-

Whales dumped significant XRP to exchanges in the last few days.

In the meantime, Ripple rejected the SEC’s revised offer, raising more fears about its future.

As an experienced financial analyst, I believe the recent whale movements of XRP to exchanges could potentially lead to increased volatility in the market. The sudden influx of a large amount of tokens could overwhelm existing buy orders and drive down the price if there aren’t enough buyers ready to absorb all the tokens at the current price. This could result in a snowball effect, with more investors following suit and selling their tokens.

Whales have been moving massive amounts of Ripple [XRP] to exchanges over the last few days.

According to a tweet from commentator MartyParty, approximately 63.57 billion XRP have been moved to exchanges since July 1st.

A significant shift in the market indicated the possibility of increased volatility, as it may have signaled that large investors were preparing for a price fluctuation.

Whales dump their tokens?

An unexpected surge of a substantial quantity of XRP entering exchanges may outstrip current buying demands, potentially leading to a price decrease.

As a crypto investor, if there aren’t sufficient buyers present in the market to purchase all the tokens available at the current price, then the situation becomes even more volatile. In such cases, the market may witness heightened instability due to reactions from investors towards large-scale whale transactions.

Some might see it as a selling opportunity and follow suit, leading to a snowball effect.

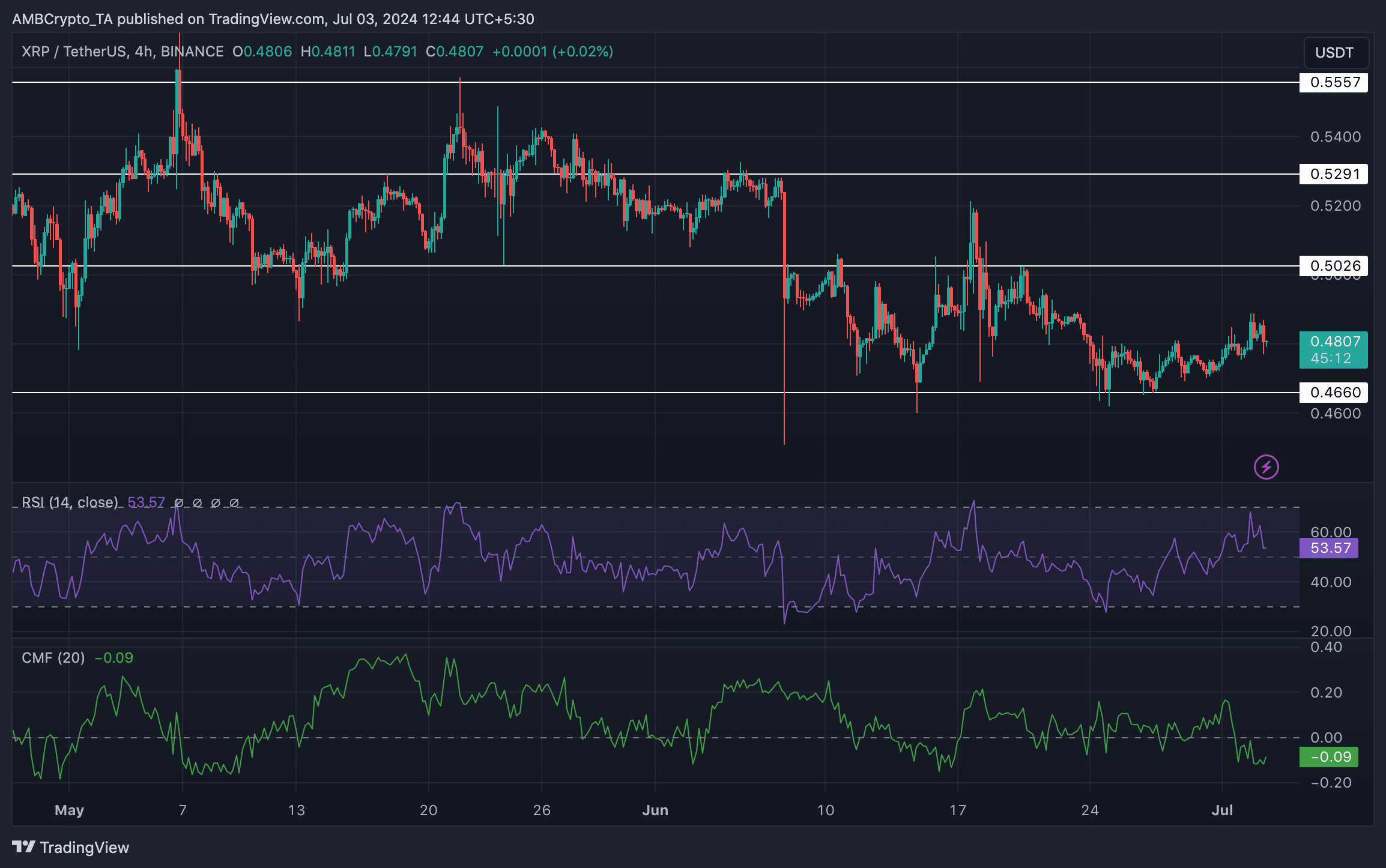

As of the deadline for this report, XRP was priced at $0.4789 on the market. Following a test of the $0.556 mark on May 6th, the token experienced a substantial decline in value.

Throughout this timeframe, the cost displayed numerous troughs lower than previous lows, as well as lower peaks, suggesting a downtrend for XRP. The latest surge in XRP’s price hasn’t been robust enough to challenge or alter this bearish trend.

As a crypto investor, I’ve noticed that XRP‘s Relative Strength Index (RSI) has stayed elevated lately, signaling a robust uptrend for the token.

As a researcher observing the market trends, I’ve noticed that while the price action of XRP remained relatively stable, the Chaikin Money Flow (CMF) indicator showed a noticeable decrease in recent days. This decline in CMF suggests that there has been less money flowing into the XRP token compared to before.

As an analyst, I would interpret XRP‘s recent whale transactions as potentially indicative of investor unease stemming from Ripple’s ongoing legal battle with the Securities and Exchange Commission (SEC).

Battles against the SEC

At first, the SEC imposed harsh penalties on Ripple, threatening a fine of approximately $2 billion due to suspected security infringements. However, more recently, the SEC has shown leniency in their approach, proposing a significantly lower fine of around $102 million instead.

Although Ripple has rejected the proposal, given its position to potentially emerge victorious rather than merely settling. Nevertheless, this prolonged legal battle might erode investor trust further.

This will naturally impact XRP’s future prospects, drastically.

The SEC’s latest action has faced backlash, with many arguing that it impedes cryptocurrency advancements by overregulating the industry.

Ripple has faced significant financial consequences from the legal complications, totaling over $200 million in expenditures thus far.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-07-03 15:03