-

XRP has a strongly bullish bias on the daily chart, and swing traders can seek to enter long positions.

In the short term, some consolidation over the next 12-24 hours is likely.

As a seasoned financial analyst with extensive experience in cryptocurrency markets, I have closely monitored Ripple (XRP) and its recent price movements. Based on my analysis of the current market trends and technical indicators, here’s my take:

As a researcher studying the cryptocurrency market, I’ve observed an intriguing development with Ripple (XRP). The number of transactions on its network has experienced a significant surge recently. This increase could be attributed to the growing popularity of micropayments, which have gained traction on the XRP Ledger. Moreover, the trading volume for XRP has been notably high during this period.

On the seventeenth of July last year, South Korea saw greater trading volume in XRP over a 24-hour period than Bitcoin experienced. Furthermore, buyers successfully safeguarded a previous barrier as a new foundation, potentially paving the way for another surge upward.

XRP bulls gear up for a 20% rally

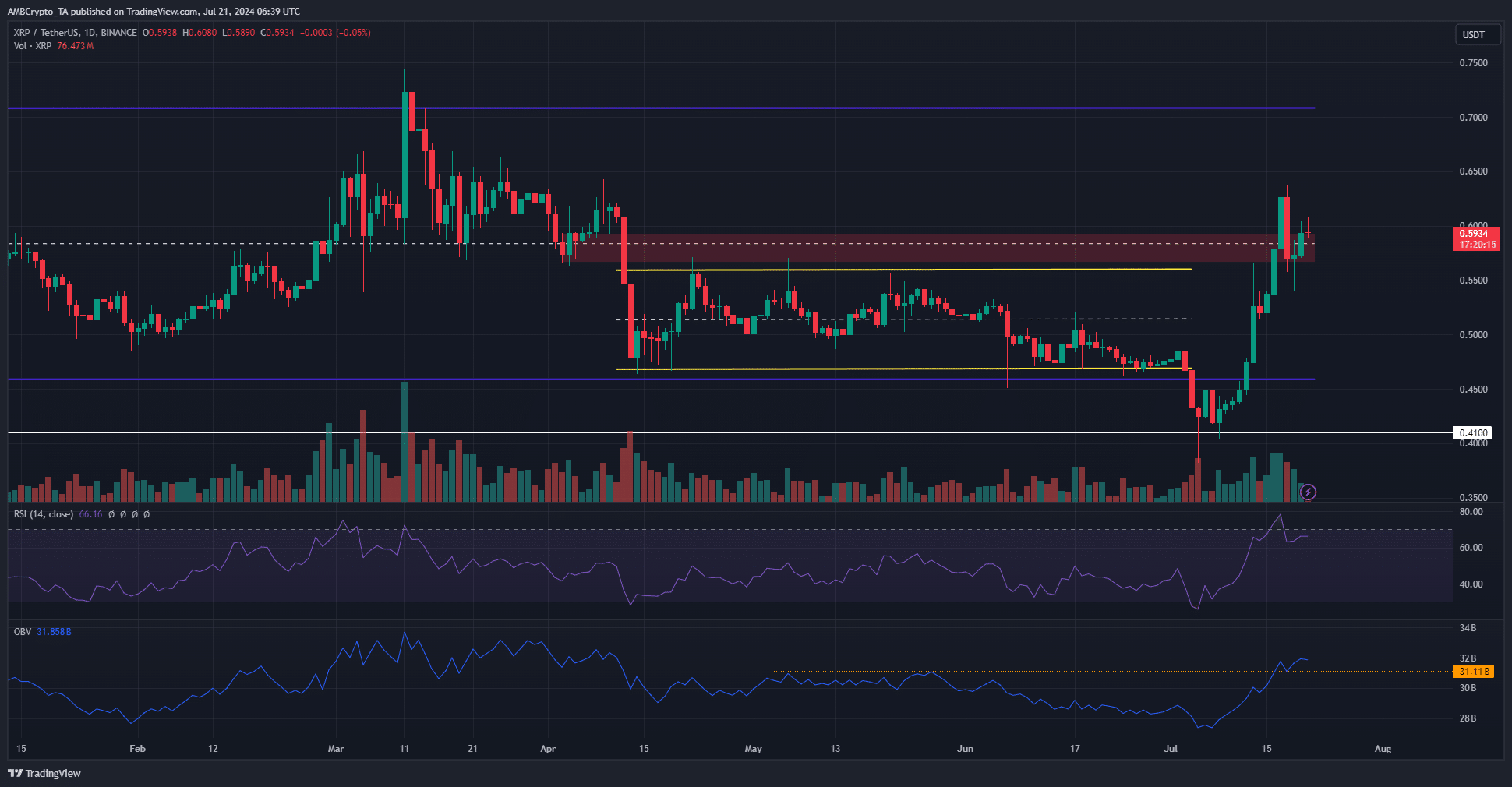

On the daily chart, the market structure showed a clear bullish trend with the pivot point at $0.585 being reclaimed as a support level. Furthermore, the On-Balance Volume (OBV) surpassed its previous highs from May, indicating substantial buying activity during the price advance.

The relative strength index (RSI) indicated a strong buying trend as it surpassed the threshold of 50, suggesting potential for XRP to reach its upper price boundary around $0.71.

On Friday, the 19th of July, XRP experienced a significant decline, reaching a low of $0.54. However, it subsequently rebounded and surpassed $0.59. The implication is that these levels – $0.54, the previous resistance (yellow) highs, and $0.585 – may function as support in the near future.

Following the decline to $0.635, this significant drop forced out heavily leveraged long investors and tardy bulls. Subsequently, the market was prepared for a more stable advance.

Gauging how the futures market is poised

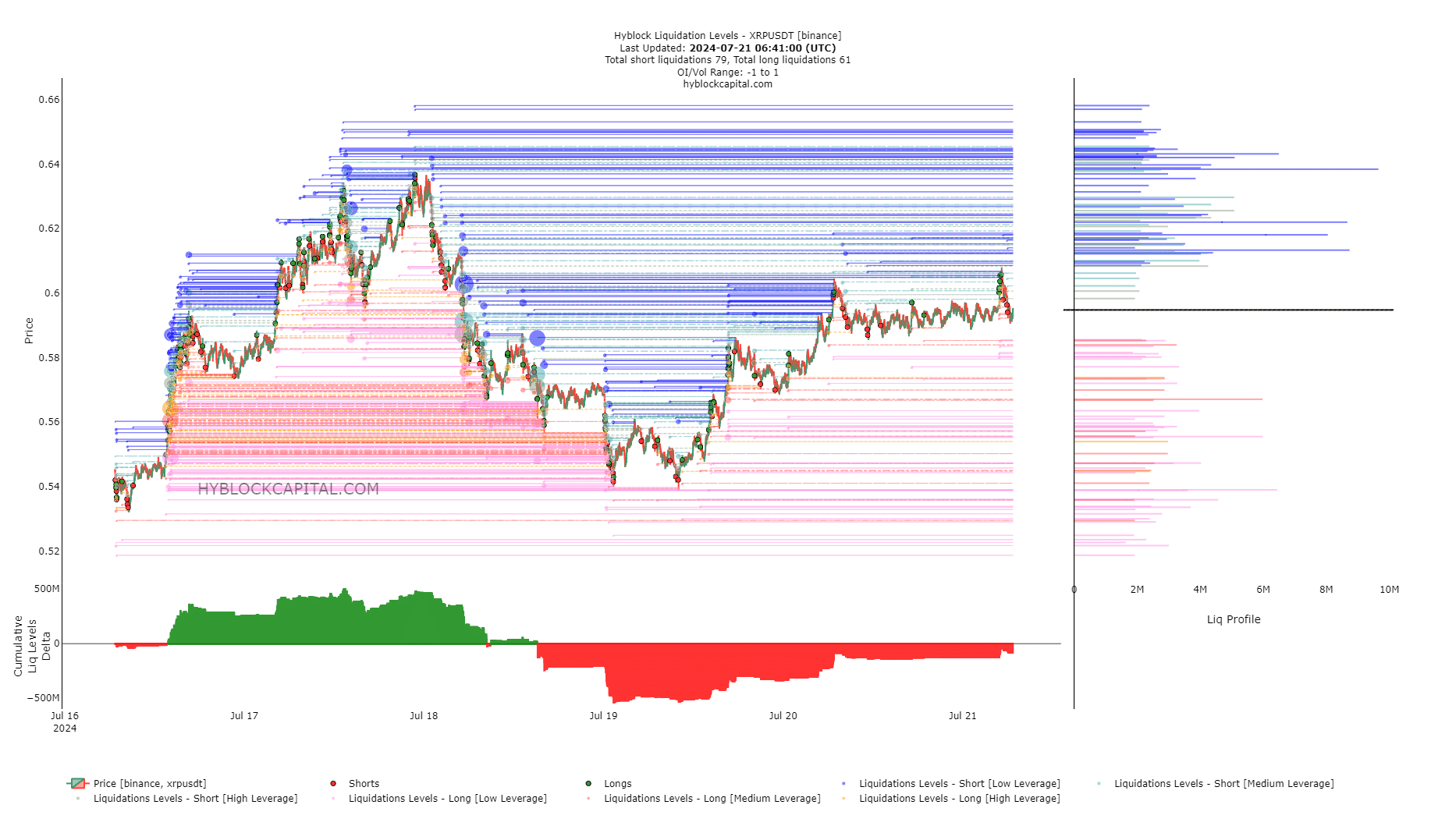

Based on AMBCrypto’s examination, the token price is likely to continue hovering near the $0.59 mark for a while due to the slightly negative cumulative liquidation levels.

Read Ripple’s [XRP] Price Prediction 2024-25

As an analyst, I would interpret the current short-term liquidity levels as neither strongly indicating a bullish nor a bearish trend. However, I caution that this situation could shift significantly based on Monday’s market activity.

As an analyst, I would identify the levels at $0.567 and $0.638 as potential pivots for market reversals. A bullish reversal may begin if the market sentiment turns positive around $0.567 on Monday, while a bearish reversal could initiate with negative sentiment emerging near $0.638.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- DOOM: The Dark Ages Debuts on Top of Weekly Retail UK Charts

- Solo Leveling Arise Tawata Kanae Guide

- Chainlink: Checking LINK’s 20% drop amid a 4x jump in fees

- Black State – An Exciting Hybrid of Metal Gear Solid and Death Stranding

- Marvel’s Spider-Man 2 PC Graphics Analysis – How Does It Stack Up Against the PS5 Version?

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- ANKR PREDICTION. ANKR cryptocurrency

2024-07-21 20:23