- The low profitability could benefit XRP’s price in the long run

A rising coin age might trigger a fall below $0.50 in the short term

EGRAG Crypto, a well-known cryptocurrency analyst on platform X, is of the opinion that XRP may once again mirror its price trend from the years 2017 and 2021. The expert explains that XRP’s current market position is being put to the test against its historic support levels.

If the current trend continues, the token’s price may reach levels not seen since nearly three years ago. For EGRAG Cryptocurrency, if XRP experiences a 17.39% increase in the near future, this forecast could be confirmed.

In the year 2017, XRP, which was the seventh most valuable cryptocurrency, increased significantly from $0.18 to approximately $1.12 by the end of the year. In contrast, during the year 2021, the value of XRP saw a remarkable surge, starting at around $0.26 and reaching a peak price of $1.59 within just a few months.

Despite its initial success, the altcoin hasn’t matched that level of achievement since. In contrast, this year, XRP‘s value dropped by 17.18%. However, there has been a change in the last 24 hours, with the price increasing by 4.04%.

Losses breed something better

To reach the beginning of XRP‘s historical price surge, it needs to pass the $0.58 mark initially. However, achieving this milestone does not automatically mean that the token will experience another impressive rise.

AMBCrypto examined the project’s prospective gains by considering its large token supply, which is well-known to be among the largest in the top 10.

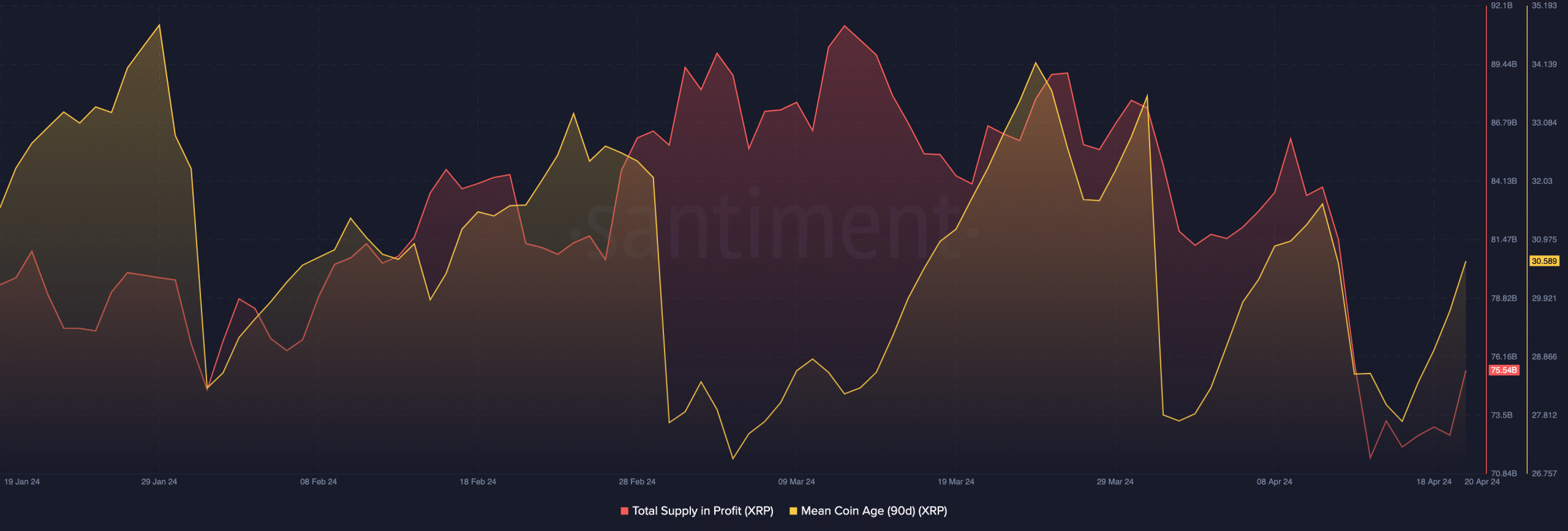

Recently, nearly all of the approximately 99.99 trillion XRP tokens were generating profits. The last occurrence of this was in the year 2021. However, current data from Santiment indicates that only about 75.54 billion tokens are currently profitable.

In general, when a metric reaches a high level, it often signals market peaks. Consequently, a decline in investor profits can be seen as a sign of an optimistic outlook for the market.

Furthermore, we analyzed the Mean Coin Age over a 90-day period. This metric indicates coins shifting between hot and cold wallets.

Having a small number of coins in circulation for an extended period is often referred to as coin age. This situation implies that tokens have been saved and held personally, away from exchanges or other custodians. However, the recent surge in XRP‘s Market Capitalization Adjusted (MCA) suggests that some older XRP coins have recently been moved from self-custody.

In many instances, a significant increase in this movement indicates that investors are likely intending to offload their holdings. Should there be an additional surge, it may lead to a decline in price. Conversely, a decrease in coin age could pave the way for a steep upward trend on the graphs.

First off — XRP to $0.48

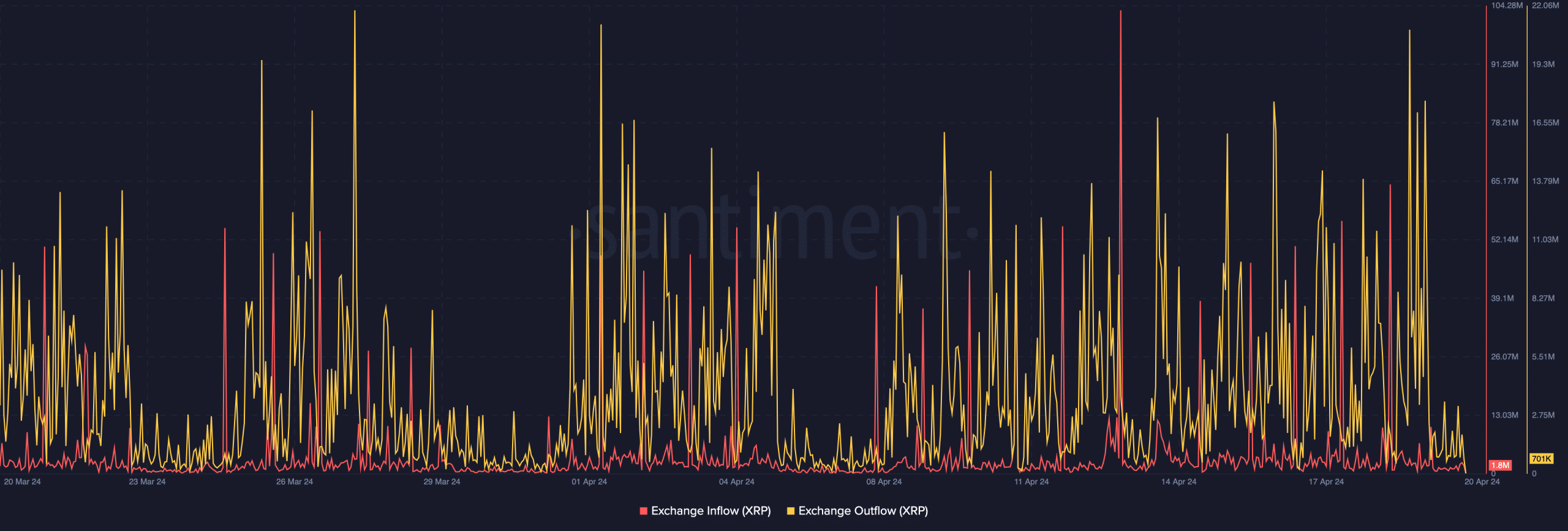

Currently, XRP may not keep rising and a drop to around $0.48 is possible instead. This prediction aligns with the recent trend observed in the exchange flows.

Currently, there are approximately 1.8 million cryptocurrencies flowing into exchanges. In contrast, 701,000 tokens have been taken out of exchanges.

If the outflows exceed the inflows in the future, XRP may keep rising. It’s important to note that this doesn’t necessarily mean XRP will experience short-term growth, but there are several factors that could potentially drive its price up further beyond what was previously mentioned.

Is your portfolio green? Check the XRP Profit Calculator

For example, certain tokens are thriving in this market cycle due to distinct stories driving their success. Unfortunately, XRP doesn’t seem to fit into any of those categories. Although its value may increase, the likelihood of it repeating past achievements is quite limited.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Injective at risk of pullback as key resistance holds strong – What now?

- Crypto mining ‘strengthens America’s energy grids’ – A 30% tax means…

2024-04-21 08:07