-

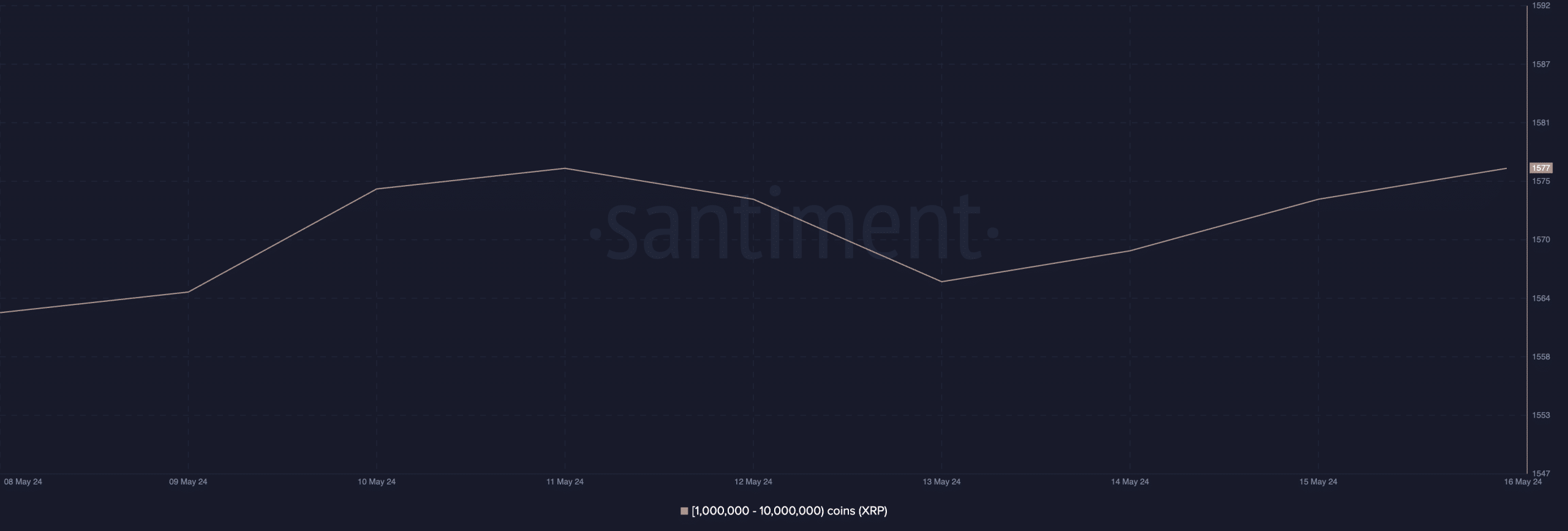

XRP whales have increased their accumulation of the token over the last 14 days

However, this failed to affect the altcoin’s price positively

As a seasoned crypto investor with a keen interest in XRP, I find myself both intrigued and concerned by the recent developments surrounding this altcoin. The increase in whale accumulation over the past 14 days is an encouraging sign, indicating strong belief among large-scale investors in the potential future growth of XRP. However, the failure of this activity to positively impact the token’s price is a cause for concern.

As a crypto investor, I’ve noticed that XRP‘s price trend has been heading downward recently. Surprisingly enough, there’s been an increase in whale activity within the last fortnight.

During this timeframe, information gleaned from on-chain data by Santiment indicated that XRP holders with a balance between one and ten million tokens purchased approximately 110 million XRP, equivalent to around $55 million in value.

Despite defying initial predictions, XRP‘s price reached a high of $0.56 on May 6th. However, it has since decreased by approximately 9%, and currently trades at $0.51 according to current market data.

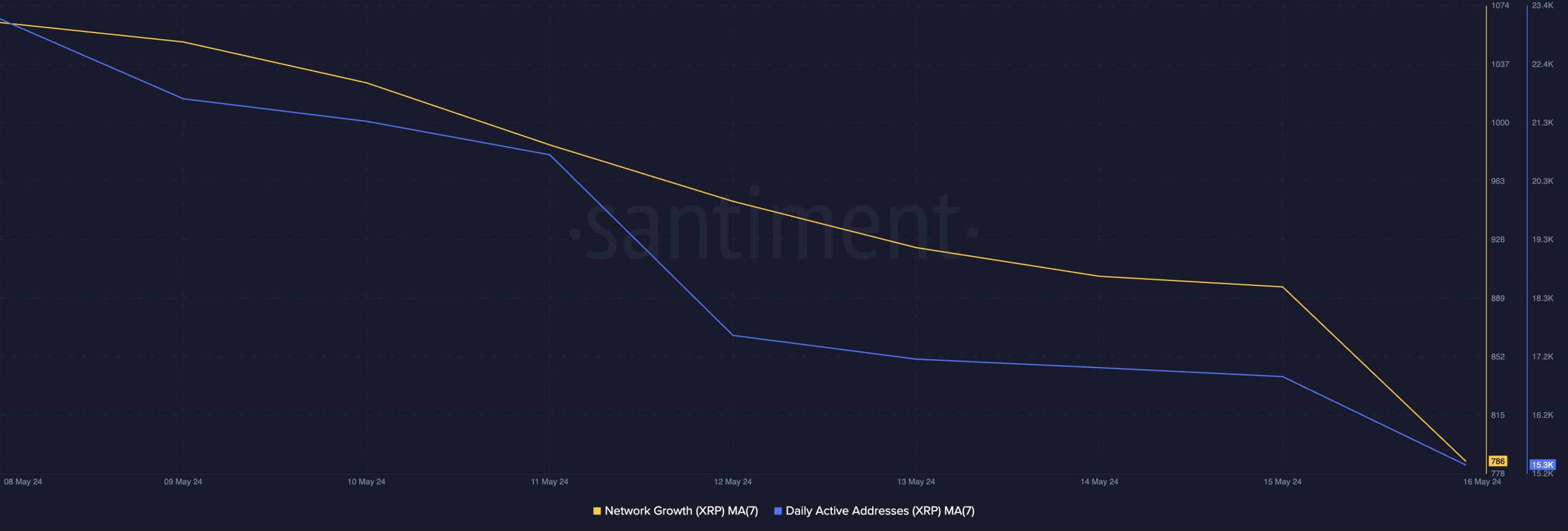

XRP’s on-chain demand has cratered

A group of significant XRP investors, referred to as whales, have increased their purchasing activity. However, there’s been a broader reduction in the overall demand for XRP in the market. For example, based on Santiment’s statistics, there was a 27% decrease in the average number of daily active addresses using a weekly moving average over the past week.

During the same time frame, there was a significant decrease in the demand for XRP as indicated by a 16% drop in the number of new addresses engaged in XRP transactions over the last seven days, according to the moving average analysis.

As a researcher examining recent market trends, I’ve discovered an intriguing finding. Despite the overall market surge over the past week, XRP investments have primarily resulted in losses for most investors.

As a researcher studying the cryptocurrency market, I analyzed the daily transaction data of XRP using AMBCrypto’s metrics. The ratio of XRP transaction volume in profits to losses, represented by a 7-day moving average, indicated that for every losing transaction in the past week, only 0.91 profitable transactions occurred. This finding suggests that XRP investors have experienced more losses than profitable transactions during this timeframe.

The pessimistic feelings towards the altcoin grew stronger, with a sentiment score of -0.56 at the current moment.

Read Ripple’s [XRP] Price Prediction 2024-25

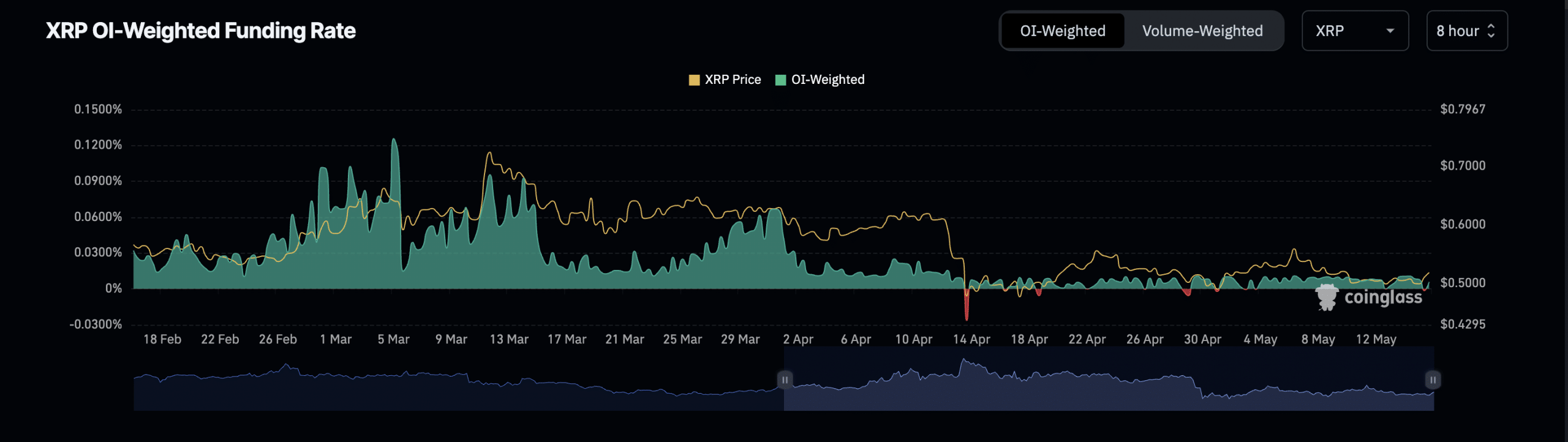

Futures traders remain focused

Despite the subdued price movement of XRP during the last week, traders in the futures market have kept a positive perspective.

As a researcher, I’ve noticed that the open interest for this token has been steadily increasing since the start of May. Currently, the open interest stands at approximately $583 million based on the most recent data from Coinglass. This represents a noteworthy 9% rise in comparison to previous figures.

As a crypto investor, I’ve noticed that the token’s funding rate continues to be positive across various cryptocurrency exchanges. In the context of perpetual futures contracts, this mechanism is utilized to keep the contract price aligned with the current market price or “spot” price. Essentially, it functions as a form of automatic fee paid by buyers or sellers depending on the market conditions, ensuring a balance between long and short positions.

When an asset’s funding rate is positive, it implies that the asset’s contract price is superior to its current market price. This situation indicates that a larger number of traders are betting on the asset’s price increase in the future markets.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- PI PREDICTION. PI cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- Dragon Ball Z: Kakarot DLC ‘DAIMA: Adventure Through the Demon Realm – Part 1’ launches between July and September 2025, ‘Part 2’ between January and March 2026

2024-05-16 18:16