Ripple (XRP) has seen more outflows than inflows from exchanges lately, according to data from Santiment. On April 27, for instance, about 3.4 million XRP were deposited while over $5 million worth were withdrawn. This could indicate bullish sentiment among holders expecting price increases.

Recently, XRP (Ripple’s digital asset) was classified among blockchains perceived to have little or no practical use. Yet, against this unfavorable assessment, there was a higher volume of transactions going out than coming in.

Ripple sees more outflow from exchanges

As a data analyst, I’ve been closely examining Santiment’s exchange flow data for Ripple. Notably, there has been a recent decline in both the incoming and outgoing transaction volumes. However, an intriguing development occurred on April 27th when the outflow volume marginally exceeded the inflow.

As a crypto investor, I observed that approximately 3.4 million XRP flowed into my wallet or investment account on the 27th of April. However, the value of XRP leaving my holdings surpassed 5 million dollars in the same timeframe.

The outflow of XRP from exchanges exceeded the inflow, implying a potential surge in demand among XRP investors who expect prices to rise.

Yet, it’s plausible that these transactions signify shuffling of assets among large crypto wallets. As of now, there haven’t been any substantial shifts in the market.

At the current moment, a larger amount of XRP, approximately 2.7 million, was being taken out of exchanges than the 2.6 million XRP that were going in.

XRP is yet to see a ripple in price

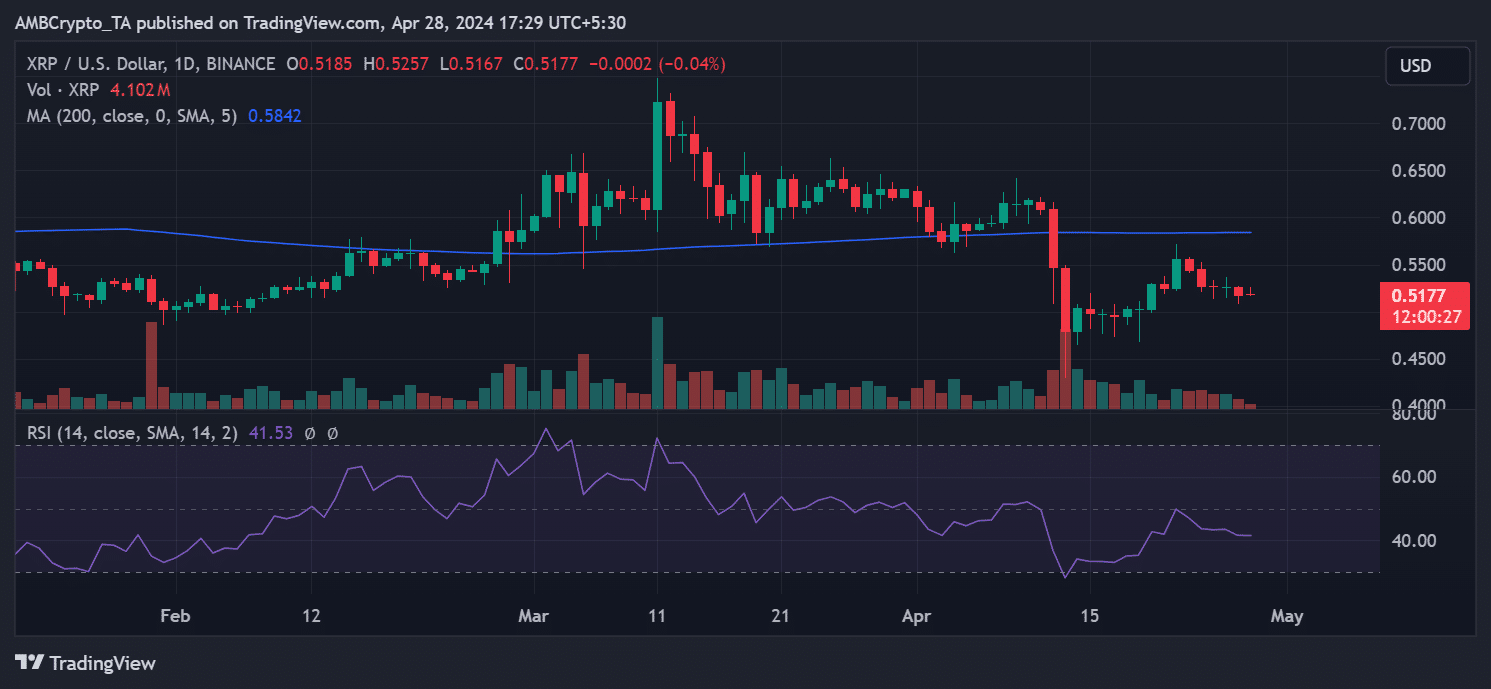

Based on AMBCrypto’s assessment, Ripple’s downward trend appeared to persist following the 27th of April. On that particular day, the value of Ripple hovered around $0.52, marking a decrease of more than 1.5% compared to its previous price.

As I pen down these words, the asset is hovering near the $0.51 mark, witnessing a minimal decrease of roughly 0.7%. Notably, the long-term moving average, represented by the blue line, persists in acting as an immediate barrier at around $0.58.

The RSI, or Relative Strength Index, continued to hover around the 40-mark as of the 11th of April, implying a downtrend and keeping the price below the neutral threshold.

Ripple’s lukewarm sentiment

At the present moment, Ripple’s public perception was subdued based on AMBCrypto’s examination of data from Coinglass. Meanwhile, the Funding Rate stood at approximately 0.0092%, suggesting that market dominance resided with buyers.

Realistic or not, here’s XRP’s market cap in BTC’s terms

It also meant that there was an expectation of a price rise.

Furthermore, the Open Interest figure of approximately $535 million suggests that trading activity has been relatively subdued.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-04-29 11:03