With the SEC and Ripple filing a joint motion to dissolve the existing injunction and release $125 million held in escrow, XRP could be positioned for a long-term bullish rally—despite recent market turbulence.

Ripple and SEC Move Toward Resolution

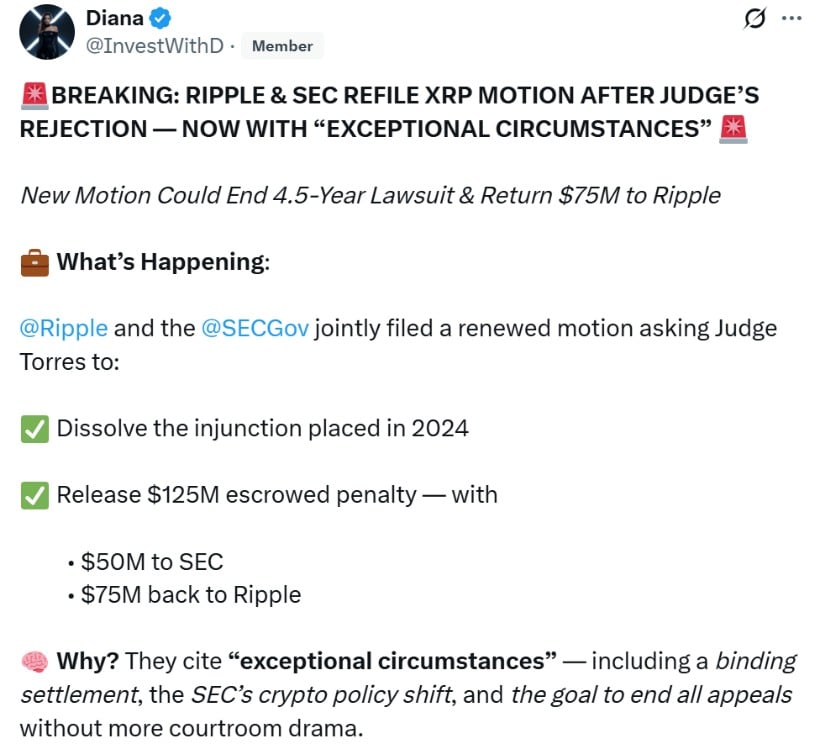

In what may be the final chapter of the high-profile Ripple lawsuit, both Ripple Labs and the U.S. Securities and Exchange Commission (SEC) have requested Judge Analisa Torres of the Southern District of New York to approve a joint motion. The proposal involves dissolving the injunction that previously blocked Ripple from institutional XRP sales and redistributing the $125 million civil penalty held in escrow.

The parties have agreed that $50 million would be paid to the SEC, while the remaining $75 million would be returned to Ripple. According to the motion, this request reflects a settlement already reached and, if approved, would allow both parties to proceed to the Court of Appeals for limited remand.

While the Court had previously denied a similar motion in May for lacking justification, the new filing argues that “exceptional circumstances” now exist. These include a finalized settlement and a broader shift in the SEC’s crypto enforcement posture.

Legal experts remain cautiously optimistic. Attorney Bill Morgan noted that “Judge Torres may be as fatigued with the case as anyone and might prefer to bring it to an end.” However, others such as Fred Rispoli believe the motion could still be denied, citing its lack of depth in addressing the court’s earlier concerns.

XRP Market Reacts to Legal Developments

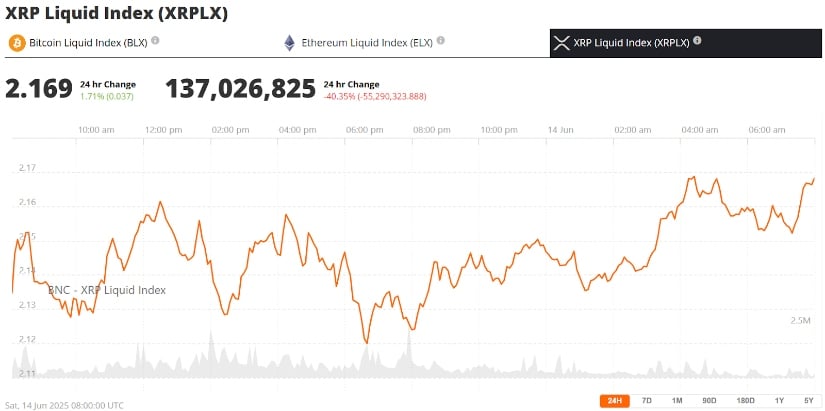

Following the announcement of the joint motion, XRP briefly dipped to $2.14, down 3.85%—amid broader crypto market volatility fueled by escalating geopolitical tensions between Israel and Iran. However, this price drop was accompanied by a 58% surge in trading volume, suggesting that traders were repositioning ahead of a potential legal resolution.

Despite the short-term dip, many long-term holders remain bullish. The motion’s approval could lift long-standing regulatory overhangs, clearing the path for Ripple’s institutional expansion plans and potentially reviving its rumored IPO and partnerships with financial giants such as Bank of America.

Ripple crypto-related treasury activity has also been picking up. Public companies, including VivoEnergy and Webus International have recently initiated XRP-focused treasury strategies, while Ondo Finance launched its tokenized short-term U.S. Treasuries (OUSG) on the Ripple ledger, deepening the bridge between DeFi and traditional finance.

XRP Technical Outlook: Recovery in Sight?

At the time of writing, XRP is trading near $2.17 after rebounding from support at $2.09, a zone backed by the 200-day Exponential Moving Average (EMA). This level appears to be a critical floor for the token amid ongoing uncertainty.

Technical indicators are mixed. While the Relative Strength Index (RSI) has dropped below the 50 midpoint and remains under a descending trendline, XRP has formed a morning star reversal pattern near the 23.6% Fibonacci retracement level at $2.146, hinting at renewed buying interest.

Resistance lies ahead at $2.183 to $2.213, with a potential breakout opening the path toward $2.243–$2.245. “This is a technical pivot zone,” according to analysts at FXLeaders. “If XRP clears it, the bullish narrative could quickly gain traction.”

XRP Price Prediction: Aiming for Higher Ground

With legal clarity on the horizon and technical support holding strong, XRP price prediction models suggest the potential for a significant breakout in the coming weeks. If the SEC-Ripple settlement is approved and institutional demand picks up, XRP could rally toward the $2.34 resistance level and potentially revisit $2.50—a 17% upside from its current price.

Looking further ahead, analysts remain bullish on XRP’s long-term trajectory. Many foresee the token climbing to $5 by 2025, assuming favorable market conditions and continued regulatory momentum.

Final Thoughts

The Ripple lawsuit update has once again placed XRP in the spotlight. The pending $125 million deal with the SEC may mark the beginning of a new era for Ripple XRP news, offering clarity to institutional investors and reinvigorating bullish sentiment in the market. While short-term volatility remains, XRP’s foundational strength and expanding use cases suggest a promising path forward.

As Brad Garlinghouse, Ripple’s CEO, has often emphasized, “Regulatory clarity is the key to unlocking the next wave of crypto adoption.” If this legal breakthrough materializes, XRP may finally have the clarity it needs to soar.

Read More

2025-06-14 18:10