- XRP’s RSI has been in the overbought zone for the past seven days.

- The price has continued to hold above $1.

As a seasoned researcher with years of market analysis under my belt, I must say that the current XRP rally is nothing short of impressive. The synchronized whale accumulation and technical indicators on the daily chart paint a bullish picture for this digital asset.

The original cryptocurrency issued by Ripple, known as XRP, is soaring to unprecedented levels, indicating robust positive market trends and a surge in buying interest.

In simpler terms, the increase in whale holdings, along with strong technical signals visible on the daily chart, suggested that the price trend would continue to rise steadily.

XRP rockets with whale activity

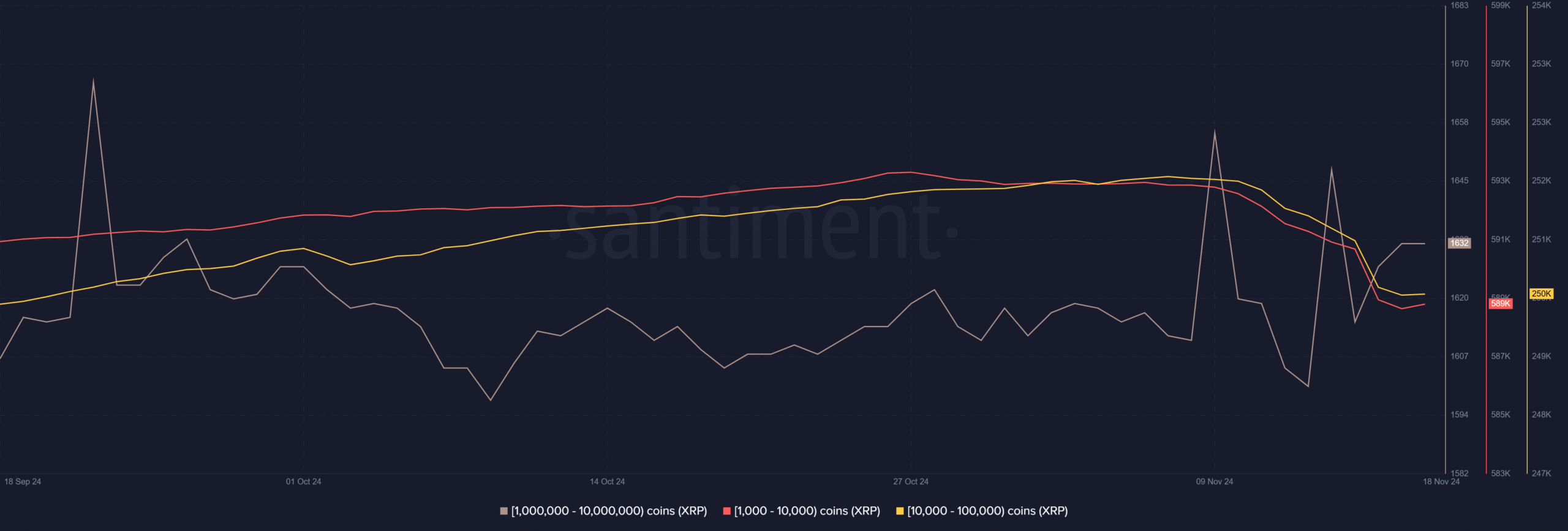

According to recent findings by Santiment, there has been a noticeable increase in large-scale investors (whales) adding more XRP to their holdings within the XRP market.

Over the past period, substantial wallets containing anywhere from one to ten million XRPs have consistently added more of this cryptocurrency to their possessions. Similarly, less affluent investors, owning between 10,000 and 100,000 XRPs, have also chosen to invest further in this digital currency.

This coordinated buildup pattern highlighted an increasing trust among investors that coins have a promising future.

The influx of whale activity has translated directly into XRP’s price surge.

At the moment of publication, the token’s value stood at approximately $1.15, showing a substantial increase in the latest trading periods, and increased on-chain activity hinting at robust institutional attention.

Such behavior often precedes substantial price rallies, further solidifying XRP’s bullish outlook.

Bullish signals abound

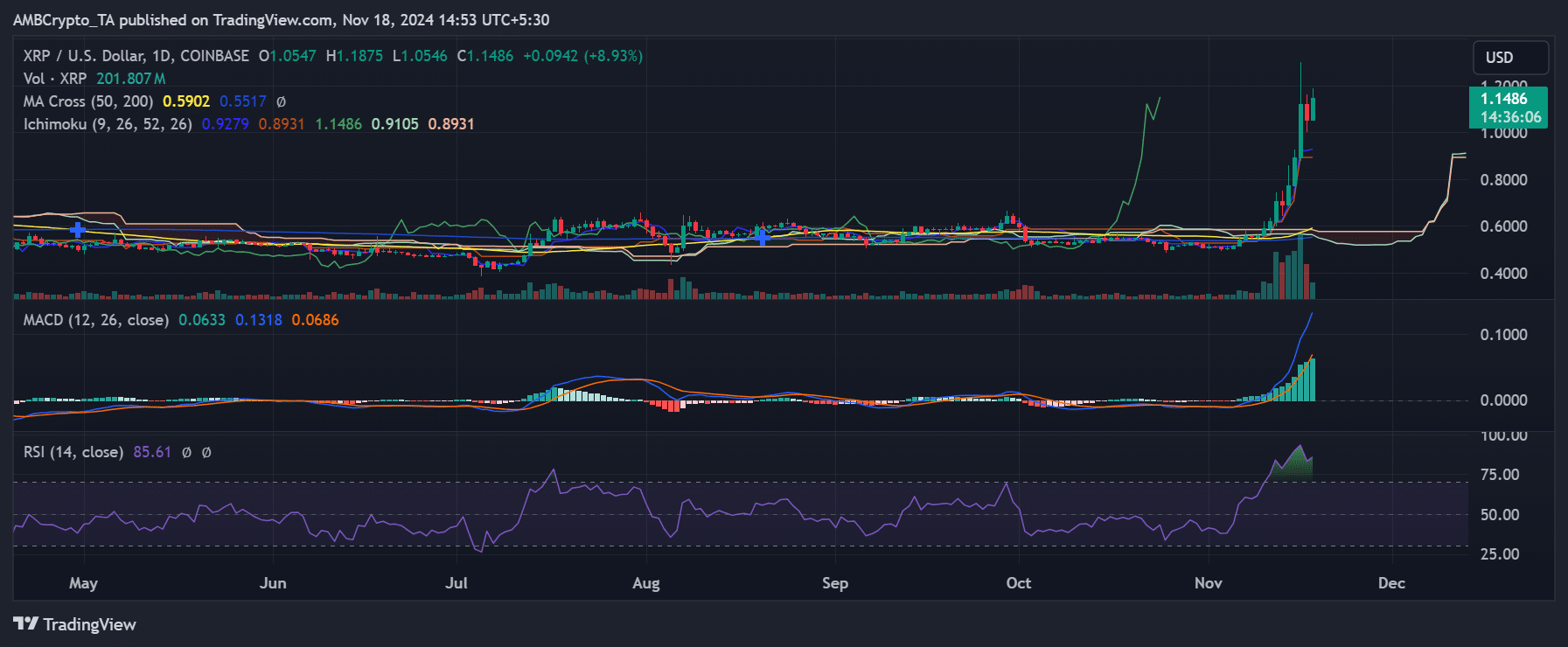

The XRP daily chart shows encouraging technical signs favoring its continued rise, as it successfully breached significant resistance points.

Currently, the asset is being traded significantly higher than the Ichimoku Cloud, indicating a continued bullish trend. The cloud’s incline serves as additional evidence supporting the power of the current uptrend.

An intersection between the 50-day Simple Moving Average (SMA) and the 200-day SMA, a significant event in market history, was about to occur. This pattern often indicates a positive outlook, suggesting that prices could rise even more.

On the daily chart, the MACD (Moving Average Convergence Divergence) line persistently grew within the positive zone, noticeably surpassing the signal line, suggesting robust bullish energy.

Meanwhile, the RSI was 85.61 at press time, firmly in overbought territory.

Although this indicates substantial demand for purchasing, it’s essential to exercise caution since prolonged overbuying might lead to temporary price drops. However, overall, the market trend continues to show a clearly positive direction.

Key levels to watch

For XRP, the next significant barrier to overcome is around $1.20, which represents a crucial psychological and technical hurdle. If it manages to break through this level, it could potentially lead to an upward trend aiming for $1.50. However, at $1.50, there may be increased selling activity due to profit-taking.

On the downside, $1.00 served as strong support, reinforced by the 50-day moving average.

As a researcher, I noticed an impressive surge in the trading volume, suggesting increased market engagement and active participation from various participants.

As a researcher, I’ve noticed an uptick in the volume of XRP transactions, which aligns with the overall optimistic mood in the market. This increase in trading activity might imply that the surge in XRP’s value is rooted in genuine investor interest rather than mere speculation or hype.

Read Ripple’s [XRP] Price Prediction 2024-25

The surge in XRP’s value demonstrates its increasing dominance within the crypto market, backed by large investors buying up the token and intriguing trends on the technical analysis charts.

Despite temporary adjustments being likely due to the overbought Relative Strength Index (RSI), the general trajectory continues to point upward, indicating that the ascent of XRP is still robust and ongoing.

Read More

2024-11-19 07:04