- XRP has a track record of bouncing back when BTC hits its peaks

- If the right factors align, a $4 target could soon be within reach

The rise of XRP above $3, fueled by whale purchases, has paid off for those who held on to their investments. However, maintaining that position hasn’t been a walk in the park. With a 53% year-to-date increase, investors find themselves in a dilemma: Should they cash out now or continue holding for potential future gains?

The age-old dilemma in a bullish market

In comparison to other high-performing assets, it’s notable that XRP experienced an impressive 40% increase over the past month, with nearly two-thirds of that growth happening within the New Year itself. This surge suggests a powerful upswing, but it also hints at potential rapid inflation – perhaps more than the market can handle in such a short timeframe. The Relative Strength Index (RSI) appears to support this observation, as it quickly climbed from a neutral state to an overbought level within only three days.

In markets like this, profit-taking is almost inevitable.

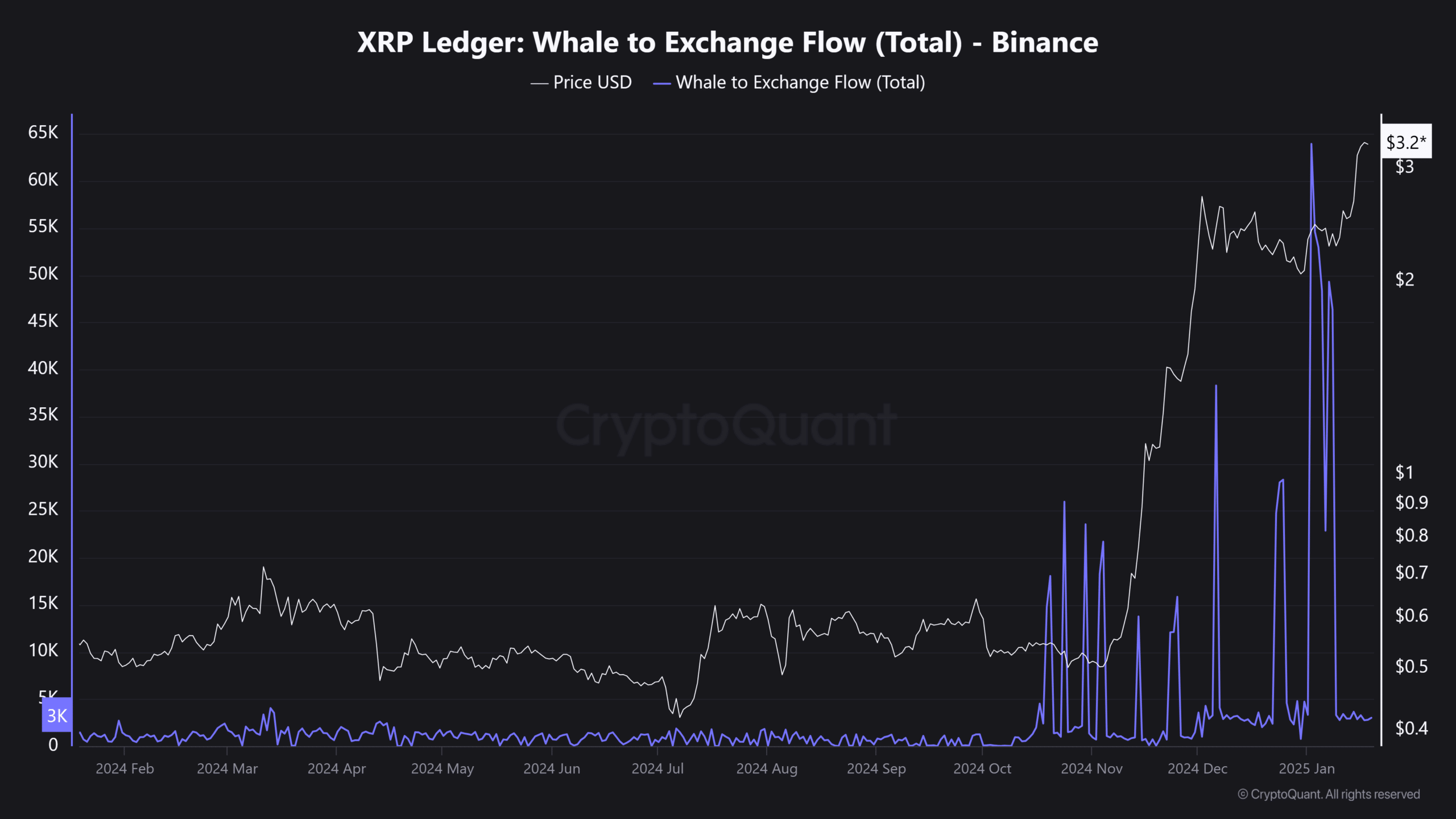

Following a dramatic 53% increase in XRP over just under three weeks, it’s hardly shocking that traders are deciding to sell off their holdings. In fact, the amount of XRP transferred into Binance has soared by almost 350 million – an incredible 1567% rise over the past two days.

Despite cashing out some profits, the whales remain steadfast. Over $4 billion has been amassed since the last ‘Trump pump’, yet the predicted massive sell-off seems to have missed its mark. It’s evident that these whales aren’t interested in a quick profit – they’re strategically playing for the long term.

If the current trend persists, their plan might set the stage for a significant surge towards $4, implying that it would be wise for investors seeking long-term benefits to hold XRP.

XRP in an economic imbalance

XRP experienced a significant rise, soaring beyond $3 for a 17% increase, reaching $3.50 – a mere 11% from its historical peak set seven years ago. However, at the time of reporting, it had dropped by 8%. This decline occurred as market conditions evolved, causing supply to exceed demand, resulting in an economic imbalance.

Currently, there’s a surge of selling activity in the perpetual market, evident from the increased taker sell orders compared to buy orders. This situation favors short positions significantly. Consequently, it led to approximately $8.44 million worth of long positions being liquidated.

It seems the volatility in the XRP Futures market may be increasing, but surprisingly, Open Interest has decreased by just 0.70%. This implies that a significant number of long positions might be forced to liquidate in the coming days as the market dynamics intensify.

Could we rephrase this sentence like this: What’s happening is that volatility might escalate temporarily as investors are concentrating on Bitcoin with the “Trump effect” taking place. As funds are being diverted from XRP to BTC, the value of XRP relative to BTC (XRP/BTC pair) has turned negative, indicating a change in market interest.

If whales don’t resume buying (accumulation phase), there could be increased selling due to profit-taking and mandatory liquidation of XRP long positions, which suggests carefulness is advisable when trading derivatives.

Realistic or not, here’s XRP market cap in BTC’s terms

In the open market, the absence of intense selling from large investors (whales) suggests they have a firm belief in their investment’s potential.

If the value of Bitcoin reaches its maximum point and people start selling less for profits, there might be an increase in the price of XRP, potentially reaching around $4. Therefore, holding onto XRP over the long term could prove to be a wise decision.

Read More

2025-01-19 20:08