- XRP has jumped 15% this week, riding the wave of a market bounce after the bearish end to Q4.

- Is this just the beginning of a larger rally for XRP, or will it be a short-lived bounce?

After just one week into the new year, several digital currencies, including Ripple (XRP), are regaining ground that was lost following the FOMC-induced downturn. Notably, Ripple has experienced a 15% increase, reaching $2.40 – an important level of resistance.

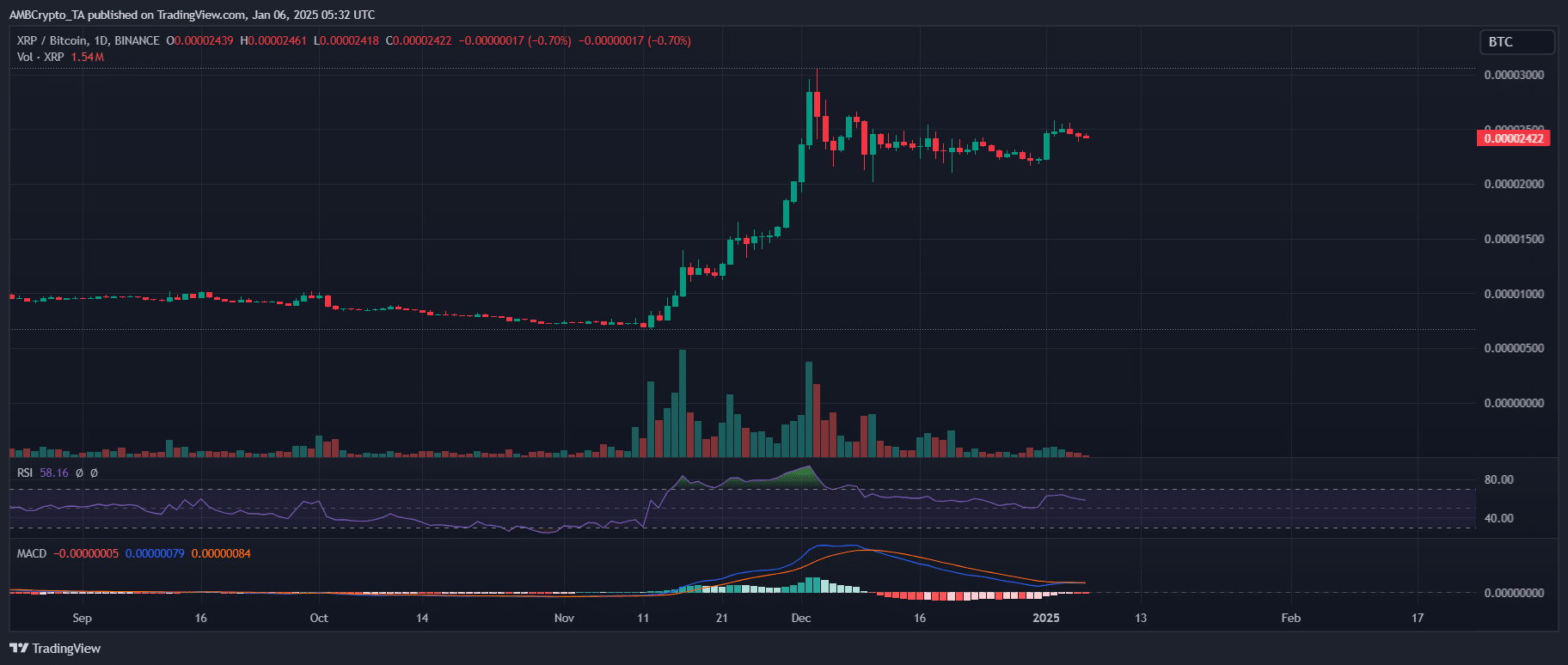

Amidst the excitement surrounding the “Trump pump,” the surge in Ripple’s value relative to Bitcoin (the XRP/BTC pair) served as a distinct indicator that money was being moved around, with investors choosing to reallocate their investments and broaden their betting strategies by diversifying.

In early November, during the voting day for elections, Bitcoin experienced a significant increase of approximately 9% in one day, with its value peaking at around $99K within merely two weeks.

As Bitcoin reached its zenith, I noticed a significant surge of over 10% in the XRP/BTC pairing, implying that XRP was steadily making its presence felt in the market.

Currently, the MACD lines are almost crossing over in a way that suggests an upcoming bullish trend. It’s possible that this pattern may recur. If Bitcoin reaches $100K, it’s plausible that Ripple might also increase, potentially aiming for a price of around $3 by the end of the month.

For XRP holders: Proceed with caution

Following a month of stabilization, there’s a strong possibility that Ripple could experience an upward surge. The increase in the number of open investment contracts (Open Interest) implies that an increasing number of investors are planning to hold onto their positions for the near future, hinting at anticipation of a price rise in the upcoming days.

However, it’s important to note that the range between $2.40 and $2.46 serves as a significant barrier – if the necessary demand isn’t present, XRP might find it challenging to surpass this zone and could potentially experience a reversal instead.

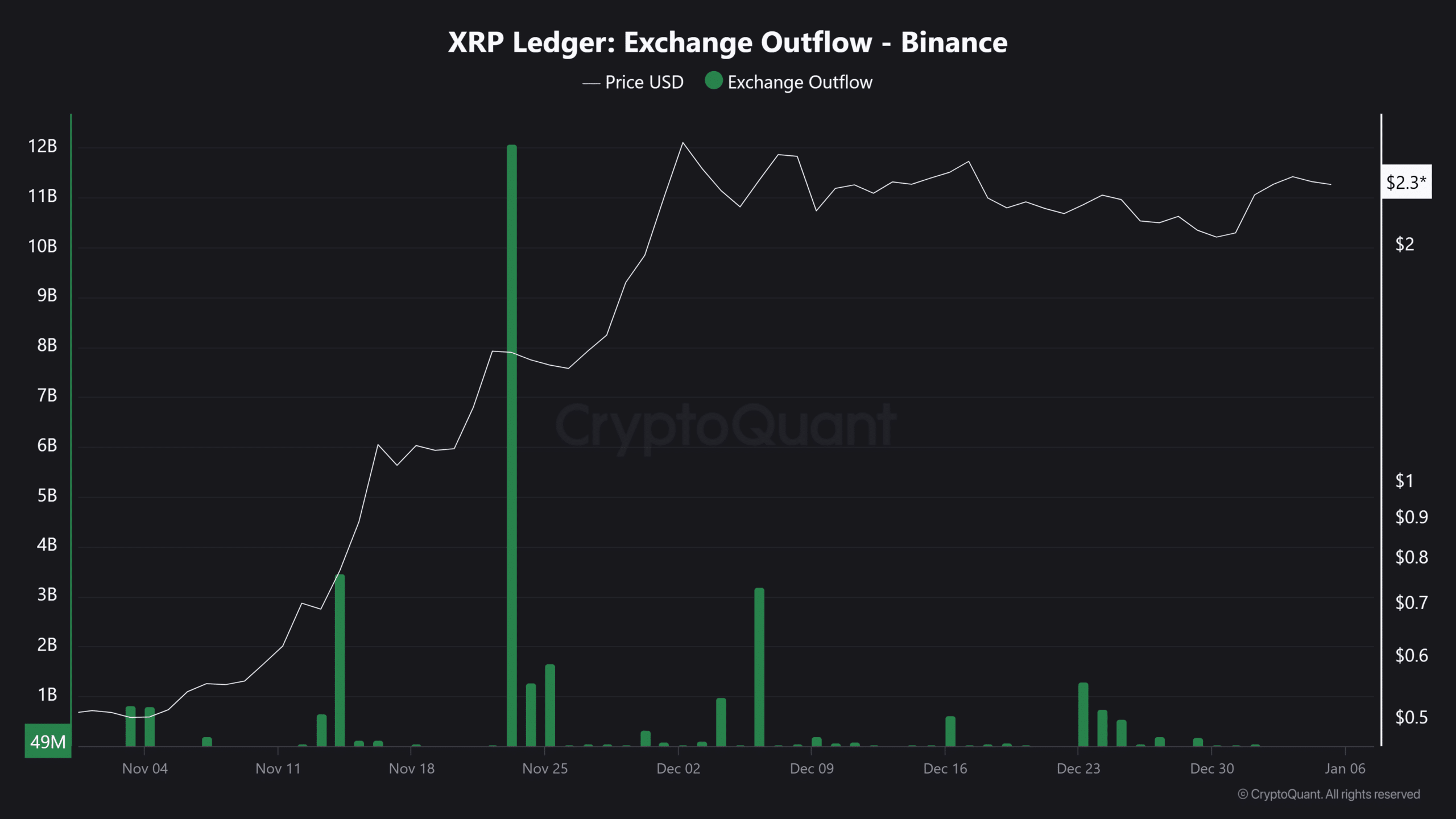

Additionally, it’s worth noting that the outflow rate remains significantly lower than before, currently sitting at less than 50 million, which is a stark contrast to the $3 billion observed when XRP hit its peak annual value of $2.48.

It appears that the recent 15% increase might have been fueled more by large investors (whales) buying up stocks, perhaps ignited by the excitement surrounding the new year, rather than a surge in individual or retail investment.

Realistic or not, here’s XRP market cap in BTC’s terms

It’s evident that the path forward will present challenges. However, given its strategic position, Ripple has a good chance of securing funds from Bitcoin. Reaching $2.46 might serve as the catalyst for this to occur.

The journey won’t be smooth sailing, but with its advantageous placement, Ripple could draw investment from Bitcoin. Achieving $2.46 could help make that happen.

With FOMO still lagging, it’s unclear if XRP can generate enough momentum.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-01-06 16:07