- Per the Fibonacci and Elliott Wave analysis, XRP could reach $15 by May 2025.

- Growing adoption and reduced selling pressure could further strengthen XRP’s bullish outlook.

As a seasoned researcher with over two decades of experience navigating the complex and ever-evolving world of digital currencies, I find myself both excited and cautiously optimistic about XRP’s potential to reach $15 by May 2025. Over the years, I have witnessed numerous market cycles, each with their unique challenges and opportunities, but the current outlook for XRP presents a compelling case.

The Fibonacci time zones and Elliott Wave analysis suggest a robust bullish trend that aligns with historical patterns. However, I always advise investors to approach predictions with a healthy dose of skepticism and a keen eye on market dynamics. As we have seen in the past, even the most promising projections can be derailed by unexpected events or shifts in sentiment.

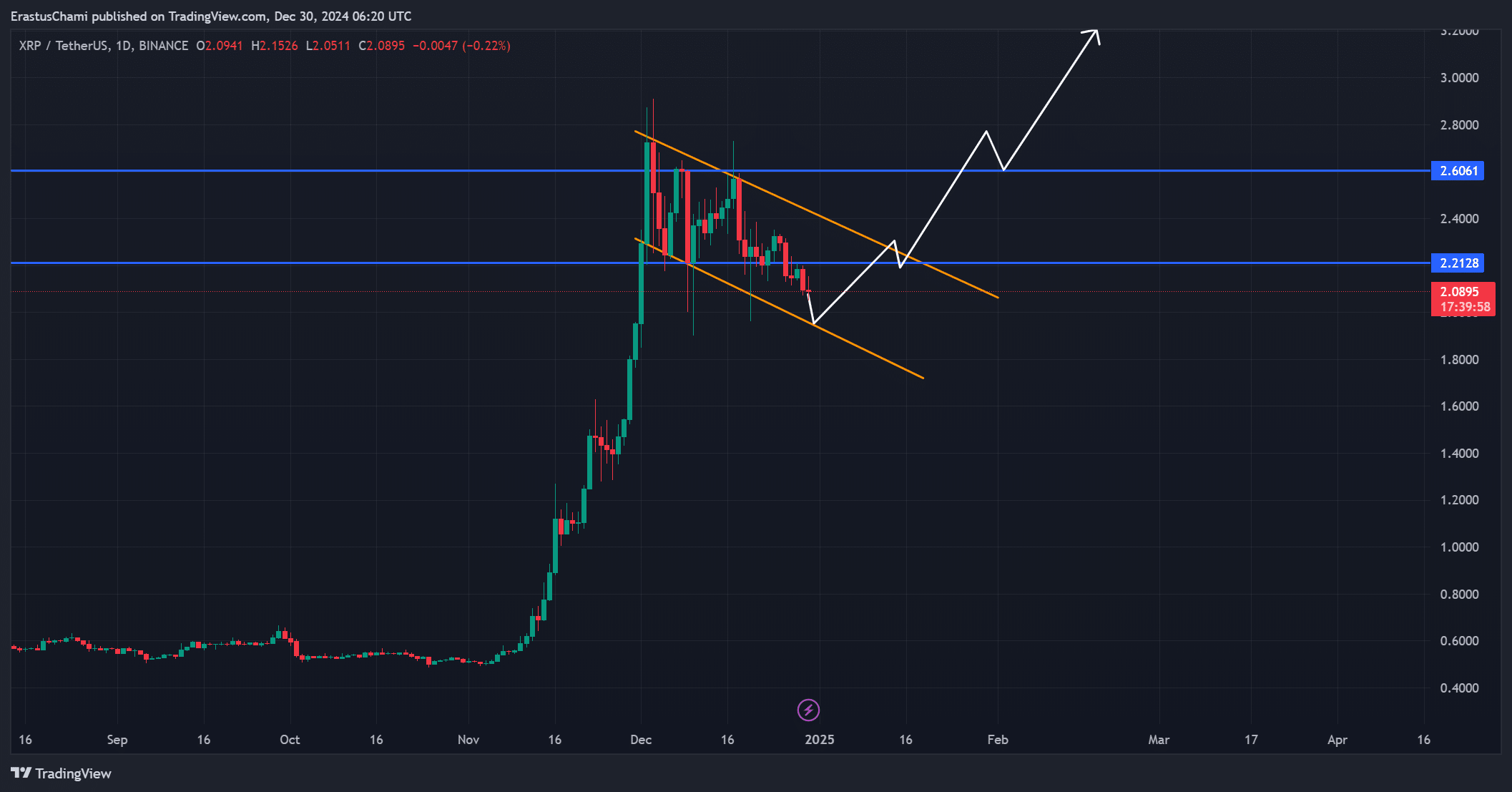

In my experience, understanding XRP’s price action and technical indicators is crucial for forecasting its future trajectory. At press time, XRP trading at $2.09 reflects a short-term decline, but the strong support around $2.05 and potential breakout point at $2.60 offer hope for a long-term bullish rally. The ongoing consolidation highlights the challenges XRP must overcome to sustain upward momentum, but any bullish reversal in technical indicators could confirm the start of a stronger upward trend.

The growing adoption and reduced selling pressure further strengthen XRP’s bullish outlook. Active addresses, exchange reserves, and derivatives data all point to increasing investor engagement, confidence, and optimism for XRP’s future. However, as with any investment, it is essential to remain vigilant and adaptable in the face of market changes.

As I always say, “The crypto market can be as unpredictable as a rollercoaster, but with patience, persistence, and a good sense of humor, we’ll navigate its twists and turns together.” So buckle up, folks! The ride to $15 might just be the most exhilarating yet.

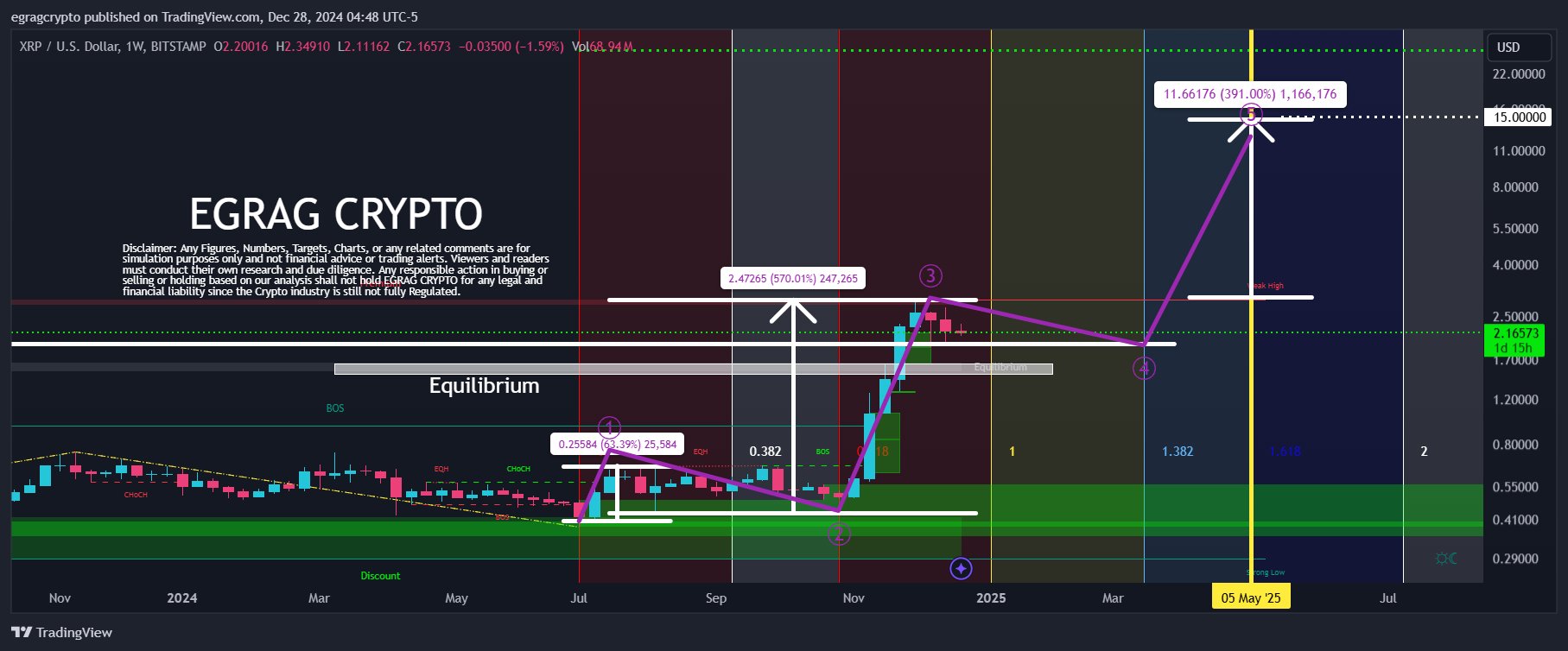

XRP (XRP) is drawing interest as forecasts suggest it could reach $15 by May 5, 2025, driven by Fibonacci timing patterns and Elliott Wave projections.

This forecast indicates a strong upward movement (bullish trend), but the present market conditions require a thorough examination before making any decisions.

As someone who has closely followed the cryptocurrency market for several years now, I’ve learned that optimism alone isn’t enough when it comes to predicting the short-term performance of a coin like XRP. From my personal experience, I’ve found that a balanced outlook, backed by thorough analysis of its price action and technical indicators, is crucial for accurately forecasting its future trajectory. In other words, while it’s great to remain optimistic about the potential of XRP, it’s equally important to stay grounded in the reality of its current market behavior in order to make informed decisions.

A bullish future for XRP?

As per EGRAG Crypto’s recent update on platform X (previously known as Twitter), they have identified May 2025 as a significant date based on Fibonacci time zones. This date corresponds with the 1.618 level, a historically notable point associated with substantial price fluctuations in markets.

According to the Elliott Wave theory, it appears that XRP is currently in a corrective phase (Wave 4), which historically comes before a potentially strong upward trend (Wave 5).

Based on my years of observing market trends, I have a strong feeling that Wave 5 could potentially lead to a significant 391% gain. My experiences have shown me that past waves’ performance can provide valuable insights into future developments. However, it is crucial to remember that these gains can only be realized if market conditions remain favorable and supportive. It is always prudent to proceed with caution and make informed decisions.

XRP price action reveals crucial levels

Currently, one XRP is being exchanged for approximately $2.09, marking a 4.14% decrease in value over the past day. The digital coin appears to be finding solid backing around $2.05, while $2.60 could potentially serve as a crucial turning point for a significant breakout.

Overcoming the present resistance could pave the way for a prolonged bullish trend for XRP. But, the ongoing price stability indicates hurdles that XRP needs to surmount in order to keep its upward trajectory going strong.

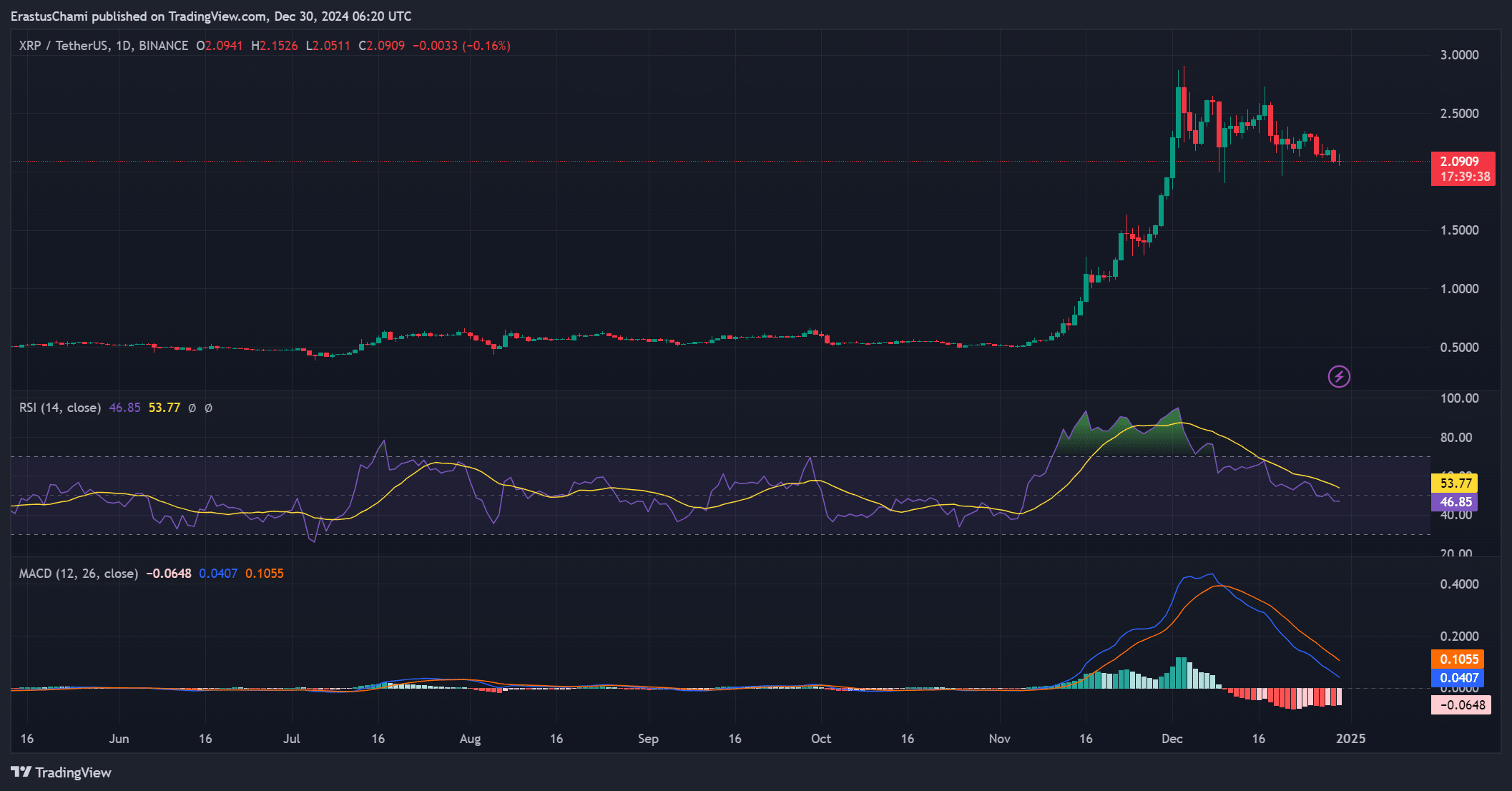

Technical indicators show mixed signals

At the current moment, RSI for XRP stood at 53.77, indicating a neutral market trend that doesn’t show signs of overbought conditions. Contrastingly, the MACD showed a bearish crossover, suggesting possible short-term downward pressure might be on the horizon.

Regardless of the current signals, the corrective phase has continued as anticipated by Elliott Wave theory. Consequently, a potential bullish shift in technical indicators might signal the commencement of a more robust uptrend.

XRP active addresses reflect growing adoption

Over the last day, the level of activity on the network stayed high, as the number of active addresses grew by approximately 1.16% to reach a total of about 37.8 million. This surge suggests that more people are embracing and showing continued curiosity towards the XRP network’s ecosystem.

Furthermore, the ongoing expansion of our network’s key performance indicators strengthens our faith in the token’s long-term viability. These fundamental aspects lay a strong base for potential price increases in the future.

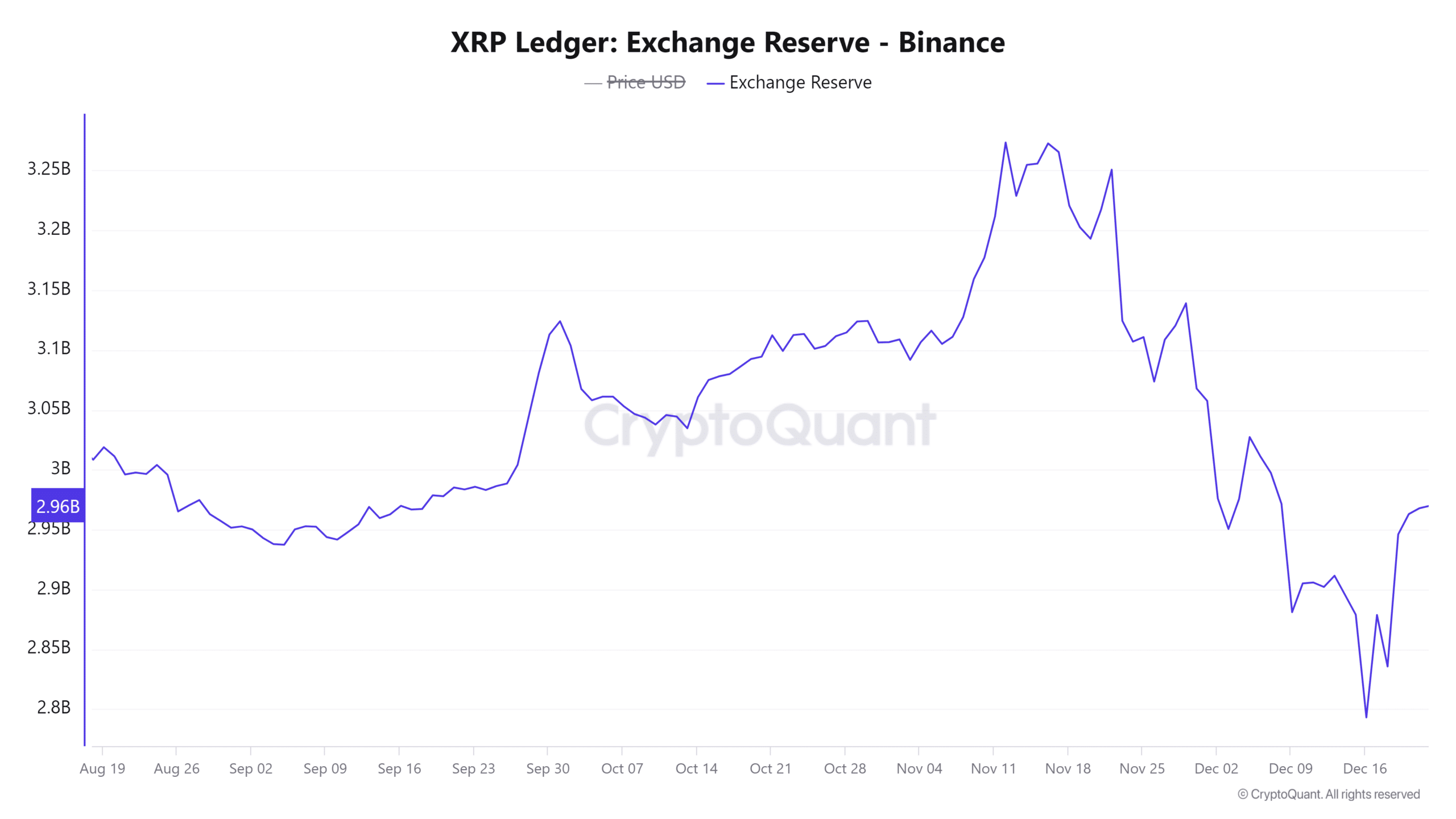

Exchange reserves signal reduced selling pressure

The drop of 0.15% in the exchange reserves implies less selling is happening on platforms, which might suggest that investors are storing more XRP for long-term purposes, indicating an increase in accumulation.

A decrease in exchange reserves for XRP tends to coincide with optimistic expectations, indicating a favorable viewpoint for its price increase. This trend supports the possibility of an upcoming surge in value.

Derivatives data point to market optimism

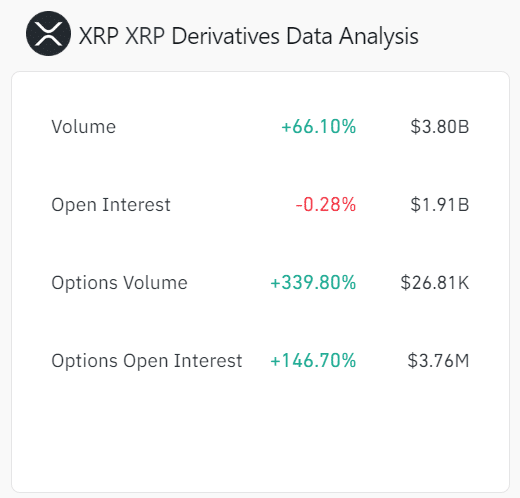

As a researcher, I’ve observed significant growth in the derivatives market, where trading volume has soared by an impressive 66.10%, while options volume has experienced a substantial boost of 339.80%. This surge indicates heightened investor interest and confidence, as evidenced by the increased Open Interest.

As an analyst, I’ve observed these figures suggesting a robustly optimistic market outlook, potentially leading to heightened volatility and additional price surges. Consequently, it’s essential to closely monitor derivatives data for insights into the market’s direction.

Read XRP’s Price Prediction 2025–2026

Conclusion: Will XRP hit $15?

According to Fibonacci sequences, Elliott Wave patterns, and robust underlying values, it’s possible that the price of XRP may reach approximately $15 by May 2025. But for this projection to come true, the market needs to maintain positive trends and investors must remain optimistic.

Despite some ongoing hurdles, the evidence suggests a positive outlook for XRP’s future, especially if its usage and network activity persistently grow.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-12-30 13:12