-

XRP has declined in the last few days.

The asset is one of the losers among top assets in the last 24 hours.

As a seasoned market analyst with over a decade of experience, I must say that XRP‘s recent performance has been disheartening to say the least. The asset, once a promising contender in the crypto space, now appears to be struggling to find its footing amidst the bearish sentiment that has gripped the market.

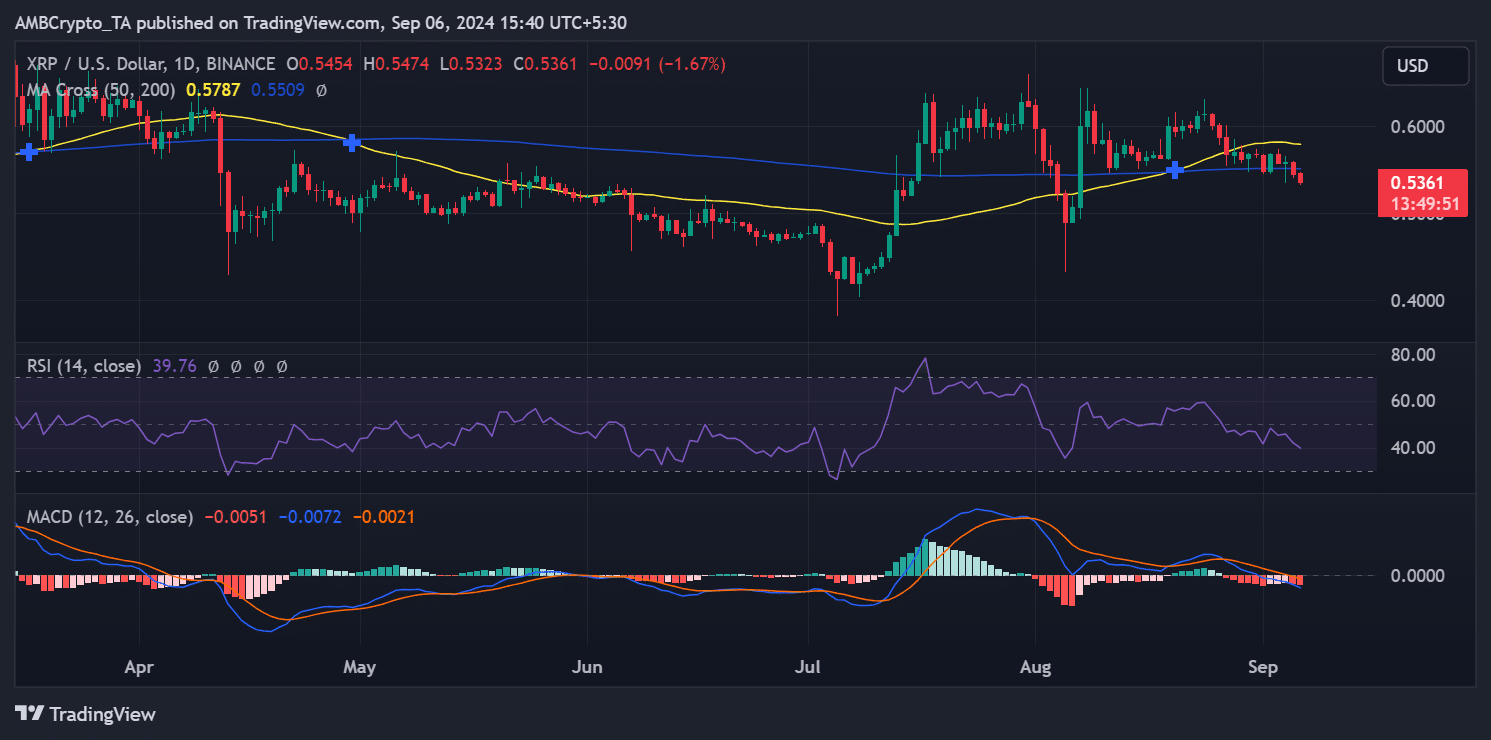

Over the last few weeks, the digital currency XRP (Ripple) has been under growing selling pressure and finding it tough to hold onto its recent prices. Currently trading at approximately $0.5361, a negative trend seems to be emerging in the market for this asset.

The technical analysis indicates that the market might be nearing an oversold state based on indicators like the Relative Strength Index (RSI) and moving averages. Furthermore, it appears that the stock’s supply held by profitable traders is diminishing.

XRP braces up for more declines

The current price trend of XRP indicates a tough fight for it to recover its upward trajectory, as the asset is currently valued less than both its 50-day and 200-day average pricing levels.

The 50-day moving average was around $0.5787, while the 200-day moving average is around $0.5509.

In simpler terms, this arrangement indicates a possible “death cross,” which is a warning sign often associated with bears in the financial market. This situation happens when a short-term average (the 50-day moving average) falls beneath a longer-term average (the 200-day moving average).

In simple terms, this intersection is often seen as a warning sign, implying that the decline in XRP‘s value might persist for some time to come.

Moreover, the asset hasn’t been able to surpass significant resistance points, which underscores a weak bullish drive and reinforces a predominantly negative outlook in the market.

Moreover, the Relative Strength Index (RSI) of XRP is presently at 39.76, indicating it’s approaching oversold territory. Typically, when RSI falls below 40, it suggests that an asset may experience heavy selling and could potentially be underpriced.

Even though a low Relative Strength Index (RSI) might signal an upcoming recovery, the feeble market momentum implies that any turnaround may be temporary unless there’s a substantial rise in demand for purchasing.

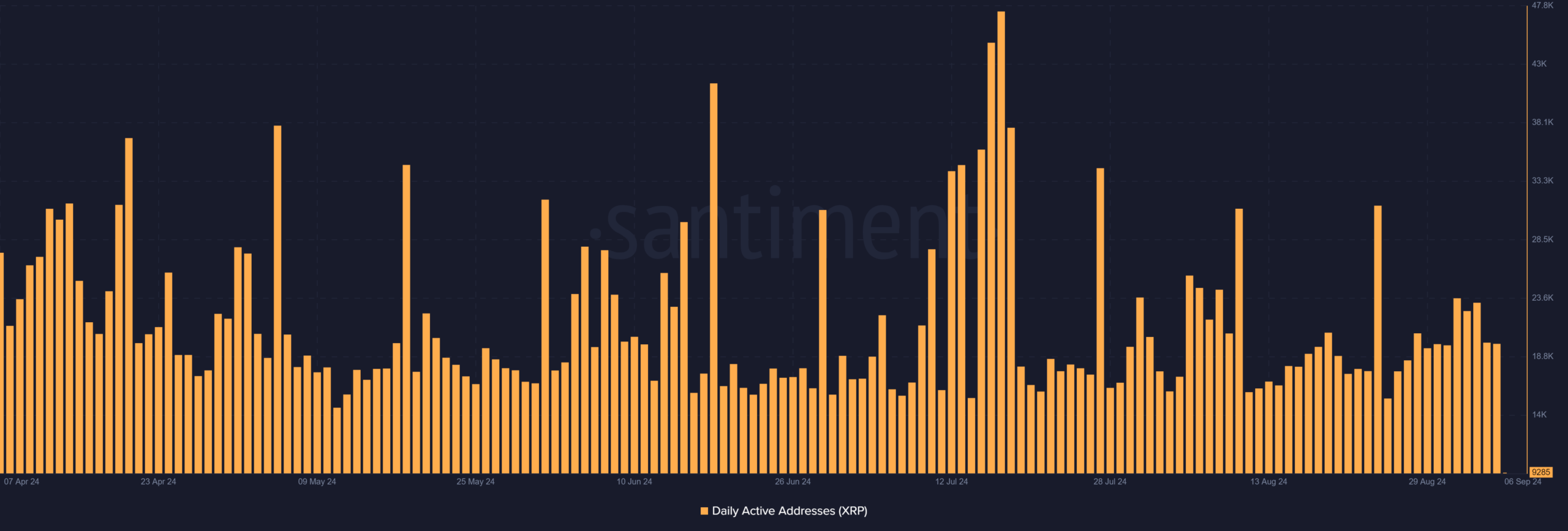

Less address activity

According to an analysis by AMBCrypto, there’s been a decrease in Ripple’s active addresses over the past few days. This figure peaked at approximately 23,000 active addresses from the 1st to the 3rd of September, but has since gone down.

In the past two days, the number of active addresses has fluctuated between 20,000 and 19,000.

The decrease in active addresses seems to imply a low probability for an increase in XRP prices, as lower levels of on-chain activity often reflect decreased user interaction and market involvement.

If there’s not enough usage or trading of XRP, it becomes harder to make a strong case for its price increasing significantly. This is because low activity on the network could indicate decreasing investor enthusiasm and transaction volumes.

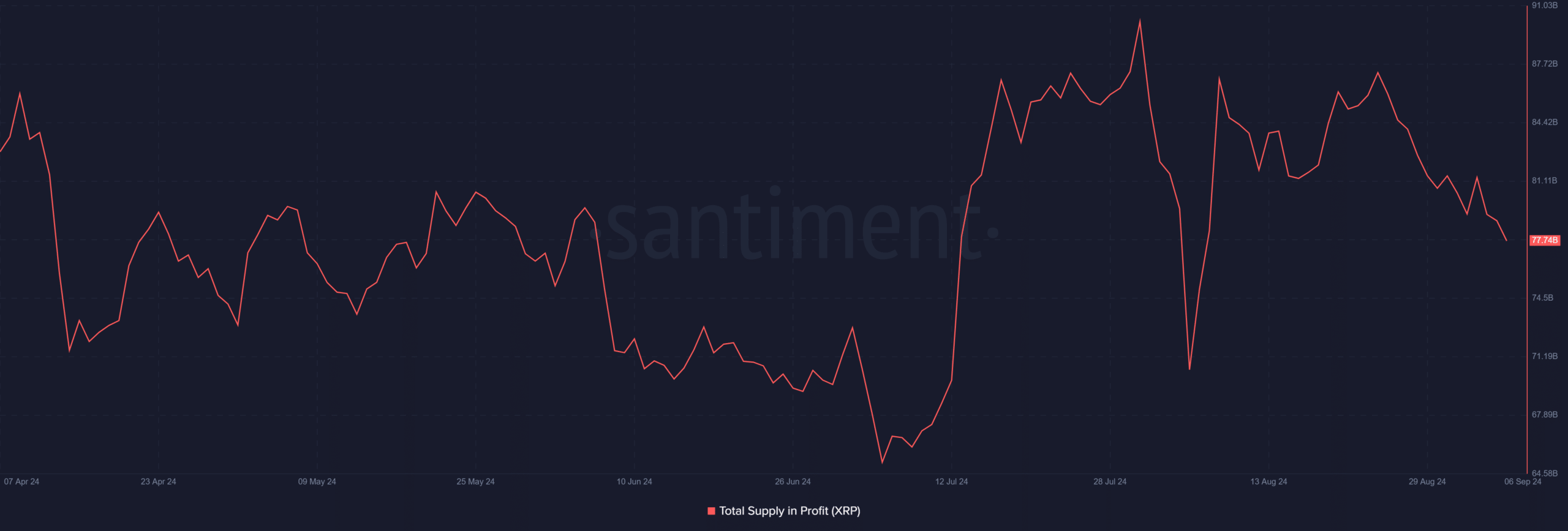

More XRP supply goes underwater

According to AMBCrypto’s assessment, the recent drop in XRP‘s price has noticeably affected the amount of XRP being held at a profit. As of the 24th of August, the supply of XRP in profit stood around 87.2 billion units.

Since that point, the decrease has been speeding up significantly. At present, the profitable supply of XRP stands approximately at 77.7 billion units.

Realistic or not, here’s XRP market cap in BTC’s terms

This significant drop underscores the fact that the ongoing reduction in the value of XRP has left many of its holders in a position where they are experiencing losses.

The significant decrease in profit-earning supplies indicates a wider downward market sentiment, as fewer investors find opportunities to sell at a profit due to the dropping prices.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

- Bitcoin’s Golden Cross: A Recipe for Disaster or Just Another Day in Crypto Paradise?

2024-09-06 19:04