- XRP surpasses 1.618 Fibonacci level, analysts eye a potential 6,800% rally to $168 this cycle.

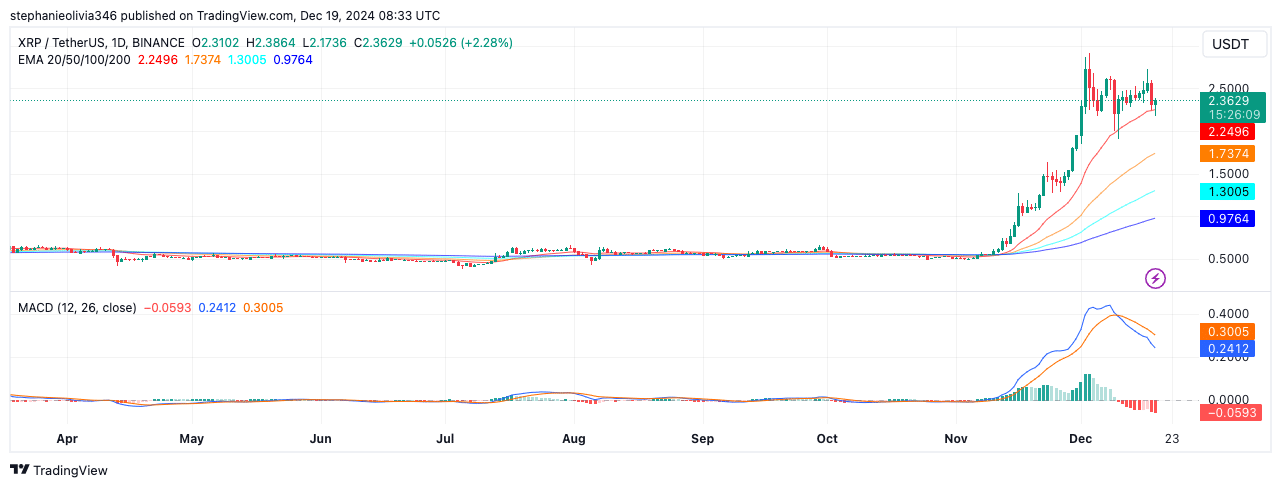

- Strong uptrend confirmed as XRP trades above 20, 50, 100, and 200-day EMAs, showing bullish momentum.

As a seasoned analyst with over two decades of experience in financial markets under my belt, I’ve seen my fair share of market cycles and trends. The recent performance of XRP has certainly piqued my interest, as it mirrors certain patterns from its 2017 bull run. While past performance is no guarantee of future results, the current technical indicators and historical fractals suggest that we might be in for a wild ride with XRP.

As an analyst, I find myself drawn to the intriguing movement in XRP’s price dynamics. My focus is on historical Fibonacci extensions, which serve as a guide in predicting prospective long-term objectives. After a significant breakout from a six-year triangular consolidation pattern, XRP currently trades at $2.37 at this moment, accompanied by a 24-hour trading volume of a substantial $20 billion.

Although it dropped by 5.32% yesterday, the asset’s technical signals and long-term patterns hint at potential significant profits during this current market trend.

Market data reveals a circulating supply of 57 billion XRP, giving it a market capitalization of $135.17 billion. Analysts argue that XRP’s breakout mirrors its 2017 bull cycle, where the asset saw a more than 600x surge, reaching its all-time high of $3.40.

Based on current predictions, it’s possible that the value of this cryptocurrency might reach around $168. This is because, if past performance is repeated, it would correspond to the 2.414 Fibonacci extension level.

Fibonacci levels provide key targets for price projections

As a researcher examining historical trends, I’ve observed that past price movements significantly influence my current analysis. In the 2017 surge, XRP adhered to Fibonacci ratios, ascending to the 2.414 extension prior to reaching its peak.

According to cryptocurrency expert Javon Marks, the historical alignment of XRP with these specific levels lends support to the current forecast suggesting a possible surge of up to 6,800%.

Currently in this phase, we’ve gone beyond the 1.618 Fibonacci level, and the price is projected to continue rising, with potential future peaks at approximately $4.50 and $13.00. These levels serve as intermediate milestones on our way to the long-term target of $168.

Yet, this hopeful outlook relies on continuous progress and widespread acceptance in the market. The affirmation of XRP’s long-term bullish trend is emerging amidst a surge in global cryptocurrency usage and the growing influence of favorable crypto regulations.

Technical indicators suggest bullish momentum

The latest technical signals suggest a bullish movement for XRP. At present, its price hovers above several moving averages: the 20-day, 50-day, 100-day, and 200-day moving averages, which are positioned at $2.25, $1.73, $1.30, and $0.97 respectively. These positions suggest that XRP is steadily climbing in an uptrend.

In simpler terms, the MACD indicator shows that we’re currently in a bullish state, as the MACD line is higher than the signal line at 0.30 and 0.24 respectively. But, there’s a slight drop seen in the histogram, which hints at a temporary decrease in the market’s momentum.

If the price of XRP were to temporarily fall back towards the $2.25 moving average support, it might create a period of stabilization prior to more advancement. Holding this support could pave the way for XRP to challenge its recent peaks around $2.50 once again.

Derivatives data points to increased activity

The market for derivatives based on XRP is experiencing a surge in popularity, as trading volume has increased by 10.34% and now stands at $24.49 billion. However, the number of open positions has decreased by 12.08%, which may be due to some traders taking profits. On the other hand, the volume of options has significantly risen by 17.41%, suggesting a higher level of speculative activity among investors.

Options open interest also grew by 16.20%, highlighting ongoing hedging interest.

On Binance and OKX, the lengthy vs. short positions (long/short ratios) are leaning toward a bullish trend. Specifically, the leading trader on Binance currently has a long/short ratio of 3.08, suggesting they’re more invested in buying than selling.

Read XRP’s Price Prediction 2024–2025

Nevertheless, the data on liquidations shows approximately $40.32 million worth of positions being closed over a 24-hour period, with most impacts felt by long positions. This indicates that market volatility may occur in the short term, despite the general optimistic outlook.

The information about the technology behind XRP and market trends suggests that it could see significant growth within the wider crypto market during an upswing.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-12-19 19:36