- XRP’s $2.60 press time price level saw heavy short positions, raising concerns about a possible squeeze

- Market makers may exploit concentrated leverage, triggering liquidations, and driving XRP’s price higher

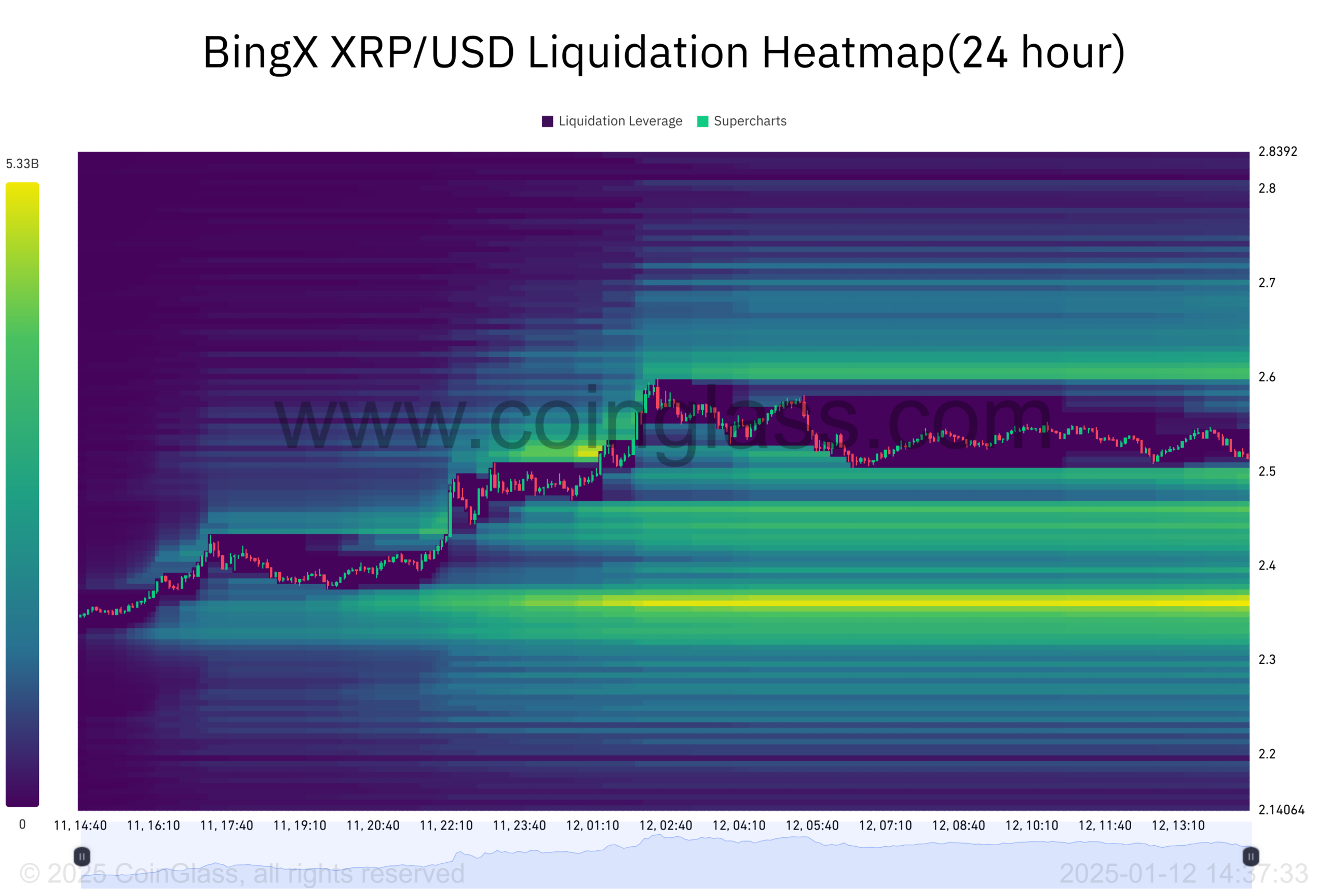

The latest advancements in XRP are sparking worries over a possible squeeze for short traders, as the high volume of short positions at approximately $2.60 could lead to a potential ‘liquidity squeeze.’ In simpler terms, this means that due to the high number of short trades around the $2.60 price point, there may not be enough sellers available to meet demand, potentially causing difficulties for those who have sold XRP but are yet to buy it back to cover their positions (short selling).

In simpler terms, this situation could give market makers an opportunity to take advantage, which might lead to a chain reaction of forced sales (liquidations) if the price moves adversely for their short positions.

XRP and its current short positions

There’s been an increase in short bets focusing on the $2.60 region for XRP. According to analyst Ali Martinez, this concentration of short bets has established a substantial area that could potentially trigger mass selling and liquidation.

The heatmap showcases a substantial buildup with high influence and large quantities at this particular level. This amassment could indicate an increasing pessimism among traders, who might be anticipating a price adjustment or flip. Yet, it’s essential to note that such a situation might bring unexpected risks for those who are short selling.

The short squeeze risk

An abrupt increase in the value of an asset occurs when it surprises short sellers, leading them to purchase their positions to minimize their losses. For instance, in the case of XRP, the price level of $2.60 serves as a significant threshold.

If XRP’s price surpasses this level, it might trigger a series of compulsory purchases, pushing the price further up. This consecutive rise would put short sellers at risk, possibly forcing them to close their positions and increasing their losses. As more shorts are forced out, the price may increase rapidly, intensifying the strain on those who have bet against it.

Yet, market situations can change quickly, and even though a short squeeze is significant, other elements like overall market tendencies, breaking news, or regulatory updates might additionally impact the price fluctuations of XRP.

The role of market movers

Market makers frequently capitalize on situations where there’s heavy use of leveraged positions. When short interest is significantly high, it offers a possible chance for market makers to nudge the prices upward, essentially tracking down and triggering the liquidation of excessively leveraged positions.

As a researcher, I’ve observed an intriguing strategy employed by market makers: initiating liquidations to gain profit. They do this by capitalizing on margin calls, which compel investors to sell their securities at prices dictated by the market maker. This process triggers forced buybacks, leading to substantial returns for them. Notably, this approach magnifies market volatility. Moreover, it intensifies the strain on short sellers, setting off a cycle that can rapidly escalate the asset’s price due to the pressure it creates.

Read Ripple [XRP] Price Prediction 2025-2026

Implications for traders

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2025-01-12 23:03