-

XRP’s $1 billion Open Interest underlined growing market activity, driven by regulatory optimism

Rising exchange reserves and long liquidations pointed to caution amid bullish momentum

As a seasoned researcher with years of experience in the cryptocurrency market, I find myself intrigued by the recent surge in XRP‘s Open Interest, which has reached an impressive $1 billion. The optimism surrounding regulatory clarity and increased institutional interest is palpable, yet it remains to be seen if this will spark a significant bullish breakout.

XRP token’s Open Interest has skyrocketed to $1 billion, raising questions about what’s fueling the recent surge. With growing speculation surrounding regulatory clarity and owing to a hike in institutional interest, XRP is now gaining a lot of attention. However, is this enough to spark a bullish breakout?

Currently, one XRP is being exchanged for approximately $0.5879, representing a decrease of 6.50% over the past day. Notably, the surge in Open Interest suggests an escalation of trading activity throughout the market. This upward trend implies that traders are now predicting substantial price fluctuations in the near future.

It’s crucial to look closely at the reasons behind the altcoin’s surge in popularity. Regulatory changes and institutional investments could be major contributors, but are there any other factors at play as well?

XRP’s price action – Key levels to watch

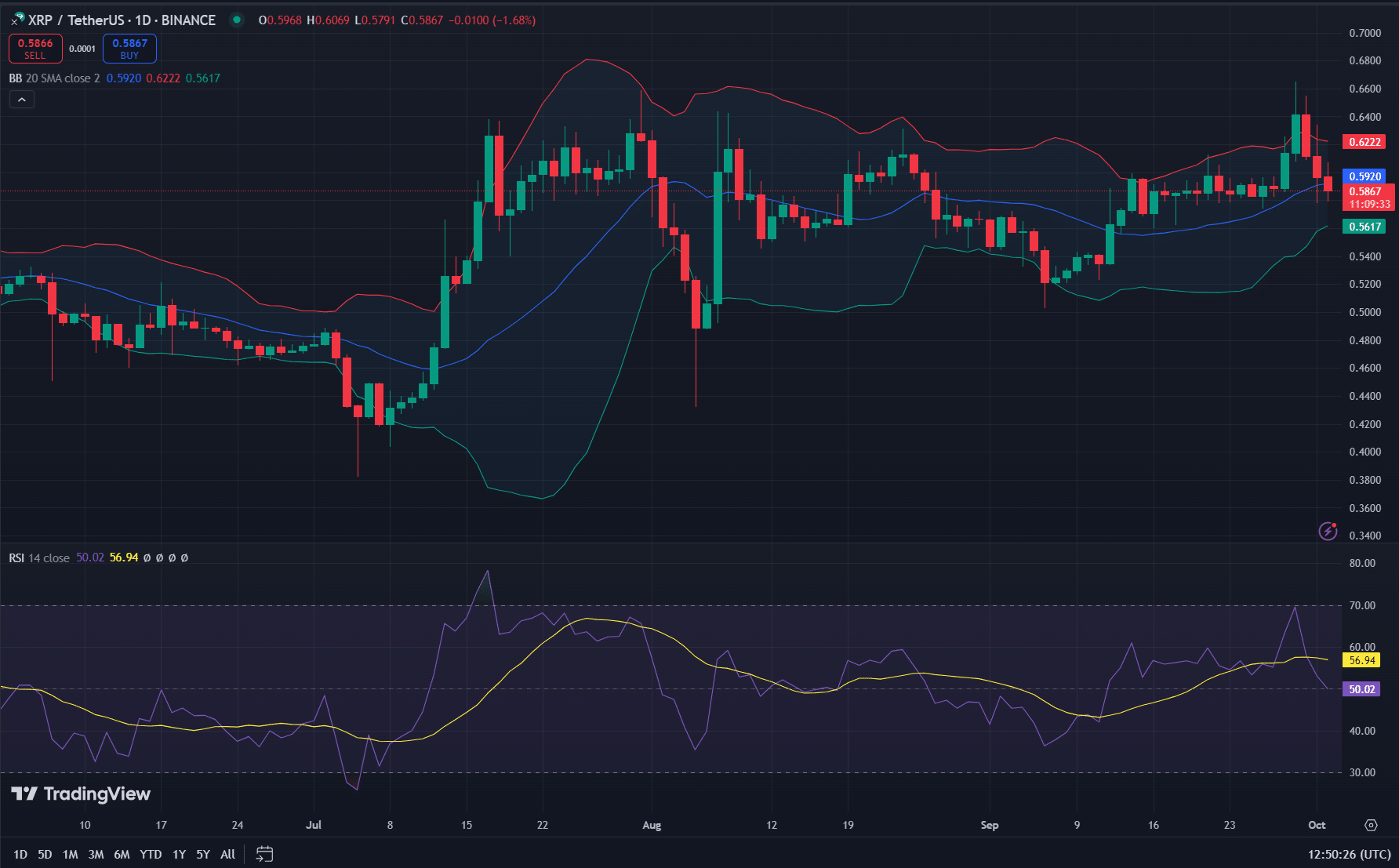

According to the graphs, the current price movement suggests the token encountering significant resistance around $0.6222. This level now serves as a crucial hurdle for any potential bullish growth. On the flip side, a robust support can be found at $0.5617, acting as a safety net should bearish pressure intensify on the charts.

It appears that the Bollinger Bands are becoming more constricted, indicating a potential upcoming shift in prices. Furthermore, the Relative Strength Index (RSI) stands at 56.94, signaling a balanced market scenario.

Consequently, it’s advisable for traders to keep a close eye on these levels, as breaching resistances might lead to a stronger upward trend in the price.

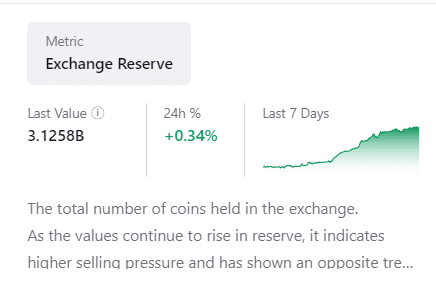

Exchange reserves – Could selling pressure rise?

Here, it’s also worth pointing out that exchange reserves rose by 0.34% to 3.1258 billion tokens in the last 24 hours. Such a hike often points to higher selling pressure, especially as more tokens are transferred to exchanges for potential liquidation.

As a crypto investor myself, I’ve noticed an increase in market interest for XRP recently. However, given the rise in reserves, it’s prudent for us to exercise caution as this could potentially indicate that some holders might be planning to offload their coins.

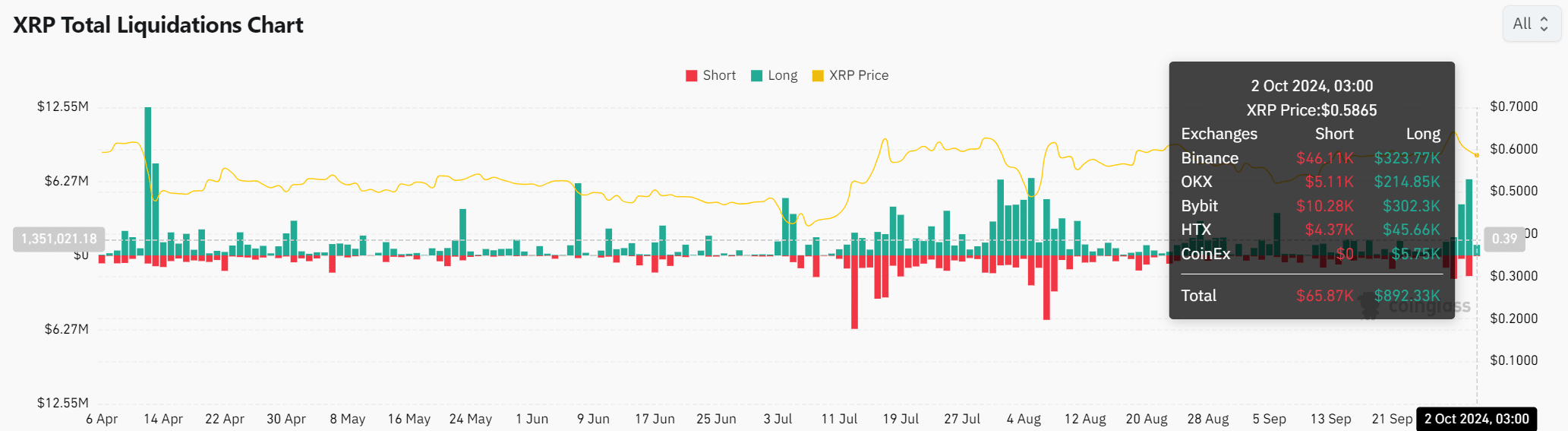

XRP liquidations – Are long positions at risk?

Finally, data on liquidations revealed that over $1.35 million has been liquidated in the last 24 hours, primarily from long positions. On Binance alone, long liquidations totaled $323.77K.

As a result, although there’s hope for a significant surge, the market’s strong opposition has caused the unwinding of excessively leveraged trades. This underscores the possible danger for optimistic traders if the cryptocurrency struggles to sustain its pace.

Read Ripple’s [XRP] Price Prediction 2024-25

To sum up, the rise in Open Interest, combined with increasing participation from institutions and retail investors, suggests a possible upward trend or bullish outlook.

On the other hand, the increase in reserve balances and extended sell-offs suggest a reason to exercise caution. Crossing over $0.6222 is crucial if the upward trend is to continue, but traders must brace themselves for market fluctuations while this digital currency passes through these vital price points.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-10-03 12:07