-

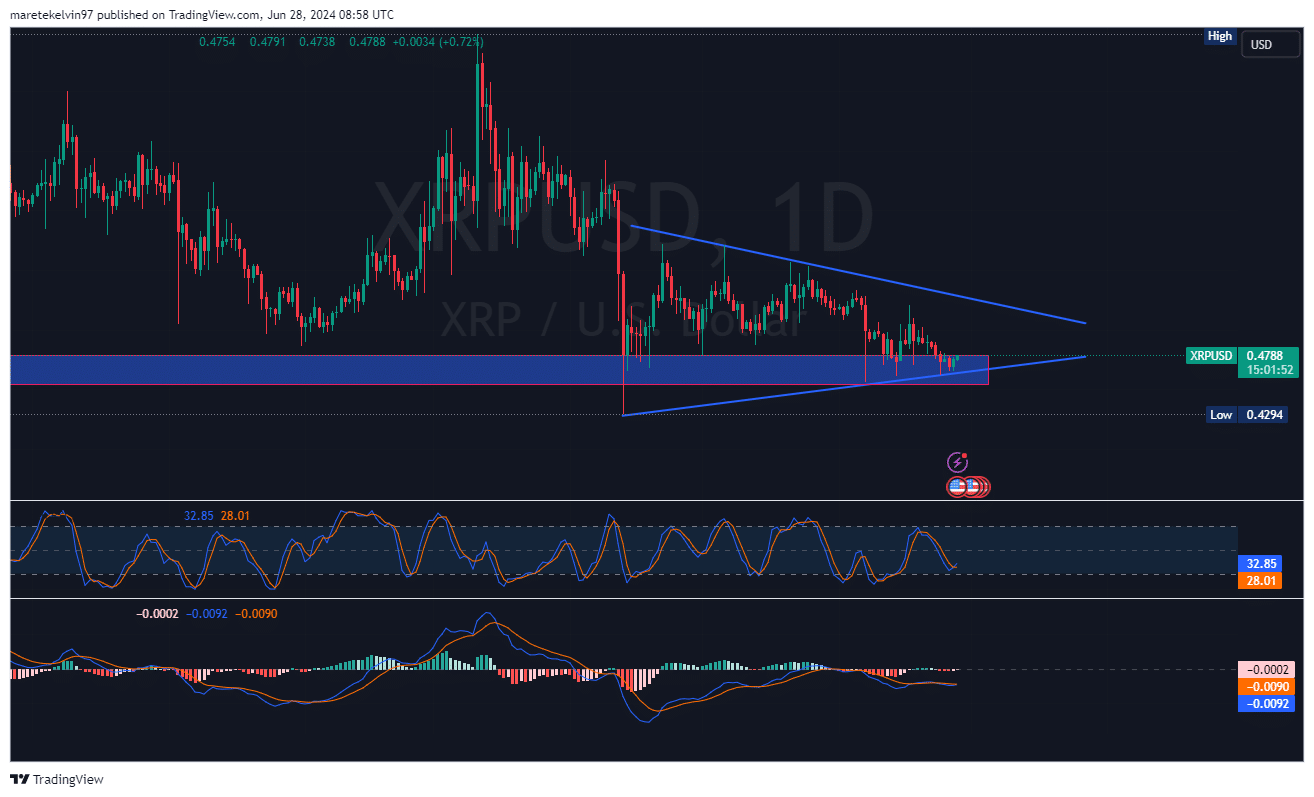

XRP price surged by 3% after rejecting key trendline support level around $0.4645 in the last 48 hours.

Solana’s ETF prospects and whale activity add curiosity to XRP correlation.

As a researcher with extensive experience in cryptocurrency markets, I find the recent XRP price action intriguing. The 3% surge in XRP prices after rejecting key trendline support around $0.4645 is a bullish sign that should not be overlooked. This support level has acted as both a resistance and support level in recent weeks, making it an essential pivot point for the XRP price.

In the past few days, XRP has exhibited encouraging signs of a bullish trend. The cryptocurrency’s price rebounded from the supporting trendline at $0.4645 and gained approximately 3% over the previous 48 hours.

This level of support is crucial because it has functioned as a pivot point, serving both as a floor for buying and a ceiling for selling in the past few weeks. The ensuing price rise hints that the bulls are gaining momentum and could be planning a more substantial advance.

This accumulation of bullish momentum could fuel XRP prices to test the trendline resistance.

Should XRP manage to surpass this downward-sloping trendline, it could be an indication that the current bearish market trend has come to an end, paving the way for an uplifting bullish trend.

Based on information from CoinMarketCap, the current price of XRP is $0.4764, representing a 1.55% increase over the past 24 hours and a 2.39% gain in the previous week. Additionally, there has been a 1.22% rise in XRP’s trading volume within the last day.

Correlation with Solana

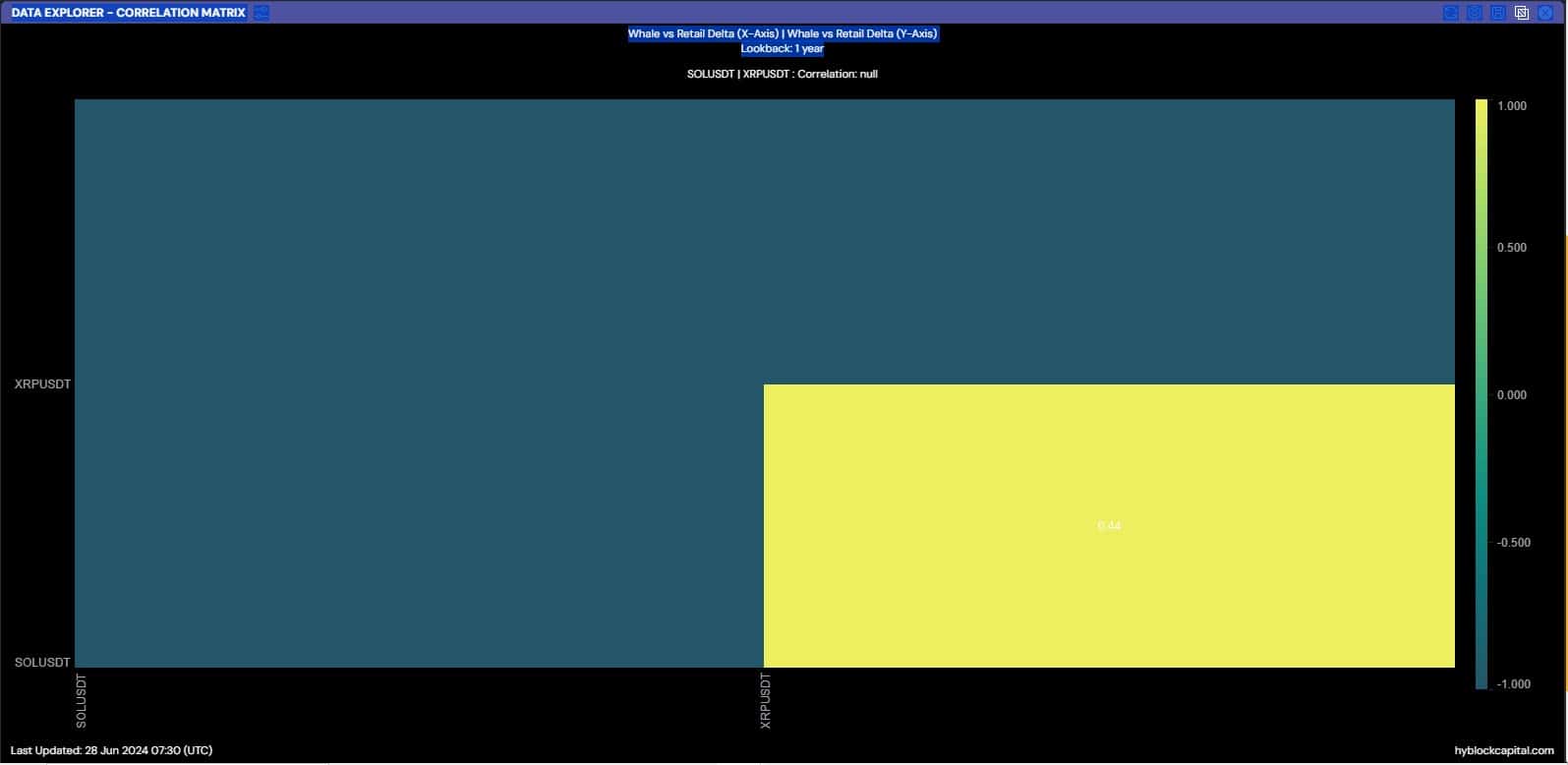

AMBCrypto’s analysis of Hyblock capital’s data revealed interesting aspects.

Over the last quarter, XRP and Solana have displayed a correlation coefficient of 0.44, suggesting a moderate relationship between their price fluctuations. This means that XRP’s price changes may be influenced by the broader market dynamics impacting Solana.

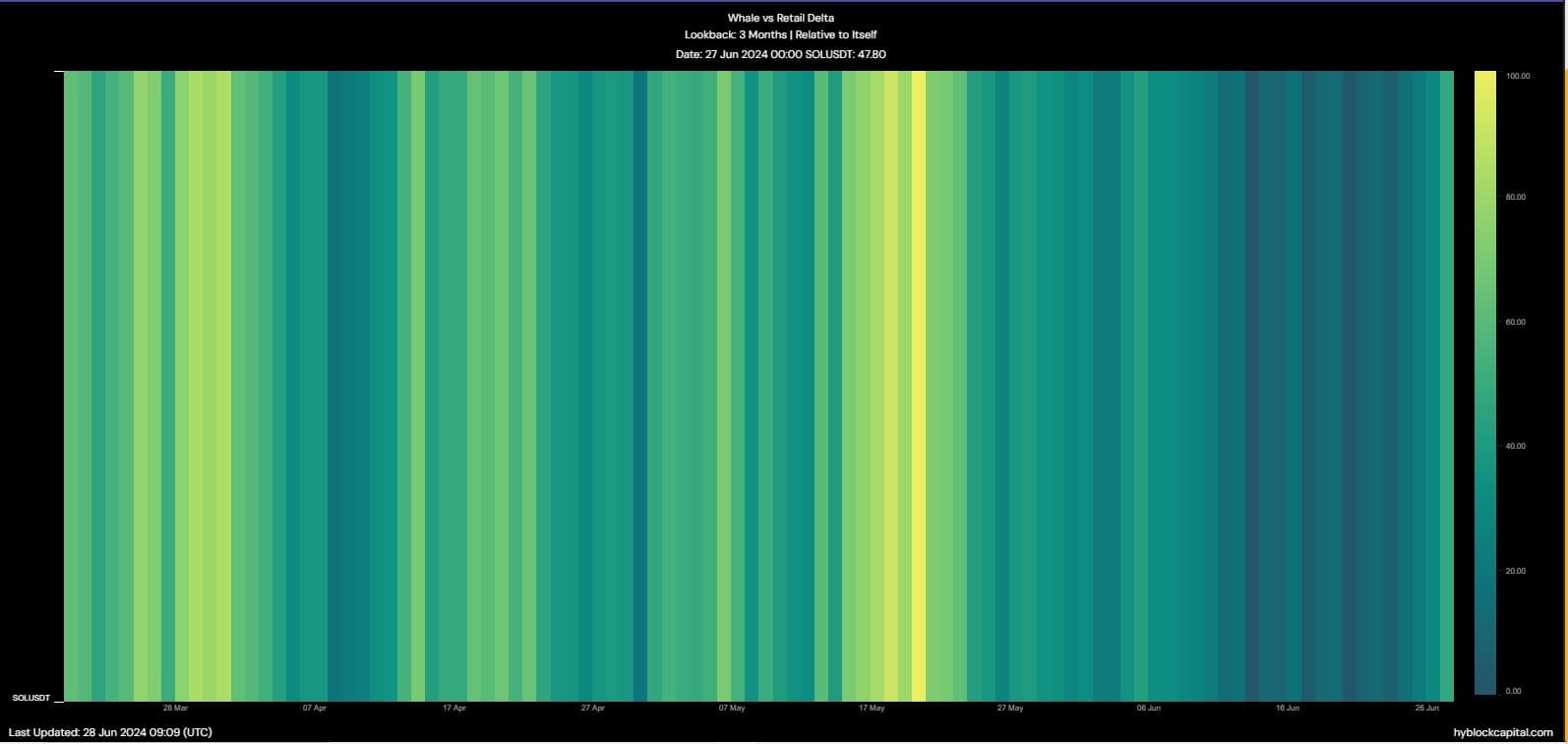

It’s intriguing to note that data from whales to retail investors indicates a high level of whale involvement with Solana. The present ratio of whale-to-retail investment in SOL is 47.80, suggesting a strong interest from major investors.

This whale activity could have a substantial impact on XRP’s price action due to their correlation.

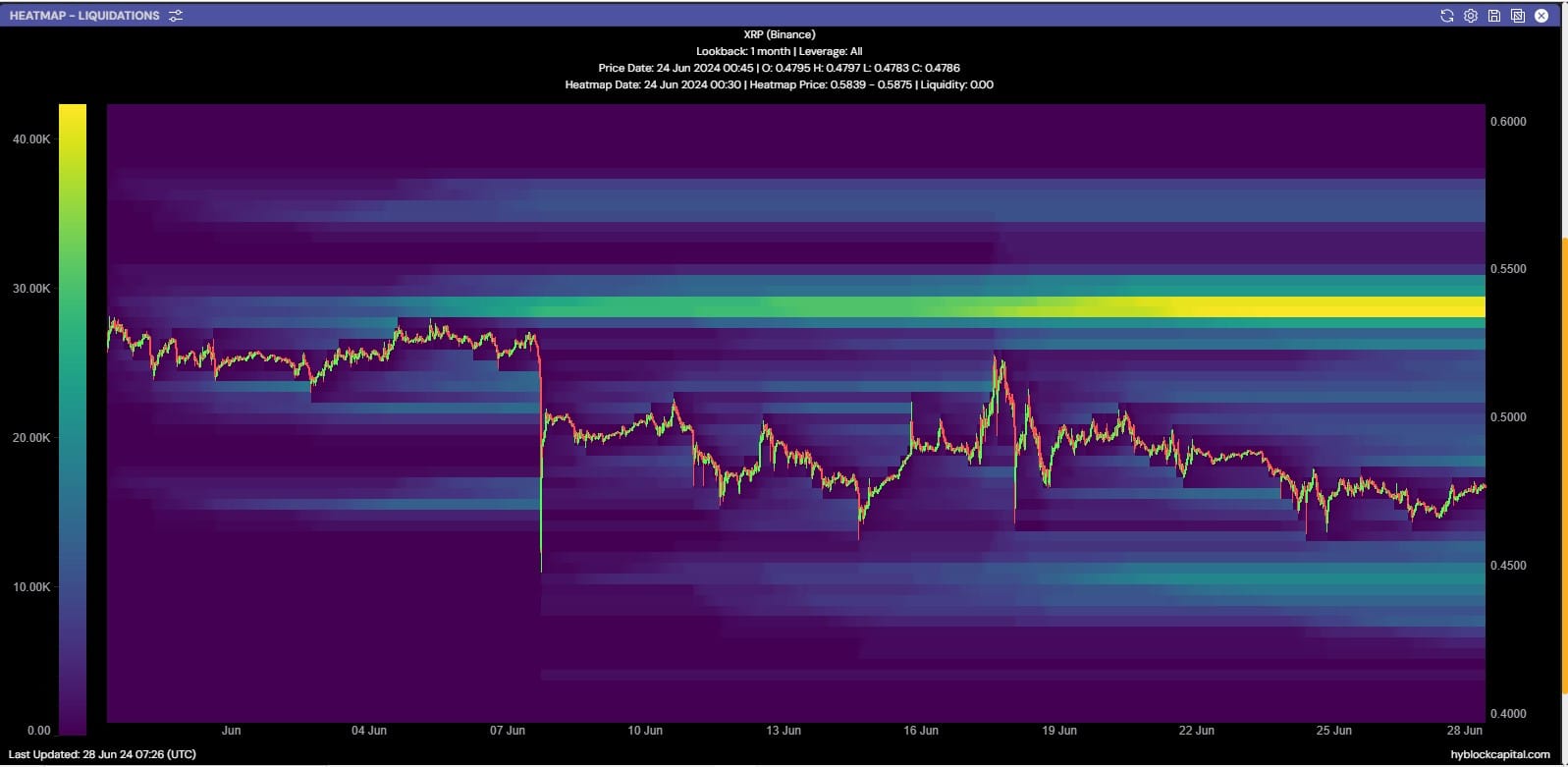

The liquidation heatmap data shows a strong preference toward the $0.5 mark, suggesting potential for additional price growth.

Solana ETF expectations and potential impact

Further fueling market sentiments was a report on Solana ETFs.

As a crypto investor, I’m excited about the prospect of a potential 8.9x appreciation for Solana if the ETF gets approved, according to GSR’s report. This optimistic viewpoint could create a ripple effect throughout the altcoin market and potentially boost the value of correlated assets like XRP.

The possibility of a Solana Exchange-Traded Fund (ETF) and its potential effects present an additional intricacy to the connection between XRP and Solana. Investors are now keeping a keen eye on how advancements within the Solana platform could influence XRP’s price trend.

At a robust level of $0.4645, XRP receives considerable backing. With accumulating positive pressure, this solid base paves the way for possible price increases towards the resistance line of the downward trend.

However, price declines cannot be written off since the liquidity shows a bearish bias.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-06-29 01:11