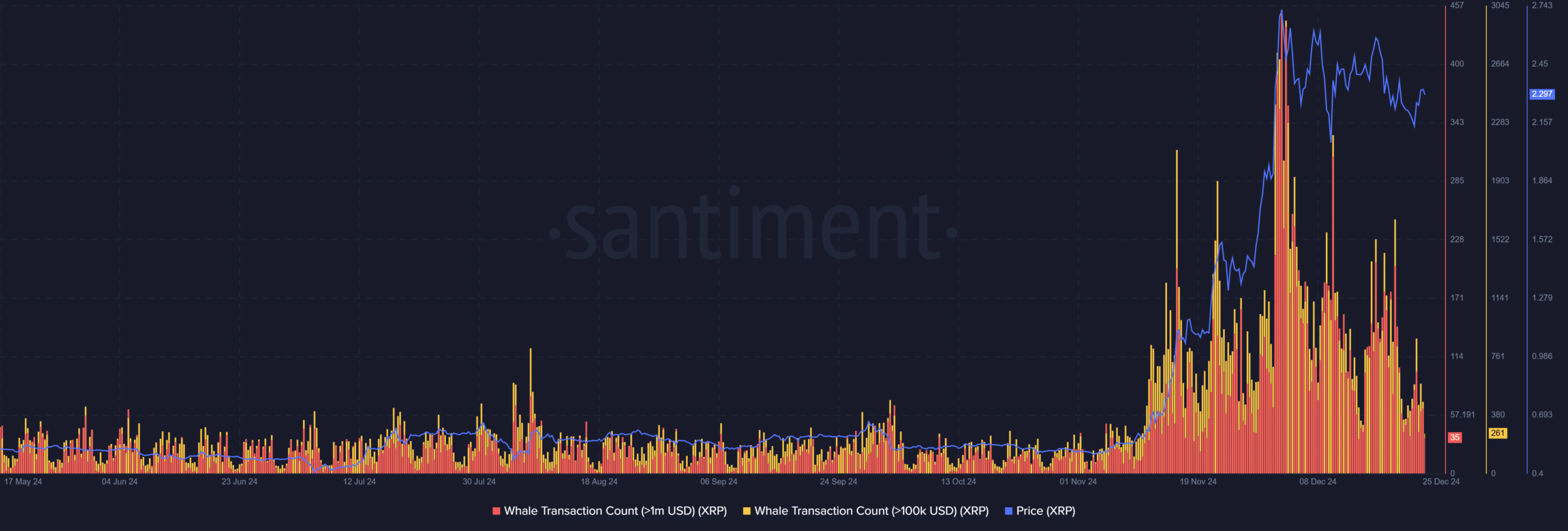

- Whale transactions over $1M signaled strategic accumulation, driving XRP’s bullish undertone.

- Price consolidated near $2.20–$2.50; a breakout could trigger bullish momentum

As a seasoned analyst with over two decades of market experience under my belt, I find the recent surge in XRP whale transactions truly intriguing. The strategic accumulation by high-net-worth and institutional investors suggests that they see great potential in Ripple‘s native token, fueling speculation about its next big move.

In the past few days, large-scale XRP transactions have seen a substantial increase, with individual exchanges surpassing forty million dollars.

This rapid amassment of tokens aligns with a continuous increase in their value, indicating that large-scale and wealthy investors might be anticipating Ripple’s native token to have a significant surge soon.

As XRP approaches key resistance points, such actions spark debate on whether this digital coin is poised for an upward trend or simply gathering strength before the next stage of market action.

A surge in transactions beyond $1 million

Latest findings show a significant surge in large-scale XRP transactions, notably those valued above one million dollars.

The graph clearly highlighted two significant trends: a persistent growth in larger transactions and their connection to rising prices.

Large transactions exceeding $1 million reached their highest point during the price increase, underscoring the significant influence that ‘whales’ have on the market behavior of XRP.

It’s worth noting that an increase in small-scale whale transactions has been observed, implying that smaller institutions may be becoming more active in the market.

In simpler terms, the coordinated actions among these layers suggest a strong buildup stage, where whales play a significant role in providing liquidity and maintaining stability during periods of increasing prices.

Large holders of XRP typically exhibit a sense of faith in its long-term value, seldom making hasty transactions. This behavior reinforces the bullish sentiment surrounding XRP at present.

Price movement and technical overview

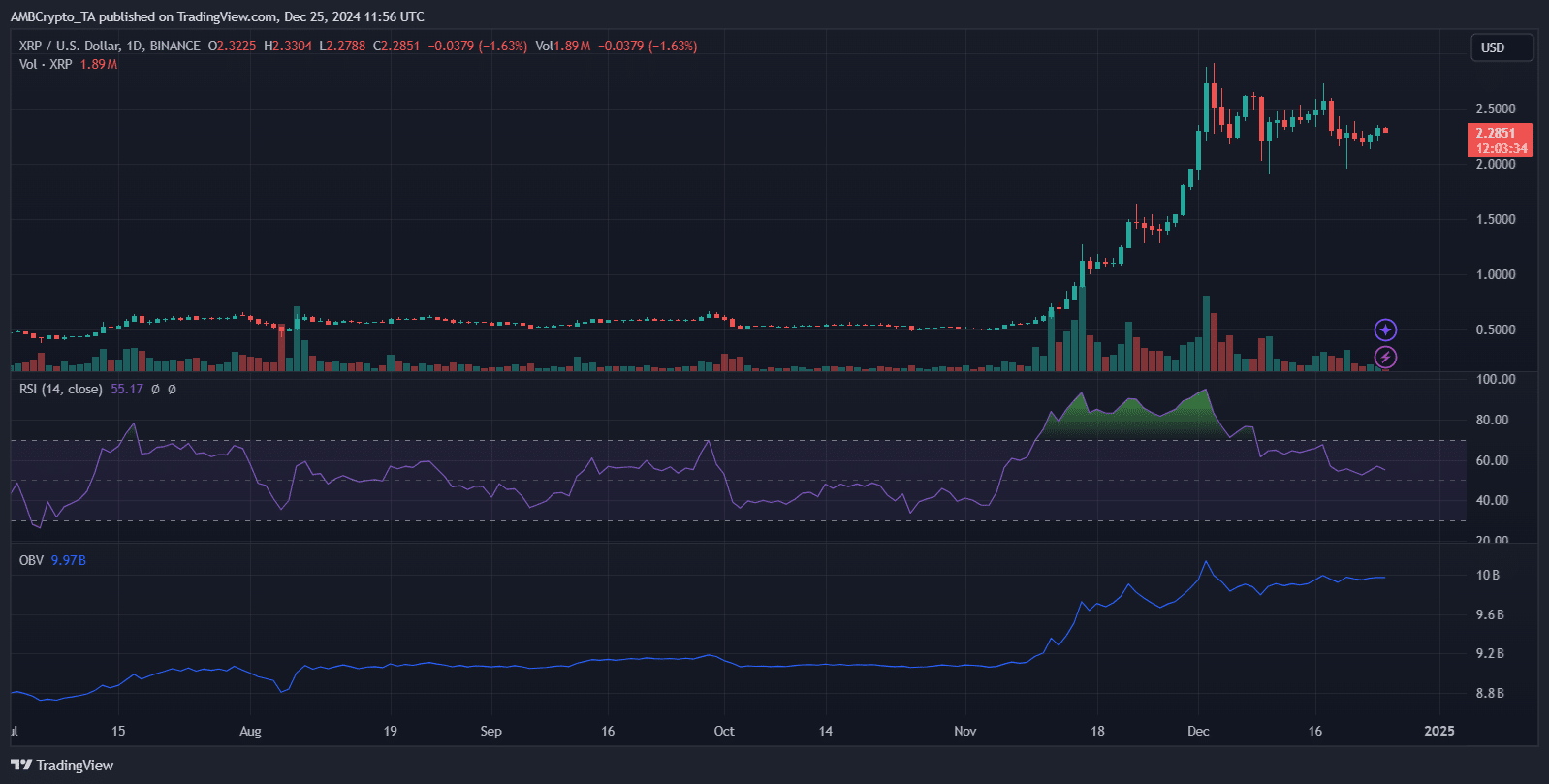

At the moment of reporting, XRP was being traded at approximately $2.2851, marking a 1.48% decrease in its value for the day. The Relative Strength Index (RSI) stood at 55.17, signaling a neutral trend as it neither showed signs of overbought nor oversold conditions.

As a researcher, I observed that the On-Balance Volume (OBV) stood at approximately 9.97 billion, indicating continued accumulation, even amidst a period of price consolidation. However, closer examination of volume trends suggests a gradual decline in buy-side momentum as daily trading volumes appear to be tapering off.

The candlestick formation indicated that there might be more price stabilization below $2.50, while the area around $2.20 serves as a crucial level offering significant support.

At the $2.50 mark, there was no successful breakthrough; this level has been repeatedly challenged but hasn’t been surpassed significantly. Meanwhile, the moving averages maintain a positive slope, suggesting a prolonged uptrend.

It seems that lower price fluctuations imply that whales could be trying to maintain stability, waiting for a trigger event before making their next significant market movement.

Market drivers and potential retail implications

The price fluctuations of XRP are significantly impacted by institutional involvement and recent judicial decisions, notably after its win against the Securities and Exchange Commission (SEC).

As an analyst, I observe a significant build-up of whales in the market, indicated by elevated On Balance Volume (OBV) levels and reduced price volatility. This trend suggests that supply is being tightly managed. While we can’t predict the future with certainty, macroeconomic factors such as market trends and regulatory updates could act as catalysts for the next significant move in this market.

For retail investors, sustained consolidation near $2.20–$2.50 signals cautious sentiment, potentially deterring short-term traders.

In simpler terms, the fact that RSI (Relative Strength Index) is neutral suggests there’s not much potential for an immediate price increase. Also, the drop in trading volumes indicates less involvement from retail investors.

Read XRP’s Price Prediction 2024–2025

If the price surges past $2.50, it could spark a resurgence of optimistic trading activity. On the other hand, if it doesn’t manage to maintain its position above $2.20, there might be a wave of selling actions.

Keep a close eye on increased trading volumes and significant news announcements, as these indicators can help you predict market volatility and adjust your investment strategies accordingly.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- PI PREDICTION. PI cryptocurrency

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- Dragon Ball Z: Kakarot DLC ‘DAIMA: Adventure Through the Demon Realm – Part 1’ launches between July and September 2025, ‘Part 2’ between January and March 2026

2024-12-26 09:12