-

XRP token leads large-cap altcoins in gains in the midweek price action.

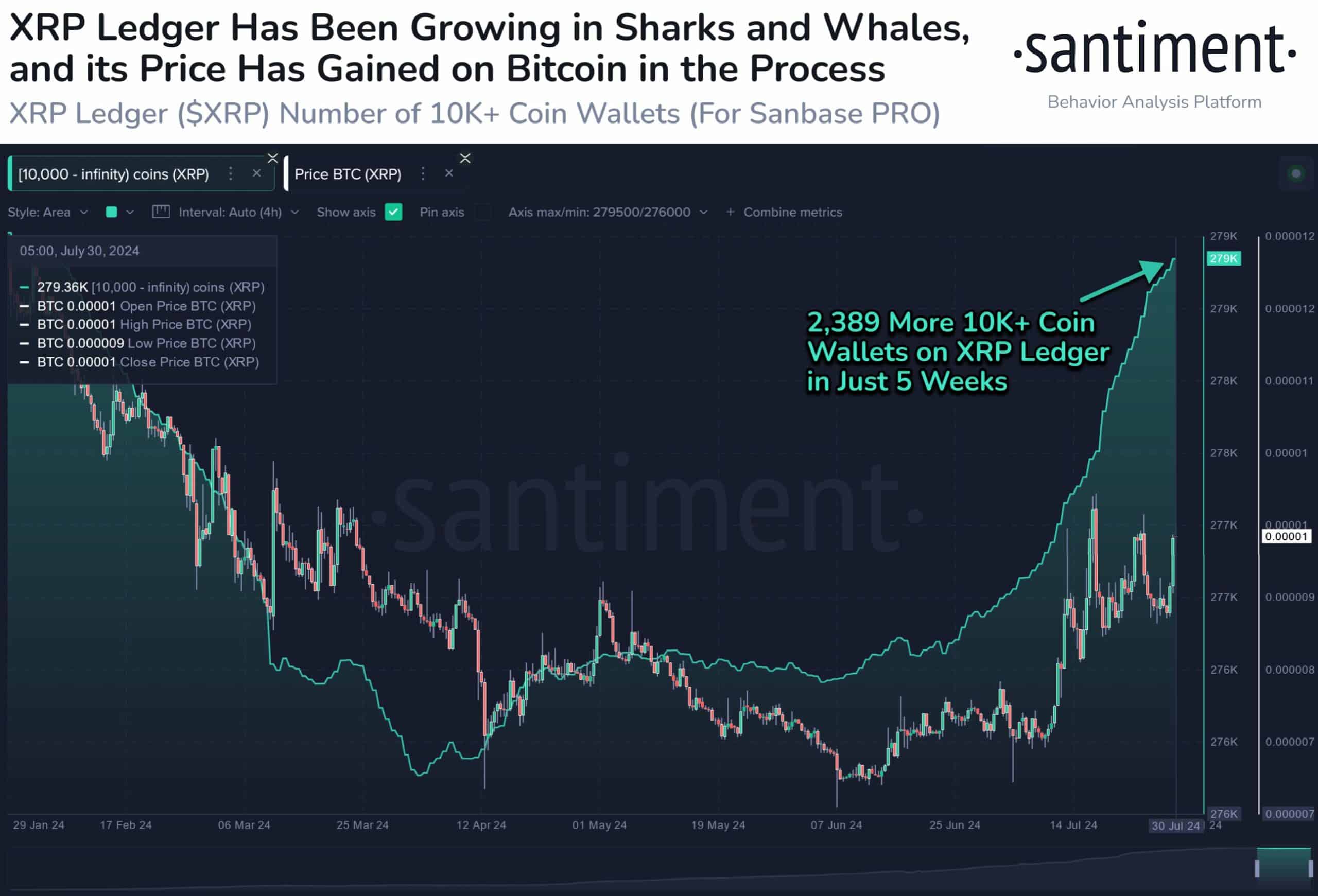

Wallets belonging to ‘shark’ and ‘whale’ XRP holders have increased in the last five weeks.

As a seasoned crypto investor who’s been through multiple market cycles since the early days of Bitcoin, I can confidently say that the recent surge in XRP is nothing short of intriguing. The double-digit growth in just a few days is reminiscent of the wild west days of cryptocurrency trading, and it’s a breath of fresh air to see such positive price action amidst a sea of red.

⚡ URGENT: Trump's Tariff Threats Shake EUR/USD Forecasts!

Will the euro survive the next Trump move? Find out the latest analysis now!

View Urgent ForecastOn the 31st of July, the value of Ripple (XRP) surged approximately 10%, reaching a peak of $0.657, even though many other altcoins were experiencing a downward trend around that period.

On a standalone basis, the price surge propelled the digital currency centered around transactions to reach its peak since March 25th, effectively displacing USD Coin from the sixth position in terms of market value.

A significant surge in trading activity on Wednesday occurred after the Securities and Exchange Commission (SEC) made changes to its lawsuit against Binance and its U.S. branches.

court papers from July 30th indicate that the Securities and Exchange Commission (SEC) does not plan to assert that tokens like Solana (SOL) and Polygon (MATIC) qualify as securities, contrary to claims made when they filed charges against the exchange in June 2023.

Previously, the regulatory body headed by Gensler classified as much as ten cryptocurrencies such as ATOM, SAND, MANA, ALGO, AXS, and COTI, among others, as unregistered securities when they were first issued.

By the end of August, the Securities and Exchange Commission (SEC) needs to finalize the proposed changes regarding the highlighted tokens. This move would delay any immediate judicial decision on these tokens in a courtroom setting.

In response to recent updates about X, top officials at Ripple, including CEO Brad Garlinghouse, criticized the commission over perceived discrepancies in how they apply and enforce digital asset regulations. The company’s legal head expressed similar reservations on a social media platform.

XRP continues appealing deep pocketed investors

Over the course of this year, I’ve noticed a significant trend among large-scale investors: they have been steadily amassing cryptocurrencies. More notably, the activity of XRP ‘whales’ and ‘sharks’ – entities holding substantial amounts – has spiked in the past few weeks.

According to a recent post on Santiment’s platform dated 30th July, the count of cryptocurrency wallets containing 10,000 or more XRP has reached its highest point in the past six months.

It’s important to mention that the daily trading volume of XRP has significantly increased by approximately 180% over the past 24 hours, reaching a total of $3.028 billion as reported by CoinMarketCap at this moment in time.

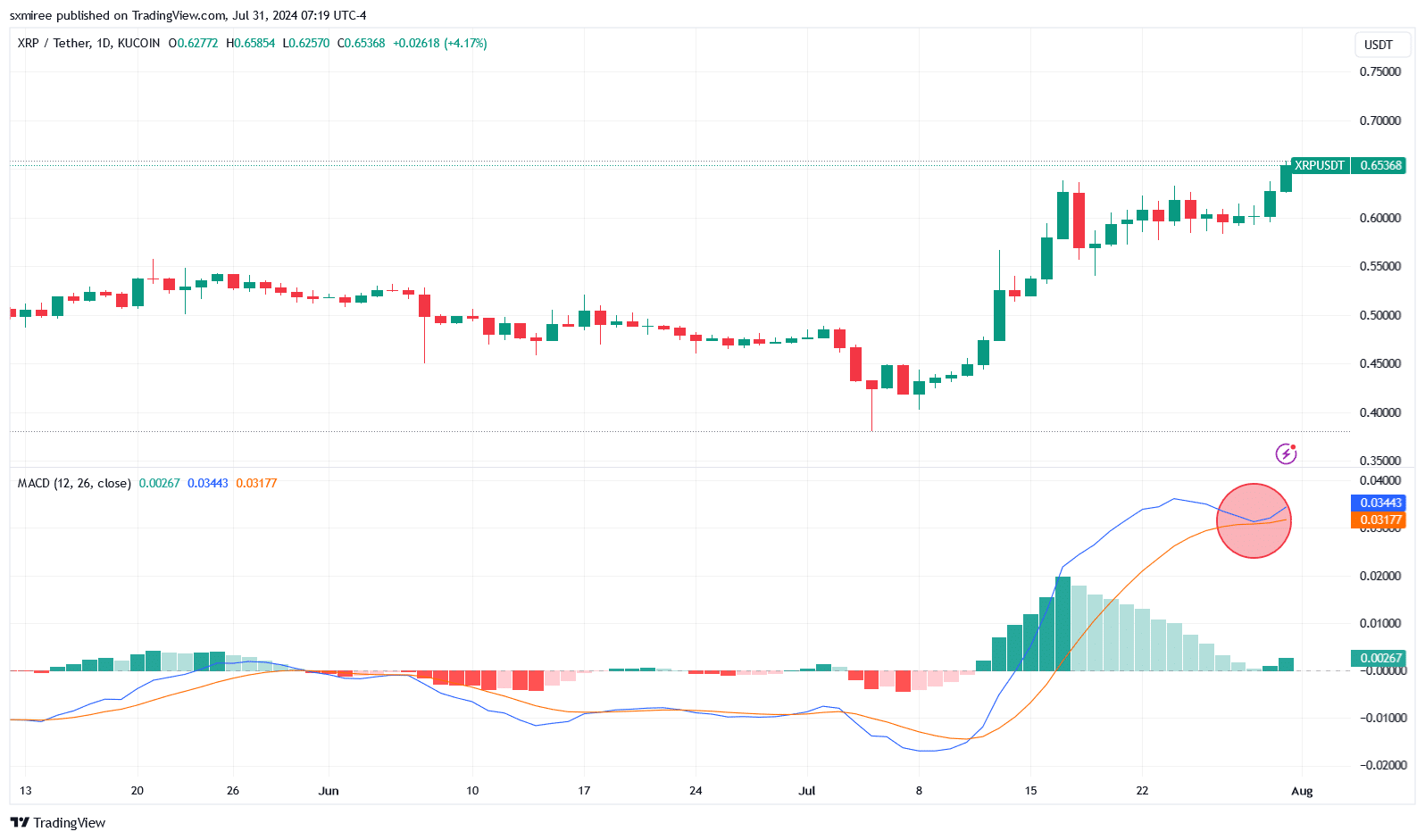

XRP/USD technical analysis

Over the past month, XRP has outperformed other large-cap altcoins with a 36% increase. If technical indicators are considered, there’s a possibility that it might revisit this year’s high of around $0.75 as a potential mid-term goal, provided the bulls manage to push it back above the current short-term target at approximately $0.66 within the next few weeks.

So far, the rapid downward trend (bearish momentum) hasn’t been intense enough to trigger a sell warning, according to the Moving Average Convergence Divergence (MACD) indicator. The MACD line approached going below the signal line, but it didn’t cross beneath it, suggesting a potential hold-off in selling activity.

As a researcher, I observed a resurgence of positive sentiment, which appeared to bolster the upward trend. Consequently, this shift caused the Moving Average Convergence Divergence (MACD) line to separate from the Signal line, indicating potential further growth ahead.

On a daily chart, when the Moving Average Convergence Divergence (MACD) line and signal line diverge, it could suggest that the asset’s price may keep increasing. This is because the bullish trend appears to be getting stronger, potentially signaling an upward trajectory ahead.

Over a longer period, the exchange rate between XRP and USD is currently confined within a pennant structure. This setup suggests a possible breakout might occur, propelling the value to challenge the resistance level of approximately $0.90.

Read Ripple’s [XRP] Price Prediction 2024-25

As a crypto investor, I’m observing that, right now, the XRP price is holding firm above the significant psychological threshold of $0.60. However, there’s a possibility that the XRP/USD pair might be pushed back towards the support at $0.56 over the next few weeks.

Investors, particularly speculators, should be mindful of the upcoming release of a billion XRP tokens slated for next month. This event may potentially induce a wave of selling due to increased supply in the market.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-07-31 22:16