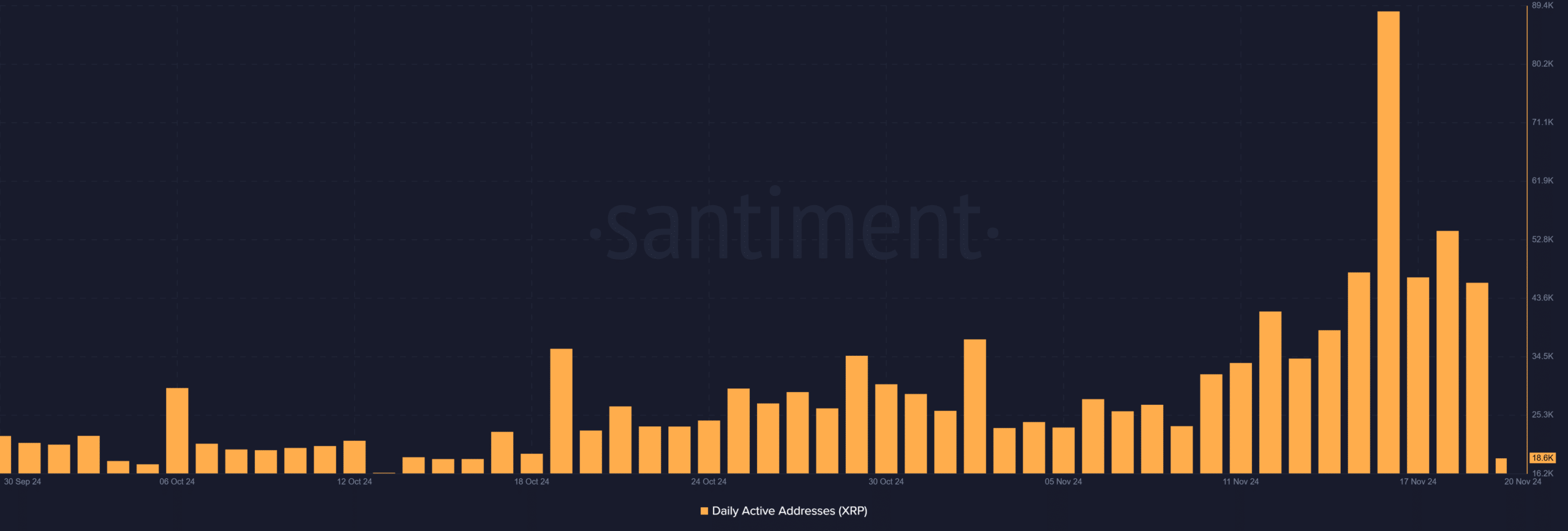

- XRP’s $1 milestone seemed uncertain, as daily active addresses declined significantly.

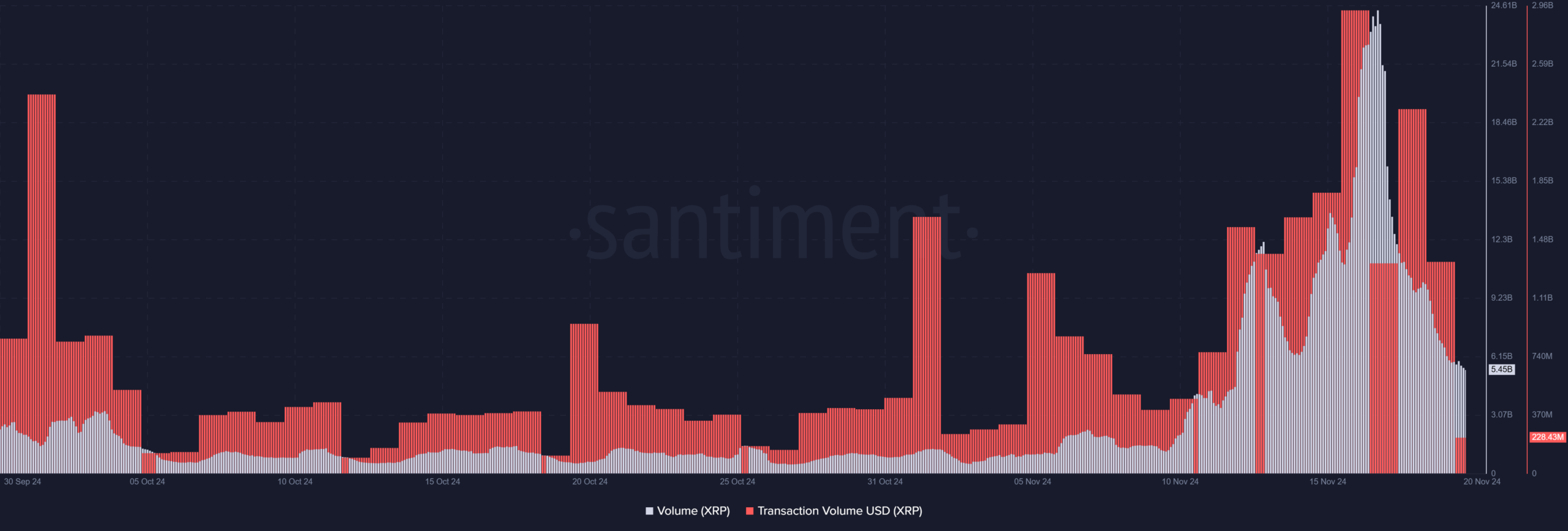

- Ripple’s trading volume dropped from almost $3 billion to around $207 million.

As a seasoned analyst with over a decade of experience in the crypto market, I have seen my fair share of price surges and volume drops. The recent $1 breakout by XRP is certainly an interesting development, but the accompanying drop in trading volume has raised some concerns.

Following several months of accumulation, Ripple [XRP] has once again surpassed the symbolic $1 price point, signifying a notable achievement in its digital currency journey.

Yet, this success is accompanied by a significant decrease in trading volume, as it has dropped from its most recent high point.

Although the increase in prices shows a revived enthusiasm among investors, the decrease in trading volumes stirs doubts about its longevity.

XRP: $1 surge and market context

After spending a considerable amount of time moving horizontally in its price action, XRP managed to surpass significant resistance barriers, eventually reaching potential prices of one dollar.

The price has reached as high as $1.10, supported by strong buying activity earlier in the rally.

In simpler terms, the overall positive trend in the market, largely driven by Bitcoin‘s recent surge, has contributed to XRP’s recent increase in value or popularity.

Meanwhile, the Relative Strength Index (RSI) for XRP suggested it was becoming overbought, with a value of 82.69, potentially hinting that the current surge could be slowing down.

On a technical level, the Moving Average Convergence Divergence (MACD) indicated an upward trend, signifying bullish momentum. However, the histogram hinted that this positive trend might gradually slow down.

On November 20th, the trading volume for XRP was approximately 5.49 billion, significantly lower than the peak of around 24 billion witnessed only a few days prior. This substantial decrease in trading activity hints at doubts regarding the longevity of XRP’s recent surge.

The impact of the 18 billion volume decline

Data from Santiment indicates a substantial decrease in XRP’s trading activity since it reached its highest point during the market surge.

According to AMBCrypto’s findings, the trading volume peaked at more than $24 billion on November 17th, however, it has now dropped to approximately $5.4 billion at present.

Additionally, it’s worth noting that the trading volume has significantly decreased from approximately $2.9 billion to roughly $207 million at present.

This volume drop highlighted a potential waning of market enthusiasm, often coinciding with traders’ profit-taking.

Historically, large increases in volume (the amount of a financial asset traded) have often coincided with extended periods of price increase. However, the recent decrease in volume might indicate that the demand to buy could be weakening.

Furthermore, daily active addresses, another critical metric, have dropped from their recent highs.

This suggests a decline in the number of users interacting with the XRP ledger, potentially indicating a temporary decrease in its demand.

To keep XRP’s value above $1, it requires ongoing involvement from investors and continuous transactional activity.

Factors driving the volume decline

As a crypto investor, I’ve noticed a substantial drop in trading activity lately. It seems that profit-taking might be the main culprit, with traders cashing out their profits after XRP hit the $1 mark, causing a decrease in trading volume.

Furthermore, it seems that the overall feeling in the market is becoming more cautious, noticeable particularly among other digital currencies that have seen a decrease in trading activity following their recent surges.

Can XRP sustain its rally?

The price of XRP staying above $1 is influenced by various elements. It’s crucial for the digital currency to preserve its significant support level at this point, since falling below it might spark additional selling and a retreat back into a holding pattern.

Resistance at $1.15 will be the next key level for a potential rally continuation.

Realistic or not, here’s XRP market cap in BTC’s terms

In simpler terms, the overall feelings or trends about various cryptocurrencies, including Bitcoin and Ethereum, can affect how alternative coins (altcoins) perform, because their momentum tends to follow these leading cryptos.

Furthermore, a resurgence in XRP’s momentum requires on-chain indicators like the number of daily active addresses and transaction volume to demonstrate improvement.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-11-21 07:04