-

XRP has tanked 20% on a year-to-date (YTD) basis.

Key whale cohorts were seen accumulating XRPs at discount.

As a researcher with a background in cryptocurrencies and market analysis, I’ve closely monitored XRP‘s performance over the past few weeks. The latest 20% decline in its year-to-date (YTD) value has raised concerns about its future prospects. However, recent observations suggest that key whale cohorts have been accumulating XRPs at discounted prices.

As a researcher studying the cryptocurrency market, I observed that Ripple [XRP], which is known for its focus on payments, experienced a 1% decline in value over the past 24 hours based on information from CoinMarketCap.

As a researcher, I’ve observed that the seventh-largest currency by market capitalization has faced significant selling pressure in recent days. Over the past week, its value has dropped by 7.72%, and in just one month, it has plummeted nearly 20%.

Nothing seems to be working?

Despite the significant partnership announcement made by Ripple Labs, the creator of XRP and XRP Ledger (XRPL), the past 24 hours saw a notable decline in value.

As a researcher studying this particular topic, I’d like to highlight an intriguing development: This company has formed significant partnerships with HashKey DX and SBI Holdings for offering supply chain finance solutions in Japan. These solutions will be driven by the company’s layer-1 blockchain technology, XRPL.

However, the news of institutional adoption failed to lift XRP out of the woods.

As a researcher studying the cryptocurrency market, I’ve observed remarkable gains in the leading industry currencies such as Bitcoin and Ethereum, with Bitcoin experiencing approximately 45% growth and Ethereum around 32% since the beginning of 2024. In contrast, XRP has underperformed, registering a decline of about 20% on a year-to-date basis.

Are whales onto something?

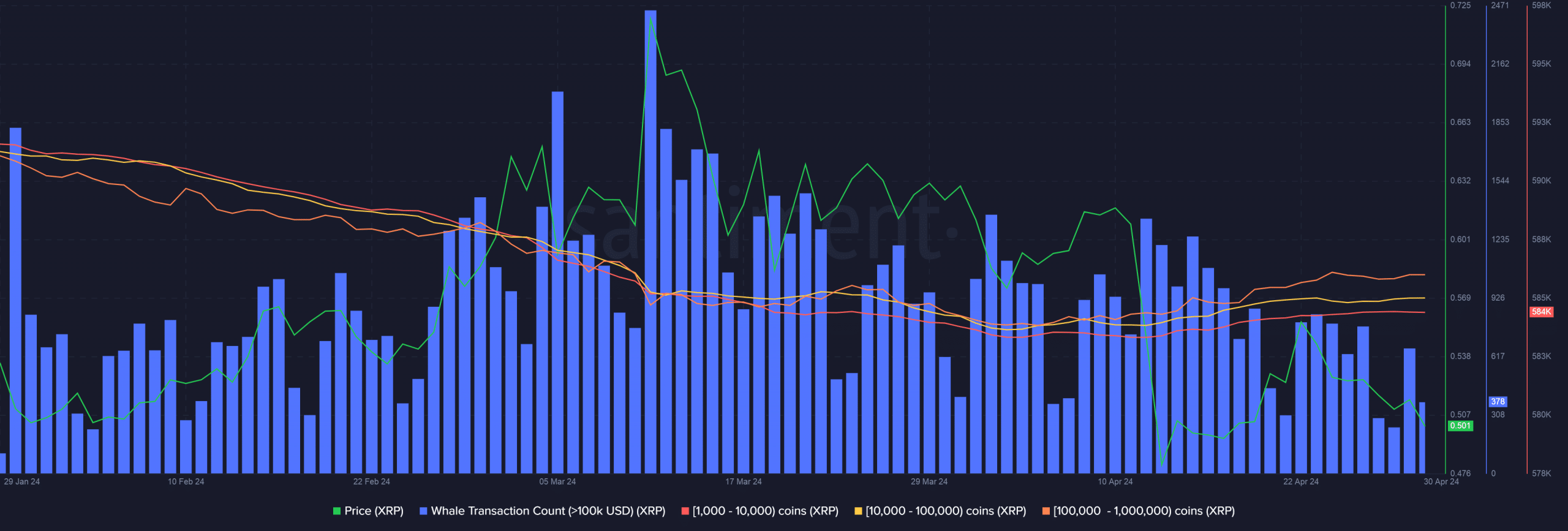

Based on my analysis of the data from Santiment, I’ve observed a decrease in the number of large transactions exceeding $100,000 over the past two weeks. This trend indicates a potential reduction in engagement from whale investors, according to AMBCrypto’s report.

As a researcher studying whale behavior in the XRP market, I discovered an intriguing pattern. Unassumingly, certain significant whale groups had been amassing XRPs at lower prices throughout the period. This was indicated by the substantial increase in their XRP holdings.

If the rate at which XRP is acquired continues at its current speed, it could be a significant factor in XRP’s potential recovery in the near future.

Will the downtrend continue?

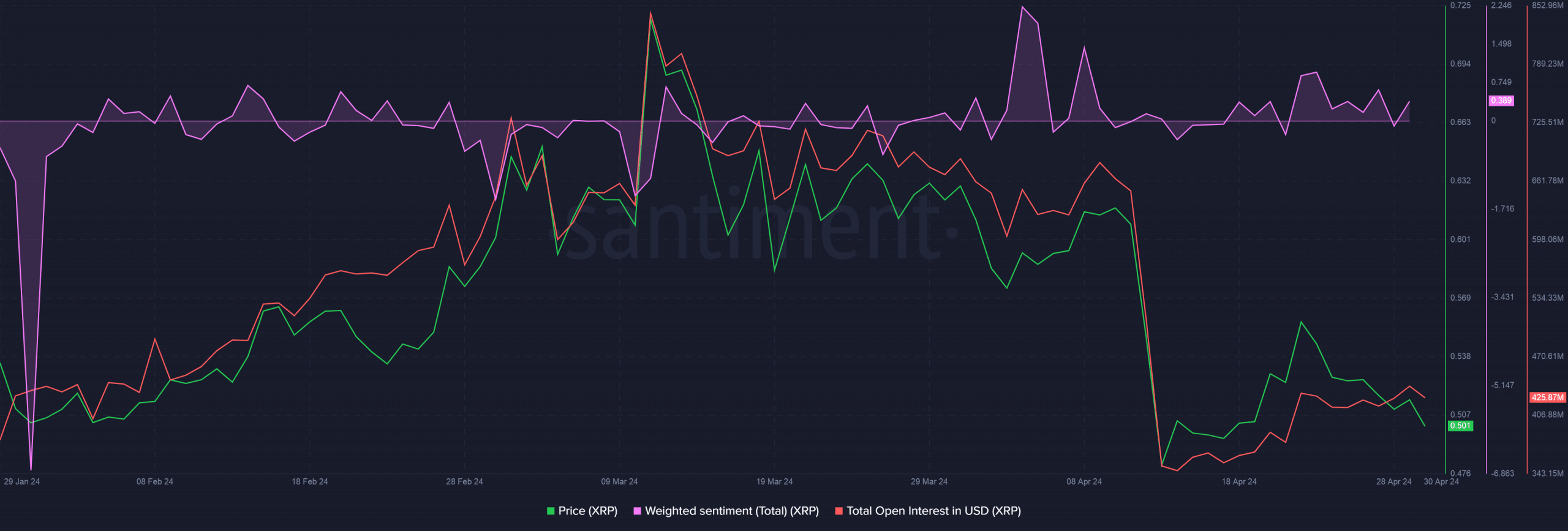

During the past month, the decreasing bearish trend in XRP‘s price caused a significant drop in investments within its derivatives market. The Open Interest for XRP fell by approximately 38%, reaching a total of $425 million.

Typically, a fall in price followed by a fall in OI confirms a downtrend.

It’s intriguing to note that there were more optimistic views towards XRP expressed on social media than pessimistic forecasts based on the upbeat Weighted Sentiment analysis.

As a crypto investor, I’ve noticed that despite the recent partnership between Ripple Labs being announced, the price of the related cryptocurrency hasn’t shown significant improvement as a result.

Read More

2024-05-01 03:03