- XRP encountered strong resistance near the $3 barrier, as profit-takers began cashing out.

- The decision to HODL will depend on both internal and external factors moving forward.

As a seasoned researcher with years of market analysis under my belt, I must admit that the current state of XRP is a veritable rollercoaster ride. The recent surge past the $2 resistance was nothing short of breathtaking, reminding me of a bull charging headlong towards an open horizon. However, the subsequent profit-taking and correction have left many traders in a conundrum – cash out now or hold on for dear life.

Among various alternative cryptocurrencies, Ripple [XRP] was tactfully positioned by bulls to capitalize on the Trump-induced price rally. Boasting a staggering monthly growth exceeding 300%, XRP captured the attention of traders, drawing in both experienced investors and curious newcomers alike.

Within thirty days, XRP successfully surpassed not one but two significant resistance thresholds. Once it regained the $1 level, its strength continued to grow, disregarding indications of a heated market, and recently soared beyond the $2 resistance barrier only a week ago.

After three years of steady consolidation, I can’t blame investors for their quick selling spree when the sudden breakout occurred, given the natural apprehension about a possible market correction. In such situations, it seems rational to offload XRP as a precautionary measure.

However, this is where things get intriguing: Market participants remain optimistic about a $3 price surge, which could propel XRP to surpass its record high. This anticipation might ignite fear of missing out (FOMO) among investors broadly.

Currently, traders find themselves facing a common predicament: Should they cash in their profits immediately for security, or continue holding with the hope of experiencing a more substantial increase later on?

XRP needs ‘consistent’ bull support

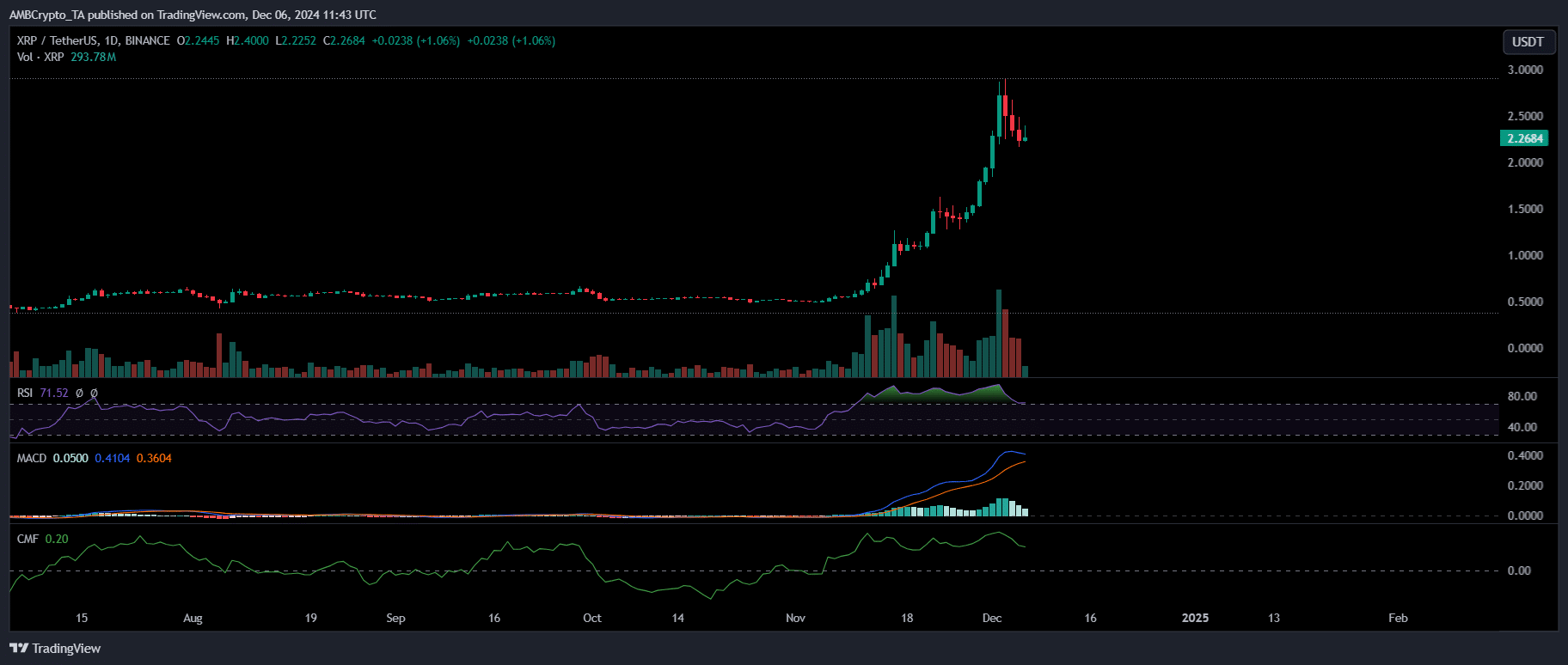

On its daily price graph, XRP typically exhibits indicators of profit-taking following each resistance test, occasionally lasting up to four straight downward trends. Notably, the fifth day tends to mark a significant recovery, propelling XRP back to its active state.

This pattern indicates that bulls are growing more optimistic, and they appear ready to overcome any bearish discrepancies. A price increase of $3 no longer seems possible, but rather it’s becoming more and more likely.

Nonetheless, merely this momentum isn’t enough. Three days ago, XRP nearly reached $3, closing at a daily high of $2.8 following four consecutive days with significant increases in price, each one more than 15%.

Source : TradingView

However, the swift climb had its costs, leading to overbuying situations that initiated a successive three-day drop. As I write this, XRP is valued at $2.27, having reversed its advancements made during previous bullish pushes.

Despite a substantial number of XRP holders having already secured their gains, the asset may become more vulnerable to volatile market movements due to speculation.

Therefore, expecting an ‘uninterrupted’ move towards $3 might be an over-exaggeration.

If historical patterns persist, there’s a possibility that XRP may see a minor uptick approaching around $2.8. However, it’s important to note that periodic adjustments due to profit-taking activities might occur along the way.

So, is it wise to hold for greater gains?

The solution to this query hinges on a combination of factors within and outside the subject matter. Inside, volume indicators point toward more upward momentum since the RSI hasn’t yet hit an overextended level, the MACD crossover maintains a bullish stance, and the CMF remains positive.

Furthermore, it’s expected that intense fear of missing out (FOMO) could grip the market, as experts are now projecting a price target of $6 for XRP by 2025.

However, the overall market volatility should not be overlooked. The past 24 hours have seen most altcoins dip into the red, with XRP leading the decline with a near 5% drop.

After Bitcoin surpassed the $100K mark, XRP’s price fluctuations appear to be influenced more by external events rather than its own internal dynamics.

Read Ripple [XRP] Price Prediction 2024-2025

If Bitcoin manages to reach its former resistance level after hitting its lowest point in the market, it might trigger a significant $3 increase. This recovery could boost investor trust not just in Bitcoin, but also in alternative coins like XRP.

For now, it appears that a return to around $2.8 is more likely, given that bulls are hopeful for a recovery. Therefore, holding onto your investment may be the wiser decision.

To find out if a $3 breakout is possible, we’ll need to observe how Bitcoin behaves on the market during this upcoming weekend.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-12-06 23:04