- XRP could be gearing up for some serious volatility, making the next few days crucial for anyone eyeing the asset

- Investors are biding their time, carefully watching for the next ‘Trump pump’

In an effort to minimize risk, investors frequently adjust their financial resources. Given the unpredictability seen in Q1, we can expect diversification strategies to become more widespread. The recent nearly 10% increase in XRP’s value over the past week, contrasting with Bitcoin‘s 5% drop, serves as a clear illustration of this transition towards a more diversified approach.

For XRP, $3 is still a long way off

Looking back at the final quarter of last year, I recall when XRP managed to breach two significant psychological barriers, largely due to the so-called Trump trade. As Bitcoin reached an astounding $99k by November’s close, the XRP/BTC pair experienced a remarkable surge, with long green candlesticks dominating the daily chart. This resulted in impressive daily gains exceeding 10% for XRP.

As a crypto investor, I’ve noticed a pattern that appears to be repeating itself. Today, a strong green candlestick signaled a 10.24% surge in a single day on the XRP/BTC chart, and the MACD is now indicating a bullish trend. Given the recent market turmoil, there’s a sense of caution among investors. However, considering this shift, it seems prudent to consider moving some funds from Bitcoin into Ripple (XRP), as it might prove to be a shrewd investment decision in the current climate.

Even though XRP is currently valued at $2.55, it encounters a recurring difficulty. Although there are positive indicators such as RSI not being overbought, whales buying 26 million XRP tokens, and the XRP/BTC pair becoming green, surpassing $2.60 has historically been challenging. It’s worth noting that reaching $3 may still seem ambitious at this point.

If a possible “Trump rally” is coming up, shrewd investors might once again direct their attention towards Bitcoin, hoping for increased profits. Under this circumstance, it seems that the rise of XRP to $3 could be postponed.

So, proceed with caution

Based on AMBCrypto’s report, it appears that the current 10% increase could be largely fueled by speculation rather than strong underlying foundations.

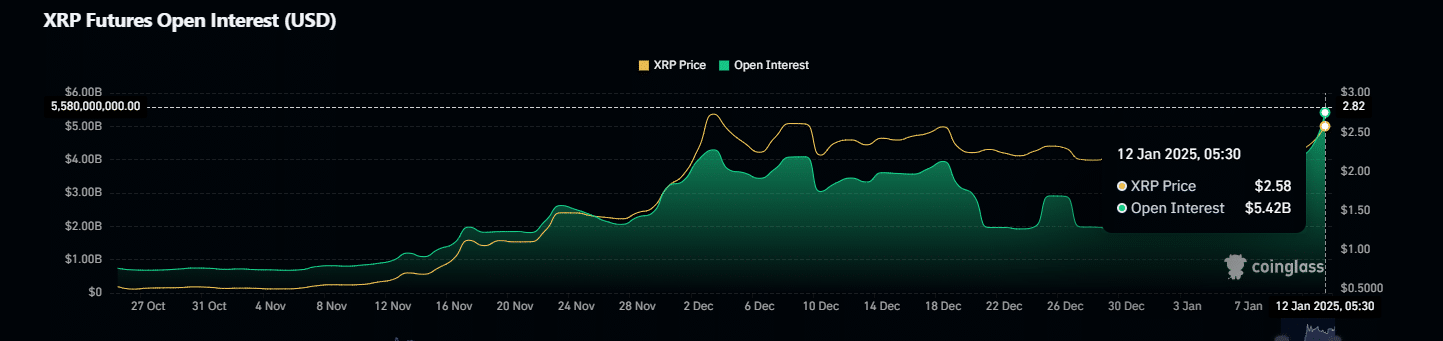

Initially, the Open Interest (OI) in the Futures market reached a record peak of $5.42 billion – significantly exceeding the $4.29 billion recorded when XRP attained its annual maximum of $2.80 during the middle of Q4.

Although it might seem positive, there are indications that should not be overlooked. For instance, the reserve amount has climbed up to 2.97 billion, which, in the past, has often pointed towards a possible peak for XRP. Moreover, data on outflows hints at a decrease in retail investment flowing into the market.

When considering whale behavior, it provided a more vivid understanding. The escalating hoard by the whales boosted long positions to unprecedented levels, potentially setting up a short-squeeze scenario. This is precisely what unfolded – a staggering $10.79 million worth of shorts were forced out in the past 24 hours.

Read Ripple [XRP] Price Prediction 2025-2026

Yet, as retail investment in the XRP/BTC pair seems to dwindle, there’s a possibility of it turning negative, which could indicate potential difficulties down the line. Therefore, even though a 10% increase may appear attractive, it’s not the anticipated “drop” that some might be expecting.

It’s possible that XRP may require another adjustment before attempting to reach $3. The reaction of the market to the impending “Trump pump” will likely provide the necessary insight. For now, exercise caution.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Solo Leveling Arise Tawata Kanae Guide

2025-01-12 15:03