-

Data revealed that XRP whales did not join the broader market sell-off.

Long-term holders also refrained from selling, hinting a possible price rebound for the token.

As a seasoned crypto investor with a keen interest in XRP, I find the recent market trends intriguing. The data suggesting that XRP whales have not participated in the broader sell-off and even accumulated more tokens is promising. This accumulation could potentially lead to price stabilization or even a rebound.

Despite the disheartening market conditions, Ripple (XRP) large investors have chosen not to worsen the situation. Instead, they have elected to purchase additional tokens.

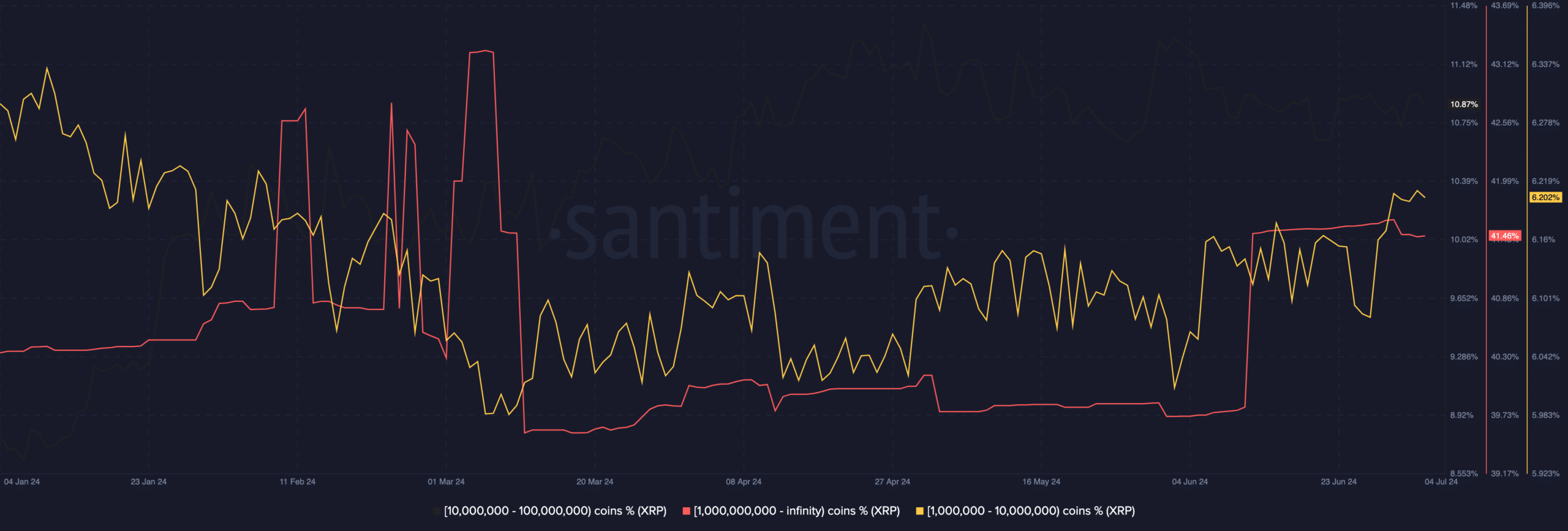

As a crypto investor following the XRP market closely, I’ve been keeping an eye on the distribution of large XRP holders according to Santiment. In mid-June, approximately 39.81% of the total addresses held over a billion XRP tokens. However, I noticed an uptick in this ratio at the time of writing, with the percentage now standing at 41.46%.

Big players offer a way out

As a crypto investor in the 1 million to 10 million dollar range, I’ve noticed an uptick in our balance’s percentage growth from 6.08% to 6.20%. This may not seem like much, but when it comes to cryptocurrencies, even small shifts can be significant. One group that has a substantial impact on these price movements are the whales – large entities that hold vast quantities of a particular crypto asset. Their transactions can cause noticeable ripples in the market, so keeping an eye on their activities is essential for us smaller investors.

As a market analyst, when I observe a significant buildup of certain factors, such as during a recent market downturn, I find that prices often respond by finding a stable footing. At times, these prices may even bounce back, recovering some or all of their losses.

At present, XRP is priced at approximately $0.43. This represents a 6.52% decline in value over the past 24 hours. However, recent large-scale transactions from cryptocurrency whales may cause the price to either remain steady around this figure or potentially rise towards $0.45.

As an analyst at AMBCrypto, I acknowledge the significance of whale accumulation in cryptocurrency markets. Nevertheless, I want to emphasize that this factor alone may not prevent price declines. To gain a more comprehensive understanding, my team and I delved into other on-chain occurrences.

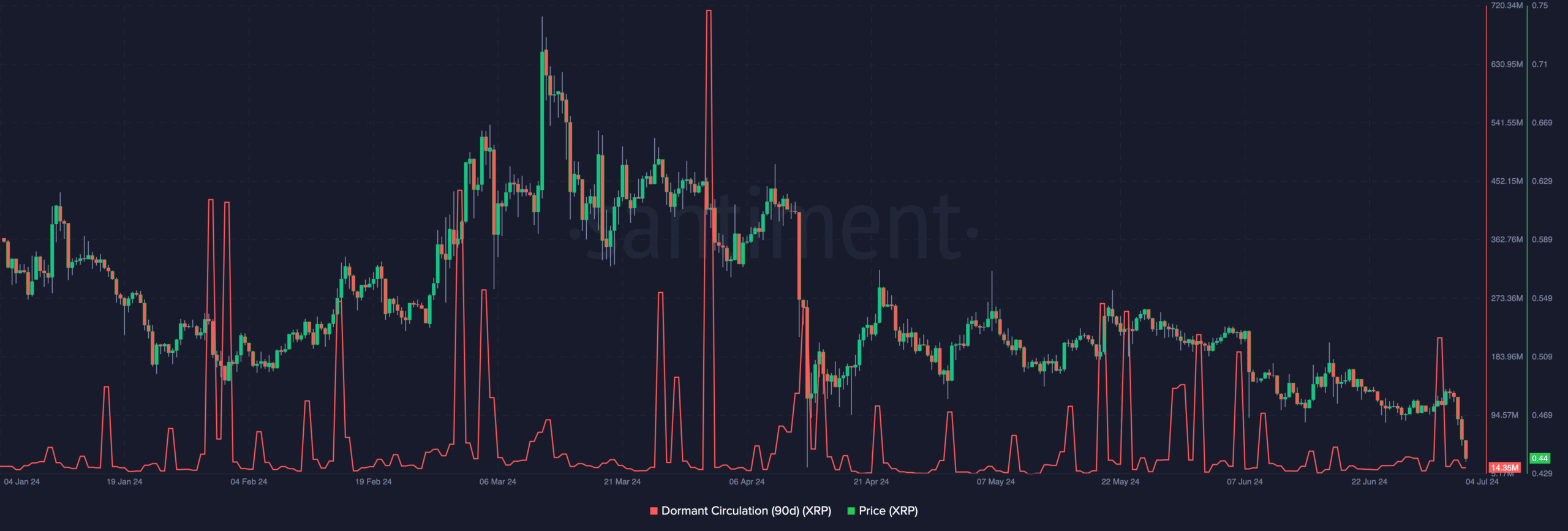

As an analyst, I examined the dormant circulation rate, which indicators the pace at which cryptographic tokens that have remained idle for extended periods are involved in trading activities once more.

When circulation of a dormant token picks up, it signifies that these tokens are shifting from individual possession to market transactions. This indicates that token owners are prepared to offload their holdings.

XRP price aims to climb above resistance

As a researcher observing the market trends, I’ve noticed that an increase in dormant circulation typically results in a decrease in price. However, when dormant circulation is low, as it was at the time of my last analysis, prices may actually rise. On July 1st, there was a significant jump in XRP‘s 90-day dormant circulation.

At the moment of publication, the token had dropped to a figure of 14.35 million. This decrease implies that long-term investors have chosen not to transfer their holdings from cold storage.

If sustained, XRP could avoid another plunge as initially mentioned.

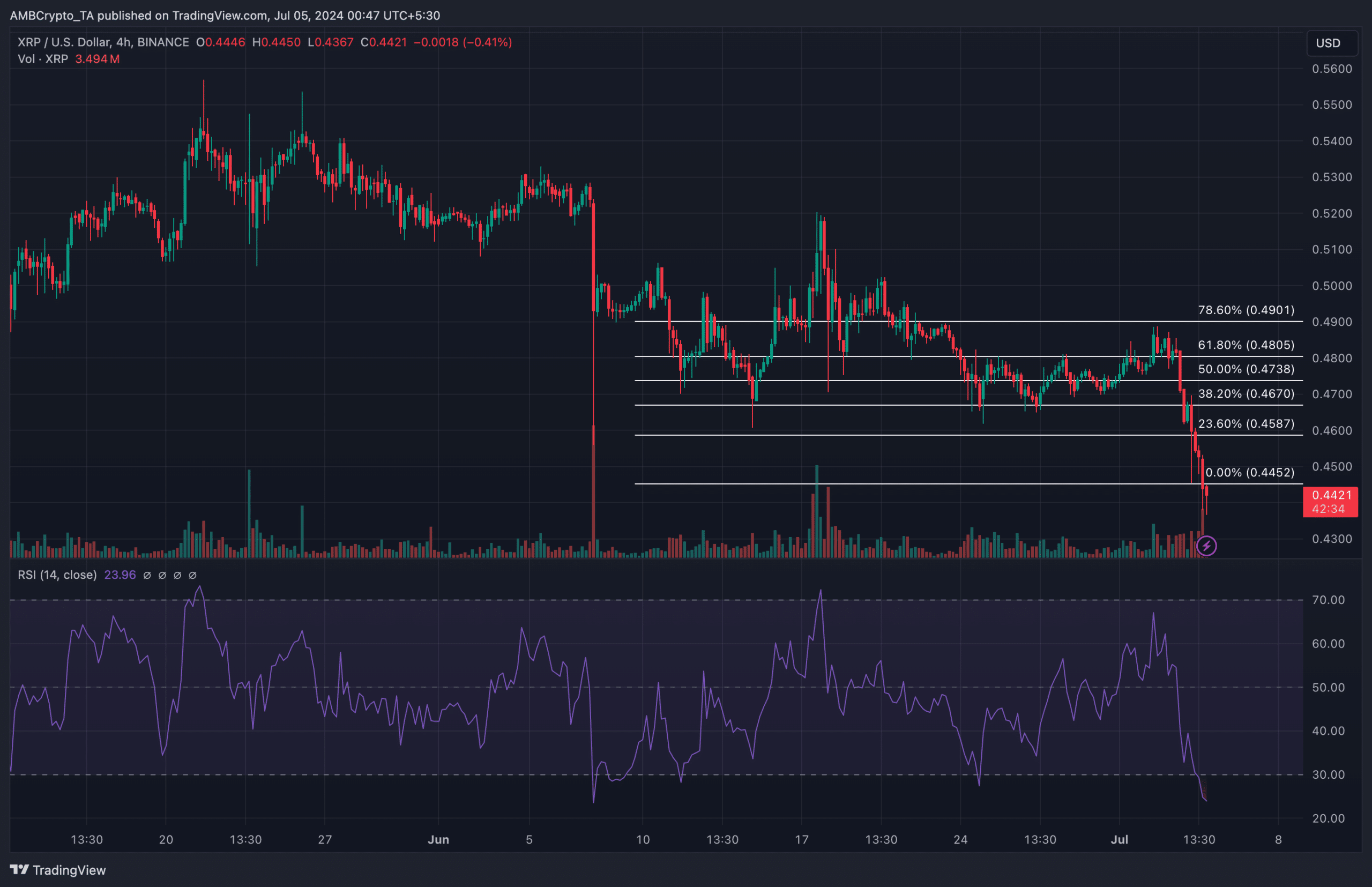

Furthermore, we examined XRP‘s technical prospects by evaluating its daily chart indicators. Based on this analysis, the Relative Strength Index (RSI), which signifies the momentum of price movements, stood at 23.96.

As a crypto investor, I understand that when the relative strength index (RSI) of an asset surpasses 70, it’s considered overbought territory. Conversely, if the RSI falls below 30, we’re looking at oversold conditions. These levels can provide valuable insights into potential buying or selling opportunities in the market.

Based on the market conditions, XRP had been undervalued, potentially signaling an impending price recovery. To identify potential targets for this rebound, AMBCrypto employed the use of the Fibonacci retracement tool. This technical analysis method pinpoints significant support and resistance levels.

Read Ripple’s [XRP] Price Prediction 2024-2025

Based on the graph, if XRP recovers from its recent lows, it may encounter resistance around the 23.6% Fibonacci level, which is located at approximately $0.45.

However, this prediction could be invalidated if selling pressure increase and whales also join in.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-07-05 10:15