-

XRP would hit the $20 mark by 2026 amidst ongoing legal issues with the SEC.

Analysis suggested continued downward price pressure, which metrics show increased interest.

As a seasoned crypto investor, I’ve witnessed the ups and downs of the market firsthand. XRP has been a rollercoaster ride for me, with its significant price drops and ongoing legal issues with the SEC casting a shadow over its future potential.

The legal dispute between the SEC and Ripple (XRP), a prominent digital currency, poses considerable hurdles for the cryptocurrency.

As a researcher examining this asset’s price history, I’ve observed a significant downturn. The value has dropped by a staggering 84.7% from its previous maximum of $3.40 reached in 2018. Unfortunately, the asset has yet to regain even a small portion of that peak value.

Over the last thirty days, XRP‘s value has seen a significant decrease, with almost a 20% price drop.

The cryptocurrency experienced a slight increase in value the previous week, but it has since begun to decline, now demonstrating a 2.3% drop over the last 24 hours.

However, despite the bearish pressure, an analyst has predicted that XRP has a bright future.

A bullish case for XRP

Armando Pantoja, a well-known cryptocurrency analyst, expresses confidence in XRP‘s prospects, projecting a value range of $8 to $20 for it by the year 2026.

This projection implies a dramatic increase of up to 3,557.6% from its current levels.

Pantoja provides justifications for the potential increase, drawing on the past example of the 2017 bull market as a strong historical precedent. During this period, XRP experienced remarkable growth, skyrocketing over 650 times to its peak.

The integration of XRP into prominent financial institutions, such as Bank of America and Royal Bank of Canada, spearheaded by its creator Ripple, holds substantial influence over XRP’s future value.

Ripple’s new collaborations, such as its partnership with HashKey DX for XRP Ledger projects in Japan and its work with SBI Ripple Asia, may significantly boost XRP’s value.

Despite these adoptions, movement is still being made to accelerate further adoptions.

Ripple’s development team, RippleX, has rolled out significant enhancements to the XRP Ledger (XRPL) in the form of the XLS-68d specification.

With this improvement, platforms can absorb the costs of transaction fees on behalf of users, eliminating the need for giving away free XRP during the sign-up process, thereby streamlining the joining procedure.

These developments are vital for broadening XRP’s appeal and utility in the digital economy.

Beyond just institutional endorsement, Pantoja emphasizes the impact of market tendencies and the growing value of financial offerings.

XRP is expected to gain legal clarity shortly, leading to a notable increase in collaborations.

With regard to the ongoing legal issues between Ripple and the U.S. Securities and Exchange Commission (SEC), matters took a turn for the worse in March when the SEC demanded a hefty $2 billion penalty from Ripple, alleging breaches concerning institutional sales of XRP.

Last week, Stuart Alderoty, Ripple’s Chief Legal Officer, countered these accusations with a comprehensive refutation on behalf of the company.

Ripple contests the SEC’s claims and proposes a significantly reduced penalty, preferably under $10 million.

According to the reports, the US Securities and Exchange Commission (SEC) has submitted its response to the challenge of the proposed fine, but the relevant documents remain sealed and currently unavailable to the general public.

As we near the conclusion of the ongoing lawsuit, I, as an analyst, understand that the crypto community is holding their breath in anticipation of the outcome. If the ruling favors XRP, there’s a strong possibility that it could surpass its previous price highs and even reach into double-digit territory.

XRP’s possible short-term move

Currently, based on technical analysis, XRP is likely to experience further price declines in the short term.

The asset has been frequently shattering its pattern on both the daily and 4-hour charts. Lately, it has attracted significant liquidity and aims to reach the previous low around $0.48.

A pessimistic viewpoint regarding XRP‘s near-term future is strengthened by a recent analysis from AMBCrypto. They pointed out that the Chaikin Money Flow indicator for XRP had dropped to zero, signaling a lack of substantial investment inflows into the market.

Realistic or not, here’s XRP’s market cap in BTC terms

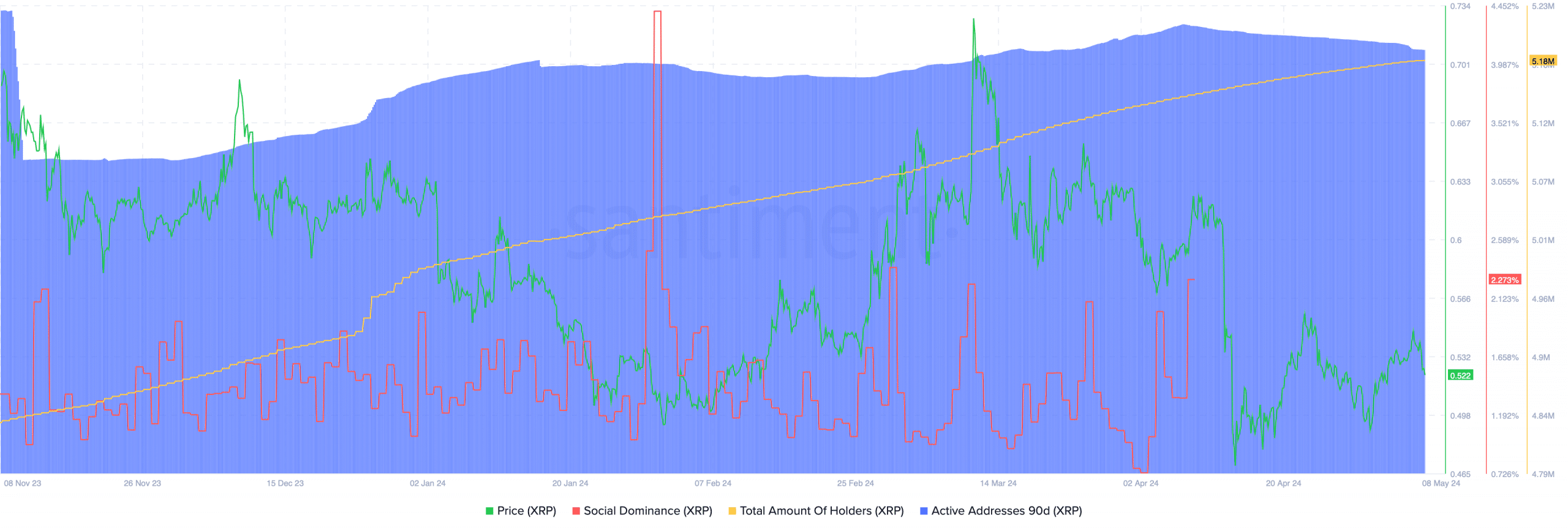

Despite the negative signals suggested by these indicators, Santiment’s data reveals a rise in key metrics like social influence, number of holders, and active users for XRP.

This suggests that many in the community remain optimistic and confident about the asset’s future.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Solo Leveling Arise Tawata Kanae Guide

2024-05-09 07:04