- Judge Netburn’s scheduling order offers hope amid uncertainty in the Ripple-SEC legal battle

- FBI’s caution and SEC’s actions signal growing regulatory pressure on crypto

As a researcher with extensive experience in the crypto space, I’ve closely followed the developments between Ripple and the SEC with great interest. The latest scheduling order by Magistrate Judge Sarah Netburn offers a glimmer of hope amidst the prolonged uncertainty surrounding this legal battle. However, it remains to be seen whether this could potentially mark the end of the saga or if we’re in for more twists and turns.

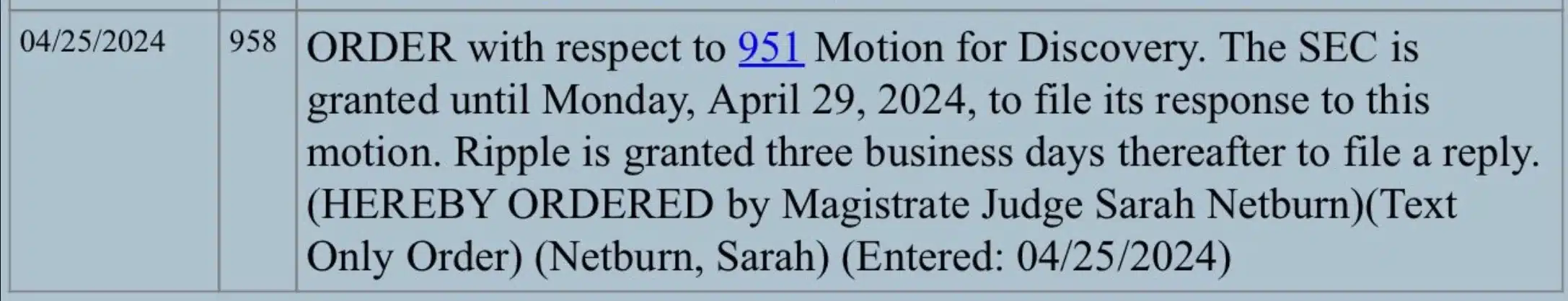

The SEC in the US has kept a vigilant eye on crypto companies for years, and Ripple is one such notable case. A legal action against Ripple, initiated in 2020, resurfaced in the news recently as Magistrate Judge Sarah Netburn released a new schedule.

Ripple has requested the court to dismiss the new expert reports recently submitted by the SEC in support of their case. Judge Netburn granted an extension until April 29 for the SEC to respond to this motion. After that, Ripple will have three business days to present its response.

This new turn of events poses a significant query: Might it mark the conclusion of the protracted legal dispute between the SEC and Ripple?

What are the execs saying?

As a crypto investor, I’d like to point out that Ripple is pushing back against the SEC’s proposed penalties for alleged violations. The company is advocating for a maximum penalty of $10 million. In their perspective, the SEC’s accusations are overblown and lack concrete evidence. Furthermore, Ripple emphasizes that there isn’t any proof of future violations in their institutional XRP sales.

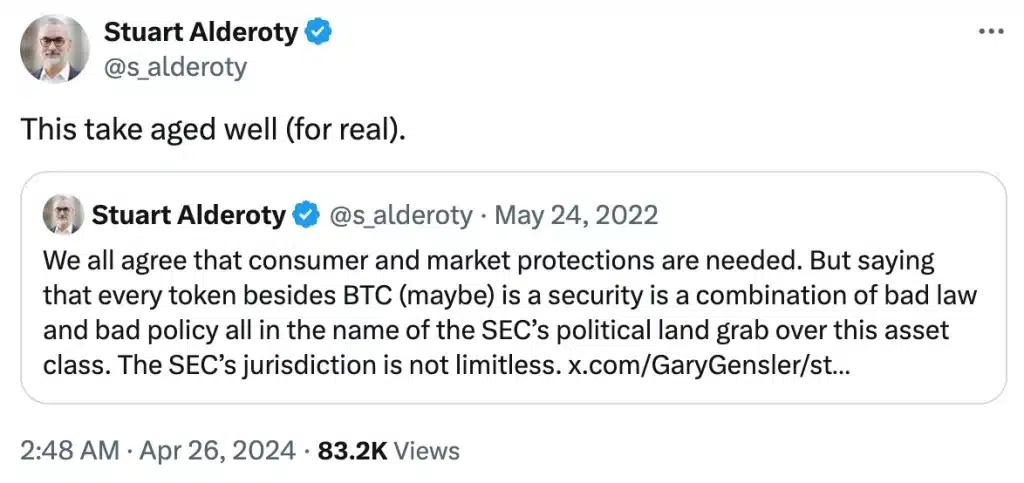

Considering the growing ambiguity, numerous crypto experts have shared their perspectives. One commentator expressed his viewpoint on this matter.

“#Ripple Vs #Sec Lawsuit Could Reach Supreme Court Of The United States.”

Alongside Stuart Alderoty, Ripple’s Chief Legal Officer, he voiced his criticism towards the SEC for allegedly misusing its authority.

SEC’s abuse of power

It’s important to note that Ripple isn’t the only cryptocurrency company under scrutiny by the SEC. Coinbase and Uniswap are also facing regulatory attention, with Uniswap recently receiving a Wells Notice from the SEC. Hayden Adams, CEO of Uniswap, expressed concerns about this development in an interview on the “Bankless” podcast.

“The SEC is essentially taking very aggressive stances and basically trying to shut down crypto.”

In light of growing worries about the SEC allegedly overstepping its bounds, Bloomberg announced the recent departures of two SEC lawyers. This came after a federal judge imposed sanctions and severely criticized the Securities and Exchange Commission for what was termed as an “egregious misuse of authority” in a cryptocurrency-related case.

Jake Chervinsky, the Chief Legal Officer at Variant, expressed agreement with previous views during the “Unchained” podcast.

As a crypto investor, I strongly believe that it’s high time for Congress to take action and establish clear regulations instead of keeping us in the limbo of regulatory ambiguity.

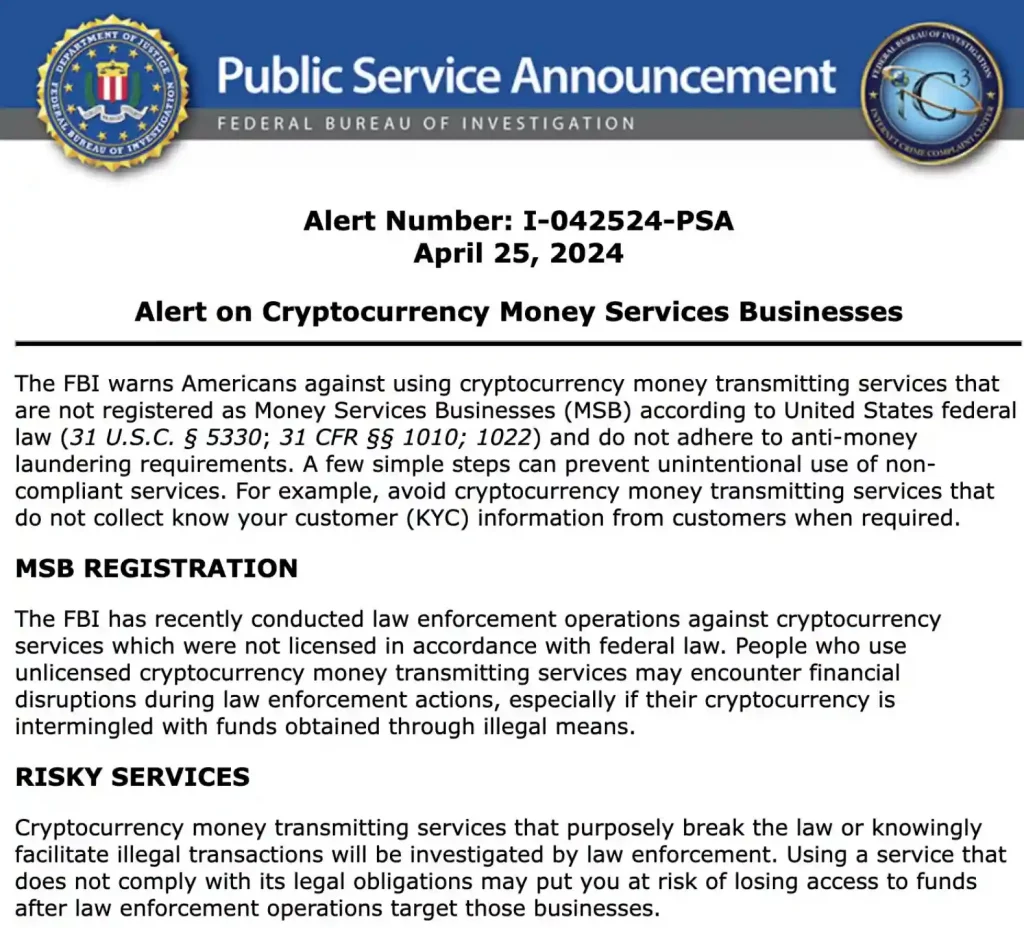

After the SEC, now it’s the FBI

Interestingly, it’s not just the SEC that’s going after crypto and crypto-entities.

The FBI has recently entered the regulatory sphere by warning citizens against using non-KYC ( Know Your Customer) Bitcoin and cryptocurrency services for money transmitting. However, it’s early to determine if this advisory will influence the behavior of the thousands of Americans who are part of the crypto community.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-04-27 14:16