-

In the last 24 hours, a whale moved 70 million XRP tokens from Binance to an unknown wallet.

An expert suggested that XRP could experience a significant rally, similar to what happened in 2018.

As a seasoned analyst with over a decade of experience in the cryptocurrency market, I find myself intrigued by the recent developments surrounding XRP. In the past 24 hours, we have witnessed a significant transfer of 70 million XRP tokens from Binance to an unknown wallet, which could potentially indicate whale activity or strategic movement of funds.

Following a strong surge, the entire cryptocurrency market experienced a dip of 2.8%. Notably, prominent assets such as Bitcoin [BTC], Solana [SOL], and Binance Coin [BNB] suffered price decreases of 4%, 5.10%, and 3.5% respectively.

1. The abrupt drop in the market could be shaping a bullish outlook for Ripple (XRP), the seventh-largest digital currency globally – let me explain why.

Whales move 70 million XRP tokens

30th of July, Whale Alert, a blockchain transaction tracker, shared updates (previously on Twitter) about significant movements in the crypto market. Specifically, they highlighted that several ‘whales’ transferred approximately 70 million XRP tokens valued at around $42.48 million from Binance exchange to different locations.

This massive token transfer occurred over the last 24 hours in three different transactions.

XRP price prediction

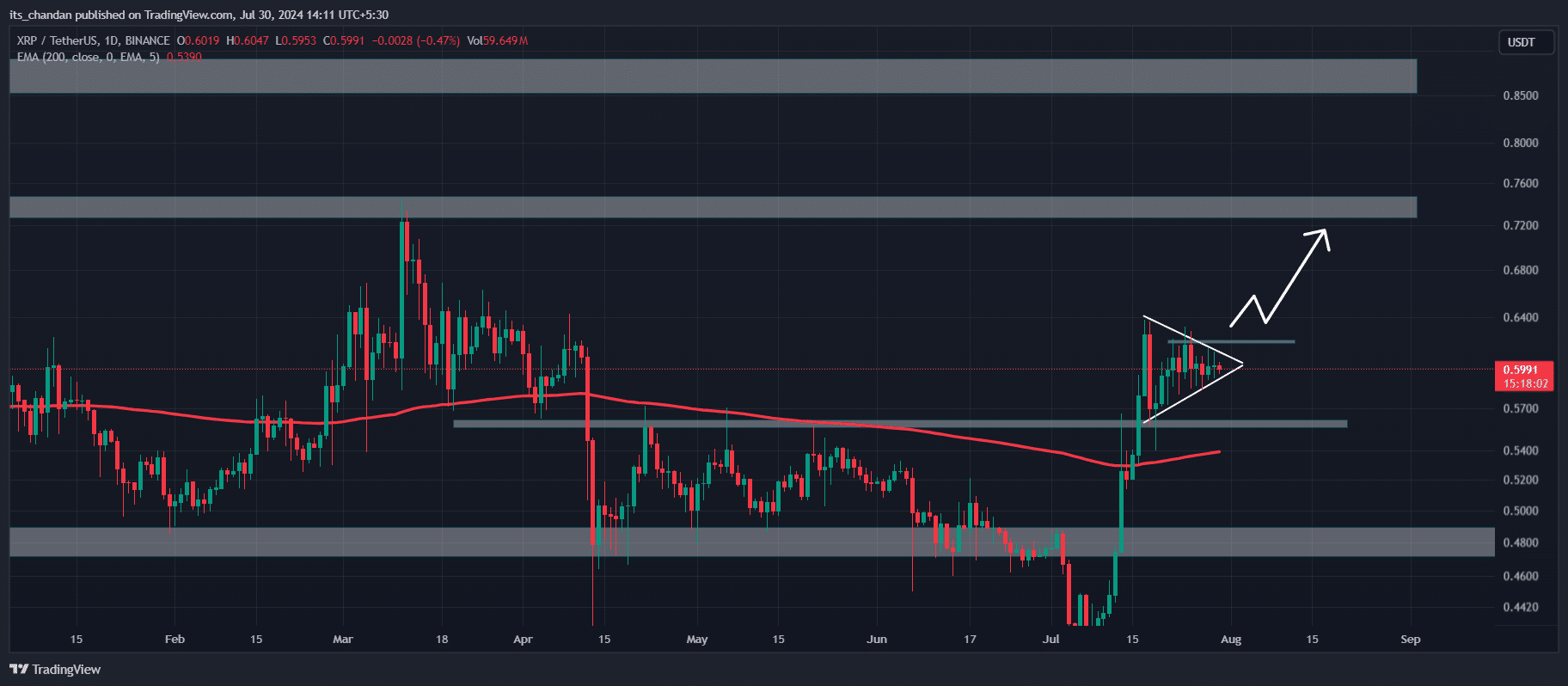

According to the analysis by AMBCrypto, XRP was showing positive signs at the current moment, having formed a bullish symmetrical triangle in its daily chart. This pattern is often seen preceding substantial price movements.

Analyzing past market trends for XRP, if its daily close surpasses the $0.618 mark significantly, there’s a strong likelihood that it might reach the $0.73 and even $0.85 price points within the near future.

As of the current news update, XRP‘s value remained superior to its 200-day Exponential Moving Average (EMA) on the daily chart. Generally, when an asset exceeds its 200 EMA on a more extensive time frame, it is considered a bullish sign.

The RSI and Stochastic readings for XRP indicated a neutral position, implying that the cryptocurrency was neither excessively sold-down nor significantly overbought at the time.

History repeats itself?

As a crypto investor, I’ve been keeping a close eye on XRP‘s price movements. According to Tony Severino, the founder of CoinChartist, XRP’s monthly Bollinger Bands have reached their tightest point yet. This indicates that XRP’s volatility has decreased significantly in the past month. It could be a sign of potential price consolidation or a quiet period in the market for this cryptocurrency. Stay tuned for further developments.

He noted that the last time this occurred — in 2018 — XRP’s price experienced a 60,000% rally.

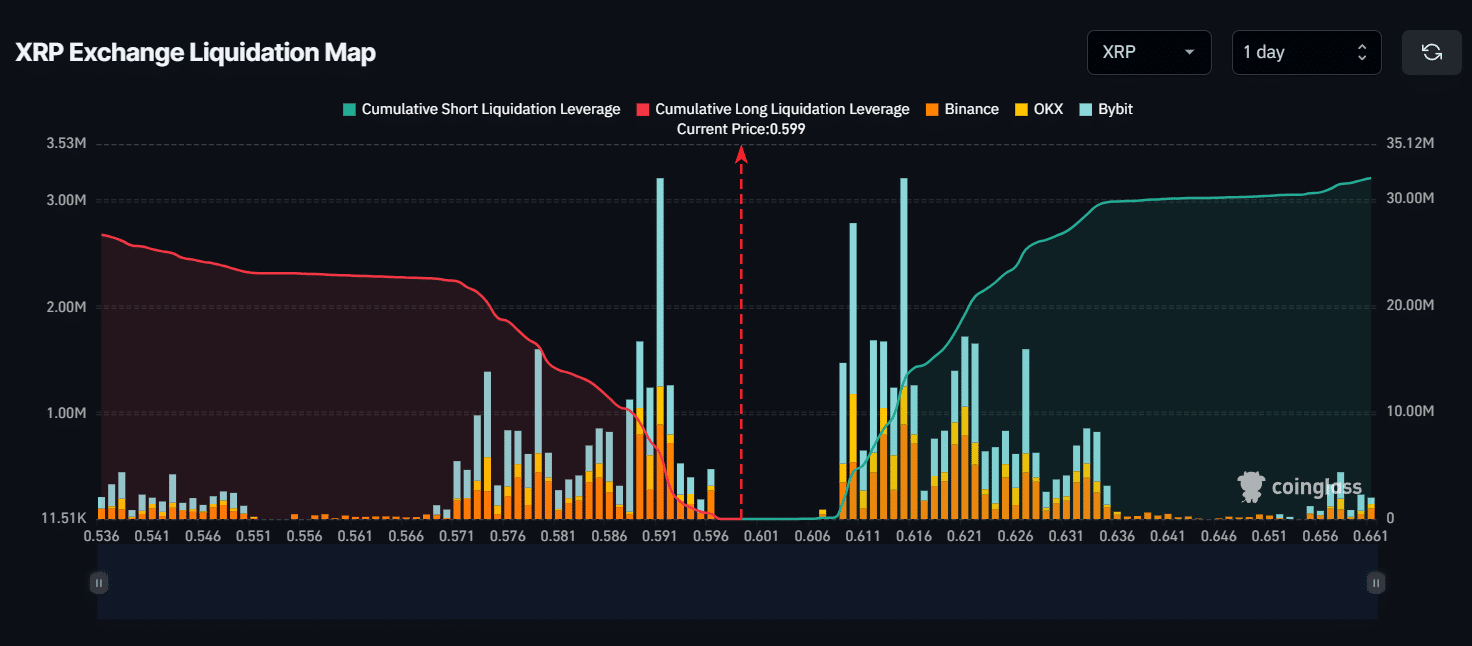

Currently, the significant liquidation points are set at $0.591 and $0.615 based on the data provided by the on-chain analytics firm, CoinGlass.

Should the market mood shift and the XRP price surpasses the $0.615 mark, approximately $12.9 million worth of short positions will need to be closed.

If the price drops beneath $0.591, a total of $6.10 million worth of long positions will be forced to close.

Read Ripple’s [XRP] Price Prediction 2024-25

Currently, at the moment of reporting, XRP was hovering around the $0.60 price point, marking a 1.7% decrease in its value over the past day.

During that timeframe, there was a 9% increase in trading activity, indicating greater involvement from investors and market players.

Read More

- WCT PREDICTION. WCT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- Cynthia Erivo’s Grammys Ring: Engagement or Just Accessory?

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Upper Deck’s First DC Annual Trading Cards Are Finally Here

- EastEnders’ Balvinder Sopal hopes for Suki and Ash reconciliation: ‘Needs to happen’

2024-07-30 18:15