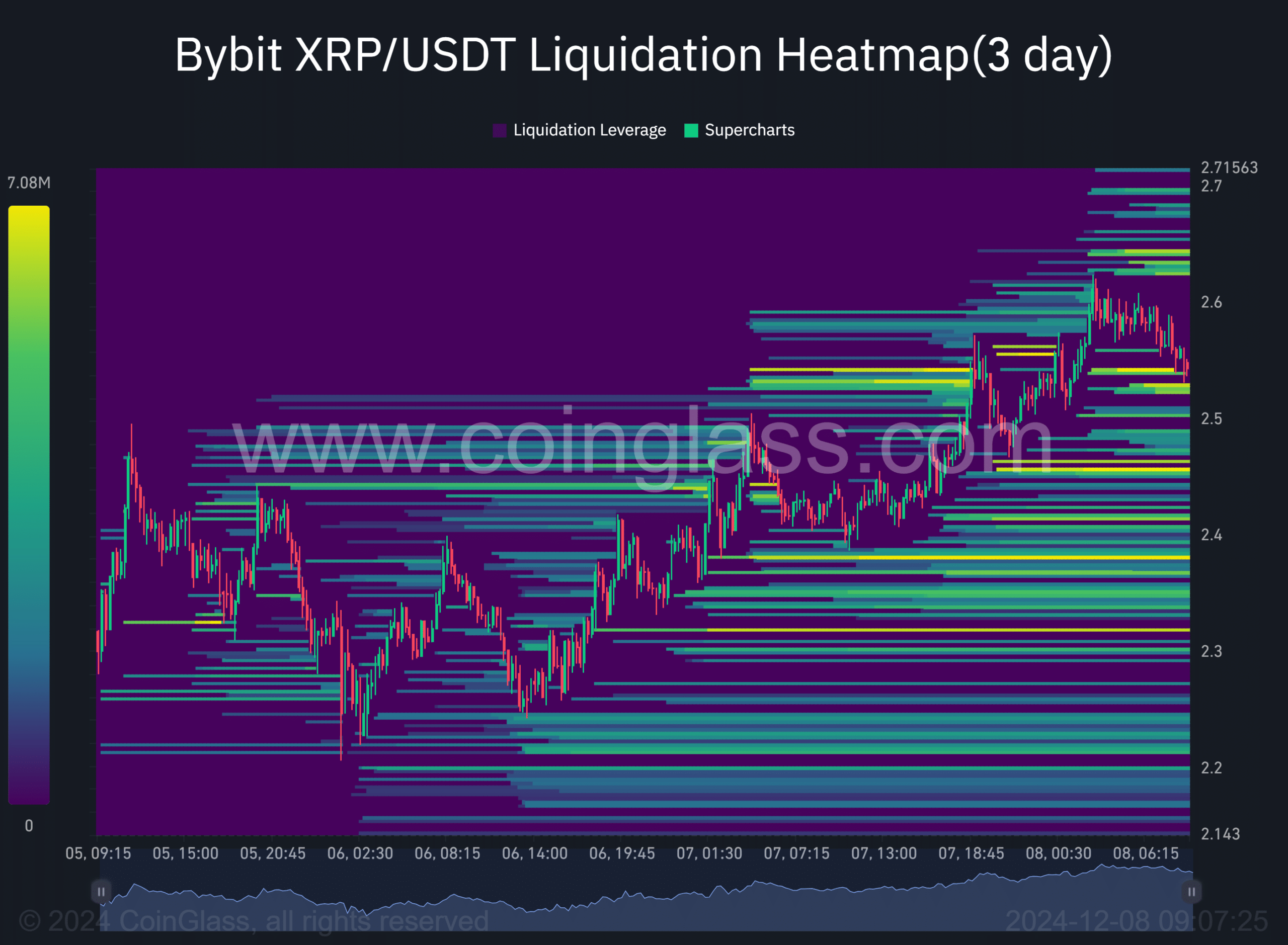

As a crypto investor, I’ve noticed from Coinglass liquidation heatmap data that there seemed to be pockets of liquidity strategically positioned around the market activity. This suggests that opportunities for entry and exit might have been available at key price points.

On the upper side, leveraged shorts piled above $2.6 (bright orange levels).

On the contrary, the lower-side liquidity at $2.53 was recently tapped.

As an analyst, I’ve observed that market makers didn’t engage other less liquid price points at $2.45 and $2.38. If they had, it might have led to the forced liquidation of leveraged long positions at these levels prior to XRP potentially advancing further.

Read Ripple [XRP] Price Prediction 2024-2025

With the influence of a downward trend called liquidity sweep, it’s possible that the price of XRP may dip towards either $2.45 or even lower to $2.38. However, once these levels are surpassed, there could be potential for the price to aim higher, possibly reaching targets above $2.60.

Yet, because $2.3 served as temporary support, a strong downward movement might challenge the current optimistic short-term forecast.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-12-09 02:15