-

XRP surged by 22.68% over the past seven days as its trading volume soared by 46.55%.

Despite these recent gains, the overall market trend remained bearish.

As a seasoned analyst with over two decades of market experience under my belt, I have seen bull markets soar and bear markets plunge. With this perspective, I find myself intrigued by the current state of Ripple (XRP).

Lately, Ripple‘s value (XRP) dropped significantly, going down from a peak of $0.6480. Post the market rebound following the crash and Ripple’s agreement with the SEC, XRP’s worth saw a notable increase.

As an analyst, I’ve noticed that while there have been some recent positive movements, these gains have proven challenging to sustain. Consequently, the overall trend continues to reflect a bearish momentum.

Regardless of XRP‘s inability to hold onto its gains, experts remain optimistic about its future potential. Specifically, Ledger Man anticipates another spike, reaching a new peak, based on his analysis.

“The value of XRP might significantly increase, possibly reaching as high as $10 or more, fueled by excitement about the upcoming XRP ETF, Ripple’s potential stablecoin, and following the payment of a $125 million fine.”

In fact, AMBCrypto’s examination indicated a significant downtrend for the altcoin, where the recent drops were more than the rises.

What XRP’s price charts indicate

Currently, XRP is being exchanged for approximately $0.5744, marking a rise of 22.68% over the past week. Simultaneously, this cryptocurrency has also seen a notable increase of 12.60% during the last month.

XRP’s trading volume, in the last 24 hours, has also surged by 46.55% to $1.4 billion.

Although there have been some advancements, the general market outlook remained pessimistic. At the current moment, the Chaikin Money Flow (CMF) stood at -0.03. This indicates that there is more selling activity than buying, leading to a bearish sentiment with sellers holding the majority of the control.

Additionally, the Relative Vigor Index (RVGI) was negative, signifying that the closing prices were closer to the lows compared to the openings. This suggests that sellers had more influence, leading us to conclude that the market is currently witnessing a significant downturn with a strong bearish trend.

As an analyst, I observed that the downward trend for XRP remained robust, as indicated by the DMI (Directional Movement Index) and Aroon lines. Specifically, the positive DMI value of 22.38 was lower than its negative counterpart at 22.43, suggesting a predominance of negative momentum over positive.

Furthermore, the Aroon Down indicator stood at 50%, surpassing the Aroon Up at 14.29%. This signified that XRP was exhibiting a prolonged downward trend.

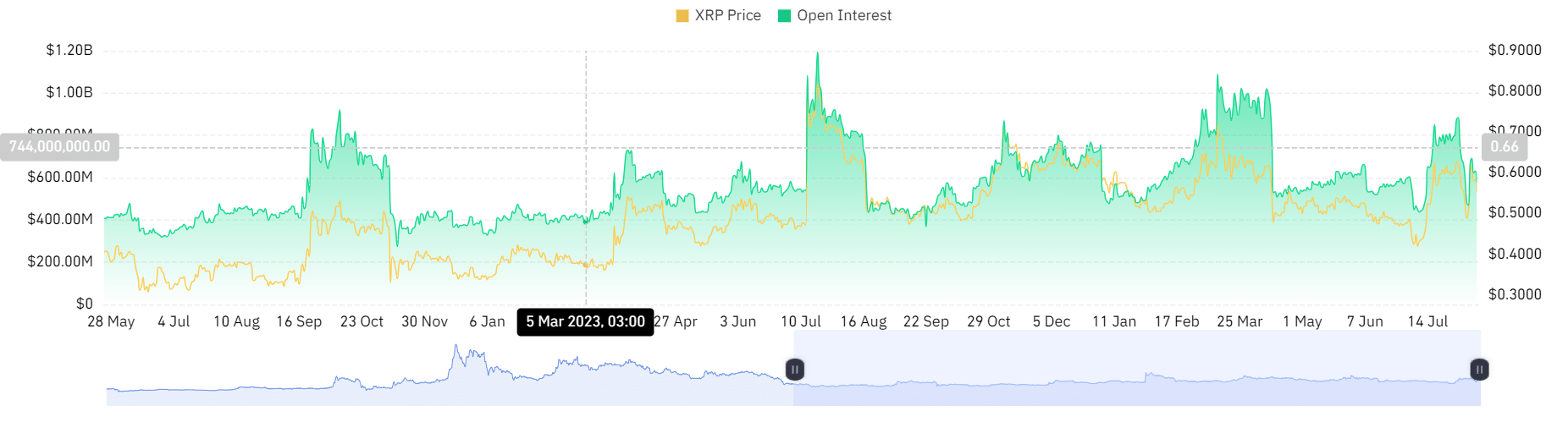

By examining data from Coinglass as reported by AMBCrypto, it was observed that the Open Interest for XRP decreased from $691 million to $578 million. This indicates that investors might be liquidating their existing positions rather than establishing new ones.

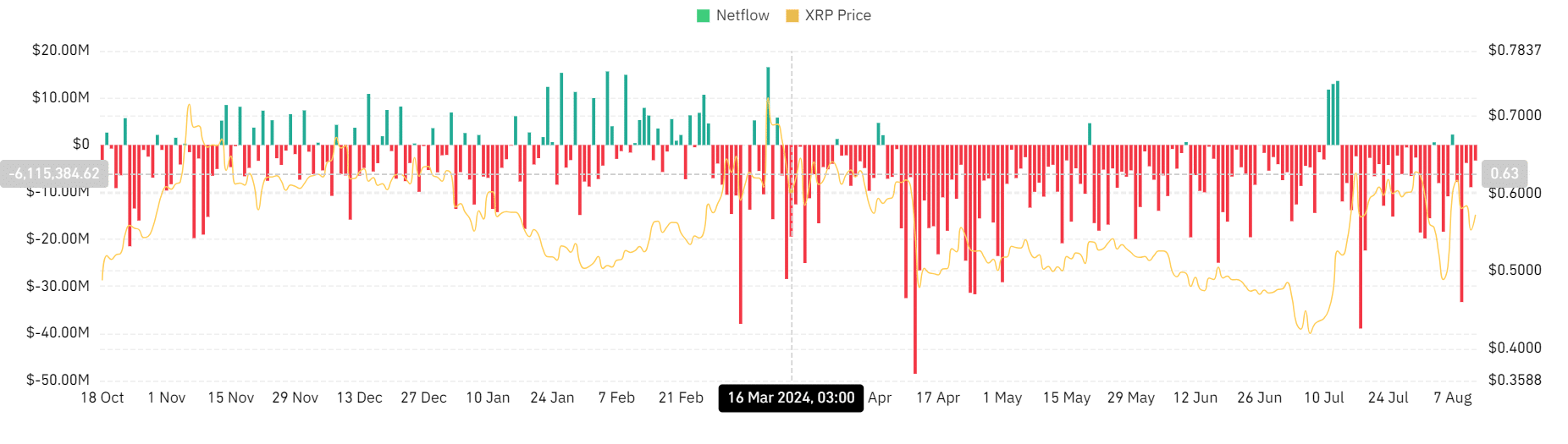

As an analyst, I’ve observed a consistent outflow of XRP over the last month, indicating a decrease in investor confidence towards this altcoin. This decline in confidence has led to a selling spree among investors who are transferring their XRP holdings to exchanges with the intention of offloading them.

XRP retests key support level

Within just over two weeks, XRP‘s value dropped significantly from its peak at approximately $0.653. Despite some recent positive movements, it hasn’t been able to sustain an increase above $0.6. At the moment of writing, XRP is encountering resistance near $0.61.

Realistic or not, here’s XRP market cap in BTC’s terms

Should the day’s price action close above my $0.580 support, I anticipate a potential rebound towards the upcoming resistance at approximately $0.60.

If it can’t maintain its value above roughly $0.58, there’s a possibility it could drop to significant support at approximately $0.55. A fall below this level might trigger a continued decline towards $0.52.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SOL PREDICTION. SOL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Bitcoin’s Golden Cross: A Recipe for Disaster or Just Another Day in Crypto Paradise?

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

2024-08-13 06:16