-

XRP has surged over 5% in the past week, trading at $0.60 at press time.

Technical and fundamental analyses suggested potential future price movements, with long-term bullish scenarios highlighted.

As a seasoned crypto investor with a knack for spotting trends and patterns, I must admit that the recent surge of XRP has piqued my interest. With over five years of investment under my belt, I’ve seen the crypto market go through its fair share of ups and downs, and I can confidently say that this bullish run is a breath of fresh air.

The price of XRP is experiencing a significant surge at present, thanks to its recent legal triumph over the U.S. Securities and Exchange Commission (SEC).

Over these last seven days, I’ve witnessed an impressive 5% increase in the value of my XRP holdings. At the moment, each unit is worth approximately $0.60.

In the last seven days, this increase is not just seen in its price, but also in its total value in the stock market, which has grown by approximately $1 billion.

The daily trading volume of XRP has significantly increased, climbing from approximately $2 billion last Friday to consistently remaining above $2.6 billion today.

Technical and fundamental outlook

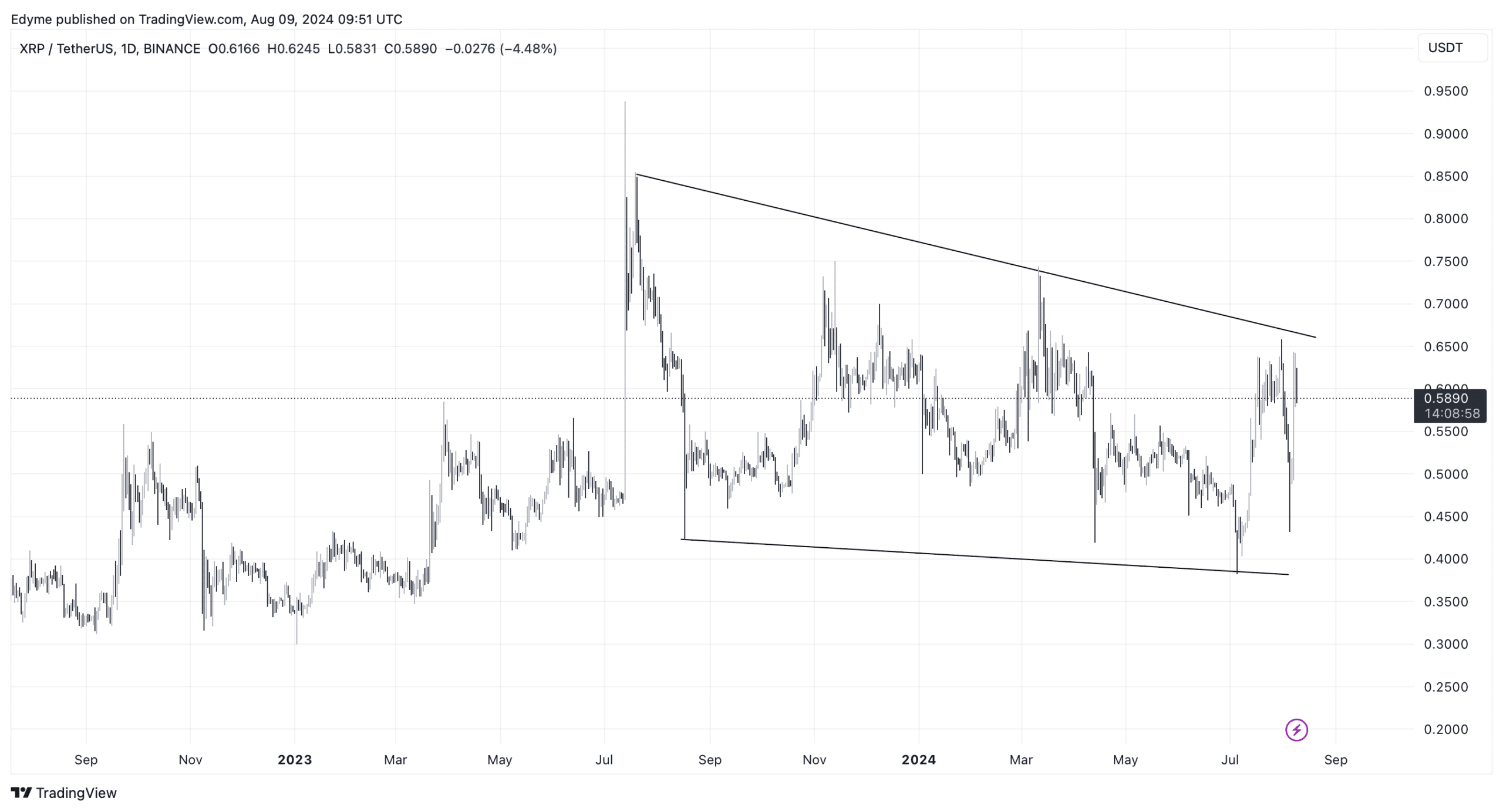

An examination of XRP‘s daily price trend revealed a series of progressively higher peaks (higher highs) and troughs (higher lows), suggesting the emergence of a downward sloping channel formation.

Within its current channel, the potential for XRP to break out – moving up or down – might signal where its future price trend is headed.

Currently, at this moment, XRP is getting close to breaking out beyond its trend line, but it’s hitting a roadblock, possibly because of a specific area marked as a supply zone in the daily chart analysis.

Keeping an eye on crucial price points at $0.74 and $0.38 is important because they might influence XRP‘s major price shifts in the near future.

If the price surpasses $0.74, it may indicate the beginning of an upward trend, whereas falling beneath $0.38 could imply a continuation of the downward movement.

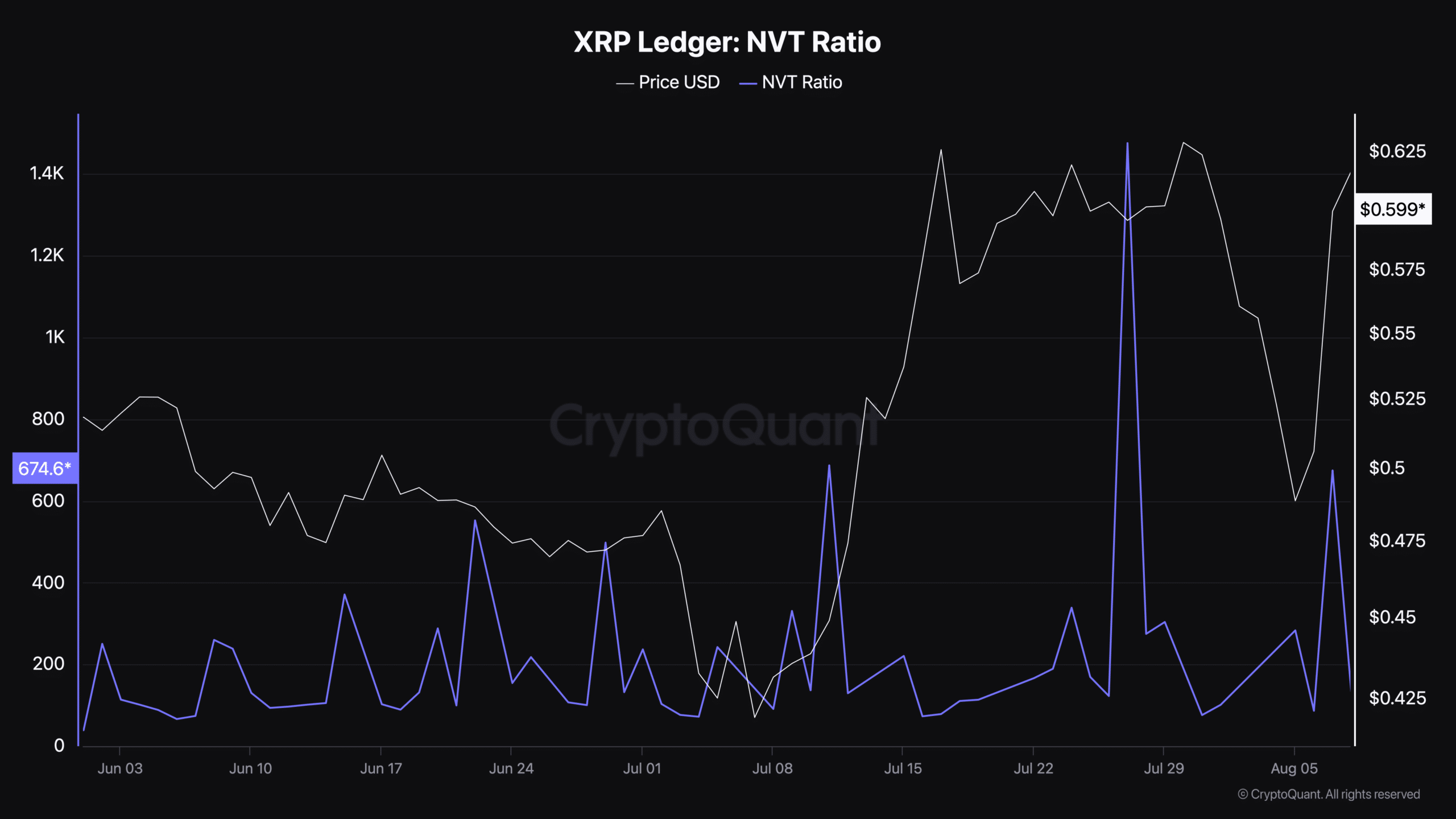

Looking at the core aspects, the Ratio of Network Value to Transactions (NVT) for XRP stood at approximately 674.69 during this period, indicating the comparison between the network’s value and the transaction volume.

A high proportion might suggest that the network is either excessively priced or its current worth isn’t backed by sufficient transaction volume, implying potential limitations in upward momentum.

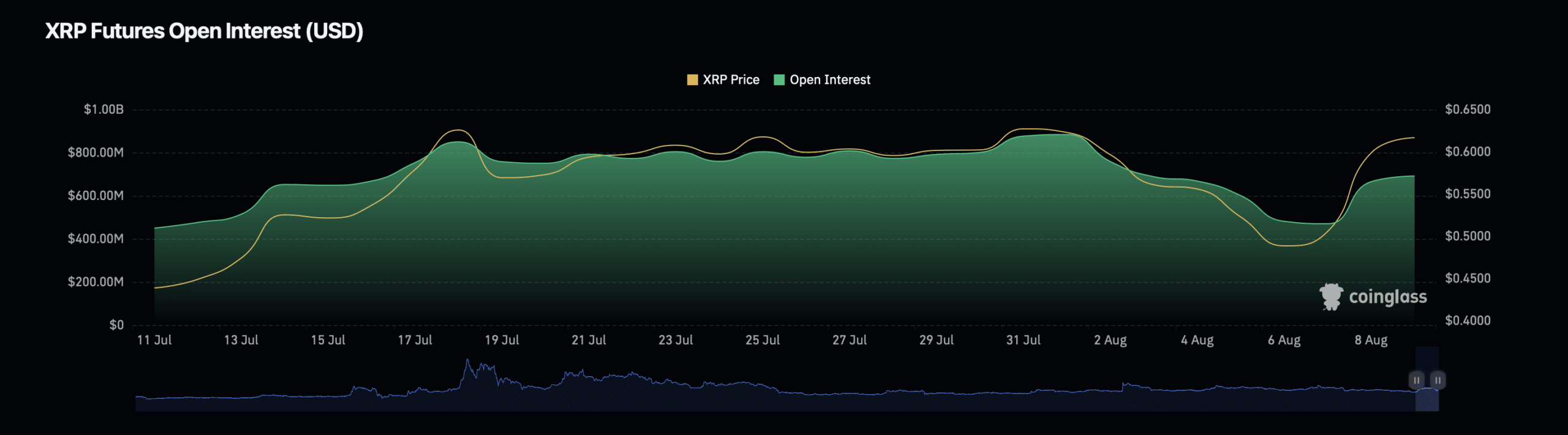

Additionally, over the past day, the Outstanding Derivative Contracts for XRP, amounting to a value of $655.35 million, have dropped by 9.27%.

The decrease in Open Interest, which led to a significant 61% drop in the volume to $5.19 billion, indicates a potential reduction in market leverage. This reduction might influence the market’s ability to maintain stable prices.

XRP’s long term outlook

Over a longer timeframe, an influential analyst called Doctor Profit on social platforms has noticed similarities between the present market trends and those preceding XRP‘s spectacular surge in 2017.

Based on Doctor Profit’s analysis, repeatedly overcoming a long-established resistance point might result in a major breakthrough, potentially pushing the price beyond $1 by early 2025.

Read Ripple’s [XRP] Price Prediction 2024-2025

The analyst particularly noted:

“If the price dips to $0.72 again, don’t worry. A breakout is imminent, and I predict prices will surpass $1 by Q1 2025 at the latest. When XRP repeats its 2017 performance and reaches the same Fibonacci levels as in 2017, we could see a peak of around $16.”

Meanwhile, he gave two price targets for XRP, noting,

“Best case: $16 – $20. Worst case: $4 – $7.”

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Elden Ring Nightreign Recluse guide and abilities explained

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-08-10 00:08