-

XRP’s support is strained due to poor price trends.

Over 1 billion XRP holders are now out of profit.

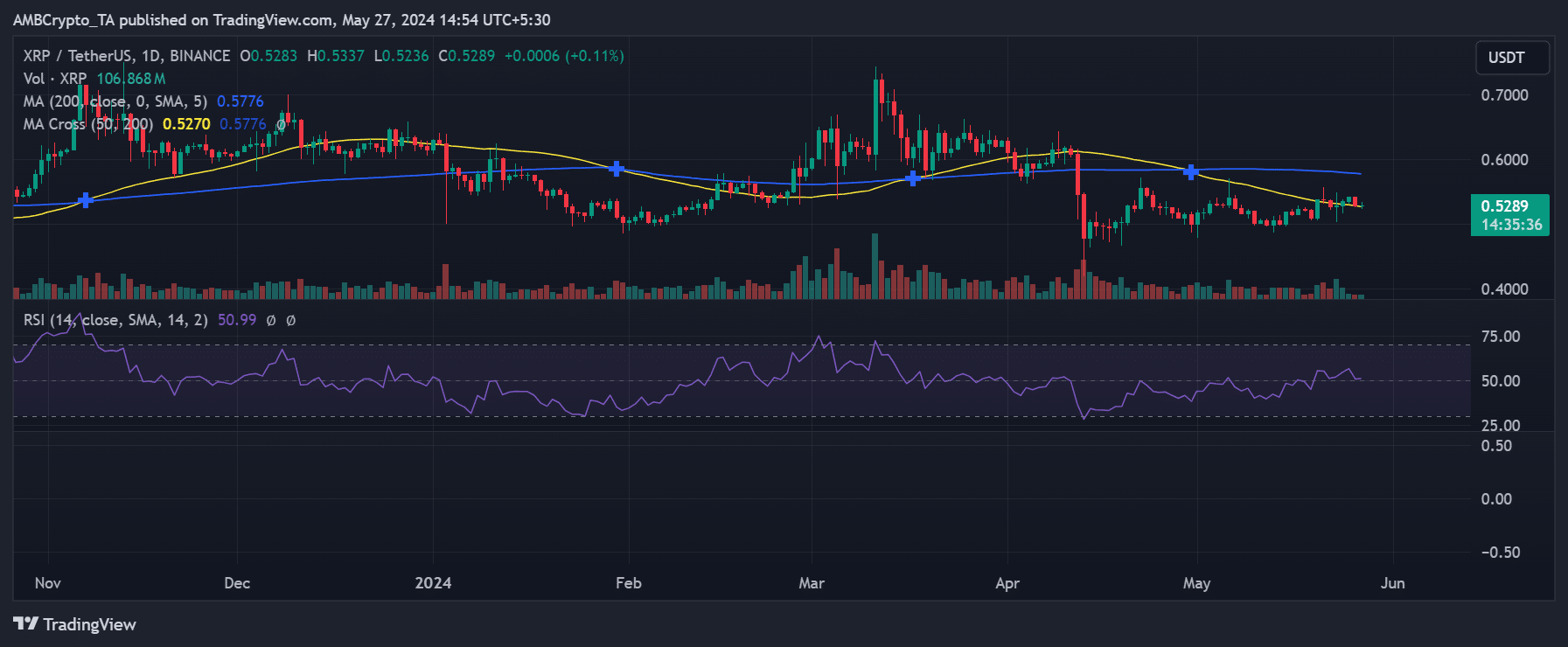

As a researcher with extensive experience in cryptocurrency market analysis, I’ve closely monitored XRP‘s recent price trends and the overall health of its supply. The data indicates that XRP is currently resting on a thin support line, as its price remains just above its short moving average.

Despite encountering challenges in the past few days, XRP has managed to remain above a significant level. Let’s examine how the overall supply is performing in terms of profitability, and consider potential elements that may aid in preserving its current pricing zone.

XRP rests heavily on support

Last week’s closing, XRP‘s price surpassed its brief moving average, marked in yellow, by more than 1%, reaching approximately $0.54. This action signaled a favorable trend.

At the beginning of this week, the price experienced a 2.46% decrease, which in turn wiped out the previous gains and caused the price to drop approximately to the level of $0.52.

As of the current moment, the price hovered around $0.52 on the chart, with the yellow line serving as a significant barrier preventing further drops.

As an analyst, I observed that the Long Moving Average, represented by the blue line, acted as a resistance point around $0.58. Furthermore, based on the Relative Strength Index (RSI), XRP exhibited signs of a weaker bullish momentum.

The RSI (Relative Strength Index) was hovering around its neutral threshold at the moment. A substantial drop in price might cause it to dip below this mark.

XRP demand stays flat

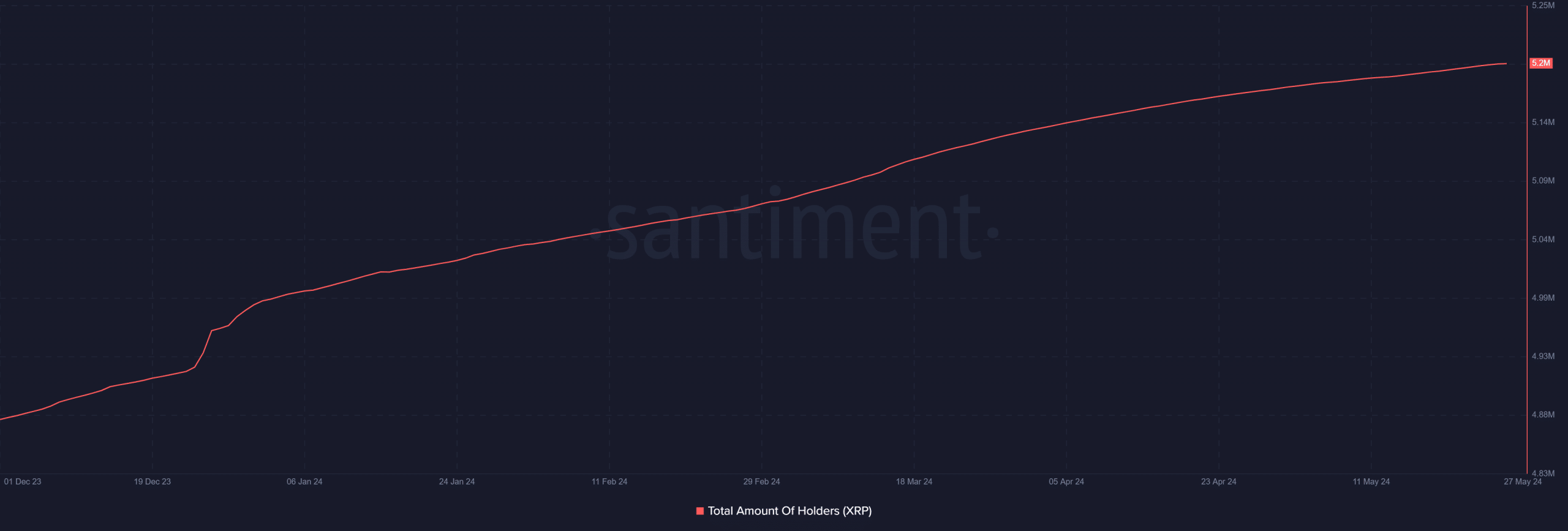

As an analyst, I have examined the data from AMBCrypto’s report on XRP holders and found that the demand for this cryptocurrency has remained fairly stable lately. At present, there are approximately 5.2 million individuals holding XRP according to the available information.

The figure has stayed constant over the last three days, suggesting a lack of urgency among those looking to acquire the asset, even with shifting price patterns.

Recently, the trading volume has been relatively quiet, hovering around $793 million.

As an analyst, I would interpret the current situation as indicating a relatively low volume of trading activity. This could make it challenging for the existing support levels to maintain their position, increasing the likelihood of a price decline in the near future.

Supply in profit declines

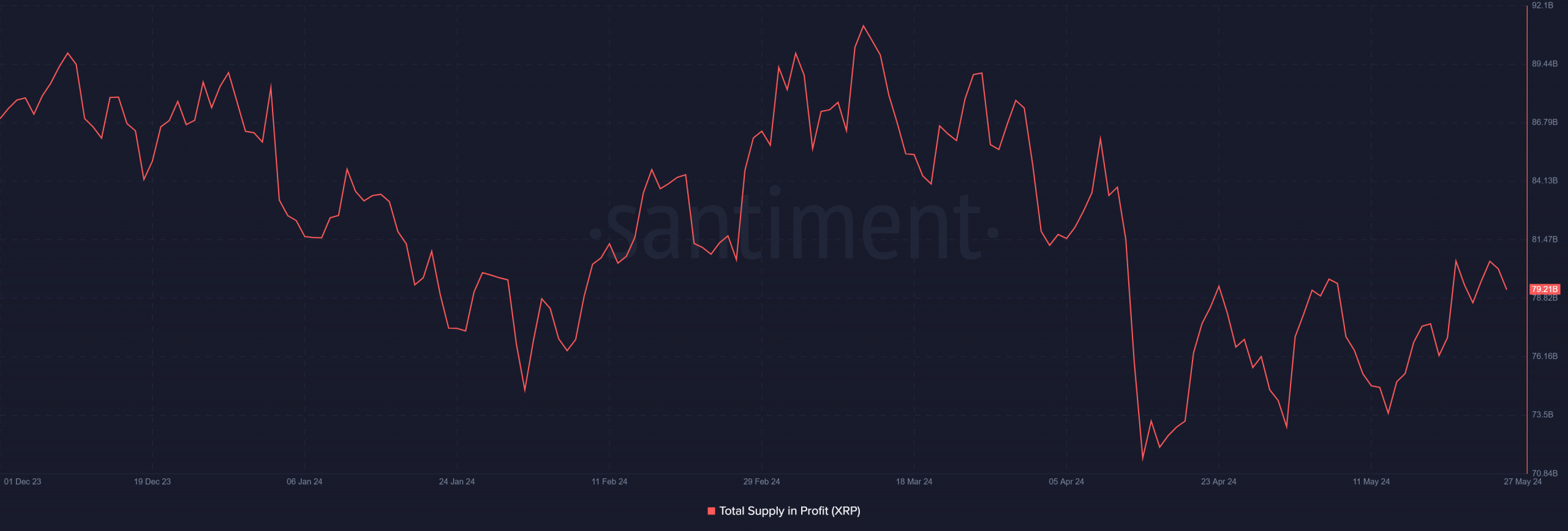

According to AMBCrypto’s analysis, the amount of XRP in circulation generating profits has diminished as a result of the recent price drop.

As a crypto investor closely monitoring my XRP holdings based on Santiment’s latest analysis, I’ve noticed an intriguing trend: around 1 billion XRP coins were shifted from profitable positions to incurring losses between the 25th of May and present day.

Realistic or not, here’s XRP’s market cap in BTC’s terms

Fifty-five billion XRP were the profits in volume on May 25th, whereas currently, the profit volume stands approximately at 79 billion XRP.

The change caused the profit derived from supply to drop from around 80% down to roughly 79% as of now.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-05-28 01:11