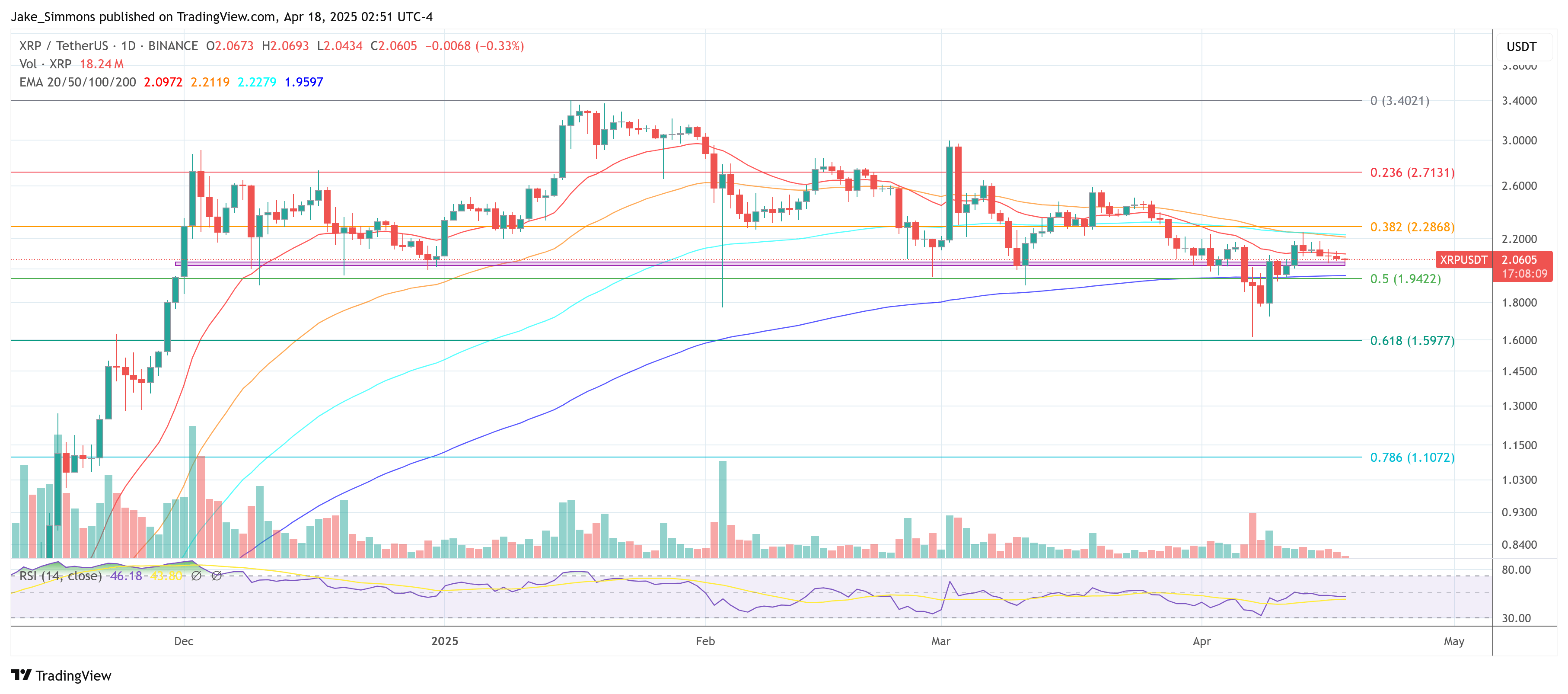

Ah, XRP. That perennial promise, forever coiling like a snake 🐍 in the grass, just above the mid-$2 mark. Market technician CasiTrades, a name whispered with reverence in certain circles (mostly her own, one suspects 🤔), sees a violent impulse brewing. A tempest, perhaps, in a teacup. On the digital scrolls of X, dated April 17th, she unveils an Elliott Wave saga. A tale of a token, allegedly completing a Wave 2 correction. One that began, naturally, after December’s cycle high, a mere stone’s throw from the 0.118 Fibonacci band at $3.40. Such precision! Such faith in numbers! 😇

From the summit, marked (1) with the solemnity of a mountain peak, XRP has endured a sharp, three-legged A–B–C pullback, drawn in gold, no less. Leg A, a descent into the abyss, bottomed in February at $1.77. Leg B, a brief respite, retraced to the 0.236 level at $2.99 before the current slide in Leg C, which has thus far clung to the 0.618 retracement at $1.54. Below, a thick liquidity pocket, a veritable treasure trove for the algos, lurks between the 0.618 and 0.65 retracements—$1.55 to $1.45—highlighted by a green box on the chart. A green box! As if the market were a child’s coloring book. 🖍️

CasiTrades, with the gravitas of a prophet, deems this zone “the most likely target” for any final sweep lower. Yet, she concedes, price “has shown solid support at the 0.5 retrace ($1.90).” On the macro timeframe, nothing has changed. Nothing, I tell you! Except, perhaps, the dwindling patience of the masses. 🙄

The chart, a tapestry of lines and numbers, also flags the 0.382 retracement at $2.24 with a red line—the final ceiling that must be breached to confirm bullish reversal. “To break major resistance at $2.24 (the 0.382), we’ll likely need one final push off either $1.90 or $1.55.” If XRP clears and holds $2.24, these lower levels become far less likely. The market, in its infinite wisdom, has already printed a series of higher lows on the four-hour Relative Strength Index while price carved lower lows, producing a clear bullish divergence. A divergence! As if the market were speaking in riddles. 🤔

CasiTrades, unshaken by doubt, argues that the macro structure remains intact: the decline of the past four months is Wave 2 inside a much larger five-wave advance. “We are very close to ending this correction, whether the low is already in or we need one more support test, I still believe we’re about to enter macro Wave 3.” Such conviction! Such unwavering belief in the Elliott Wave gospel! 🙏

Under classical Elliott guidelines, one wave of every impulse must extend. And the analyst, with the confidence of a seasoned gambler, expects that role to fall to Wave 3. Using Fibonacci expansion from the Wave 1 impulse—the vertical purple projection—she derives upside objectives at the 1.618, 2.618 and 3.618 extensions: $6.50, $9.50 and “$12+” respectively. To the moon, comrades! 🚀

“One wave must extend in every impulse and most likely this will happen on Wave 3. This isn’t hype, this is textbook Fibonacci + Elliott Wave logic. Correction bottom is either here or very near. Once Wave 3 begins, it only takes weeks, not months.” Weeks! As if the market operates on a predictable schedule. Perhaps it does, in the minds of those who see patterns in everything. 🤪

Sceptics, those miserable souls who dare to question the sacred texts, suggest that algorithmic manipulation might have invalidated traditional tools. But the analyst remains unmoved. “This price action has been frustrating, but I believe the market is largely driven by algos that to complete specific patterns, these patterns make money for their creator. Strong demand may be delaying the final push lower, but I still believe the market likely needs to test those support levels to grab liquidity before a breakout. We’re at a critical test right now. If buyers can push the price above $2.24, it could shift the algos instead of hunting lower, they may flip direction and chase momentum.” The algos! Those mysterious entities that control our financial destinies. 🤖

Time, she insists, is running out for bears. “We’re mid-April now. If XRP tags that final support, even by the end of this week, and volume steps in, a breakout to new highs could very realistically kick off in late April and still satisfy the April breakout outlook.” Tick-tock, bears! Your time is nigh! ⏰

As of press time XRP is trading near $2.16 on Binance, only a few percentage points below the critical $2.24 trigger. A few percentage points! The difference between riches and ruin! 🤑

Read More

- OM PREDICTION. OM cryptocurrency

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Solo Leveling Season 3: What You NEED to Know!

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Beyond Paradise Season 3 Release Date Revealed – Fans Can’t Wait!

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

2025-04-18 15:46