- XRP witnessed accumulation within a range over the past month.

- The short-term speculative sentiment was bearish, but a move to $2.4 is anticipated in the near-term.

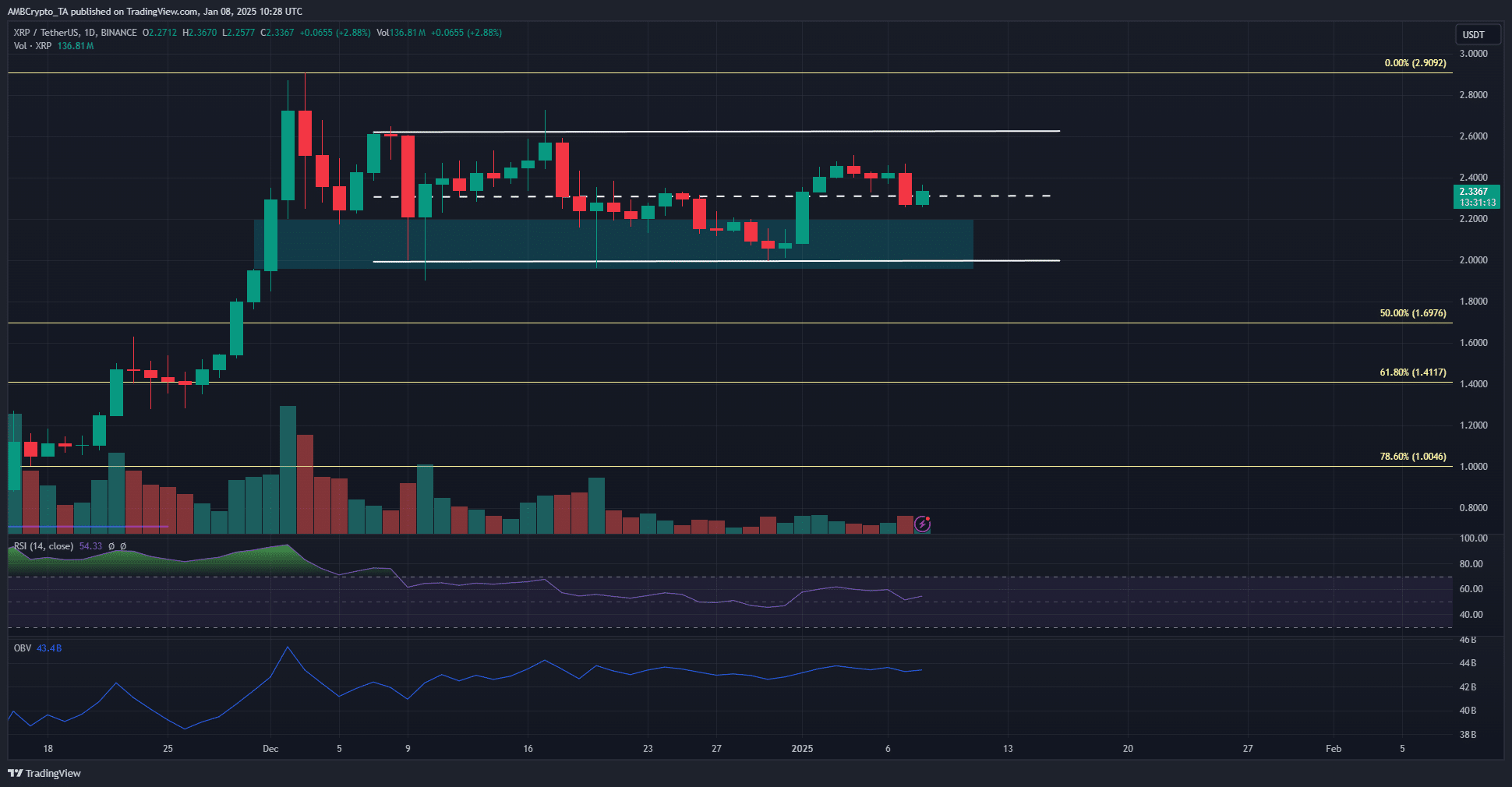

Ripple (XRP) shows a favorable long-term perspective, with its surge to $2.9 being succeeded by a period of fluctuation characterized by consistent buying activity from optimistic investors.

Veteran commodities trader Peter Brandt, who also follows classical chart analysis, has predicted that the market capitalization of XRP could reach an impressive $500 billion.

XRP range formation and the next buying opportunity

Over the course of a month, the price of XRP fluctuated between $2 and $2.62. During this period, the midpoint at $2.31 functioned as a dual barrier, acting as both a support and a resistance level. At the current moment, it is serving as resistance.

As I analyze the price movements of XRP, I noticed that a potential fair value gap from late November serves as the next demand zone that could trigger a bullish response. Interestingly, despite the range formation we’ve seen, the On-Balance Volume (OBV) has been steadily ascending over the past month, suggesting increasing buying pressure.

This scene was uplifting, implying that the resistance to buying was low. Furthermore, the Relative Strength Index (RSI) on the daily graph remained above 50, suggesting that the market was experiencing a strong bullish trend.

A revisit of the range lows or even the $1.9 level would be a long-term buying opportunity.

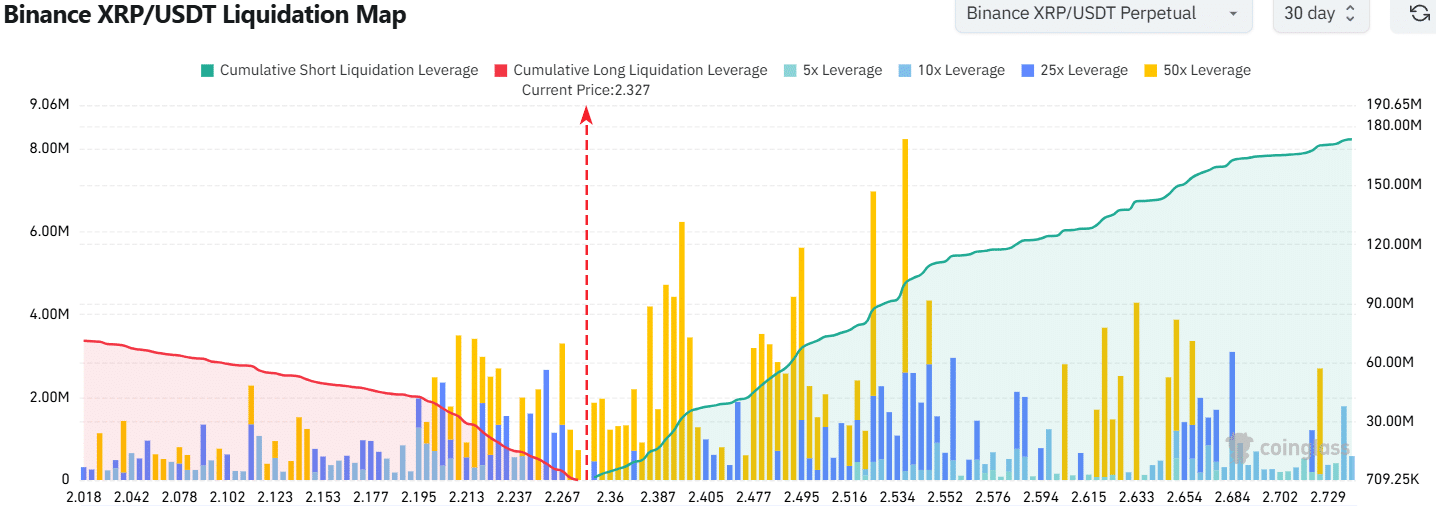

Short liquidations abound overhead

Last month’s liquidation data displayed a significant concentration of high-leverage sell-offs happening between approximately $2.33 and $2.4. More liquidation activity was accumulated at $2.4 compared to around $2.21.

This meant that a move northward would result in a higher volume of liquidations.

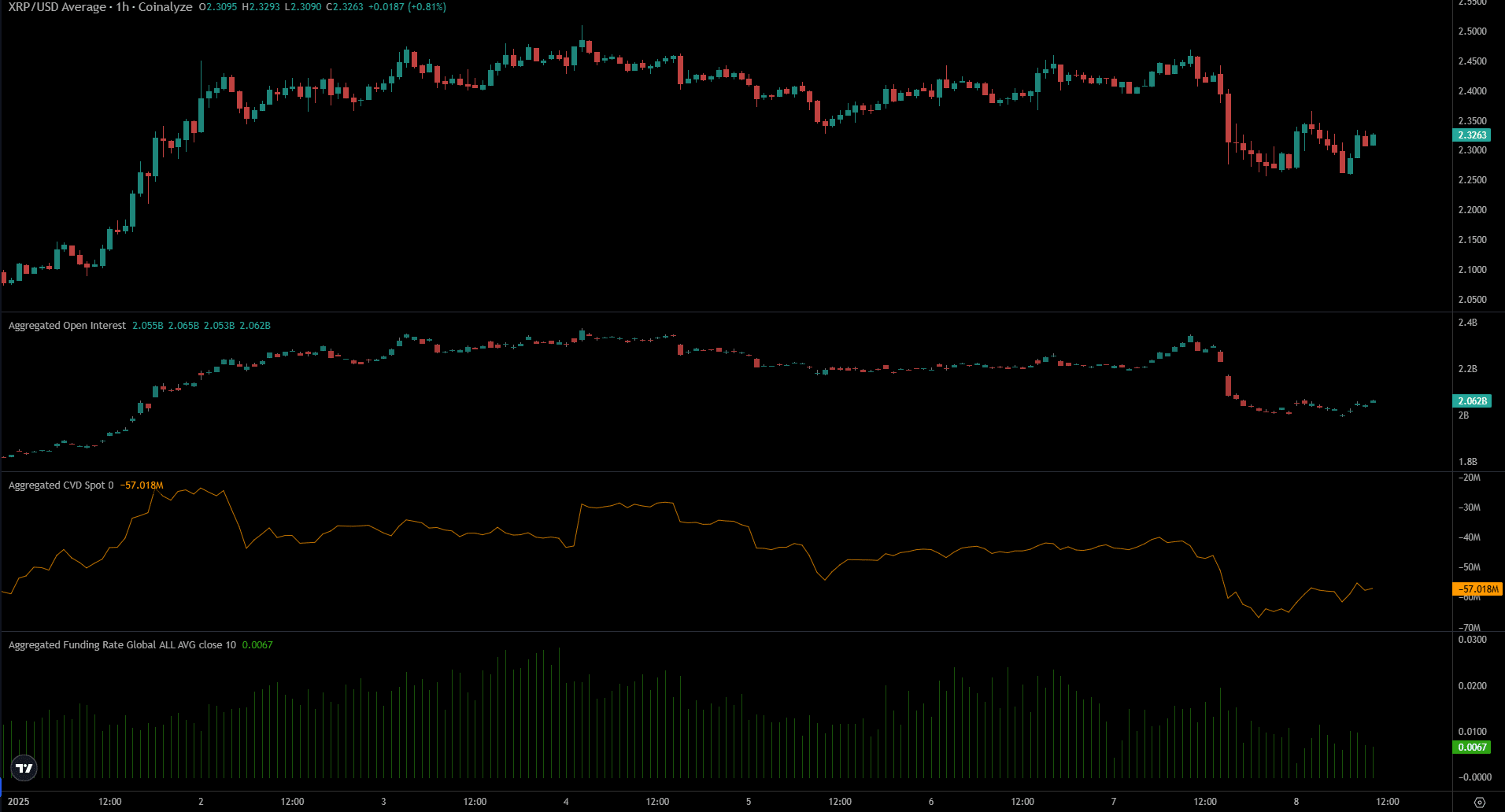

As a researcher, I’ve observed a significant decrease in both Open Interest and Spot CVD within the last 24 hours. This downward trend appears to be directly linked to the market-wide selling pressure triggered by Bitcoin‘s [BTC] fall. Consequently, the Funding Rate also dipped lower.

Together, the short-term data showed sentiment was bearish.

Realistic or not, here’s XRP’s market cap in BTC’s terms

The suggested direction based on the liquidation map points towards a potential approach towards the higher end of the current price range in the upcoming days. However, it remains uncertain whether this movement will be followed by a breakout from the range.

For swing traders, it’s crucial to seize the opportunity for gains while the market is moving, and they may consider buying back at around $2.35 to $2.40 if the price tests this range as potential support.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2025-01-09 06:15