-

The XRP metrics indicated that bulls might see some relief over the next week or two.

Traders need to plan and be prepared for two scenarios that might play out in July.

As a seasoned crypto investor with a keen interest in XRP, I find the current market conditions intriguing. The bullish pattern on XRP’s price chart and the promising on-chain metrics suggest that relief for bulls might be just around the corner within the next week or two. However, it is essential to remain cautious and plan for potential scenarios that could unfold in July.

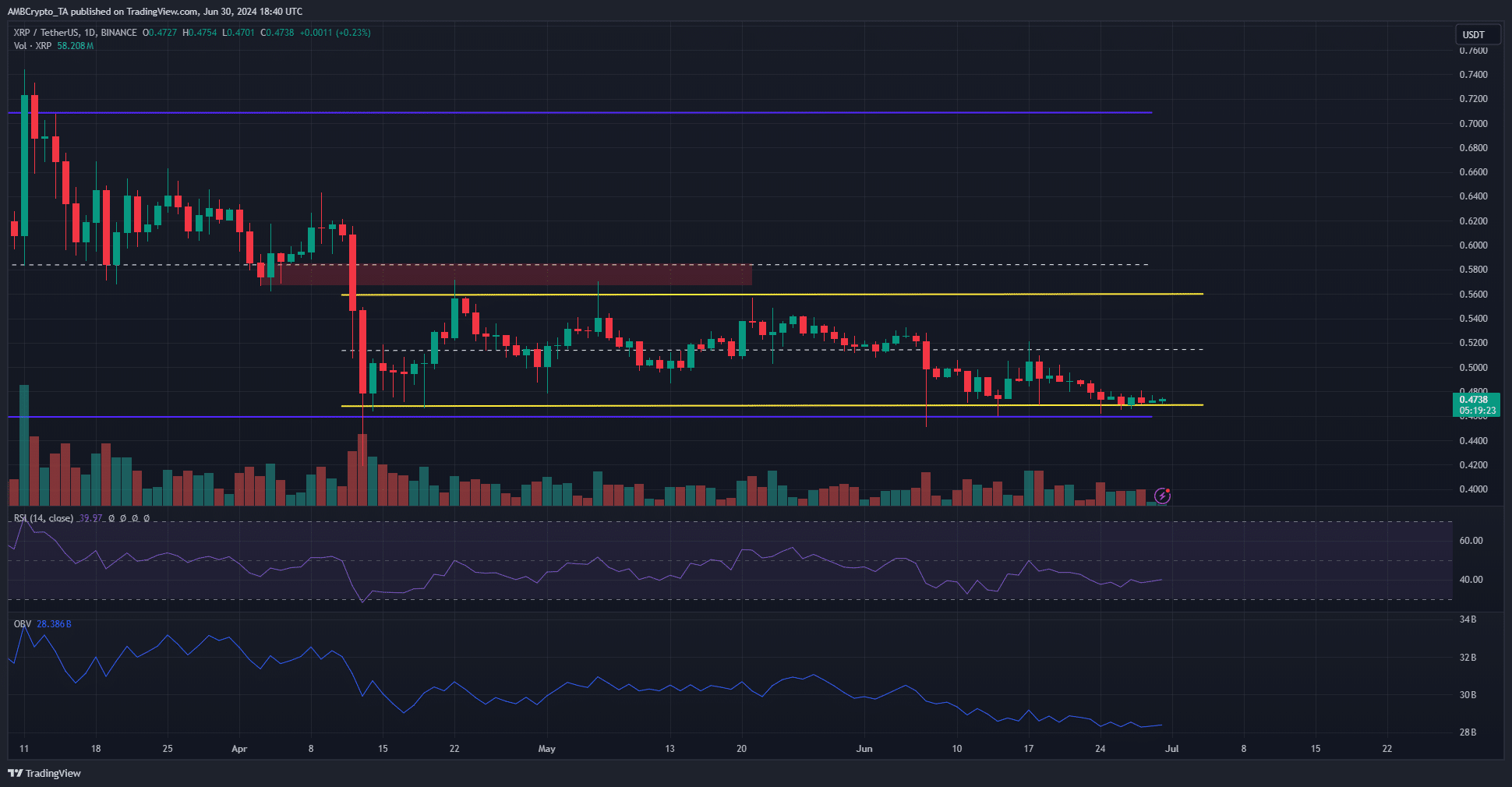

As a crypto investor, I’ve noticed that Ripple (XRP) had hit the bottom end of a price range that extended back to mid-April. However, according to a recent report from AMBCrypto, the price formed a bullish pattern during its period of consolidation. This means that despite the low prices, the market indicators suggested potential for an upward trend.

Should the price successfully breach the wedge pattern, there is a higher probability for a surge of around 30-40%. However, based on current momentum and trading volume signs, the market exhibits bearish tendencies.

XRP on-chain metrics signal a buying opportunity

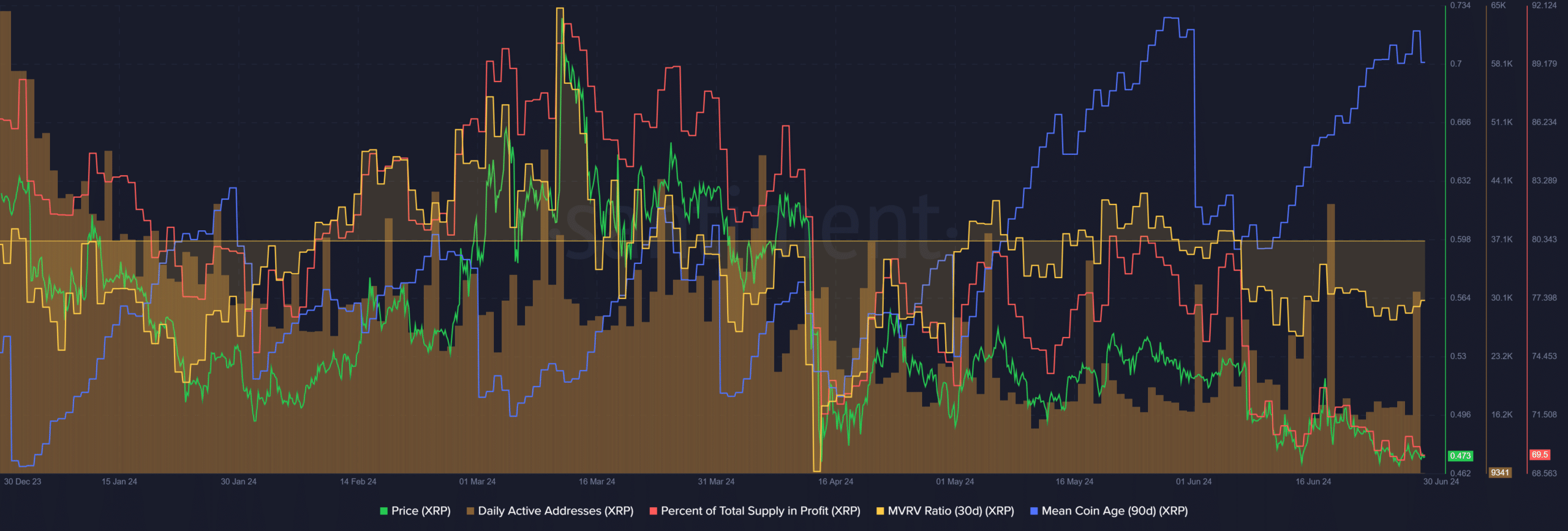

As an analyst, I’ve noticed that the number of daily active addresses has been gradually decreasing since late March. While there have been some notable spikes in activity on particular days, the overall trend points downward. This is a concerning development as it suggests less usage and demand.

In June, the percentage of supplies generating a profit decreased along with falling prices, as anticipated. This price adjustment caused the 30-day MVRV (Moving Average of Realized Value) to dip below zero.

However, in the past month, the mean coin age began to trend upward.

In unison, the increasing median holding period for profitable coins and decreasing Market Value Realized Value (MVRV) indicated a buying opportunity due to perceived undervaluation. However, traders should carefully consider their individual risk tolerance and market conditions before making a decision.

The liquidation data and the two scenarios that can unfold here

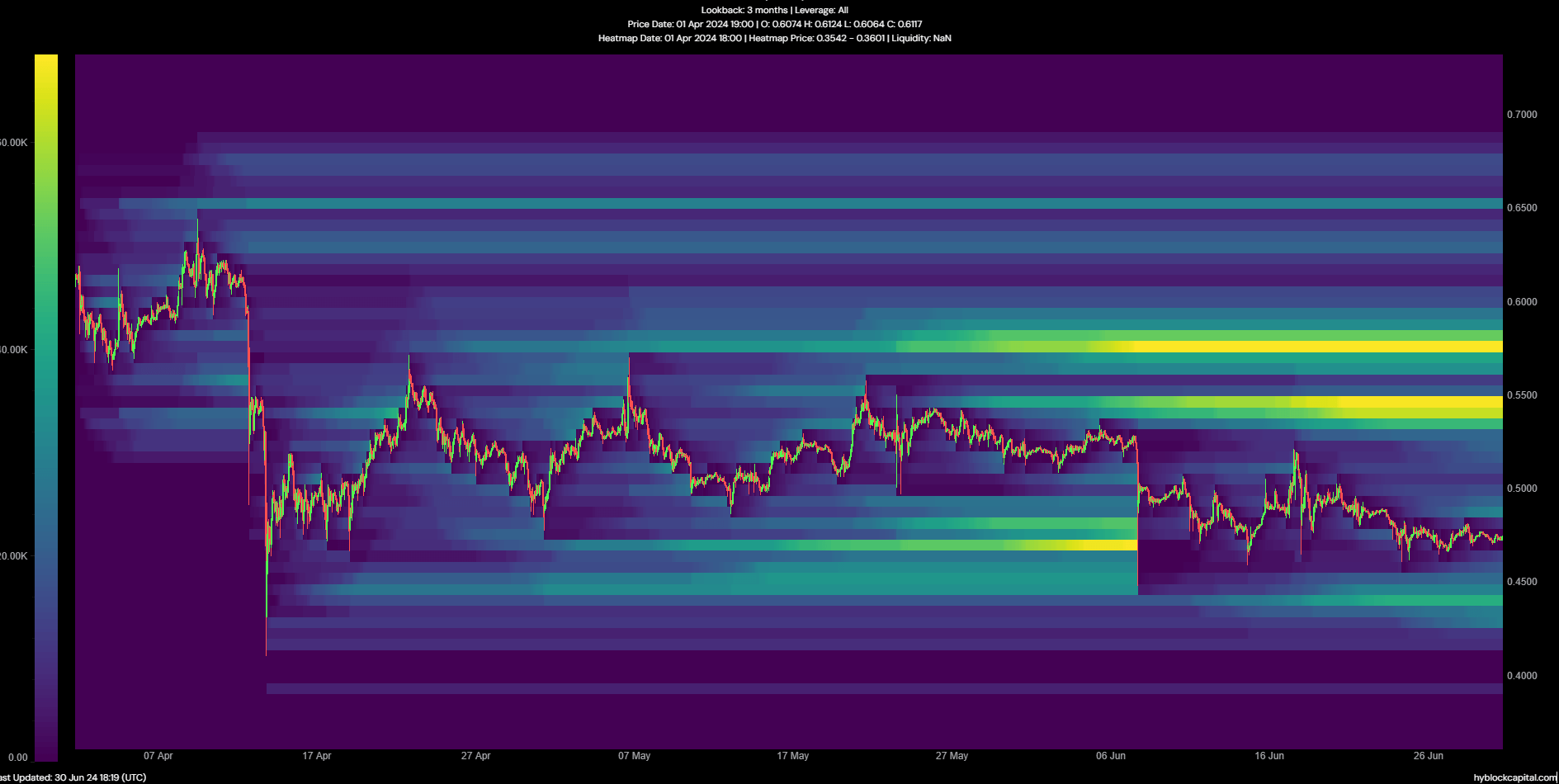

As a researcher studying market trends, I’ve noticed an intriguing pattern in the liquidation heatmap. A significant cluster of liquidation levels lies just beneath the $0.55 mark. This magnetic region may exert a strong pull on prices, potentially causing them to rise towards the short liquidations.

However, the $0.436 presented another attractive pocket of liquidity closer to market prices.

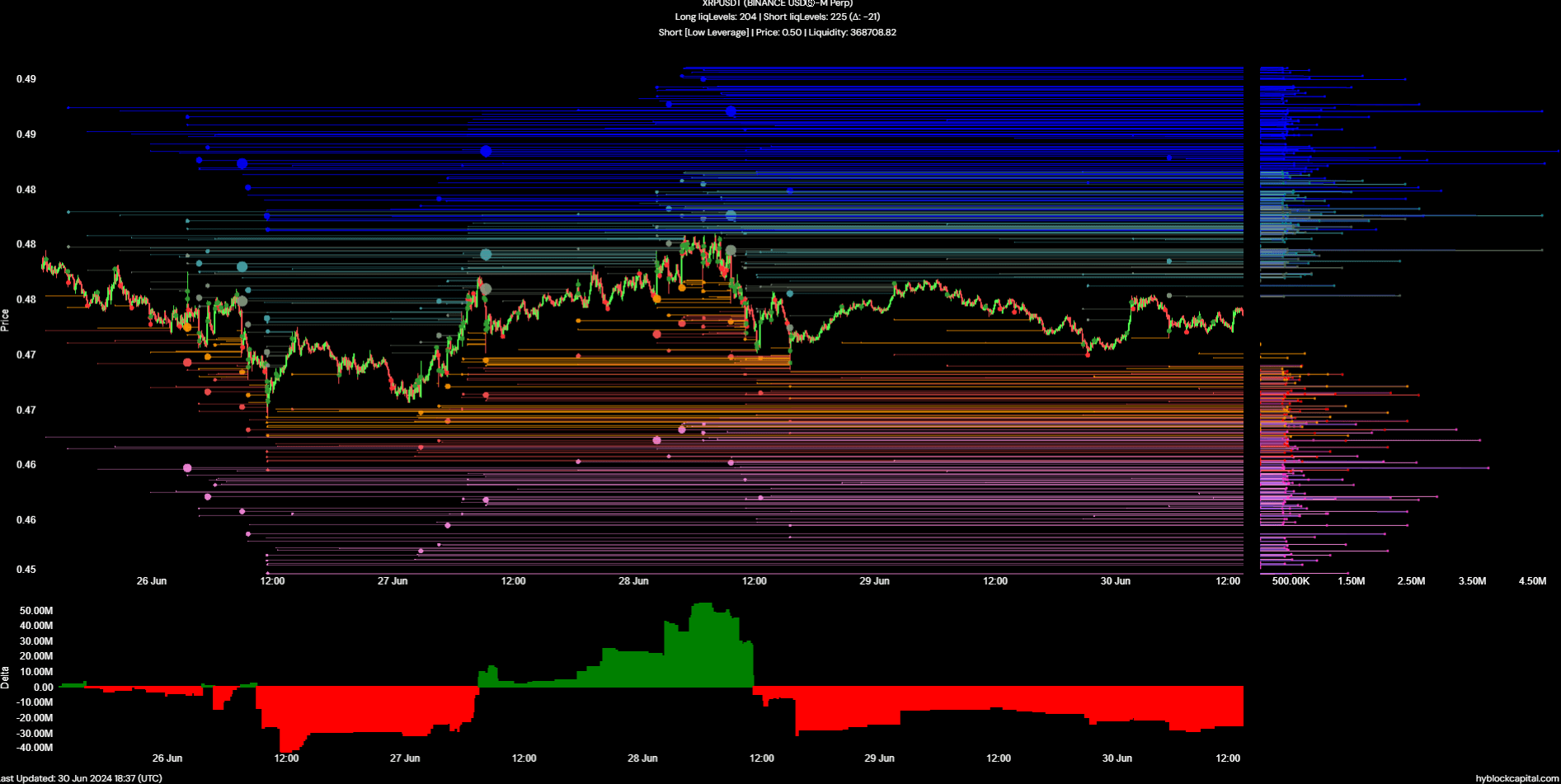

In simpler terms, the difference between the total long and short positions being closed (liquidated) was significantly larger in favor of the short positions.

Realistic or not, here’s XRP’s market cap in BTC’s terms

Turning the tables, this could signal the start of a rise to force out short sellers. The significant short-term objective lies at $0.485, representing a nearly 2.5% increase from current prices. In one possible outcome, XRP recovers from its recent setbacks and advances towards $0.55.

In an alternate turn of events, XRP could potentially reach a price point between $0.485 and $0.49. Following this, there is a strong possibility of rejection leading to a decline in prices around $0.436. However, if prices continue to fall, investors must remain agile and prepare for a subsequent recovery that could potentially push the price range up towards $0.56.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-07-01 09:11