- XRP’s selling pressure has been waning in the near-term, based on metrics and price action

- Rising leverage ratio was a result of bullish optimism, but also a warning to futures/perp traders

This week, Ripple (XRP) made headlines as it surpassed its 7-year peak and moved above $3 on the price charts. Starting from January 1st, this digital currency has increased by approximately 52%. Additionally, there’s been a significant increase in whale purchases – over 1.4 billion XRP have been bought within the last two months. This represents a 35% rise in demand for Ripple.

The data showed a decrease in the amount of XRP being sent to exchanges. As a result, AMBCrypto examined this trend together with other indicators to determine whether it could be favorable for XRP investors.

XRP – Mixed signals need decoding

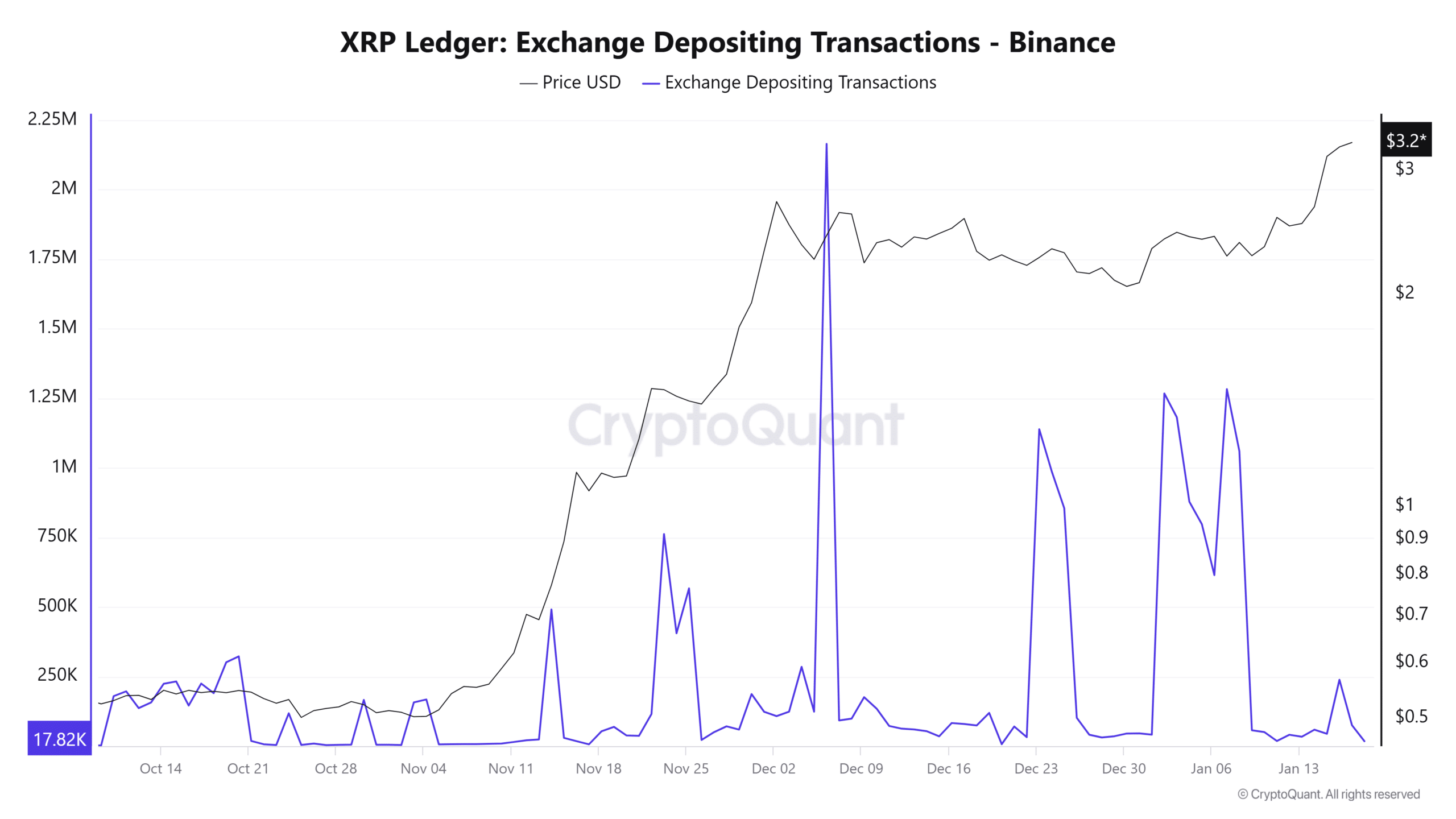

This indicator monitors the overall number of deposits made into exchanges for trades. A larger count suggests a potential surge in selling activity is approaching, since higher deposits often indicate selling pressure. Moreover, increased deposits may suggest a rise in margin trading, where XRP is being utilized as collateral.

In late December, there were substantial increases in XRP deposits during the consolidation period. Despite this, the bulls successfully maintained the $2 price level as resistance to selling pressure. Interestingly, the recent surge of XRP has been accompanied by fewer deposits, indicating that selling pressure has remained relatively low over the past few days.

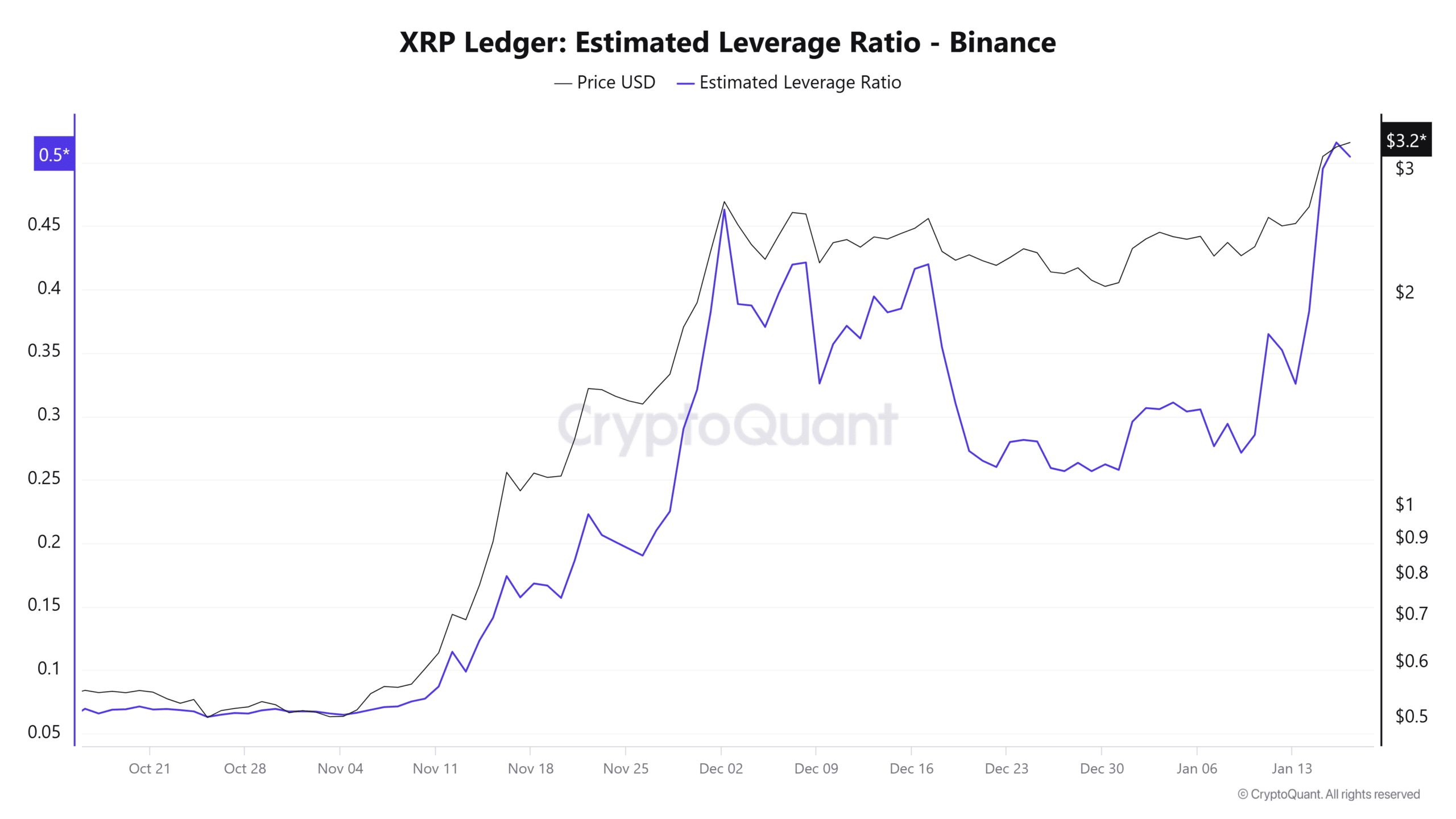

Starting from early November, the value of XRP started climbing significantly. At the same time, the Estimated Leverage Ratio (ELR), a metric that measures Open Interest against coin reserves, also increased. This ratio provides information about whether traders are using more leverage in their transactions, which is often indicative of a robust uptrend.

In the latter part of December, the ELR experienced a brief relaxation thanks to consolidation. Subsequently, the surge beyond $3 triggered the ELR’s upward movement, causing a caution sign to flash for traders.

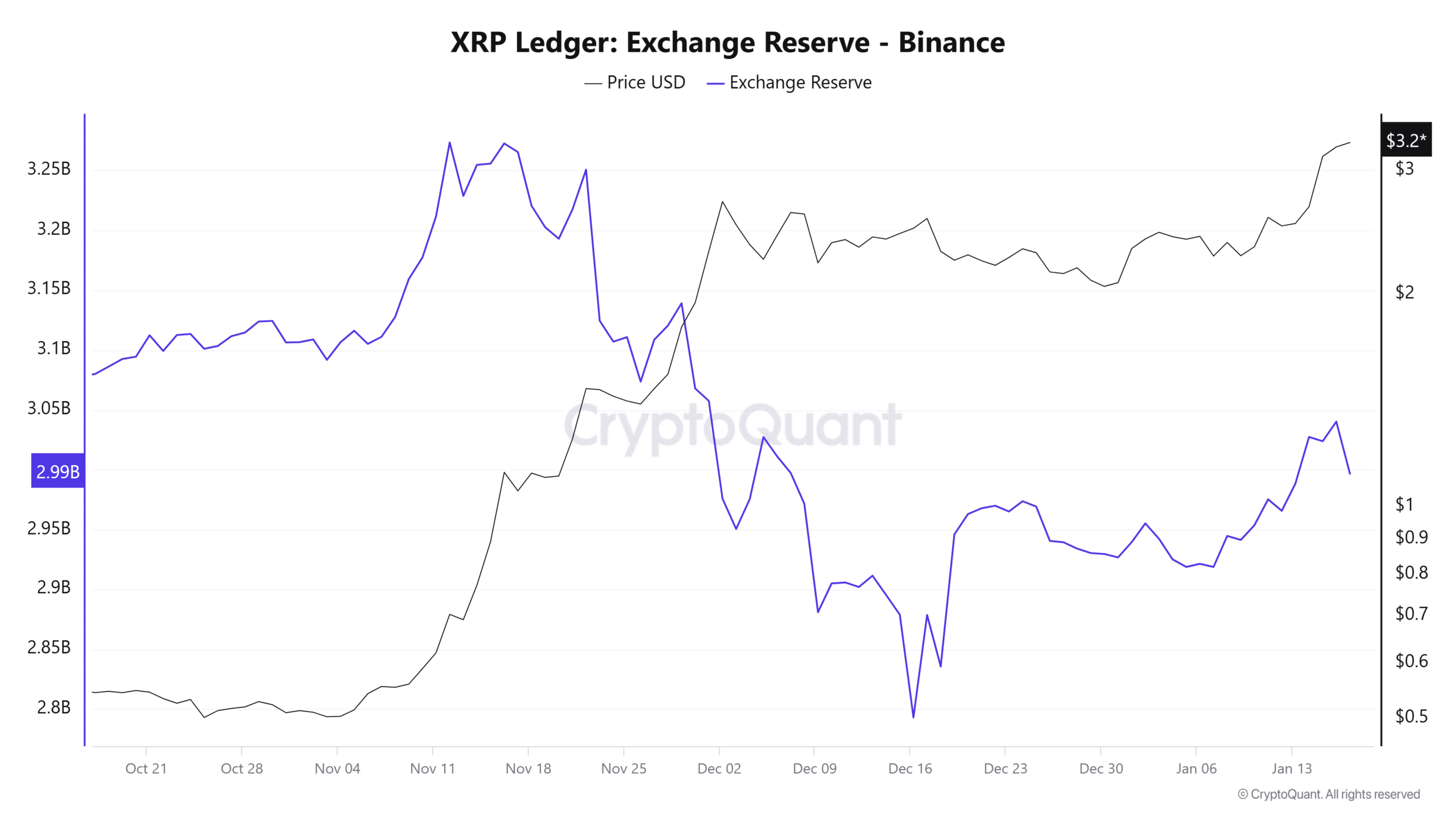

For the past fortnight, there’s been an increase in XRP held by exchanges. This trend might be interpreted as a bearish signal since it contrasts with the decreasing number of deposits being made.

In simpler terms, it seems like some investors might be cashing out their profits (selling under pressure), but this action hasn’t significantly slowed down the overall upward trend (the bulls). This situation suggests a possibility that traders could have been employing XRP as security or collateral in margin trading.

Read Ripple’s [XRP] Price Prediction 2025-26

Increases in the Effective Liquidity Ratio (ELR) and exchange reserves collectively imply that the market may become turbulent for traders in the near future. This turmoil could lead to periods of liquidity hunting and consolidation, though the exact timing remains unclear.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2025-01-18 23:03